pls i need it as soon as posible step by step

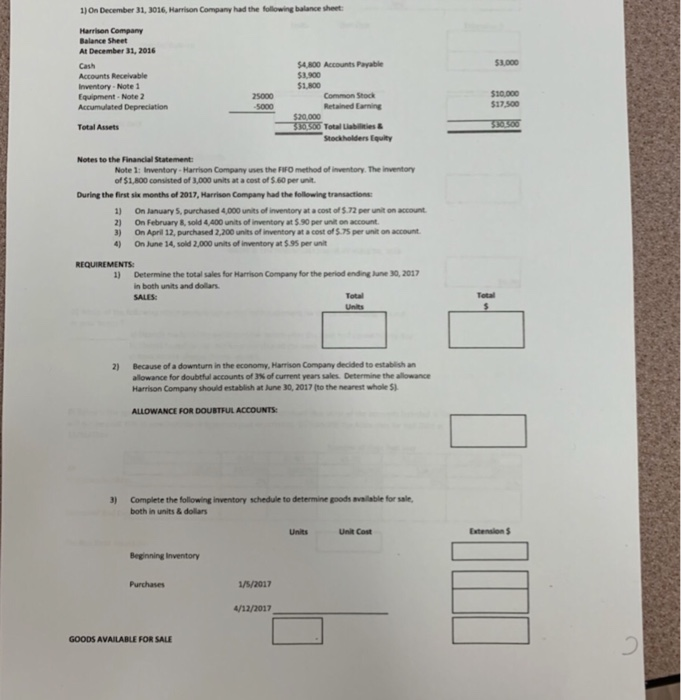

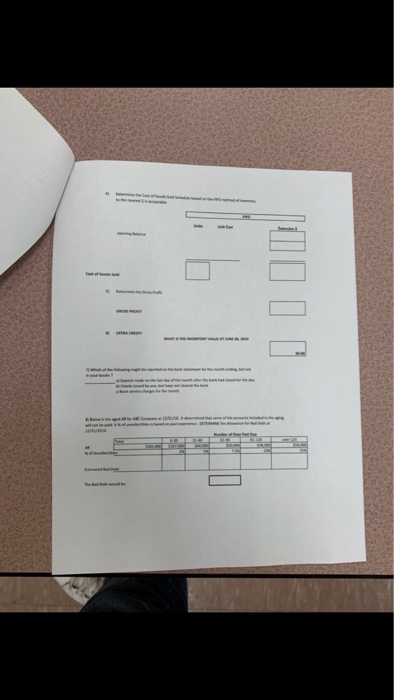

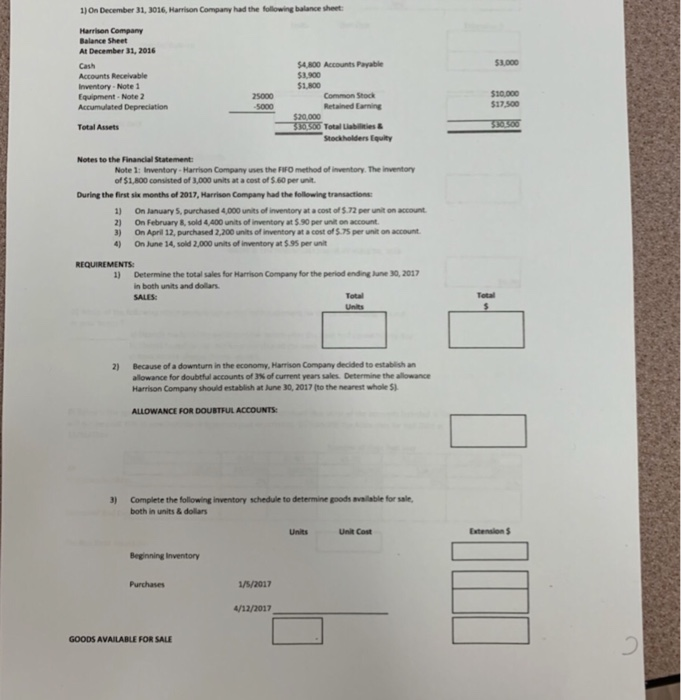

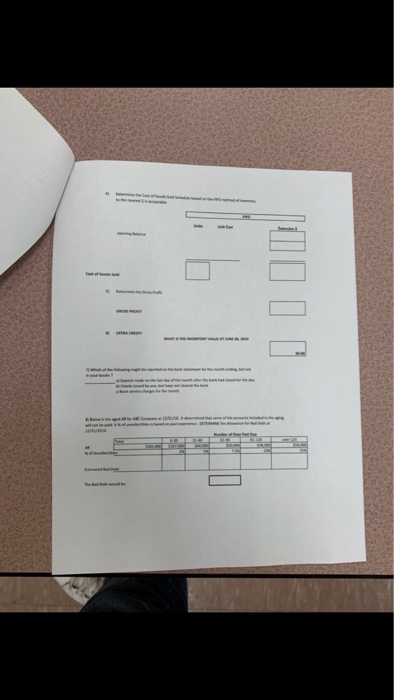

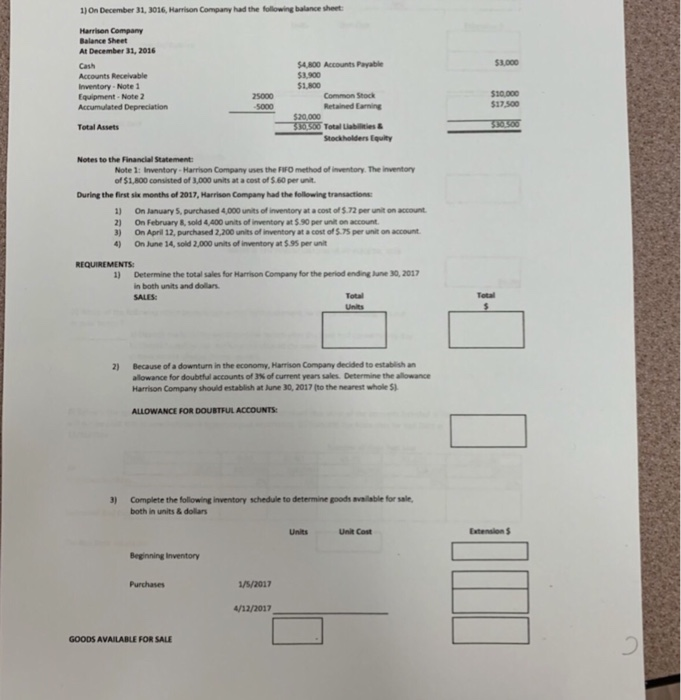

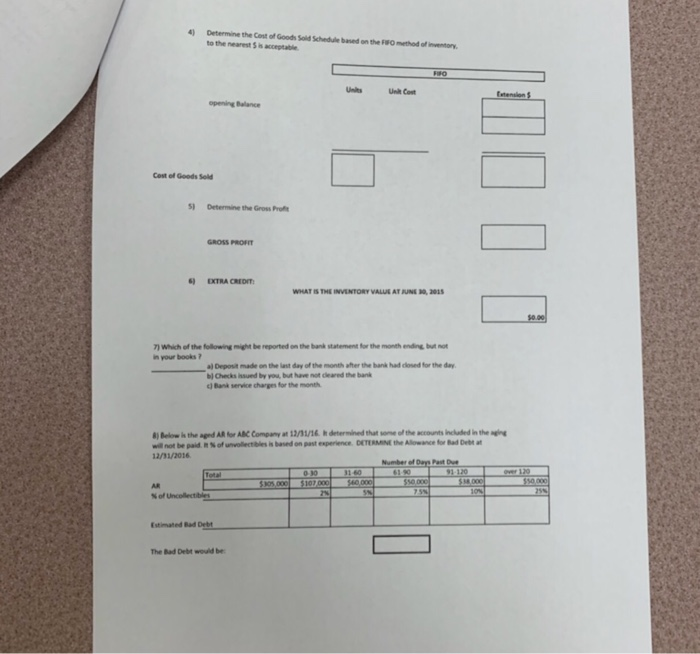

) On December 31, 3016 Harrison Company had the following balance sheet Marrisen Company Balance Sheet At December 31, 2016 $3,000 Cash Accounts Receivable Inventory-Note Equipment Note 2 $4,800 Accounts Payable 53,900 $1,800 Common Stock Retained Earning 10,000 $17,300 25000 $20,000 Total Assets Stockholders Equit Notes to the Financial Statement Note 1: Inventory-Harrison Company uves the FIFO method of inventory. The inventory of $1,800 consisted of 3,000 units at a cost of $.60 per unit During the first six months of 2017, Harrison Company had the following transactions 1) On January 5, purchased 4,000 units of inventory at a cost of $ 72 per unit on account 2) On February & sold 4,400 units of inventory at $ 90 per unit on account 3) On April 12, purchased 2,200 units of inventory at a cost of $.75 per unit on account 4) On June 14, sold 2,000 units of inventory at $.95 per unit REQUIREMENTS 1) Determine the total sales for Harrison Company for the period ending June 30, 2017 in