Question

PLS I HAVE 25 MIN LEFT! Dana Accounting Corporation (DAC), employs activity-based costing (ABC) The following budgeted data for each of the activity cost pools

PLS I HAVE 25 MIN LEFT!

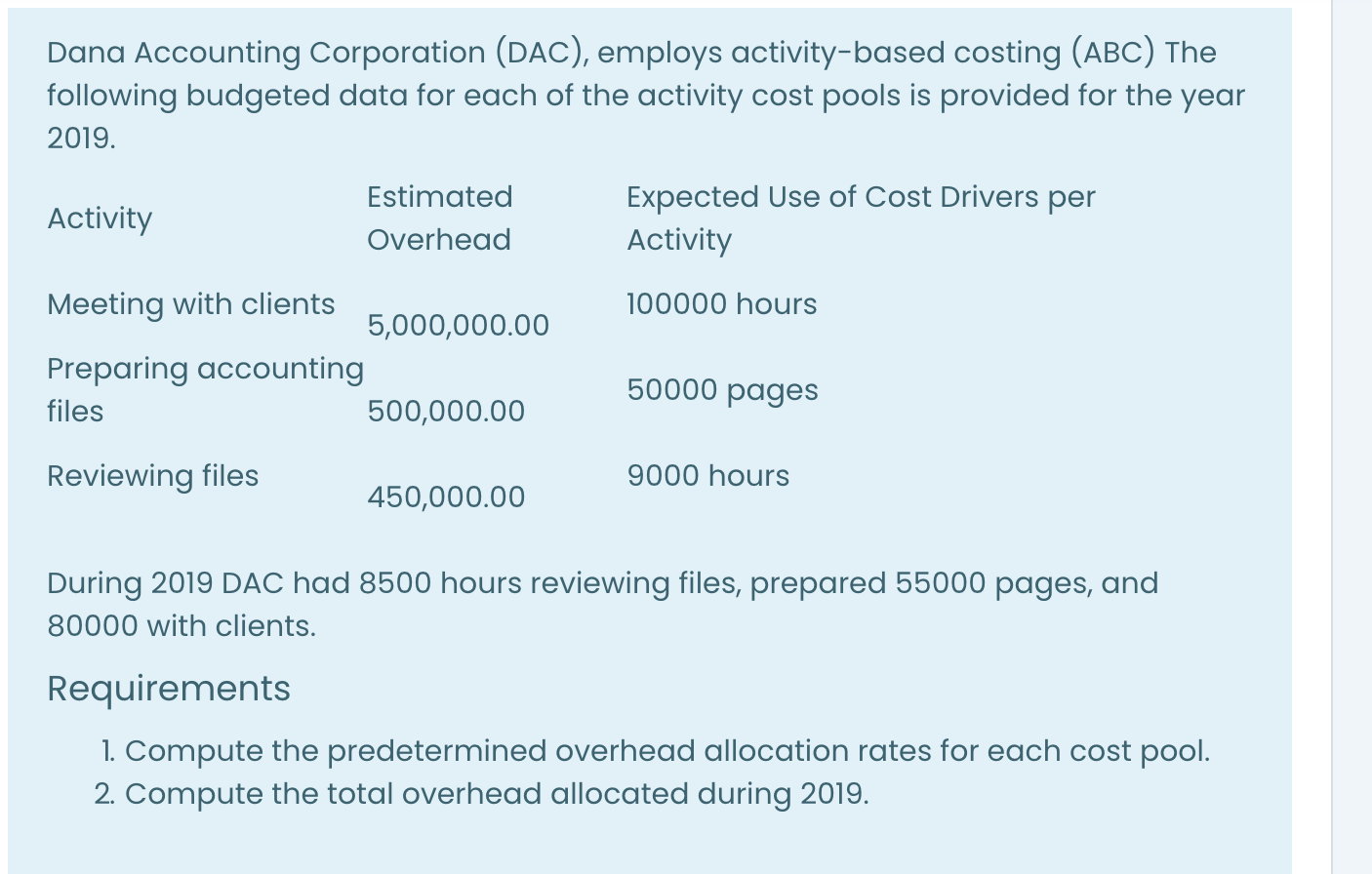

Dana Accounting Corporation (DAC), employs activity-based costing (ABC) The following budgeted data for each of the activity cost pools is provided for the year 2019.

Activity Estimated Overhead Expected Use of Cost Drivers per Activity Meeting with clients 5,000,000.00 100000 hours Preparing accounting files 500,000.00 50000 pages Reviewing files 450,000.00 9000 hours During 2019 DAC had 8500 hours reviewing files, prepared 55000 pages, and 80000 with clients.

Requirements

Compute the predetermined overhead allocation rates for each cost pool.

Compute the total overhead allocated during 2019.

Dana Accounting Corporation (DAC), employs activity-based costing (ABC) The following budgeted data for each of the activity cost pools is provided for the year 2019. Activity Estimated Overhead Expected Use of Cost Drivers per Activity 100000 hours Meeting with clients 5,000,000.00 Preparing accounting files 500,000.00 50000 pages Reviewing files 9000 hours 450,000.00 During 2019 DAC had 8500 hours reviewing files, prepared 55000 pages, and 80000 with clients. Requirements 1. Compute the predetermined overhead allocation rates for each cost pool. 2. Compute the total overhead allocated during 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started