pls i need the CAD schedule

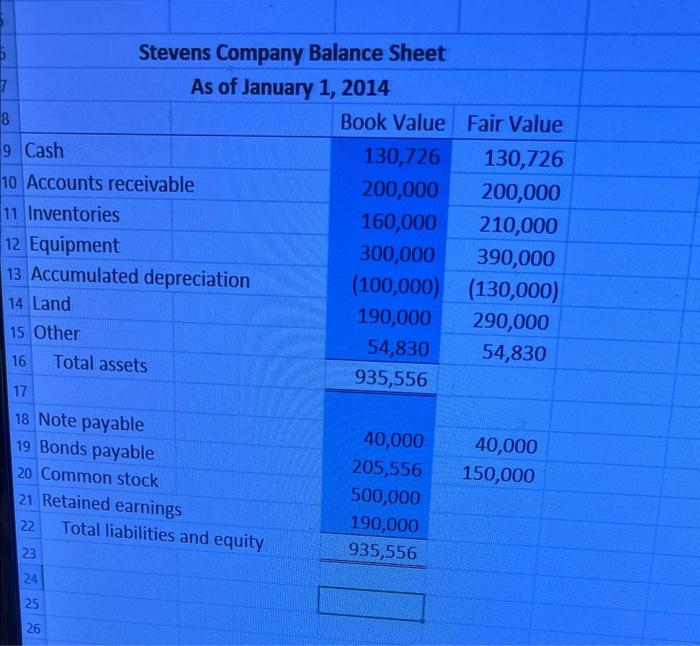

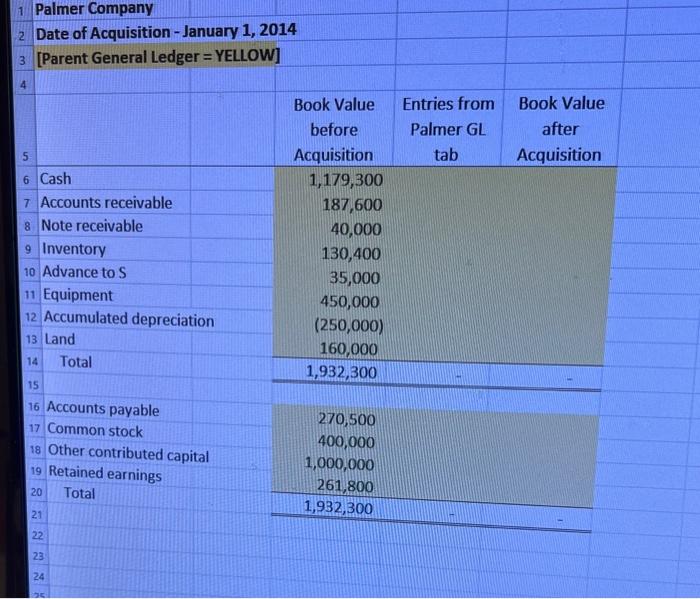

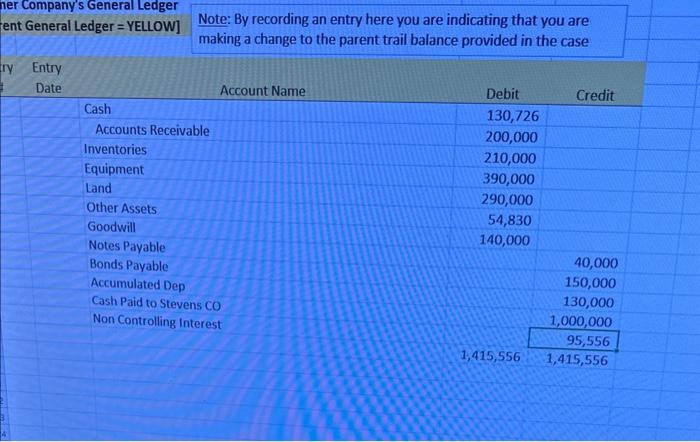

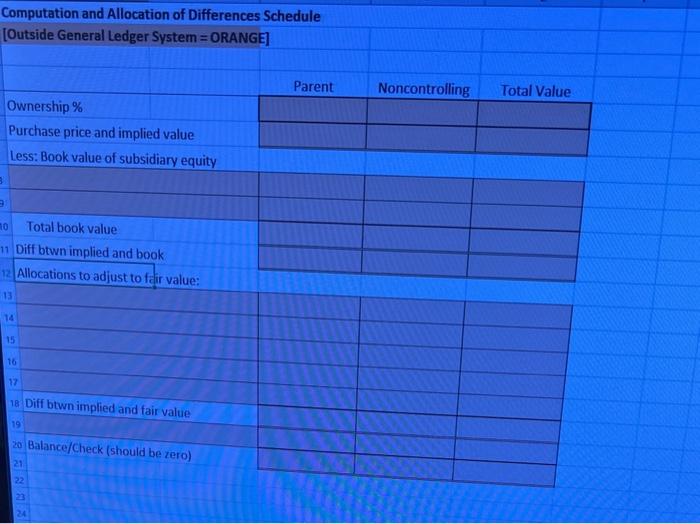

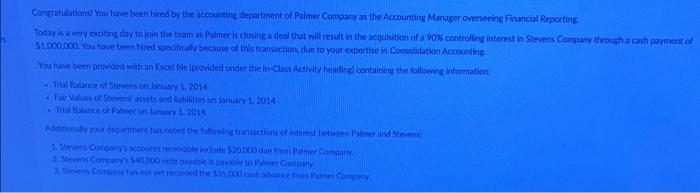

Corqratulations: You have bech hired by the accounting departinent of Palines Company as the Acmonting Maroger oversecing Fintncial Reporting Today is a very escibng day toyoin the team av Paliner is closing a deal that wall rewilt in the acquisition of a 90% coatrabling interest in Stevens Conpany throush a casth payment of Si co0,coo. You tuve beeh hired specinaly becauue of this transaction dae to your expertive in Consollathoo Accounting You have been provided whth an Excet flie iprovided under the in-Ctisc Actwity hepding containing the following ifformation: - Trial Bsiance oitstiveds on daniary 1, 2014 - Fair Values of Ctevens onsits and hatilicies tin danuary 1, 2014. - Trial talarke ol Paliner an kimuarn 1,2014 2 Stivers Crompand 140 poo notr gapale N travable to Palince Company. Stevens Company Balance Sheet As of January 1, 2014 1 Palmer Company Date of Acquisition - January 1, 2014 [Parent General Ledger = YELLOW] ner Company's General Ledger ent General Ledger = YELLOW] Note: By recording an entry here you are indicating that you are making a change to the parent trail balance provided in the case Entry Date Account Name Debit Credit Cash 130,726 Accounts Receivable Inventories Equipment Land Other Assets Goodwill Notes Payable Bonds Payable Accumulated Dep Cash Paid to Stevens CO Non Controlling Interest Computation and Allocation of Differences Schedule [Outside General Ledger System = ORANGE] \begin{tabular}{|l|l|l|l|} \hline Ownership % & Parent & Noncontrolling & Total Value \\ \hline Purchase price and implied value & & & \\ \hline Less: Book value of subsidiary equity & & & \\ \hline \end{tabular} Total book value Diff btwn