Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls quickly I need it clear and not long Question #1: Case study on Cash Flow Project Decision Based on Cash flow Forecast Eric Casting

pls quickly

I need it clear and not long

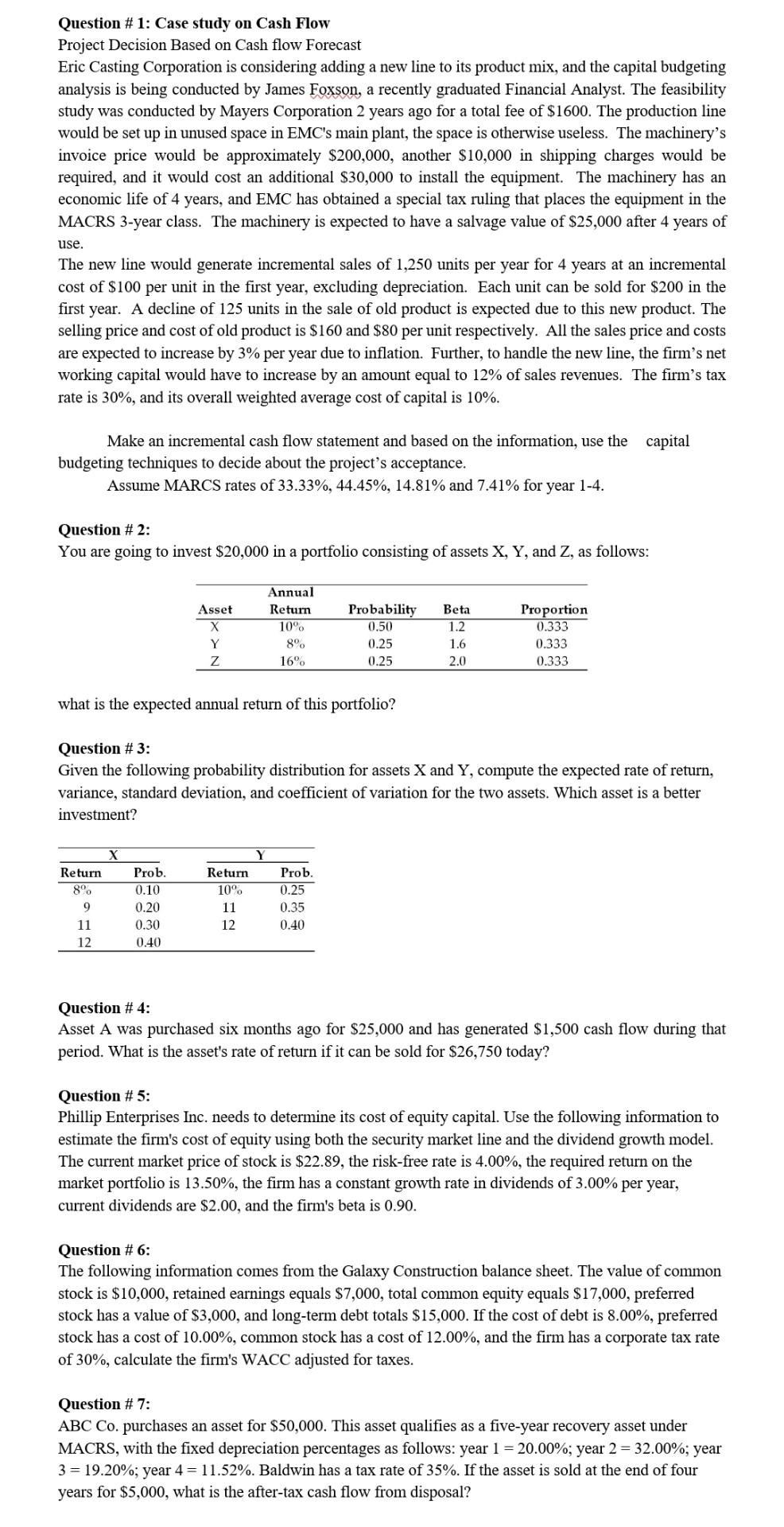

Question #1: Case study on Cash Flow Project Decision Based on Cash flow Forecast Eric Casting Corporation is considering adding a new line to its product mix, and the capital budgeting analysis is being conducted by James Foxson, a recently graduated Financial Analyst. The feasibility study was conducted by Mayers Corporation 2 years ago for a total fee of $1600. The production line would be set up in unused space in EMC's main plant, the space is otherwise useless. The machinery's invoice price would be approximately $200,000, another $10,000 in shipping charges would be required, and it would cost an additional $30,000 to install the equipment. The machinery has an economic life of 4 years, and EMC has obtained a special tax ruling that places the equipment in the MACRS 3-year class. The machinery is expected to have a salvage value of $25,000 after 4 years of use. The new line would generate incremental sales of 1,250 units per year for 4 years at an incremental cost of $100 per unit in the first year, excluding depreciation. Each unit can be sold for $200 in the first year. A decline of 125 units in the sale of old product is expected due to this new product. The selling price and cost of old product is $160 and $80 per unit respectively. All the sales price and costs are expected to increase by 3% per year due to inflation. Further, to handle the new line, the firm's net working capital would have to increase by an amount equal to 12% of sales revenues. The firm's tax rate is 30%, and its overall weighted average cost of capital is 10%. Make an incremental cash flow statement and based on the information, use the capital budgeting techniques to decide about the project's acceptance. Assume MARCS rates of 33.33%, 44.45%, 14.81% and 7.41% for year 1-4. Question #2: You are going to invest $20,000 in a portfolio consisting of assets X, Y, and Z, as follows: Asset X Y Z Annual Return 10% 8% 16 Probability 0.50 0.25 0.25 Beta 1.2 1.6 2.0 Proportion 0.333 0.333 0.333 what is the expected annual return of this portfolio? Question # 3: Given the following probability distribution for assets X and Y, compute the expected rate of return, variance, standard deviation, and coefficient of variation for the two assets. Which asset is a better investment? X Return 8% 9 11 12 Prob. 0.10 0.20 0.30 0.40 Y Return 10% 11 12 Prob. 0.25 0.35 0.40 Question #4: Asset A was purchased six months ago for $25,000 and has generated $1,500 cash flow during that period. What is the asset's rate of return if it can be sold for $26,750 today? Question #5: Phillip Enterprises Inc. needs to determine its cost of equity capital. Use the following information to estimate the firm's cost of equity using both the security market line and the dividend growth model. The current market price of stock is $22.89, the risk-free rate is 4.00%, the required return on the market portfolio is 13.50%, the firm has a constant growth rate in dividends of 3.00% per year, current dividends are $2.00, and the firm's beta is 0.90. Question #6: The following information comes from the Galaxy Construction balance sheet. The value of common stock is $10,000, retained earnings equals $7,000, total common equity equals $17,000, preferred stock has a value of $3,000, and long-term debt totals $15,000. If the cost of debt is 8.00%, preferred stock has a cost of 10.00%, common stock has a cost of 12.00%, and the firm has a corporate tax rate of 30%, calculate the firm's WACC adjusted for taxes. Question #7: ABC Co. purchases an asset for $50,000. This asset qualifies as a five-year recovery asset under MACRS, with the fixed depreciation percentages as follows: year 1 = 20.00%; year 2 = 32.00%; year 3 = 19.20%; year 4 = 11.52%. Baldwin has a tax rate of 35%. If the asset is sold at the end of four years for $5,000, what is the after-tax cash flow from disposalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started