Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls provide the ans of this ques as fast you acn do Current Attempt in Progress The unadjusted trial balance for Sandhill Designs at its

pls provide the ans of this ques as fast you acn do

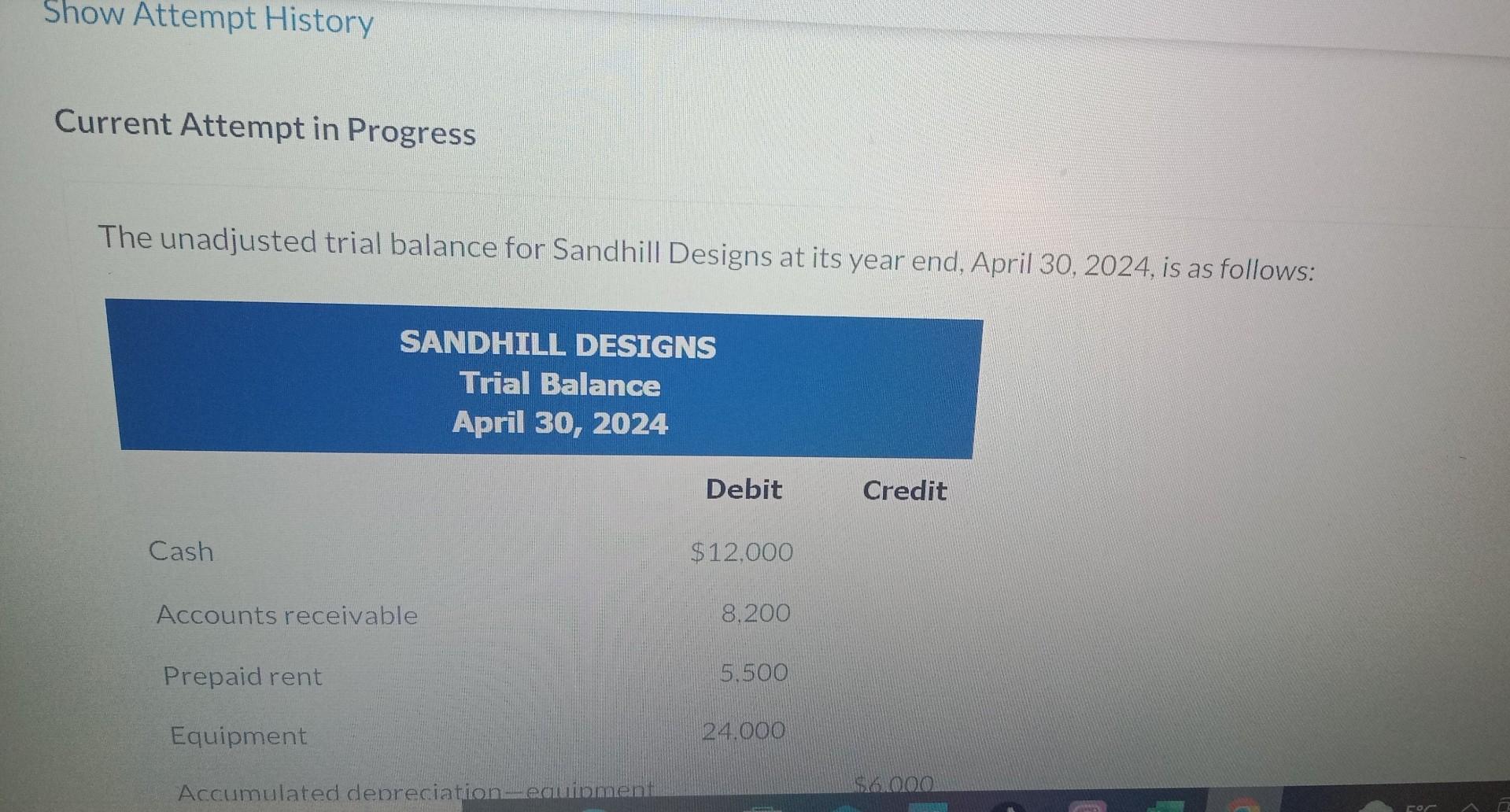

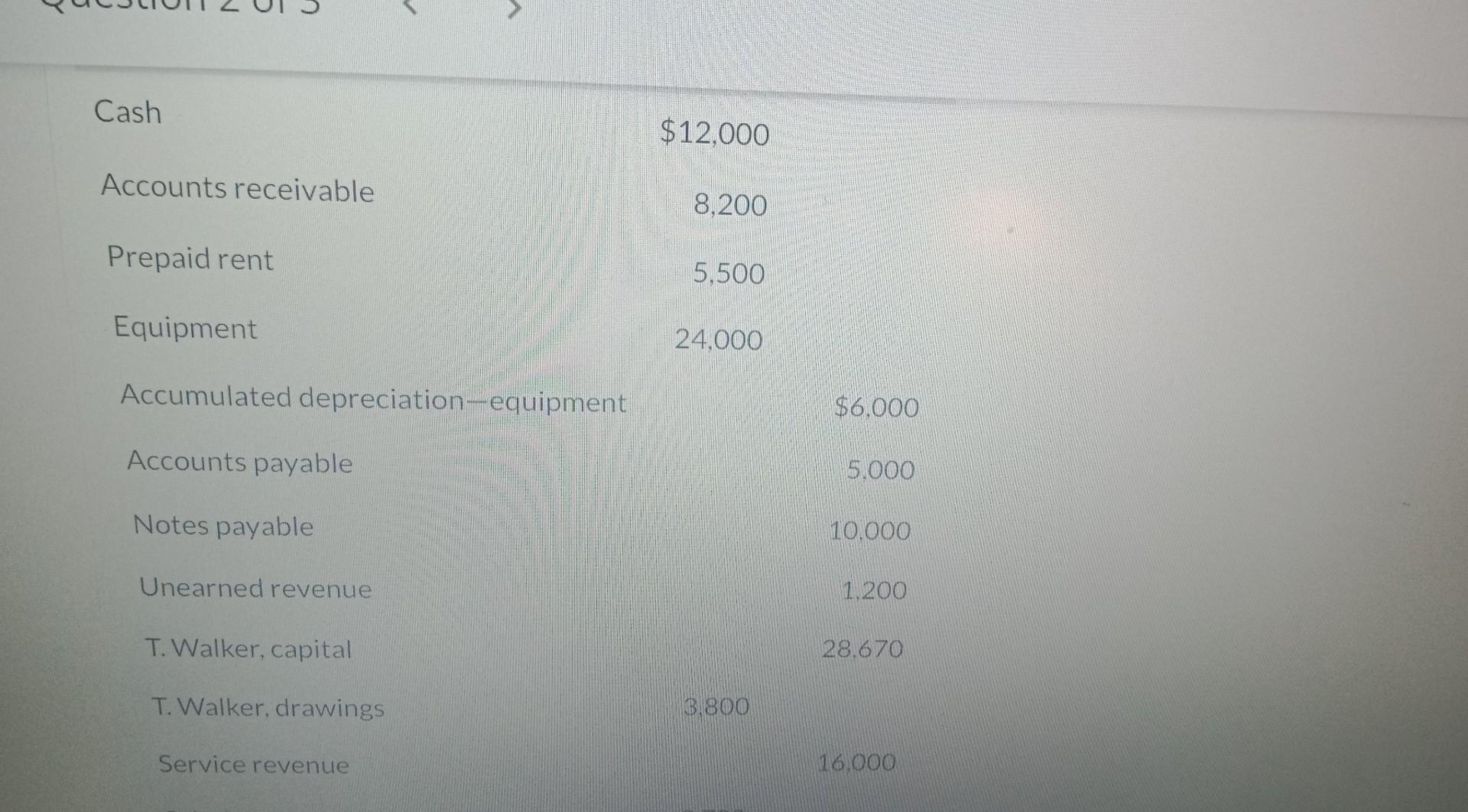

