pls solve q2 only

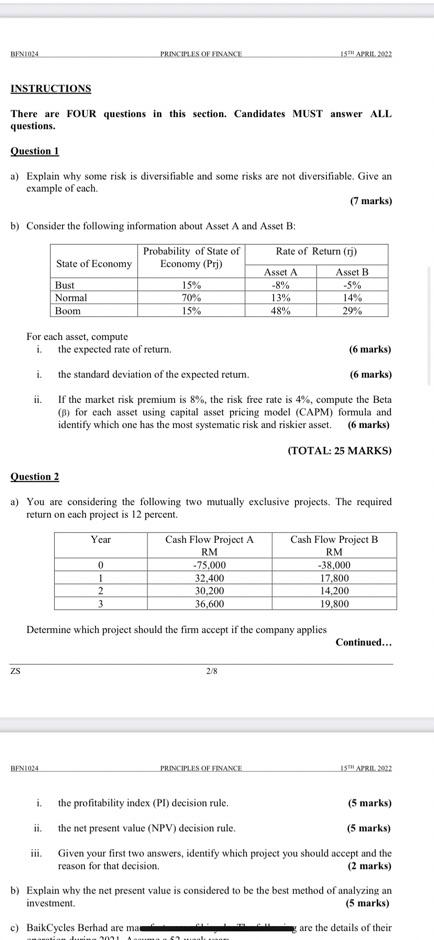

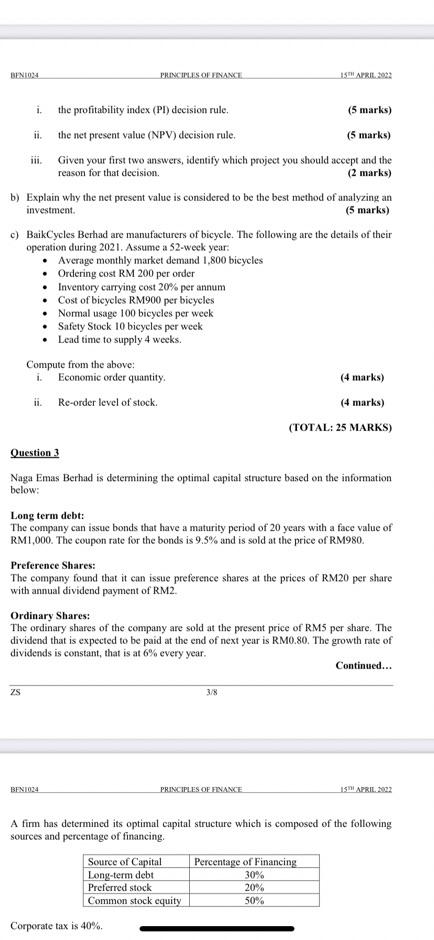

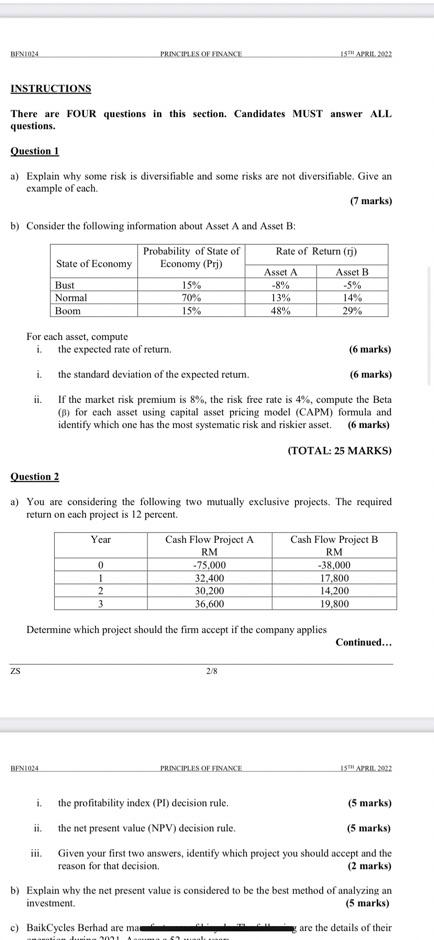

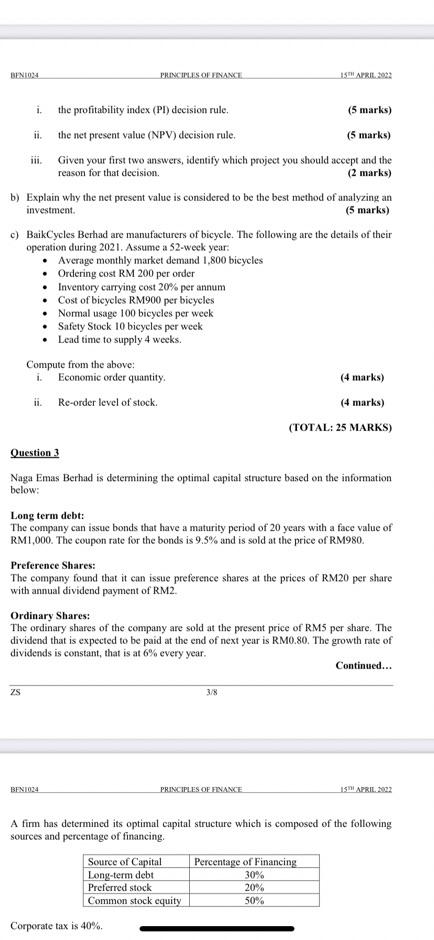

BENIN PRINCIPLES OF FINANCE 15 APRIL 2002 INSTRUCTIONS There are Four questions in this section. Candidates MUST answer ALL questions. Question 1 a) Explain why some risk is diversifiable and some risks are not diversifiable. Give an example of each (7 marks) b) Consider the following information about Asset A and Asset B: Probability of State of Rate of Return (r) State of Economy Economy (Pri) Asset A Asset B Bust 15% -8% -5% Normal 70% 13% 14% Boom 15% 48% 29% For each asset, compute i. the expected rate of return (6 marks) i. the standard deviation of the expected retum. (6 marks) If the market risk premium is 8%, the risk free rate is 4%, compute the Beta () for each asset using capital asset pricing model (CAPM) formula and identify which one has the most systematic risk and riskier asset. (6 marks) (TOTAL: 25 MARKS) ii. Question a) You are considering the following two mutually exclusive projects. The required return on each project is 12 percent. Year Cash Flow Project A Cash Flow Project B RM RM 0 -75.000 -38.000 1 32.400 17.800 2 30,200 14,200 3 36,600 19,800 Determine which project should the firm accept if the company applies Continued... ZS 2/8 BEN1024 PRINCIPLES O FINANCE ISHARRIL 2922 i. the profitability index (PI) decision rule. (5 marks) the net present value (NPV) decision rule. (5 marks) iii Given your first two answers, identify which project you should accept and the reason for that decision (2 marks) b) Explain why the net present value is considered to be the best method of analyzing an investment (5 marks) c) BaikCycles Berhad are man are the details of their ima BENEO PRINCIPLES OLVINANI 15 APRIL 