Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls solve urgent help Q6 (60 points) Use selected data for Schlumberger and industry-level data. All numbers are in million, including number of shares. Market

pls solve urgent help

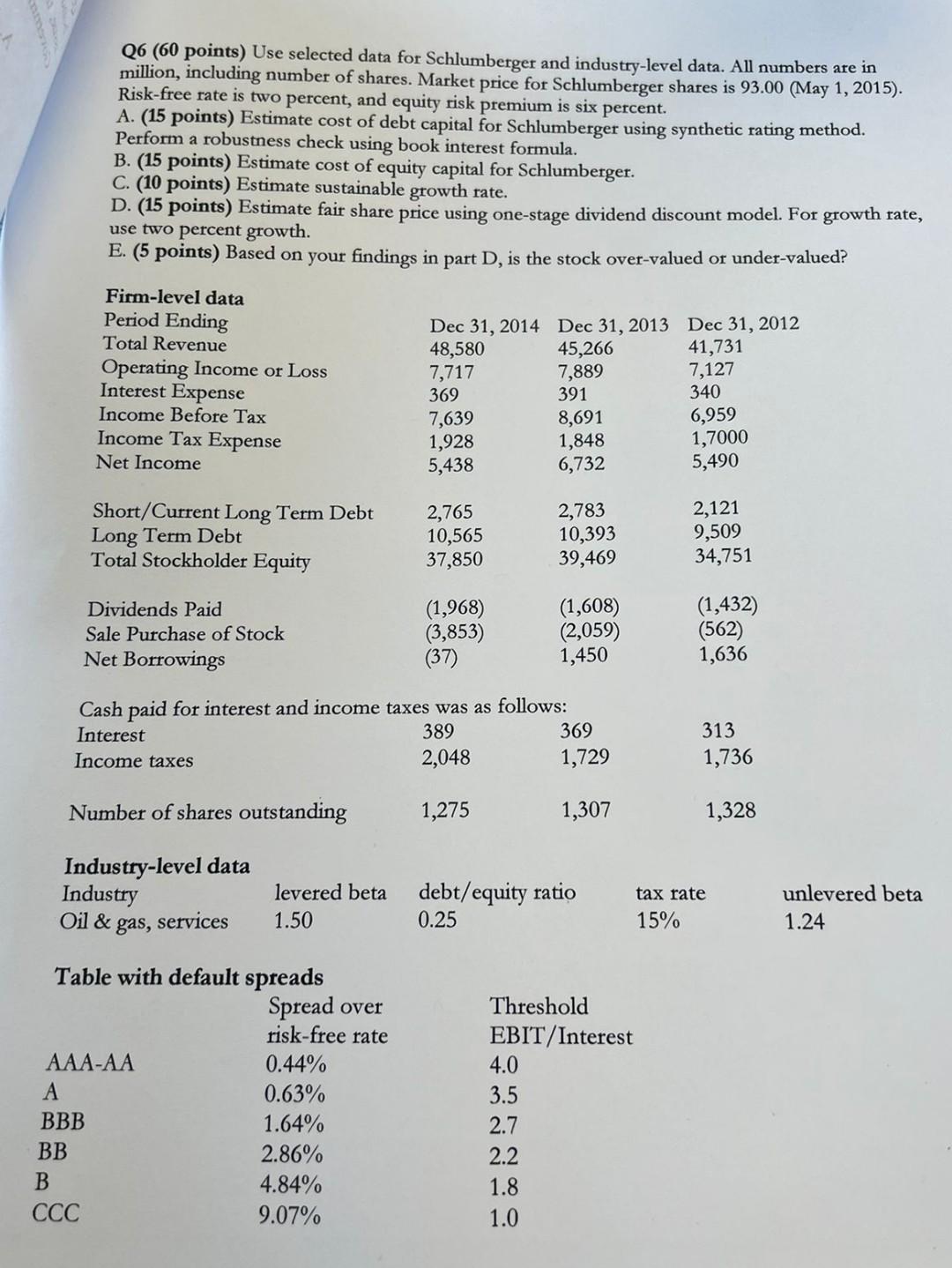

Q6 (60 points) Use selected data for Schlumberger and industry-level data. All numbers are in million, including number of shares. Market price for Schlumberger shares is 93.00 (May 1, 2015). Risk-free rate is two percent, and equity risk premium is six percent. A. (15 points) Estimate cost of debt capital for Schlumberger using synthetic rating method. Perform a robustness check using book interest formula. B. (15 points) Estimate cost of equity capital for Schlumberger. C. (10 points) Estimate sustainable growth rate. D. (15 points) Estimate fair share price using one-stage dividend discount model. For growth rate, use two percent growth. E. (5 points) Based on your findings in part D, is the stock over-valued or under-valued? Firm-level data Period Ending Total Revenue Operating Income or Loss Interest Expense Income Before Tax Income Tax Expense Net Income Dec 31, 2014 Dec 31, 2013 Dec 31, 2012 48,580 45,266 41,731 7,717 7,889 7,127 369 391 340 7,639 8,691 6,959 1,928 1,848 1,7000 5,438 6,732 5,490 Short/Current Long Term Debt Long Term Debt Total Stockholder Equity 2,765 10,565 37,850 2,783 10,393 39,469 2,121 9,509 34,751 Dividends Paid Sale Purchase of Stock Net Borrowings (1,968) (3,853) (37) (1,608) (2,059) 1,450 (1,432) (562) 1,636 Cash paid for interest and income taxes was as follows: Interest 389 369 Income taxes 2,048 1,729 313 1,736 Number of shares outstanding 1,275 1,307 1,328 Industry-level data Industry Oil & gas, services levered beta 1.50 debt/equity ratio 0.25 tax rate 15% unlevered beta 1.24 Threshold EBIT/Interest 4.0 Table with default