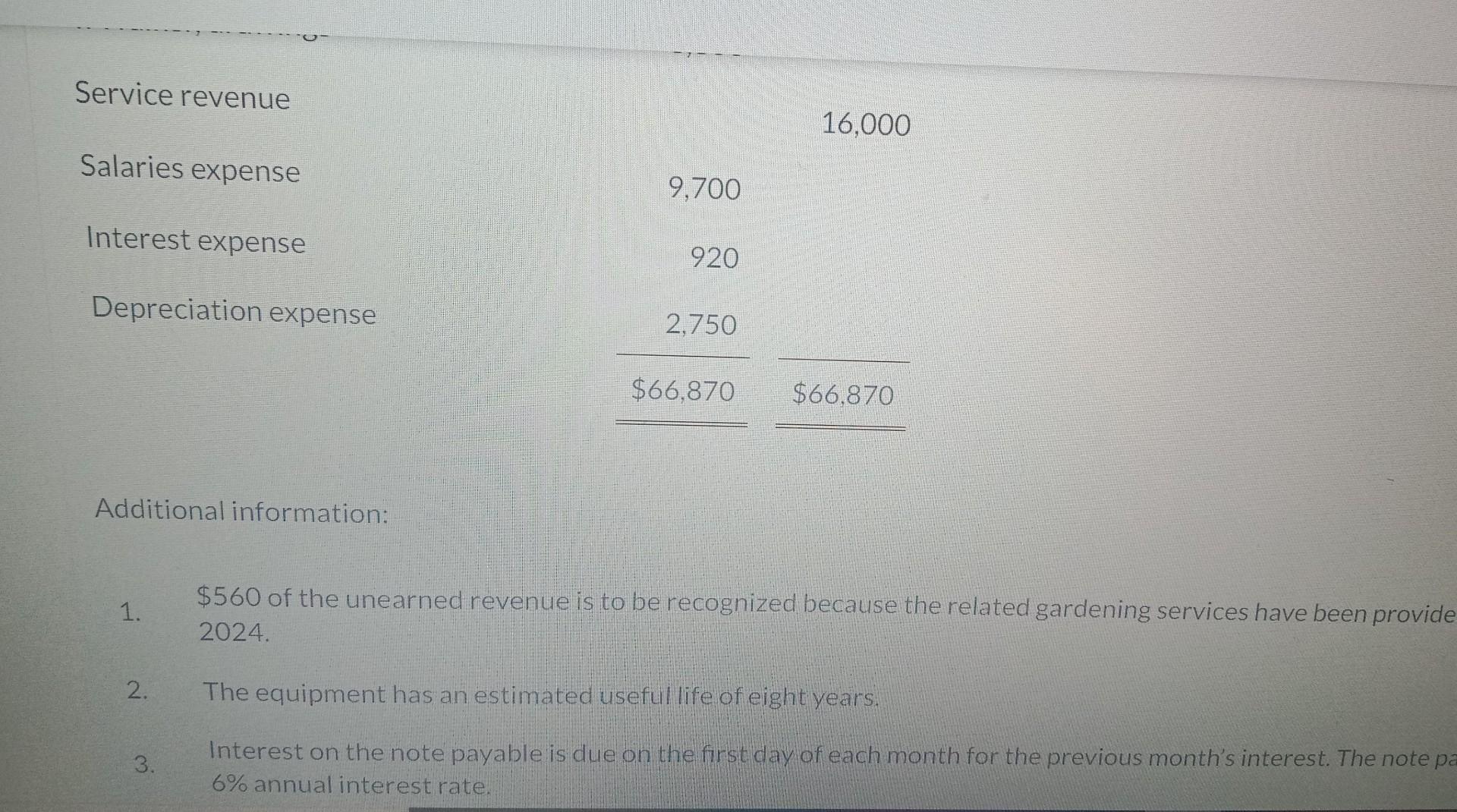

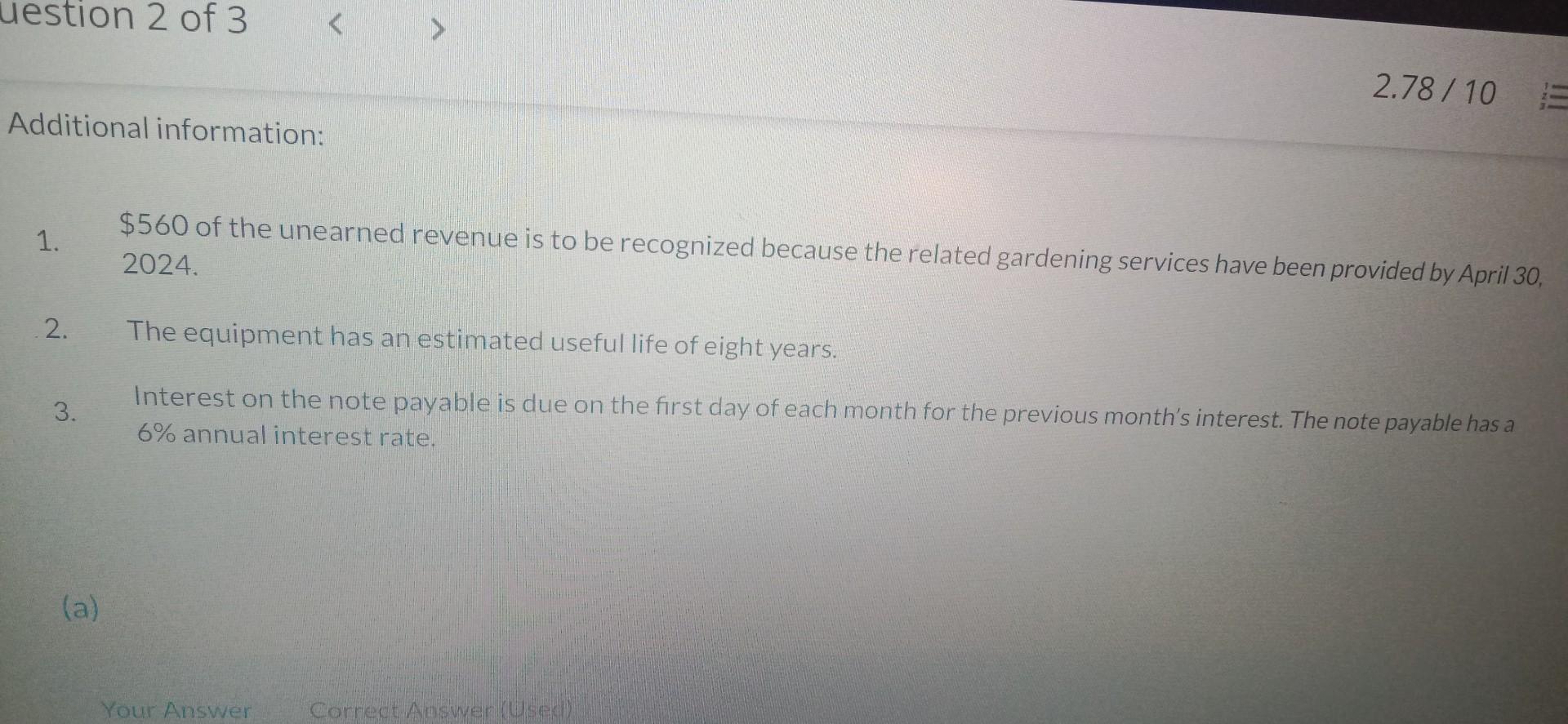

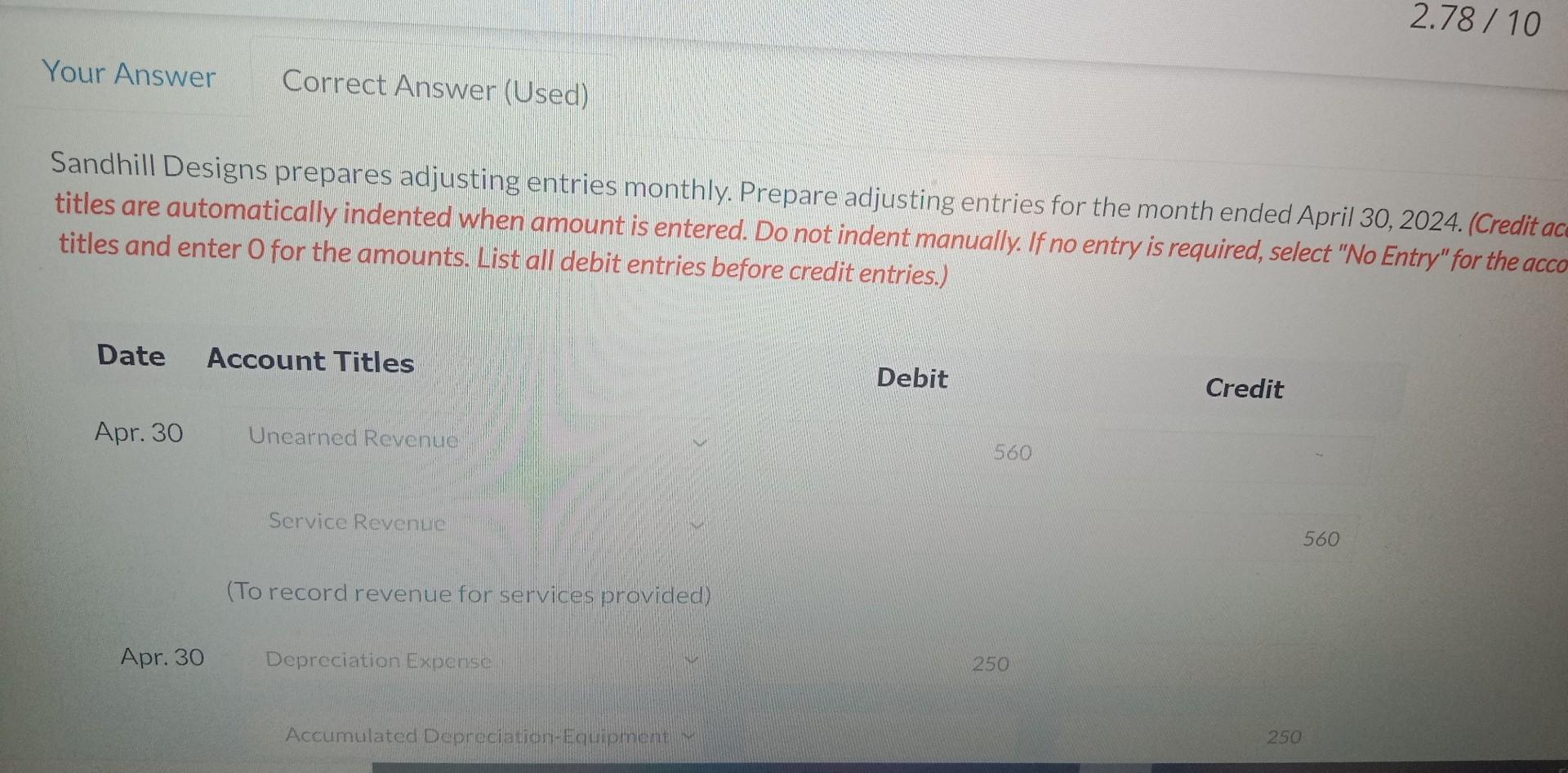

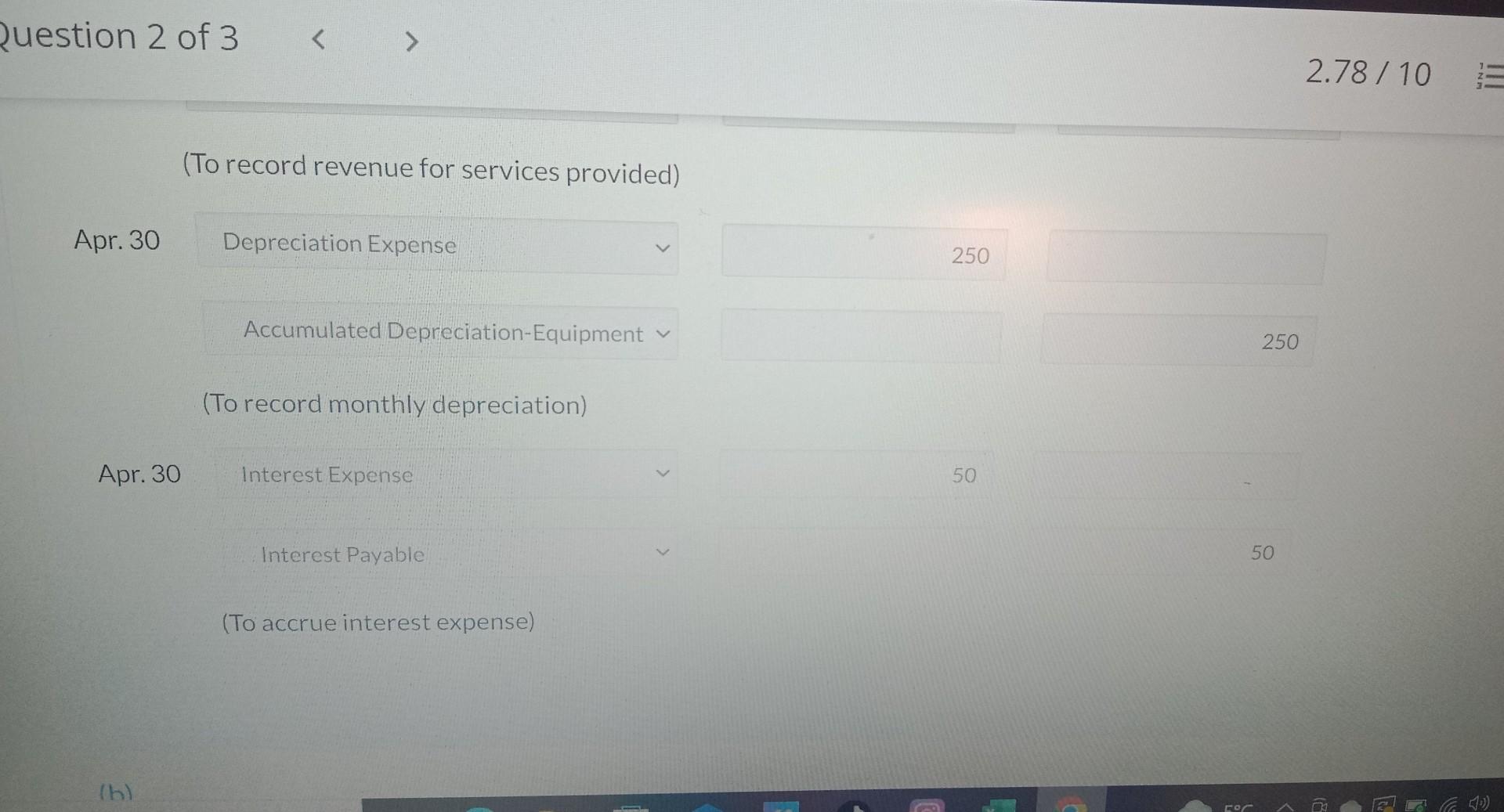

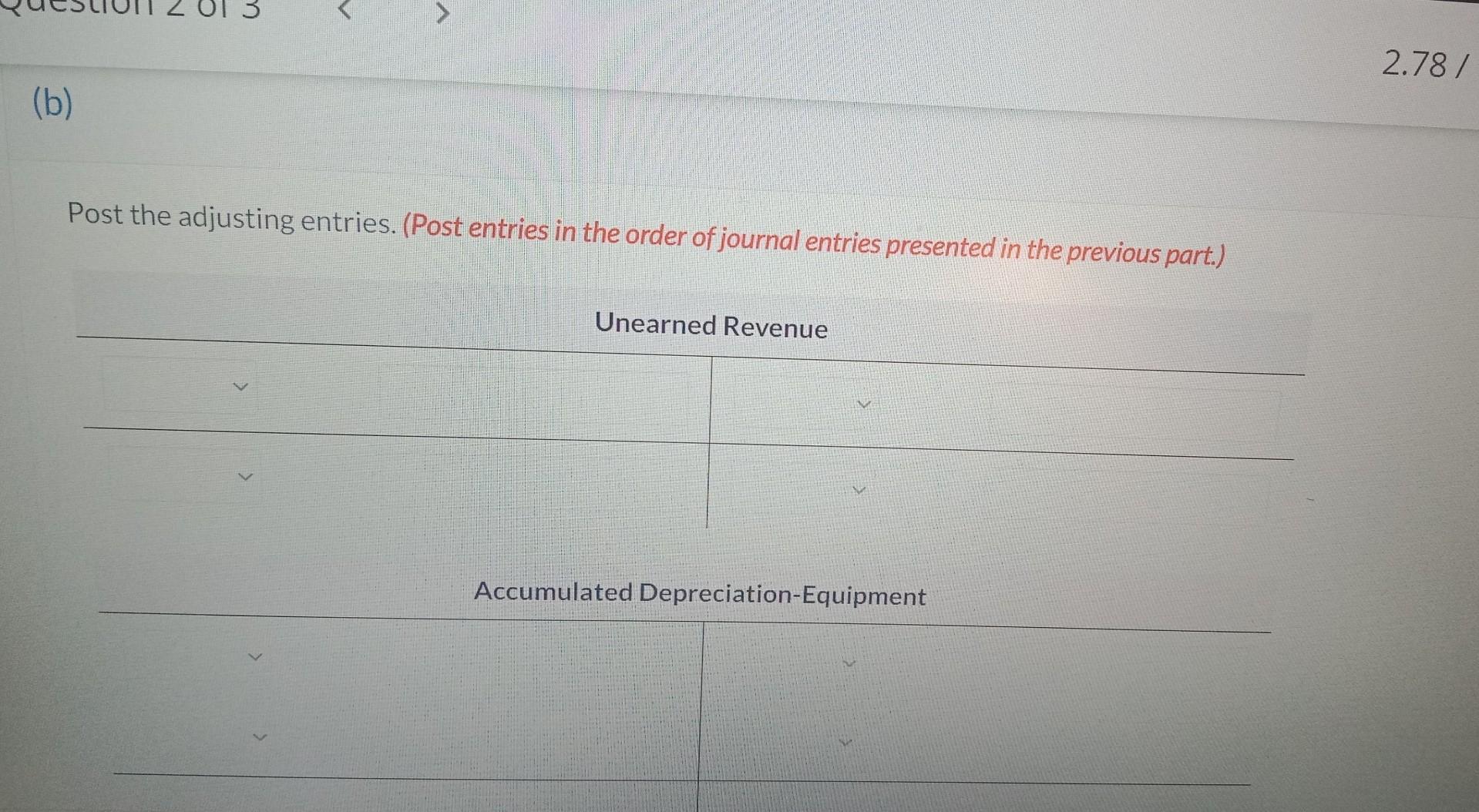

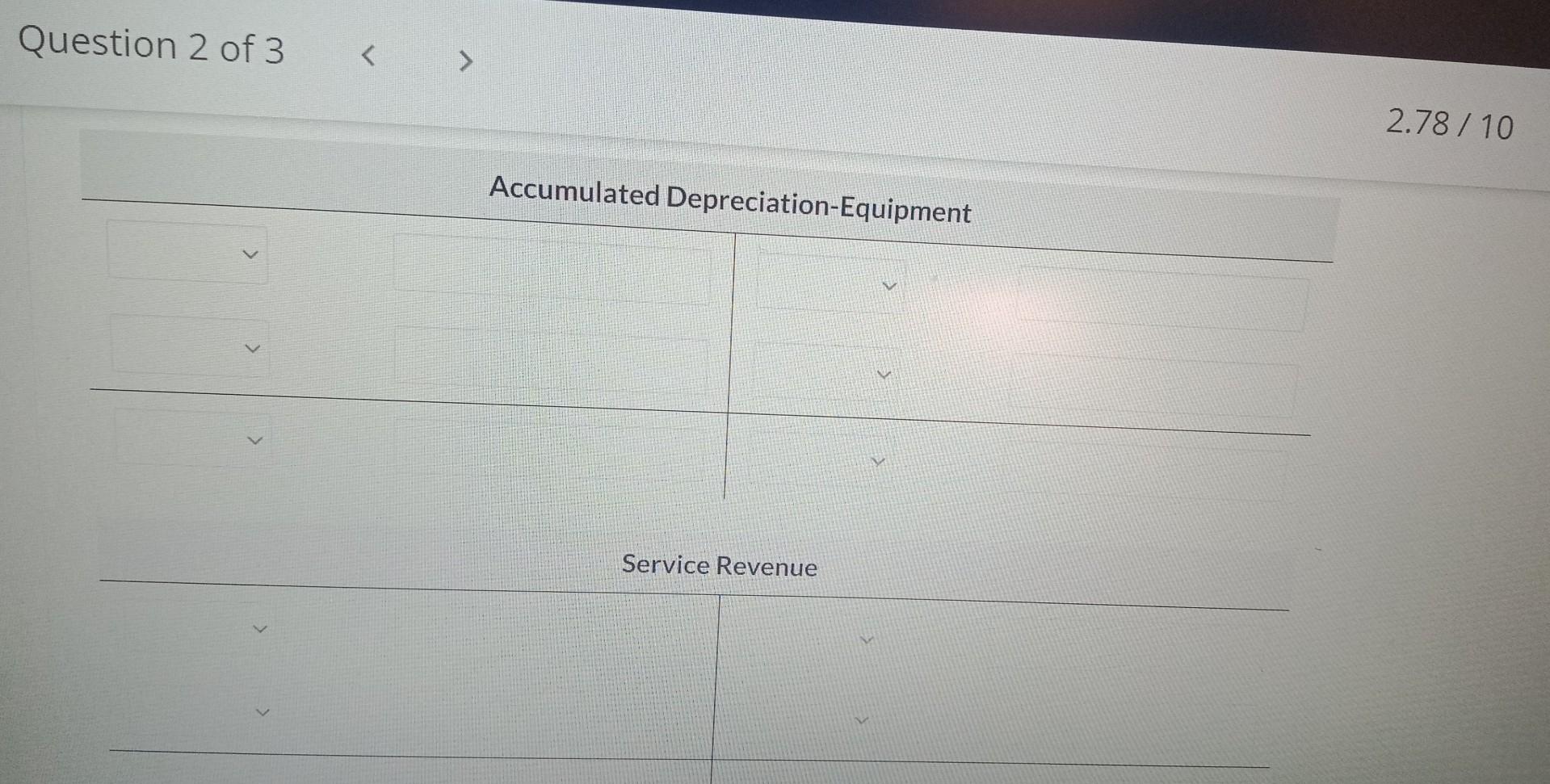

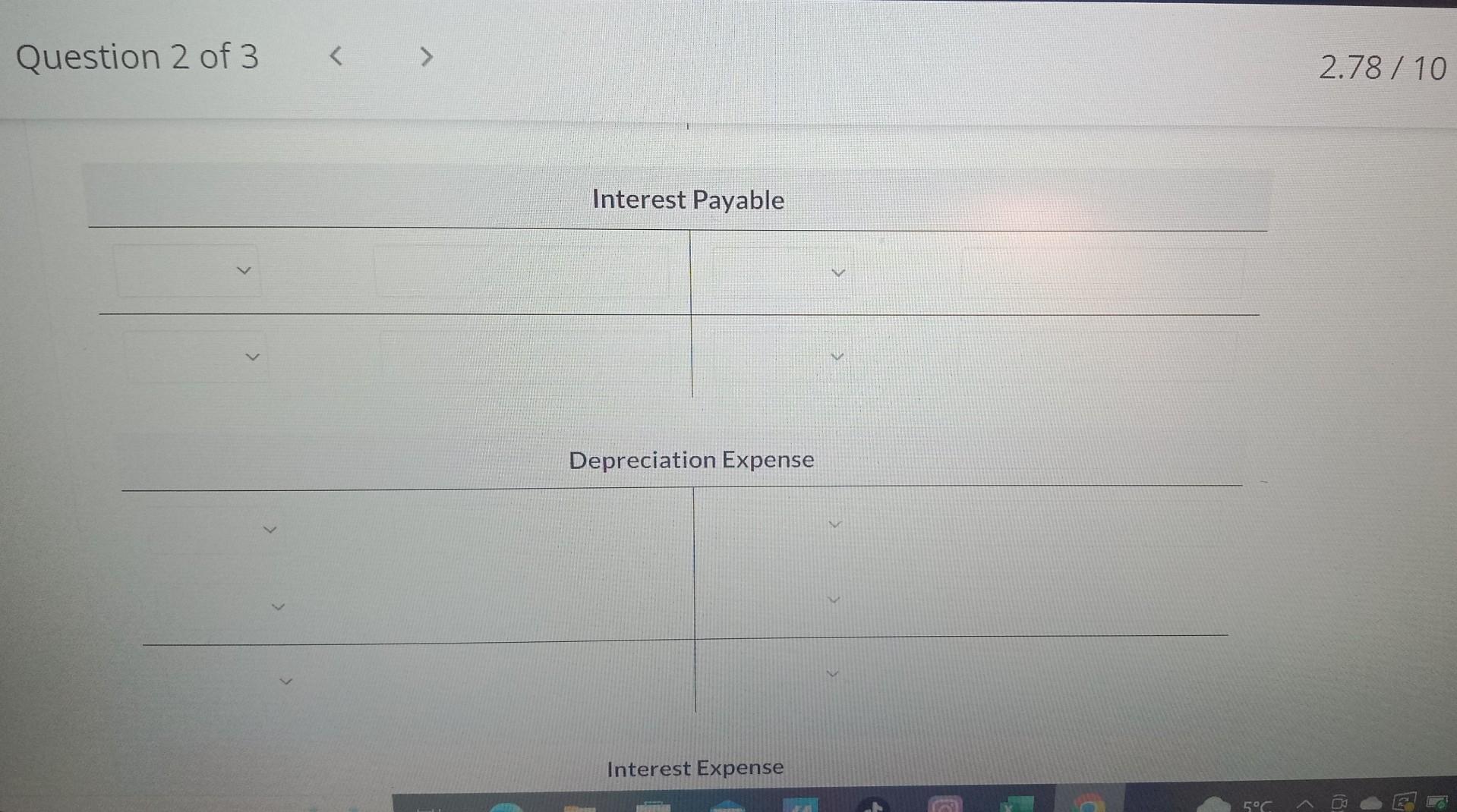

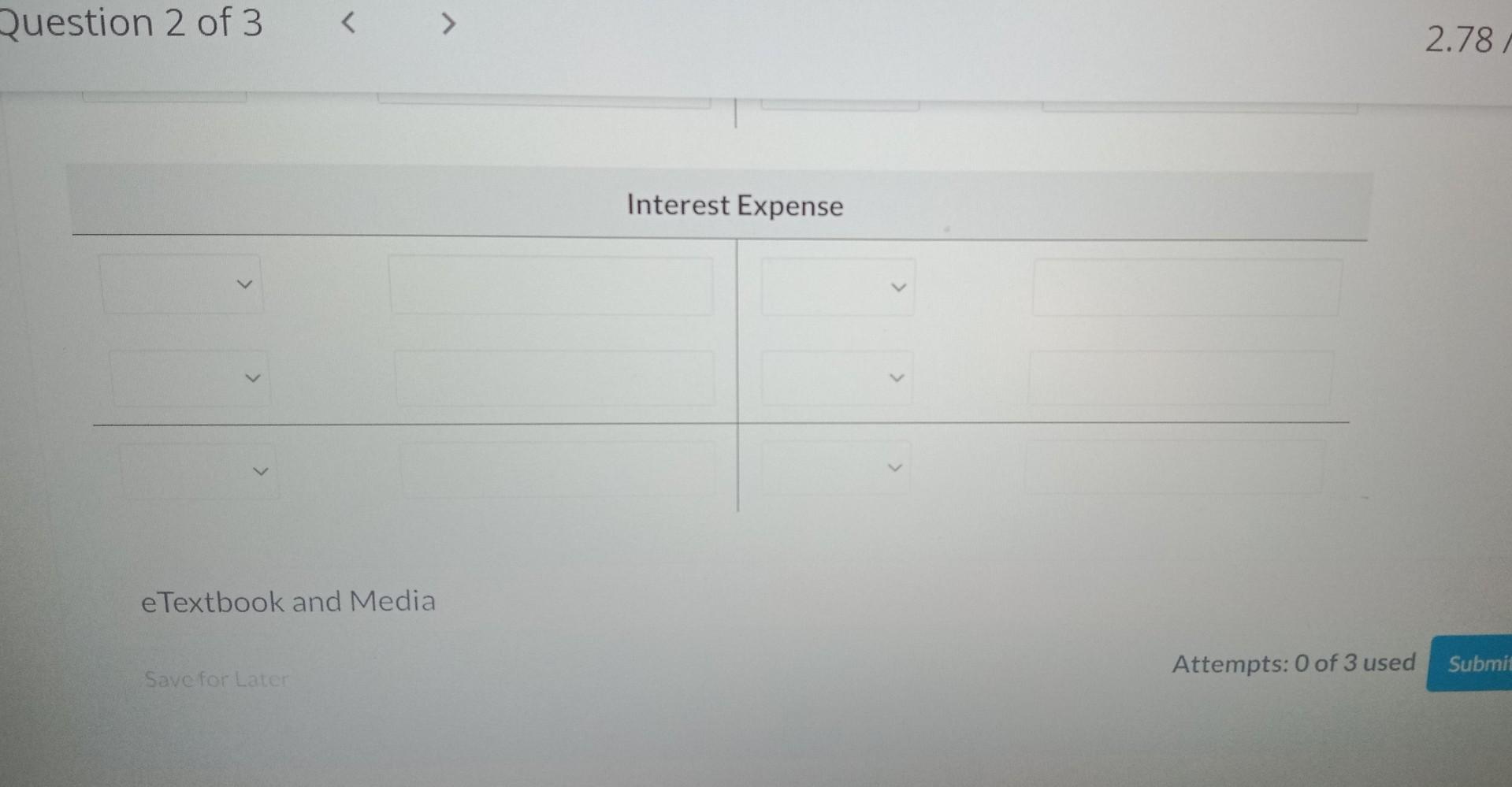