2003 i. the profitability index (PI) decision rule. (5 marks) ii. the net present value (NPV) decision rule. (5 marks) ii. Given your first two answers, identify which project you should accept and the reason for that decision. (2 marks) b) Explain why the net present value is considered to be the best method of analyzing an investment (5 marks) c) BaikCycles Berhad are manufacturers of bicycle. The following are the details of their operation during 2021. Assume a 52-week year Average monthly market demand 1,800 bicycles . Ordering cost RM 200 per order Inventory carrying cost 20% per annum Cost of bicycles RM900 per bicycles Normal usage 100 bicycles per week Safety Stock 10 bicycles per week Lead time to supply 4 weeks. Compute from the above: i. Economic order quantity (4 marks) ii. Re-order level of stock. (4 marks) (TOTAL: 25 MARKS) Question 3 Naga Emas Berhad is determining the optimal capital structure based on the information below: Long term debt: The company can issue bonds that have a maturity period of 20 years with a face value of RM1,000. The coupon rate for the bonds is 9.5% and is sold at the price of RM980. Preference Shares: The company found that it can issue preference shares at the prices of RM20 per share with annual dividend payment of RM2. Ordinary Shares: The ordinary shares of the company are sold at the present price of RM5 per share. The dividend that is expected to be paid at the end of next year is RM0.80. The growth rate of dividends is constant, that is at 6% every year Continued... zs 3/8 BEN024 PRINCIPLES OF FINANCE SI APRIL 2022 A firm has determined its optimal capital structure which is composed of the following sources and percentage of financing, Source of Capital Long-term debt Preferred stock Common stock equity Percentage of Financing 30% 20% 50% Corporate tax is 40%