Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls show working I need it in thirty minutes time Kaosarat Limited is to start business on 1 July 2022 to produce and sell an

pls show working I need it in thirty minutes time

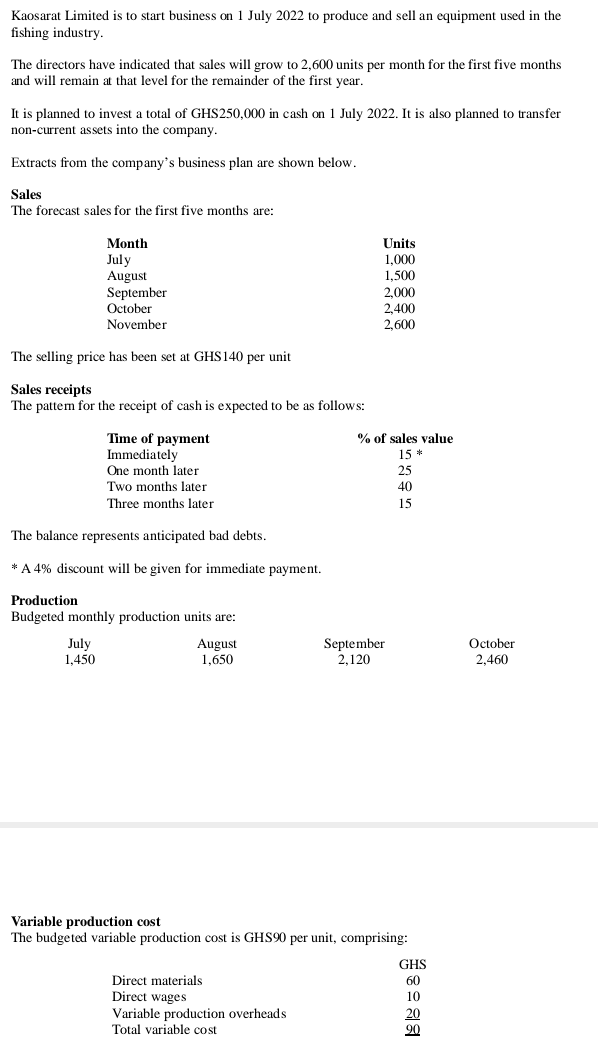

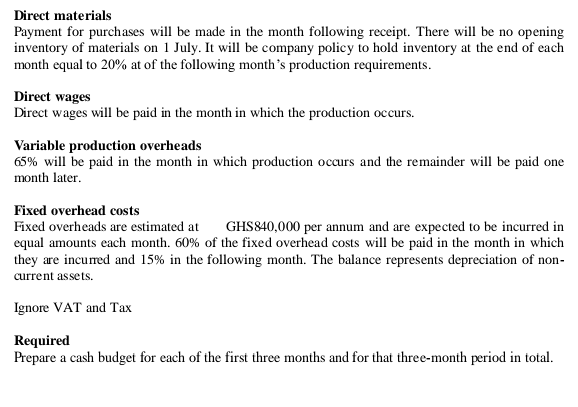

Kaosarat Limited is to start business on 1 July 2022 to produce and sell an equipment used in the fishing industry. The directors have indicated that sales will grow to 2,600 units per month for the first five months. and will remain at that level for the remainder of the first year. It is planned to invest a total of GHS250,000 in cash on 1 July 2022. It is also planned to transfer non-current assets into the company. Extracts from the company's business plan are shown below. Sales The forecast sales for the first five months are: Month July August September October November The selling price has been set at GHS140 per unit Sales receipts The patter for the receipt of cash is expected to be as follows: Time of payment Immediately One month later Two months later Three months later The balance represents anticipated bad debts. * A 4% discount will be given for immediate payment. July 1,450 Production Budgeted monthly production units are: August 1,650 Direct materials Direct wages Units 1,000 1,500 Variable production overheads Total variable cost 2,000 2,400 2,600 % of sales value 15 * September 2.120 Variable production cost The budgeted variable production cost is GHS90 per unit, comprising: 25 40 15 GHS 60 10 20 90 October 2,460 Direct materials Payment for purchases will be made in the month following receipt. There will be no opening inventory of materials on 1 July. It will be company policy to hold inventory at the end of each month equal to 20% at of the following month's production requirements. Direct wages Direct wages will be paid in the month in which the production occurs. Variable production overheads 65% will be paid in the month in which production occurs and the remainder will be paid one month later. Fixed overhead costs Fixed overheads are estimated at GHS840,000 per annum and are expected to be incurred in equal amounts each month. 60% of the fixed overhead costs will be paid in the month in which they are incurred and 15% in the following month. The balance represents depreciation of non- current assets. Ignore VAT and Tax Required Prepare a cash budget for each of the first three months and for that three-month period in totalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started