Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls show work. Ty kind sir or madam 19. Jonathan's Golf Company (JGC) is a producer of golf clubs. Each golf club includes a metal

pls show work. Ty kind sir or madam

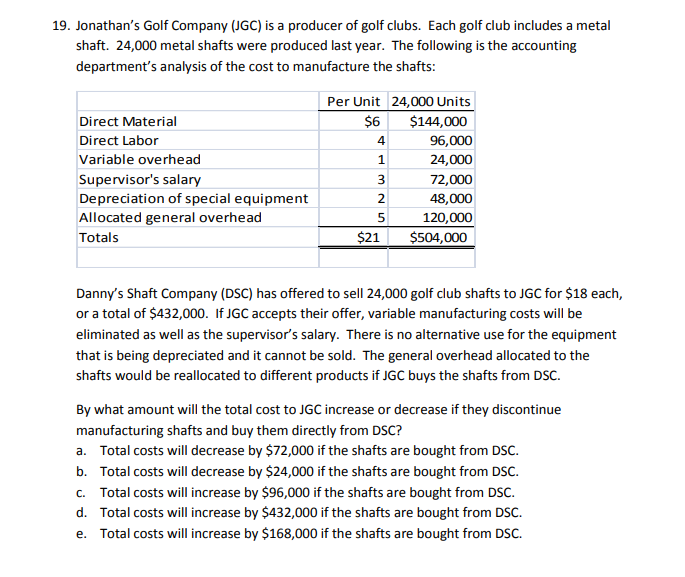

19. Jonathan's Golf Company (JGC) is a producer of golf clubs. Each golf club includes a metal shaft. 24,000 metal shafts were produced last year. The following is the accounting department's analysis of the cost to manufacture the shafts Direct Material Direct Labor Variable overhead Supervisor's salary Depreciation of special equipment Allocated general overhead Per Unit 24,000 Units $6 $144,000 96,000 24,000 72,000 48,000 120,000 4 1 2 otals $21 $504,000 Danny's Shaft Company (DSC) has offered to sell 24,000 golf club shafts to JGC for $18 each, or a total of $432,000. If JGC accepts their offer, variable manufacturing costs will be eliminated as well as the supervisor's salary. There is no alternative use for the equipment that is being depreciated and it cannot be sold. The general overhead allocated to the shafts would be reallocated to different products if JGC buys the shafts from DSO. By what amount will the total cost to JGC increase or decrease if they discontinue manufacturing shafts and buy them directly from DSC? a. Total costs will decrease by $72,000 if the shafts are bought from DSC. b. Total costs will decrease by $24,000 if the shafts are bought from DSC. c. Total costs will increase by $96,000 if the shafts are bought from DSC. d. Total costs will increase by $432,000 if the shafts are bought from DSC. e. Total costs will increase by $168,000 if the shafts are bought from DSCStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started