PLS SHOW AND EXPLAIN HOW TO DO REQUIREMENT 3 ONLY. PLS AND THANK YOU

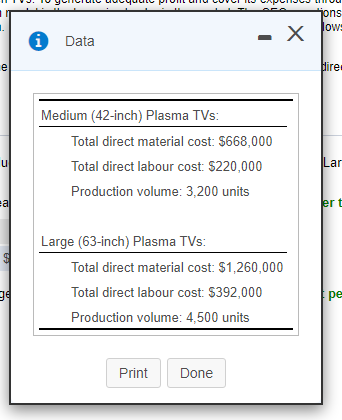

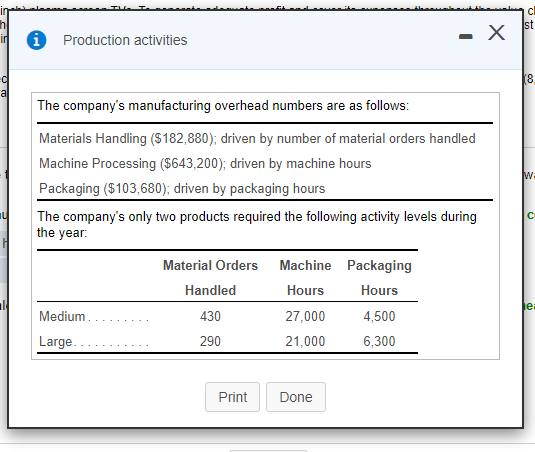

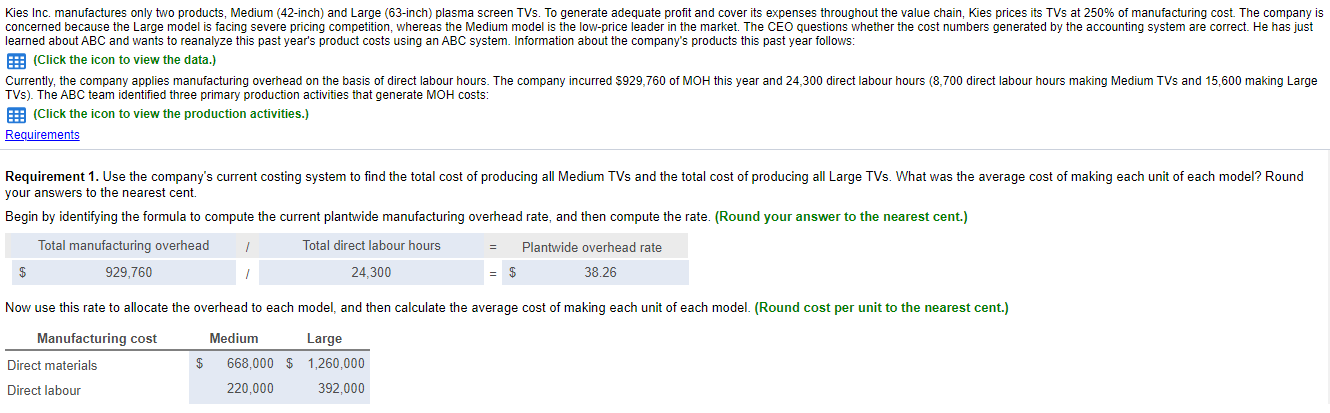

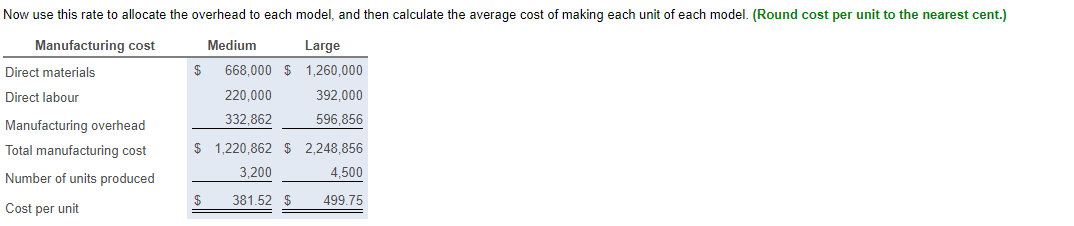

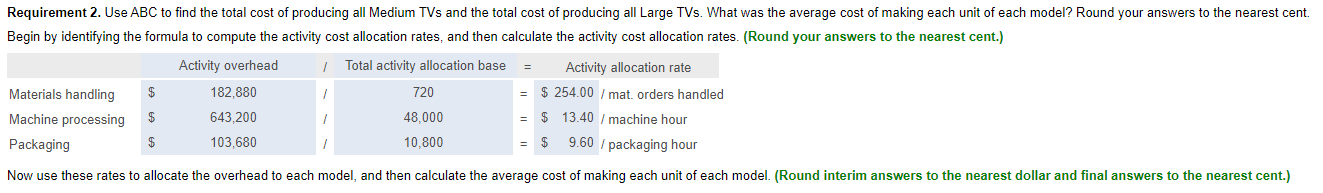

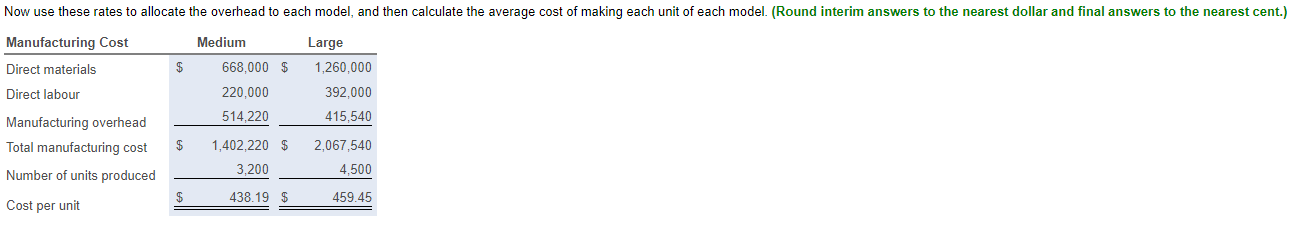

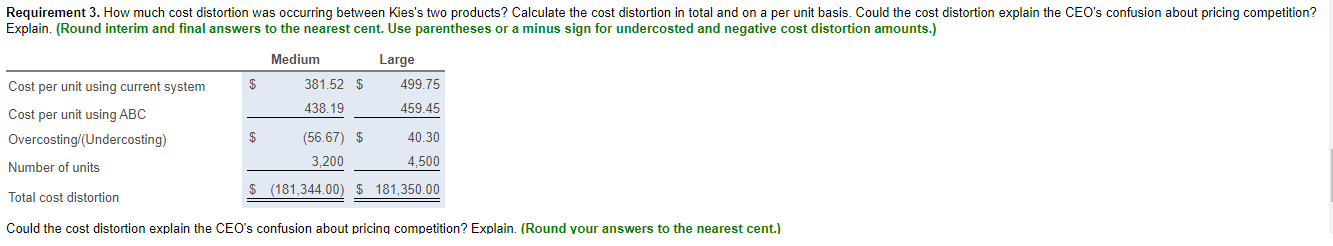

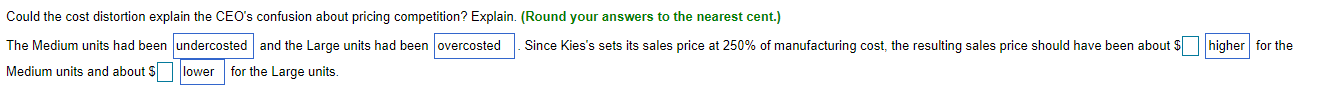

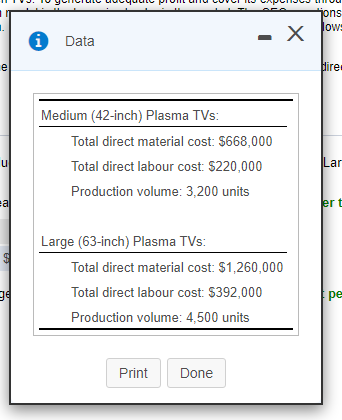

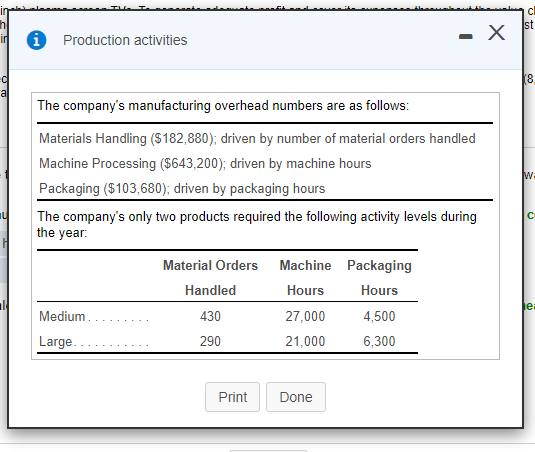

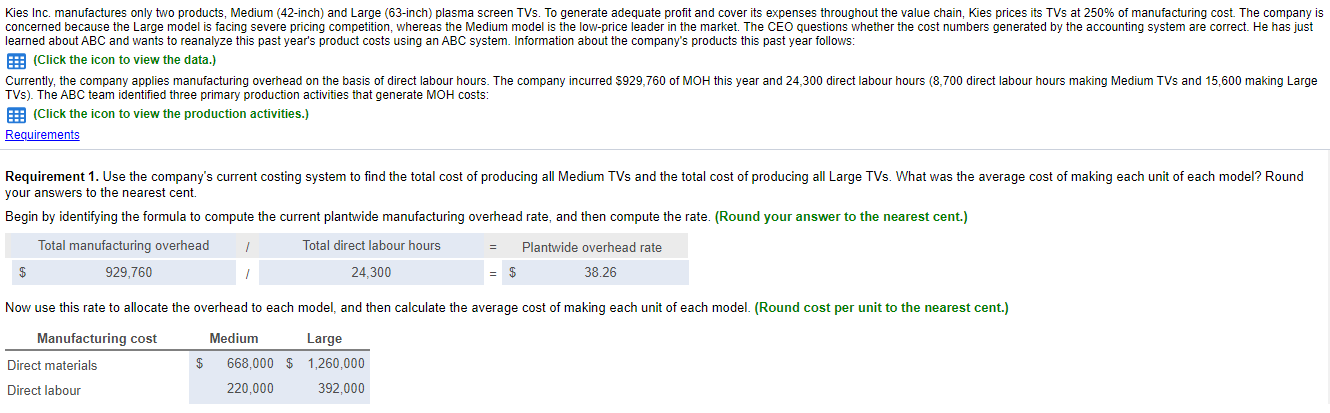

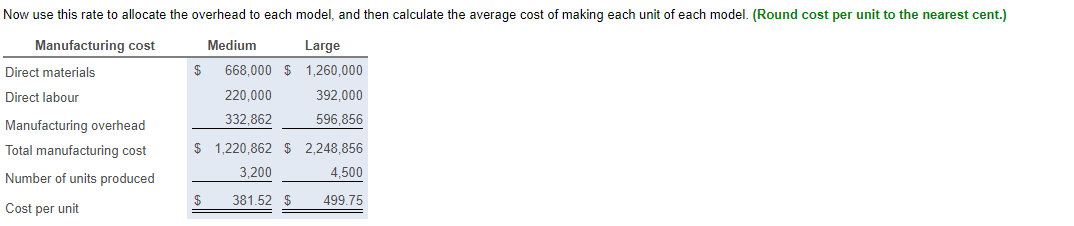

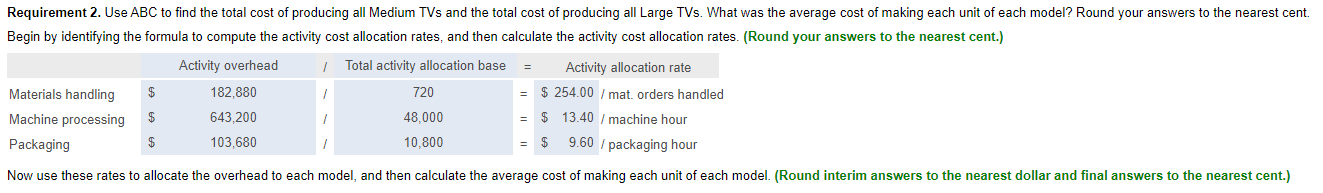

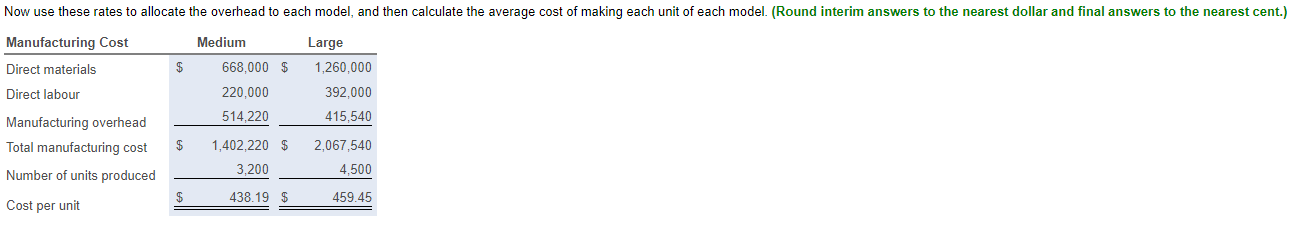

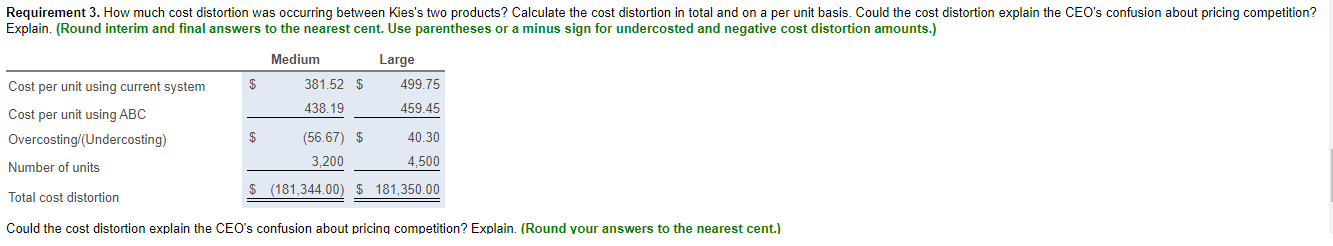

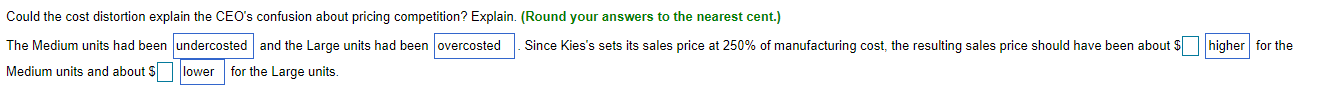

jons LOWE 1. Data - X CD Hire: Medium (42-inch) Plasma TVs: Total direct material cost: $668,000 Total direct labour cost $220,000 Production volume: 3,200 units ul Lar al ert $ Large (63-inch) Plasma TVs: Total direct material cost: $1,260,000 Total direct labour cost: $392,000 Production volume: 4,500 units Print Done Ist h if 0 Production activities 8 d al The company's manufacturing overhead numbers are as follows: Materials Handling ($182,880), driven by number of material orders handled Machine Processing ($643,200); driven by machine hours Packaging ($103,680); driven by packaging hours The company's only two products required the following activity levels during w the year 11 Material Orders Machine Packaging Handled Hours Hours 430 27,000 4,500 290 21,000 6,300 je Medium Large Print Done Kies Inc. manufactures only two products, Medium (42-inch) and Large (63-inch) plasma screen TVs. To generate adequate profit and cover its expenses throughout the value chain, Kies prices its TVs at 250% of manufacturing cost. The company is concerned because the Large model is facing severe pricing competition, whereas the Medium model is the low-price leader in the market. The CEO questions whether the cost numbers generated by the accounting system are correct. He has just learned about ABC and wants to reanalyze this past year's product costs using an ABC system. Information about the company's products this past year follows: E (Click the icon to view the data.) Currently, the company applies manufacturing overhead on the basis of direct labour hours. The company incurred $929,760 of MOH this year and 24,300 direct labour hours (8,700 direct labour hours making Medium TVs and 15,600 making Large TVS). The ABC team identified three primary production activities that generate MOH costs: : (Click the icon to view the production activities.) Requirements Requirement 1. Use the company's current costing system to find the total cost of producing all Medium TVs and the total cost of producing all Large TVs. What was the average cost of making each unit of each model? Round your answers to the nearest cent. Begin by identifying the formula to compute the current plantwide manufacturing overhead rate, and then compute the rate. (Round your answer to the nearest cent.) Total manufacturing overhead 1 Total direct labour hours Plantwide overhead rate $ 929.760 24.300 38.26 Now use this rate to allocate the overhead to each model, and then calculate the average cost of making each unit of each model. (Round cost per unit to the nearest cent.) Manufacturing cost Direct materials $ Medium Large 668,000 $ 1,260,000 220,000 392,000 Direct labour Now use this rate to allocate the overhead to each model, and then calculate the average cost of making each unit of each model. (Round cost per unit to the nearest cent.) Manufacturing cost Direct materials Direct labour $ Medium Large 668,000 $ 1,260,000 220,000 392,000 332,862 596.856 Manufacturing overhead Total manufacturing cost Number of units produced $ 1,220,862 $ 2,248,856 3,200 4,500 $ 381.52 $ 499.75 Cost per unit = Requirement 2. Use ABC to find the total cost of producing all Medium TVs and the total cost of producing all Large TVs. What was the average cost of making each unit of each model? Round your answers to the nearest cent. Begin by identifying the formula to compute the activity cost allocation rates, and then calculate the activity cost allocation rates. (Round your answers to the nearest cent.) Activity overhead Total activity allocation base Activity allocation rate Materials handling $ 182,880 / 720 = $ 254.00 / mat. orders handled Machine processing $ 643,200 / 48,000 = $ 13.40 / machine hour Packaging $ 103,680 10.800 $ 9.60 / packaging hour Now use these rates to allocate the overhead to each model, and then calculate the average cost of making each unit of each model. (Round interim answers to the nearest dollar and final answers to the nearest cent.) Now use these rates to allocate the overhead to each model, and then calculate the average cost of making each unit of each model. (Round interim answers to the nearest dollar and final answers to the nearest cent.) Manufacturing Cost Medium Large Direct materials $ 668,000 $ 1,260,000 Direct labour 220,000 392,000 Manufacturing overhead 514,220 415,540 Total manufacturing cost $ 1,402,220 $ 2,067,540 3.200 Number of units produced 4,500 $ 438.19 $ 459.45 Cost per unit Requirement 3. How much cost distortion was occurring between Kies's two products? Calculate the cost distortion in total and on a per unit basis. Could the cost distortion explain the CEO's confusion about pricing competition? Explain. (Round interim and final answers to the nearest cent. Use parentheses or a minus sign for undercosted and negative cost distortion amounts.) Medium Large 499.75 $ 381.52 $ 438.19 459.45 Cost per unit using current system Cost per unit using ABC Overcosting/(Undercosting) Number of units (56.67) $ 3,200 40.30 4.500 Total cost distortion $ (181,344.00 181,350.00 Could the cost distortion explain the CEO's confusion about pricing competition? Explain. (Round your answers to the nearest cent.) Could the cost distortion explain the CEO's confusion about pricing competition? Explain. (Round your answers to the nearest cent.) The Medium units had been undercosted and the Large units had been overcosted Since Kies's sets its sales price at 250% of manufacturing cost, the resulting sales price should have been about $ higher for the Medium units and about $ lower for the Large units