pls show the work

pls show the work

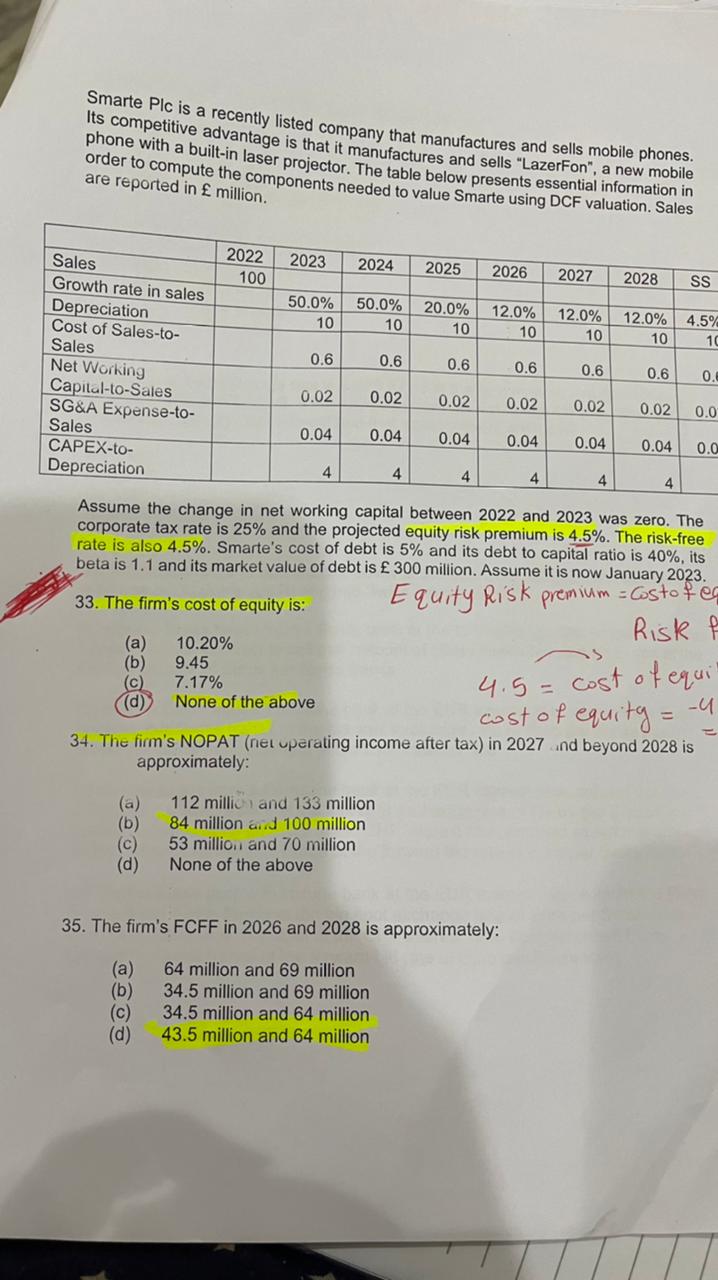

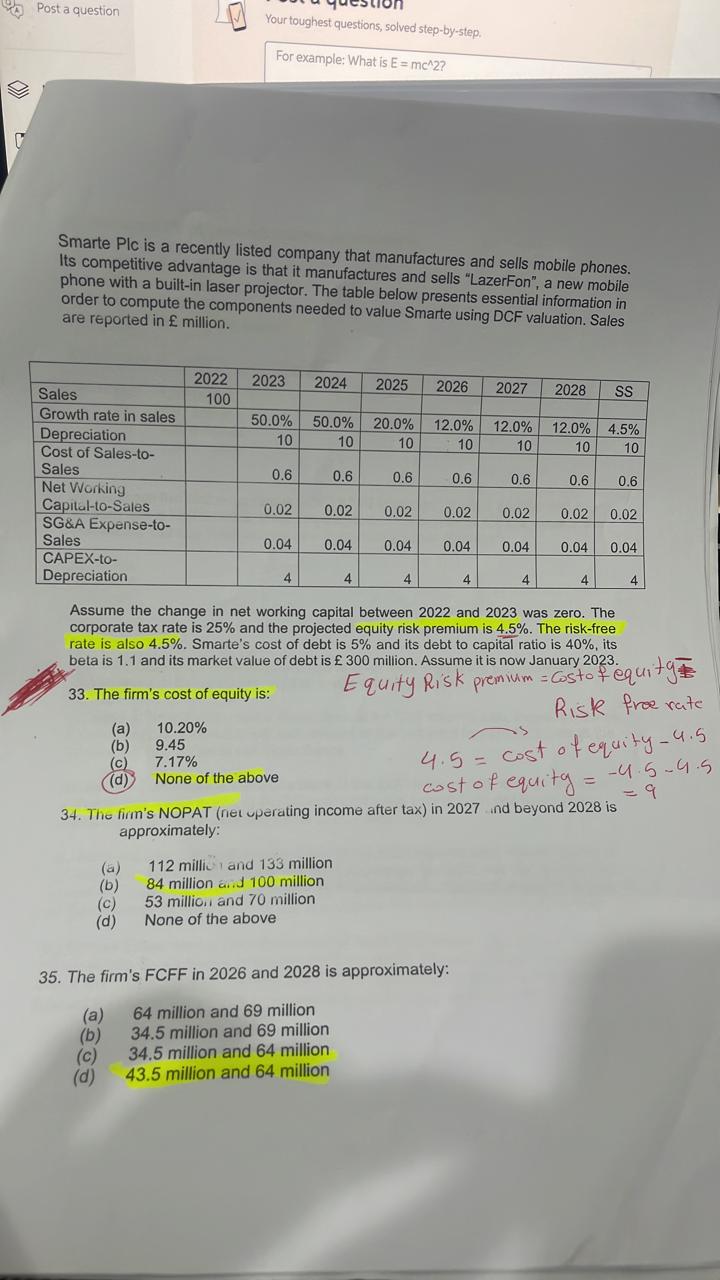

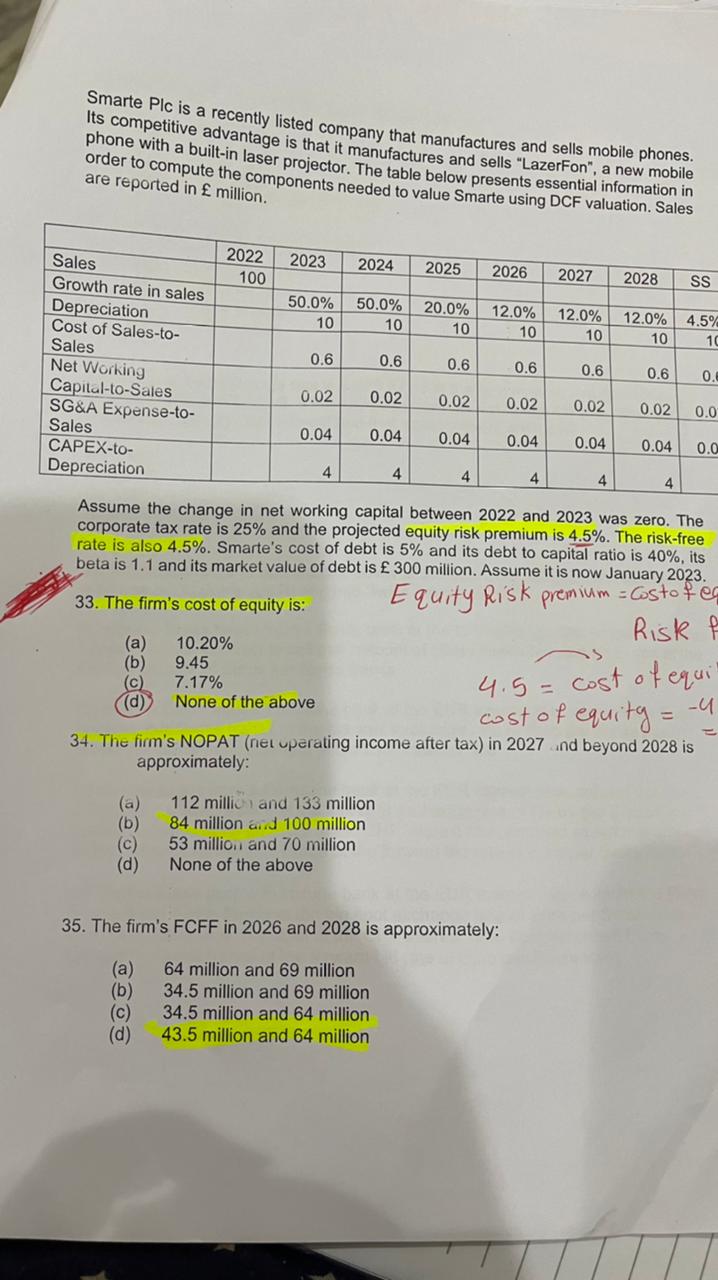

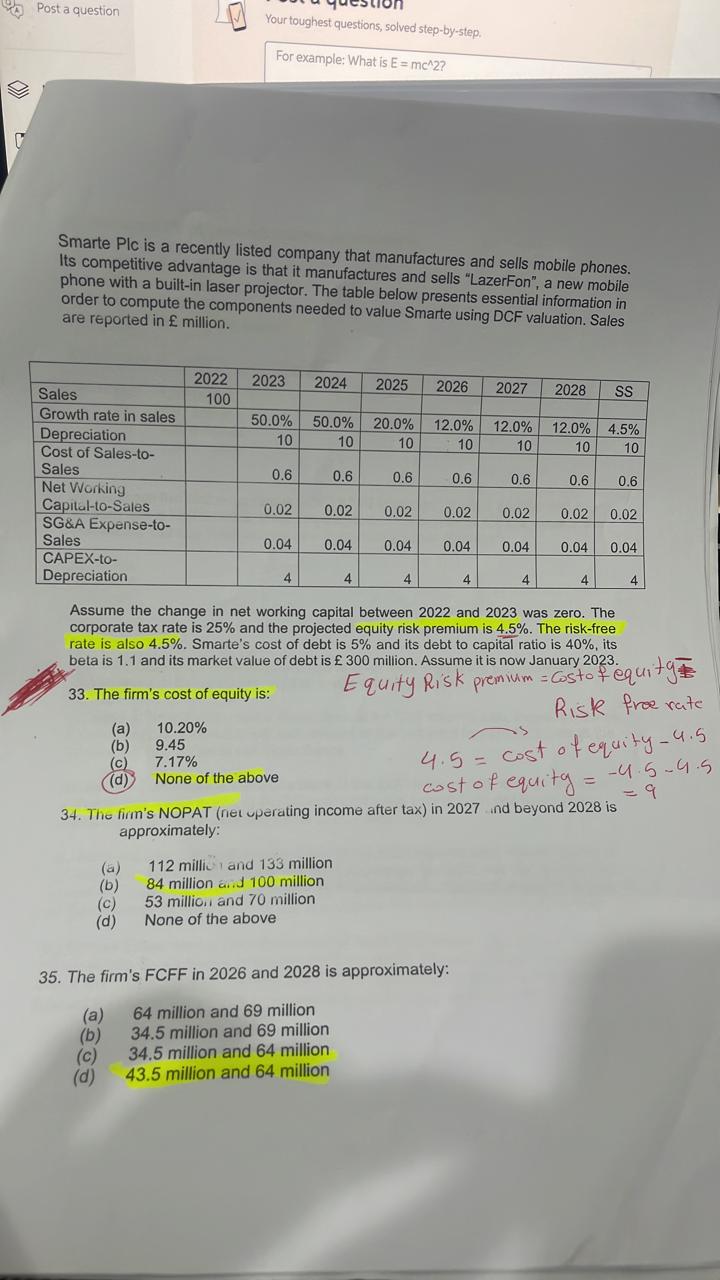

Smarte Plc is a recently listed company that manufactures and sells mobile phones. Its competitive advantage is that it manufactures and sells "LazerFon", a new mobile phone with a built-in laser projector. The table below presents essential information in order to compute the components needed to value Smarte using DCF valuation. Sales are reported in f million. Assume the change in net working capital between 2022 and 2023 was zero. The corporate tax rate is 25% and the projected equity risk premium is 4.5%. The risk-free rate is also 4.5%. Smarte's cost of debt is 5% and its debt to capital ratio is 40%, its beta is 1.1 and its market value of debt is 300 million. Assume it is now January 2023. 