Current Attempt in Progress The unadjusted trial balance for Sandhill Designs at its year end, April 30,2024 , is as follows: Cash $12,000 Accounts receivable 8,200 Prepaid rent 5,500 Equipment 24,000 Accumulated depreciation-equipment $6.000 Accounts payable 5.000 Notes payable 10.000 Unearned revenue 1.200 T. Walker, capital 28.670 T. Walker, drawings 3.800 Service revenue 16.000 Additional information: 1. $560 of the unearned revenue is to be recognized because the related gardening services have been provide 2024. 2. The equipment has an estimated useful life of eight years. 3. Interest on the note payable is due on the first day of each month for the previous month's interest. The note pe 6% annual interest rate. 1. $560 of the unearned revenue is to be recognized because the related gardening services have been provided by April 30 , 2024. 2. The equipment has an estimated useful life of eight years. 3. Interest on the note payable is due on the first day of each month for the previous month's interest. The note payable has a 6% annual interest rate. Sandhill Designs prepares adjusting entries monthly. Prepare adjusting entries for the month ended April 30,2024 . (Credit ac titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the acco titles and enter 0 for the amounts. List all debit entries before credit entries.) 2uestion 2 of 3 (To record revenue for services provided) Apr. 30 Depreciation Expense Accumulated Depreciation-Equipment 250 (To record monthly depreciation) Apr. 30 Interest Expense 50 Interest Payable 50 (To accrue interest expense) Post the adjusting entries. (Post entries in the order of journal entries presented in the previous part.) Question 2 of 3 2.78/10 Accumulated Depreciation-Equipment Service Revenue Question 2 of 3 2.78/10 Interest Payable Depreciation Expense Interest Expense Question 2 of 3 2.781 Interest Expense eTextbook and Media Attempts: 0 of 3 usedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started