implied and book Allocations to adjust to fair value: Diff btwn implied and fair value Balance/Check (should be zero) Corqratulations: You have bech hired by the accounting departinent of Palines Company as the Acmonting Maroger oversecing Fintncial Reporting Today is a very escibng day toyoin the team av Paliner is closing a deal that wall rewilt in the acquisition of a 90% coatrabling interest in Stevens Conpany throush a casth payment of Si co0,coo. You tuve beeh hired specinaly becauue of this transaction dae to your expertive in Consollathoo Accounting You have been provided whth an Excet flie iprovided under the in-Ctisc Actwity hepding containing the following ifformation: - Trial Bsiance oitstiveds on daniary 1, 2014 - Fair Values of Ctevens onsits and hatilicies tin danuary 1, 2014. - Trial talarke ol Paliner an kimuarn 1,2014 2 Stivers Crompand 140 poo notr gapale N travable to Palince Company. Stevens Company Balance Sheet As of January 1, 2014 1 Palmer Company Date of Acquisition - January 1, 2014 [Parent General Ledger = YELLOW] ner Company's General Ledger ent General Ledger = YELLOW] Note: By recording an entry here you are indicating that you are making a change to the parent trail balance provided in the case Entry Date Account Name Debit Credit Cash 130,726 Accounts Receivable Inventories Equipment Land Other Assets Goodwill Notes Payable Bonds Payable Accumulated Dep Cash Paid to Stevens CO Non Controlling Interest Computation and Allocation of Differences Schedule [Outside General Ledger System = ORANGE] \begin{tabular}{|l|l|l|l|} \hline Ownership % & Parent & Noncontrolling & Total Value \\ \hline Purchase price and implied value & & & \\ \hline Less: Book value of subsidiary equity & & & \\ \hline \end{tabular} Total book value Diff btwn implied and book Allocations to adjust to fair value: Diff btwn implied and fair value Balance/Check (should be zero)