Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pls someone help me out with this and solve it correctly. II-(11 pts) Consider the following estimated equation of a CAPM model for IBM securities

Pls someone help me out with this and solve it correctly.

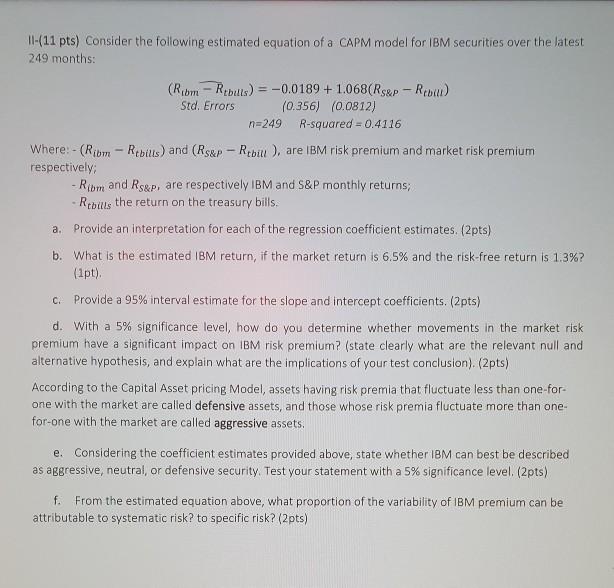

II-(11 pts) Consider the following estimated equation of a CAPM model for IBM securities over the latest 249 months: (Riom - Rebuts) = -0.0189 +1.068(Rgp - Rou) Std. Errors (0.356) (0.0812) n=249 R-squared=0.4116 Where: - (Riom - Ribills) and (Rs&p - Reball ), are IBM risk premium and market risk premium respectively - Riom and Rs&p, are respectively IBM and S&P monthly returns; - Rtoills the return on the treasury bills. a. Provide an interpretation for each of the regression coefficient estimates. (2pts) b. What is the estimated IBM return, if the market return is 6.5% and the risk-free return is 1.3%? (1pt), c. Provide a 95% interval estimate for the slope and intercept coefficients. (2pts) d. With a 5% significance level, how do you determine whether movements in the market risk premium have a significant impact on IBM risk premium? (state clearly what are the relevant null and alternative hypothesis, and explain what are the implications of your test conclusion). (2pts) According to the Capital Asset pricing Model, assets having risk premia that fluctuate less than one-for- one with the market are called defensive assets, and those whose risk premia fluctuate more than one for-one with the market are called aggressive assets, e. Considering the coefficient estimates provided above, state whether IBM can best be described as aggressive, neutral, or defensive security. Test your statement with a 5% significance level. (2pts) f. From the estimated equation above, what proportion of the variability of IBM premium can be attributable to systematic risk? to specific risk? (2pts) II-(11 pts) Consider the following estimated equation of a CAPM model for IBM securities over the latest 249 months: (Riom - Rebuts) = -0.0189 +1.068(Rgp - Rou) Std. Errors (0.356) (0.0812) n=249 R-squared=0.4116 Where: - (Riom - Ribills) and (Rs&p - Reball ), are IBM risk premium and market risk premium respectively - Riom and Rs&p, are respectively IBM and S&P monthly returns; - Rtoills the return on the treasury bills. a. Provide an interpretation for each of the regression coefficient estimates. (2pts) b. What is the estimated IBM return, if the market return is 6.5% and the risk-free return is 1.3%? (1pt), c. Provide a 95% interval estimate for the slope and intercept coefficients. (2pts) d. With a 5% significance level, how do you determine whether movements in the market risk premium have a significant impact on IBM risk premium? (state clearly what are the relevant null and alternative hypothesis, and explain what are the implications of your test conclusion). (2pts) According to the Capital Asset pricing Model, assets having risk premia that fluctuate less than one-for- one with the market are called defensive assets, and those whose risk premia fluctuate more than one for-one with the market are called aggressive assets, e. Considering the coefficient estimates provided above, state whether IBM can best be described as aggressive, neutral, or defensive security. Test your statement with a 5% significance level. (2pts) f. From the estimated equation above, what proportion of the variability of IBM premium can be attributable to systematic risk? to specific risk? (2pts)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started