Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pls solve properly in excel sheet, give proper formulas James Kirk is planning to set up an on-line dating agency for the over 50 s

Pls solve properly in excel sheet, give proper formulas

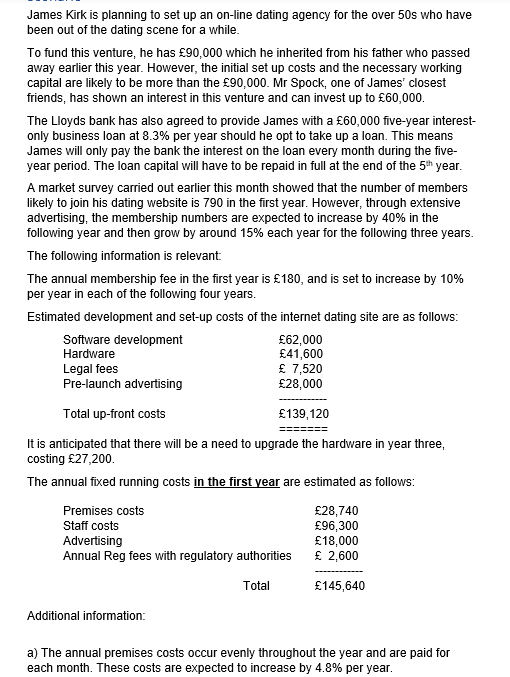

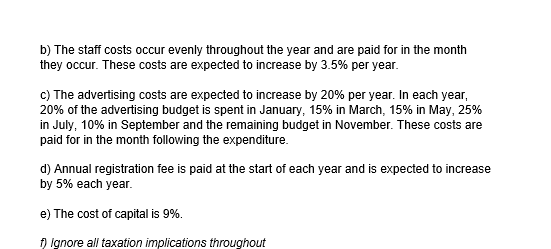

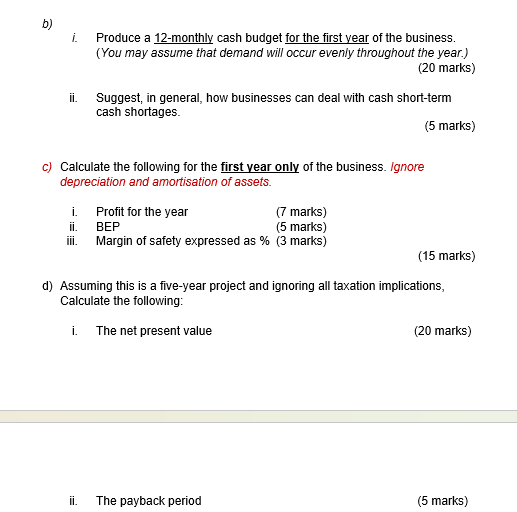

James Kirk is planning to set up an on-line dating agency for the over 50 s who have been out of the dating scene for a while. To fund this venture, he has 90,000 which he inherited from his father who passed away earlier this year. However, the initial set up costs and the necessary working capital are likely to be more than the 90,000. Mr Spock, one of James' closest friends, has shown an interest in this venture and can invest up to 60,000. The Lloyds bank has also agreed to provide James with a 60,000 five-year interestonly business loan at 8.3% per year should he opt to take up a loan. This means James will only pay the bank the interest on the loan every month during the fiveyear period. The loan capital will have to be repaid in full at the end of the 5th year. A market survey carried out earlier this month showed that the number of members likely to join his dating website is 790 in the first year. However, through extensive advertising, the membership numbers are expected to increase by 40% in the following year and then grow by around 15% each year for the following three years. The following information is relevant: The annual membership fee in the first year is 180, and is set to increase by 10% per year in each of the following four years. Estimated development and set-up costs of the internet dating site are as follows: It is anticipated that there will be a need to upgrade the hardware in year three, costing 27,200. The annual fixed running costs in the first year are estimated as follows: Additional information: a) The annual premises costs occur evenly throughout the year and are paid for each month. These costs are expected to increase by 4.8% per year. b) The staff costs occur evenly throughout the year and are paid for in the month they occur. These costs are expected to increase by 3.5% per year. c) The advertising costs are expected to increase by 20% per year. In each year, 20% of the advertising budget is spent in January, 15% in March, 15% in May, 25% in July, 10% in September and the remaining budget in November. These costs are paid for in the month following the expenditure. d) Annual registration fee is paid at the start of each year and is expected to increase by 5% each year. e) The cost of capital is 9%. i. Produce a 12-monthly cash budget for the first year of the business. (You may assume that demand will occur evenly throughout the year.) (20 marks) ii. Suggest, in general, how businesses can deal with cash short-term cash shortages. (5 marks) c) Calculate the following for the first vear only of the business. Ignore depreciation and amortisation of assets. i. Profit for the year ii. BEP iii. Margin of safety expressed as % (7 marks) (5 marks) (15 marks) d) Assuming this is a five-year project and ignoring all taxation implications, Calculate the following: i. The net present value (20 marks)

James Kirk is planning to set up an on-line dating agency for the over 50 s who have been out of the dating scene for a while. To fund this venture, he has 90,000 which he inherited from his father who passed away earlier this year. However, the initial set up costs and the necessary working capital are likely to be more than the 90,000. Mr Spock, one of James' closest friends, has shown an interest in this venture and can invest up to 60,000. The Lloyds bank has also agreed to provide James with a 60,000 five-year interestonly business loan at 8.3% per year should he opt to take up a loan. This means James will only pay the bank the interest on the loan every month during the fiveyear period. The loan capital will have to be repaid in full at the end of the 5th year. A market survey carried out earlier this month showed that the number of members likely to join his dating website is 790 in the first year. However, through extensive advertising, the membership numbers are expected to increase by 40% in the following year and then grow by around 15% each year for the following three years. The following information is relevant: The annual membership fee in the first year is 180, and is set to increase by 10% per year in each of the following four years. Estimated development and set-up costs of the internet dating site are as follows: It is anticipated that there will be a need to upgrade the hardware in year three, costing 27,200. The annual fixed running costs in the first year are estimated as follows: Additional information: a) The annual premises costs occur evenly throughout the year and are paid for each month. These costs are expected to increase by 4.8% per year. b) The staff costs occur evenly throughout the year and are paid for in the month they occur. These costs are expected to increase by 3.5% per year. c) The advertising costs are expected to increase by 20% per year. In each year, 20% of the advertising budget is spent in January, 15% in March, 15% in May, 25% in July, 10% in September and the remaining budget in November. These costs are paid for in the month following the expenditure. d) Annual registration fee is paid at the start of each year and is expected to increase by 5% each year. e) The cost of capital is 9%. i. Produce a 12-monthly cash budget for the first year of the business. (You may assume that demand will occur evenly throughout the year.) (20 marks) ii. Suggest, in general, how businesses can deal with cash short-term cash shortages. (5 marks) c) Calculate the following for the first vear only of the business. Ignore depreciation and amortisation of assets. i. Profit for the year ii. BEP iii. Margin of safety expressed as % (7 marks) (5 marks) (15 marks) d) Assuming this is a five-year project and ignoring all taxation implications, Calculate the following: i. The net present value (20 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started