Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pls I need all the questions answered 6. Your roommate in Legon Hall of University of Ghana offers to pay you an annuity of GHS

Pls I need all the questions answered

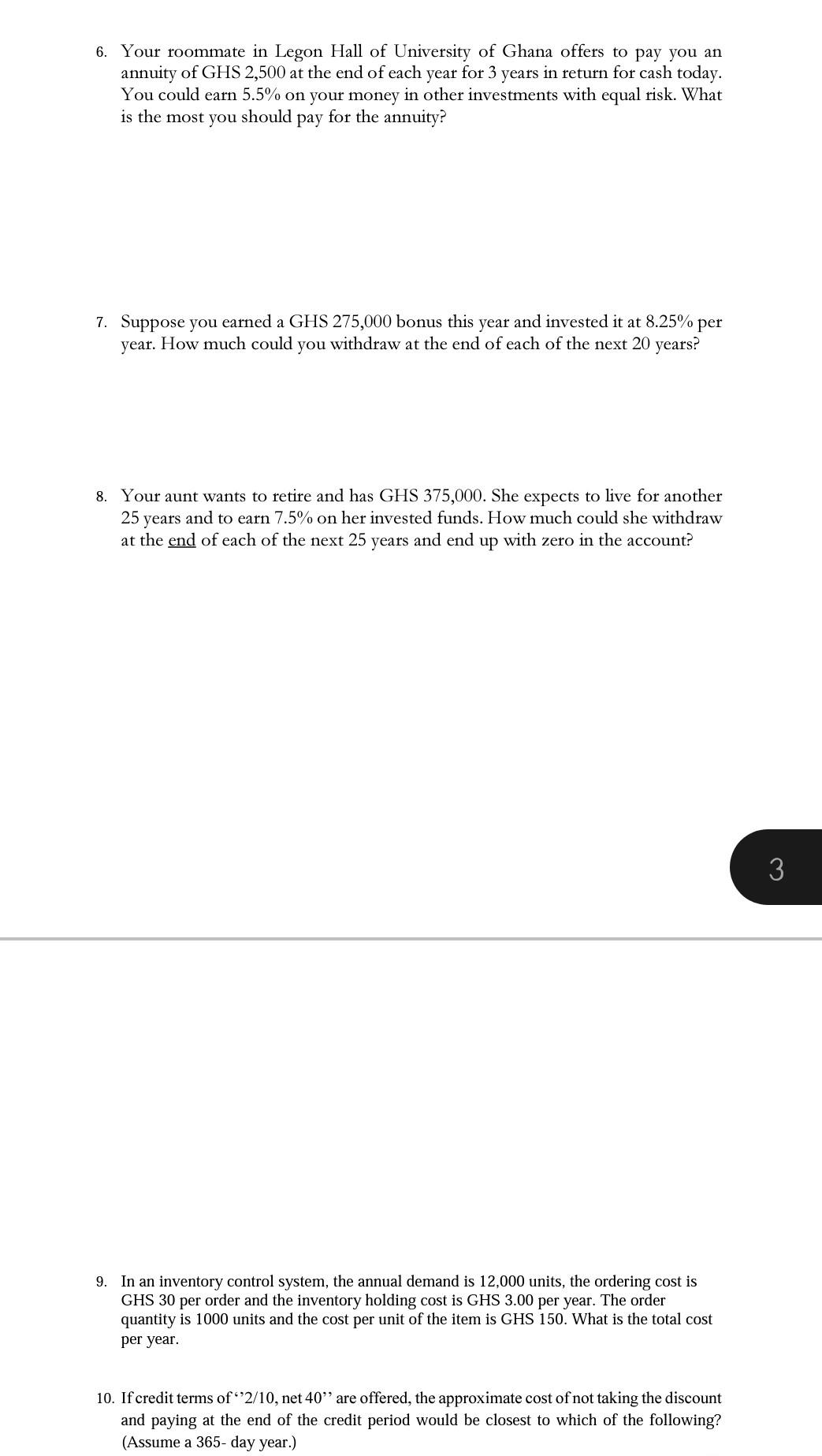

6. Your roommate in Legon Hall of University of Ghana offers to pay you an annuity of GHS 2,500 at the end of each year for 3 years in return for cash today. You could earn 5.5% on your money in other investments with equal risk. What is the most you should pay for the annuity? 7. Suppose you earned a GHS 275,000 bonus this year and invested it at 8.25% per year. How much could you withdraw at the end of each of the next 20 years? 8. Your aunt wants to retire and has GHS 375,000. She expects to live for another 25 years and to earn 7.5% on her invested funds. How much could she withdraw at the end of each of the next 25 years and end up with zero in the account? 3 9. In an inventory control system, the annual demand is 12,000 units, the ordering cost is GHS 30 per order and the inventory holding cost is GHS 3.00 per year. The order quantity is 1000 units and the cost per unit of the item is GHS 150. What is the total cost per year. 10. If credit terms of 2/10, net 40 are offered, the approximate cost of not taking the discount and paying at the end of the credit period would be closest to which of the following? (Assume a 365-day year.) 6. Your roommate in Legon Hall of University of Ghana offers to pay you an annuity of GHS 2,500 at the end of each year for 3 years in return for cash today. You could earn 5.5% on your money in other investments with equal risk. What is the most you should pay for the annuity? 7. Suppose you earned a GHS 275,000 bonus this year and invested it at 8.25% per year. How much could you withdraw at the end of each of the next 20 years? 8. Your aunt wants to retire and has GHS 375,000. She expects to live for another 25 years and to earn 7.5% on her invested funds. How much could she withdraw at the end of each of the next 25 years and end up with zero in the account? 3 9. In an inventory control system, the annual demand is 12,000 units, the ordering cost is GHS 30 per order and the inventory holding cost is GHS 3.00 per year. The order quantity is 1000 units and the cost per unit of the item is GHS 150. What is the total cost per year. 10. If credit terms of 2/10, net 40 are offered, the approximate cost of not taking the discount and paying at the end of the credit period would be closest to which of the following? (Assume a 365-day year.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started