Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls show excel formula to calculate. thx. i need orange answered for #3 and 4 The table to the left includes a sample of the

pls show excel formula to calculate. thx. i need orange answered for #3 and 4

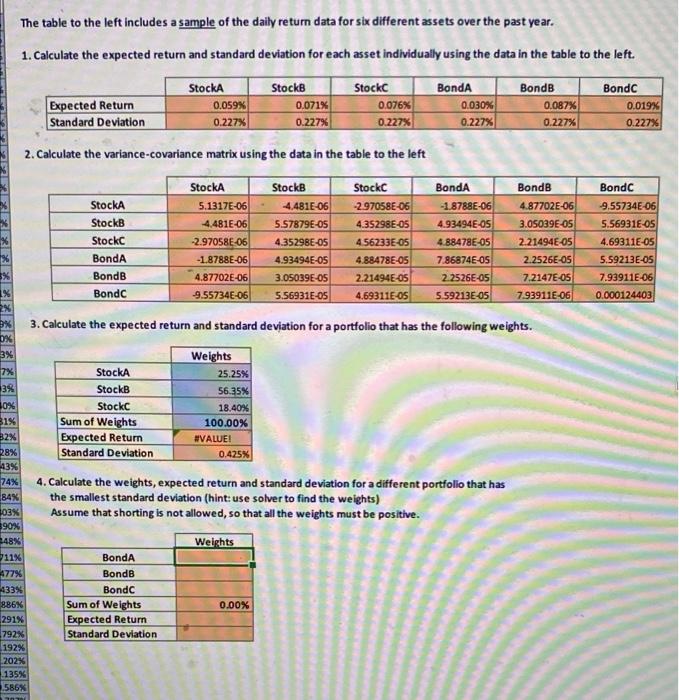

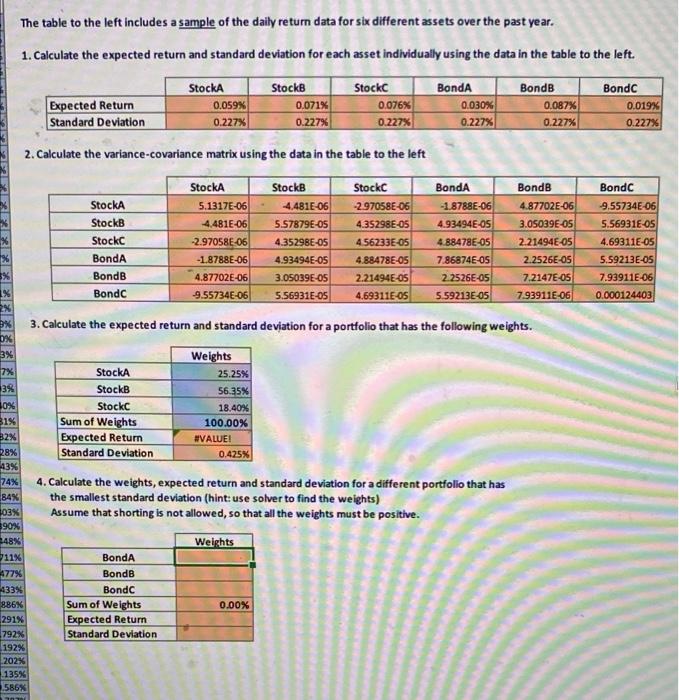

The table to the left includes a sample of the daily return data for six different assets over the past year. 1. Calculate the expected return and standard deviation for each asset individually using the data in the table to the left. StockA 0.059% 0.227% Expected Return Standard Deviation Stocks 0.071% 0.227% Stock 0.076% 0.227% BondA 0.030% BondB 0.087% 0.227% BondC 0.019% 0.227% 0.227% 2. Calculate the variance-covariance matrix using the data in the table to the left BondB StockA StockB Stock Bonda BondB Bonde Stocka 5.1317E-06 4.481E-06 -2.97058E-06 -1.8788E-06 4.87702E-06 9.55734E-06 StockB 4.481E-06 5.57879E-05 4.35298E-05 4.93494E-05 3.05039E-05 5.56931E-OS Stock -297058E-06 4.35298E-OS 4.56233E-OS 488478E-05 Bonda -1.8788E-06 4.93494E-OS 4.88478E-05 7.86874E-OS 2.2526E-05 4.87702E-06 3.05039E-OS 2.21494E-05 2.2526E-OS 7.2147E-OS 7.93911E-06 Bondc -9.55734E-06 5.56931E-05 4.69311E-05 5.59213E-OS 7.93911E-06 0.000124403 2.21494E-OS 4.69311E-OS 5.59213E-05 3. Calculate the expected return and standard deviation for a portfolio that has the following weights. OX 7% 3% 10% 31% 32% 28% 13% 74% 84% 103N 390% 348% 11% 477% 433% 886% 291% 792% 192% 202% 135% 586X Weights StockA 25.25% StockB 56.35% Stock 18.40% Sum of Weights 100.00% Expected Return #VALUE! Standard Deviation 0.425% 4. Calculate the weights, expected return and standard deviation for a different portfolio that has the smallest standard deviation (hint: use solver to find the weights) Assume that shorting is not allowed, so that all the weights must be positive. Weights Bonda BondB Bondc Sum of Weights 0.00% Expected Return Standard Deviation The table to the left includes a sample of the daily return data for six different assets over the past year. 1. Calculate the expected return and standard deviation for each asset individually using the data in the table to the left. StockA 0.059% 0.227% Expected Return Standard Deviation Stocks 0.071% 0.227% Stock 0.076% 0.227% BondA 0.030% BondB 0.087% 0.227% BondC 0.019% 0.227% 0.227% 2. Calculate the variance-covariance matrix using the data in the table to the left BondB StockA StockB Stock Bonda BondB Bonde Stocka 5.1317E-06 4.481E-06 -2.97058E-06 -1.8788E-06 4.87702E-06 9.55734E-06 StockB 4.481E-06 5.57879E-05 4.35298E-05 4.93494E-05 3.05039E-05 5.56931E-OS Stock -297058E-06 4.35298E-OS 4.56233E-OS 488478E-05 Bonda -1.8788E-06 4.93494E-OS 4.88478E-05 7.86874E-OS 2.2526E-05 4.87702E-06 3.05039E-OS 2.21494E-05 2.2526E-OS 7.2147E-OS 7.93911E-06 Bondc -9.55734E-06 5.56931E-05 4.69311E-05 5.59213E-OS 7.93911E-06 0.000124403 2.21494E-OS 4.69311E-OS 5.59213E-05 3. Calculate the expected return and standard deviation for a portfolio that has the following weights. OX 7% 3% 10% 31% 32% 28% 13% 74% 84% 103N 390% 348% 11% 477% 433% 886% 291% 792% 192% 202% 135% 586X Weights StockA 25.25% StockB 56.35% Stock 18.40% Sum of Weights 100.00% Expected Return #VALUE! Standard Deviation 0.425% 4. Calculate the weights, expected return and standard deviation for a different portfolio that has the smallest standard deviation (hint: use solver to find the weights) Assume that shorting is not allowed, so that all the weights must be positive. Weights Bonda BondB Bondc Sum of Weights 0.00% Expected Return Standard Deviation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started