spreads Spread over risk-free rate AAA-AA 0.44% A 0.63% BBB 1.64% BB 2.86% 4.84% CCC 9.07% 3.5 2.7 2.2 1.8 1.0 Q6 (60 points) Use selected data for Schlumberger and industry-level data. All numbers are in million, including number of shares. Market price for Schlumberger shares is 93.00 (May 1, 2015). Risk-free rate is two percent, and equity risk premium is six percent. A. (15 points) Estimate cost of debt capital for Schlumberger using synthetic rating method. Perform a robustness check using book interest formula. B. (15 points) Estimate cost of equity capital for Schlumberger. C. (10 points) Estimate sustainable growth rate. D. (15 points) Estimate fair share price using one-stage dividend discount model. For growth rate, use two percent growth. E. (5 points) Based on your findings in part D, is the stock over-valued or under-valued? Firm-level data Period Ending Total Revenue Operating Income or Loss Interest Expense Income Before Tax Income Tax Expense Net Income Dec 31, 2014 Dec 31, 2013 Dec 31, 2012 48,580 45,266 41,731 7,717 7,889 7,127 369 391 340 7,639 8,691 6,959 1,928 1,848 1,7000 5,438 6,732 5,490 Short/Current Long Term Debt Long Term Debt Total Stockholder Equity 2,765 10,565 37,850 2,783 10,393 39,469 2,121 9,509 34,751 Dividends Paid Sale Purchase of Stock Net Borrowings (1,968) (3,853) (37) (1,608) (2,059) 1,450 (1,432) (562) 1,636 Cash paid for interest and income taxes was as follows: Interest 389 369 Income taxes 2,048 1,729 313 1,736 Number of shares outstanding 1,275 1,307 1,328 Industry-level data Industry Oil & gas, services levered beta 1.50 debt/equity ratio 0.25 tax rate 15% unlevered beta 1.24 Threshold EBIT/Interest 4.0 Table with default spreads Spread over risk-free rate AAA-AA 0.44% A 0.63% BBB 1.64% BB 2.86% 4.84% CCC 9.07% 3.5 2.7 2.2 1.8 1.0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started