both units and dolars SALES Total Total 2) Because of a downturn in the economy, Harrison Company decided to establish an allowance for doubtfual accounts of 3% of current years sales. Determine the allowance Harrison Company should establish at June 30, 2017 (to the nearest whole S ALLOWANCE FOR DOUBTFUL ACCOUNTS 3) Complete the following inventory schedule to determine goods avallable for sale both in units & dollars Extension Beginning Inventory Purchases 1/5/2017 4/12/2017 GOODS AVAILABLE FOR SALE 1) On December 31, 3016, Harmison Company had the following balance sheet Harrison Company Balance Sheet At December 31, 2016 $3,000 Cash Accounts Receivable Inventory-Note Equipment Note 2 $4,800 Accounts Payable $3,900 $1,800 Common Stock Retained Earning 10,000 17,500 25000 520,000 Total Assets Stockholders Equit Notes to the Financial Statement Note 1 : Inventory . Harrison Company uses the FIFO method oivent of$1NO comited of 3,000 units at a osso per unit. The memory During the first six months of 2017, Harrison Company had the following transactions 1) On January 5, purchased 4,000 units of inventory at a cost of $ 72 per unit on acount 2) On February & sold 4,400 units of inventory at $.90 per unit on account 3) O, Apr. 12, purchased 2.200 units of inventory at #costof$.75 