33. The firm's cost of equity is: Equity Risk premium = Costo f equitg (a) 10.20% Risk froe rate (b) 9.45 (c) 7.17% 4.5=costofequity4.5 (d) None of the above 4.5costofequitg=costofequity=4.54.5=9 34. The firm's NOPAT (net uperating income after tax) in 2027 ind beyond 2028 is approximately: (a) 112 millic and 133 million (b) 84 million and 100 million (c) 53 millio, and 70 million (d) None of the above 35. The firm's FCFF in 2026 and 2028 is approximately: (a) 64 million and 69 million (b) 34.5 million and 69 million (c) 34.5 million and 64 million (d) 43.5 million and 64 million Smarte Plc is a recently listed company that manufactures and sells mobile phones. Its competitive advantage is that it manufactures and sells "LazerFon", a new mobile phone with a built-in laser projector. The table below presents essential information in order to compute the components needed to value Smarte using DCF valuation. Sales are reported in million. Assume the change in net working capital between 2022 and 2023 was zero. The corporate tax rate is 25% and the projected equity risk premium is 4.5%. The risk-free rate is also 4.5%. Smarte's cost of debt is 5% and its debt to capital ratio is 40%, its beta is 1.1 and its market value of debt is 300 million. Assume it is now January 2023. 33. The firm's cost of equity is: Equity Risk premium = Costo fe (a) 10.20% Risk (b) 9.45 (c) 7.17% (d) None of the above 4.5=costofequicostofequitg=4 34. The firm's NOPAT (net uperating income after tax) in 2027 and beyond 2028 is approximately: (a) 112 millic and 133 million (b) 84 million aid 100 million (c) 53 millioir and 70 million (d) None of the above 35. The firm's FCFF in 2026 and 2028 is approximately: (a) 64 million and 69 million (b) 34.5 million and 69 million (c) 34.5 million and 64 million (d) 43.5 million and 64 million

pls show the work

pls show the work