Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pls solve the problem urgently if you know only... All bits plz Question Description Question: A testing lab owns a hydraulic load frame, which was

Pls solve the problem urgently if you know only... All bits plz

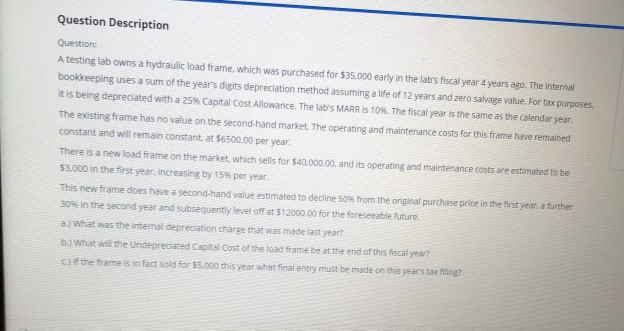

Question Description Question: A testing lab owns a hydraulic load frame, which was purchased for $35.000 early in the lab's fiscal year 4 years ago. The Internal bookkeeping uses a sum of the year's digits depreciation method assuming a life of 12 years and zero salvage value. For tax purposes. it is being depreciated with a 25 Capital Cost Allowance. The lab's MARR is 10%. The fiscal year is the same as the calendar year. The existing frame has no value on the second-hand market. The operating and maintenance costs for this frame have remained constant and will remain constant at $6500.00 per year. There is a new load frame on the market which sells for $40.000.00, and its operating and maintenance costs are estimated to be $3.000 in the first year, increasing by 15 per year. This new frame does have a second-hand value estimated to decline 50% from the original purchase price in the first year, a further 30% in the second year and subsequently level off at 5:2000.00 for the foreseeable future. 2.) What was the internal depreciation charge that was made last year b.) What will the Undepreciated Capital Cost of the load frame be at the end of this fiscal year? C) If the frame is in fact sold for 55.000 this year what final entry must be made on this year's tax finingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started