onaccovm 4) On June 14, sold 2,000 units of inventory at $.95 per unit REQUIREMENTS 1) Determine the total sales for Harrison Company for the period ending June 30, 2017 in both units and dolans SALES Total 2) Because of a downturn in the economy, Harrison Company decided to establishan allowance for doubtful accounts of 3% of current years sales. Determine the allowance Harrison Company should establish at June 30, 2017 (to the nearest whole S ALLOWANCE FOR DOUBTFUL ACCOUNTS 3) Complete the following inventory schedule to determine goods avallable for sale, both in units & dollars Units Unit Cost Extension Beginning Inventory Purchases 1/5/2017 4/12/2017 GOODS AVAILABLE FOR SALE 4) Determine the Cost of Goods Sold Schedule based on the FO method of inventory to the nearest 5 is accepitable opening Balance Cest of Goods Sold Determine the Gross Profl GROSS PROFIT EXTRA CREDIT WHAT IS THE INVENTORY VALUE AT PUNE , 201 n your books aj Deposit made on the last day of the month aher the bank had closed for the day bl Checks issued by you, but have not dleared the bank cj Bank service charges for the month Below iks the aged All for AC Company at 12/31/16 determined that soe of the accounts incladed in the gi 12/31/2016. Number of Dys st AR %of Estimated Bad Debt The Bad Debt wouid be