Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls they are in order and this is concidered my homework:( it due friday EST 11pm Perpetual inventory using FIFO Beginning inventory, purchases, and sales

pls they are in order and this is concidered my homework:( it due friday EST 11pm

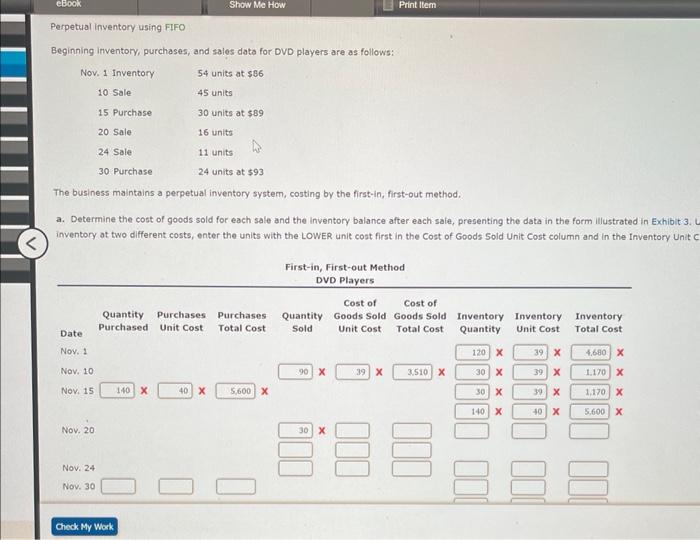

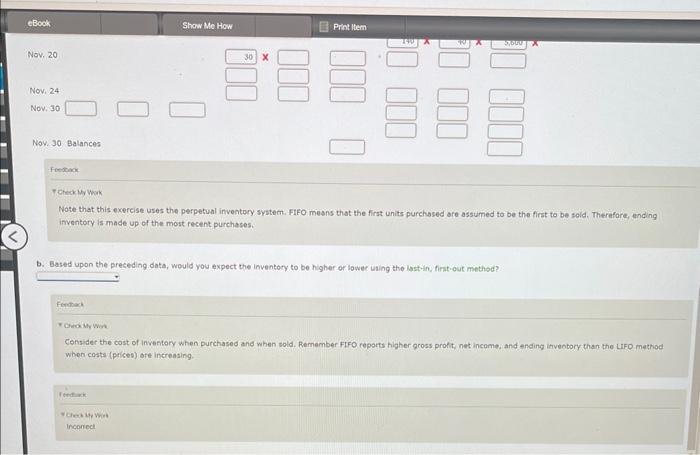

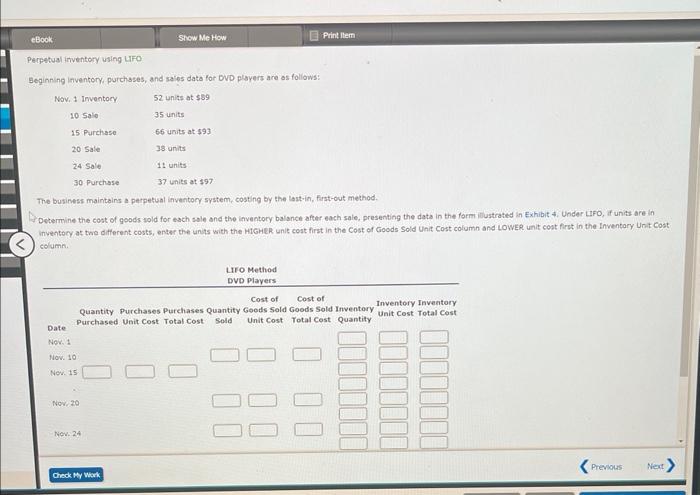

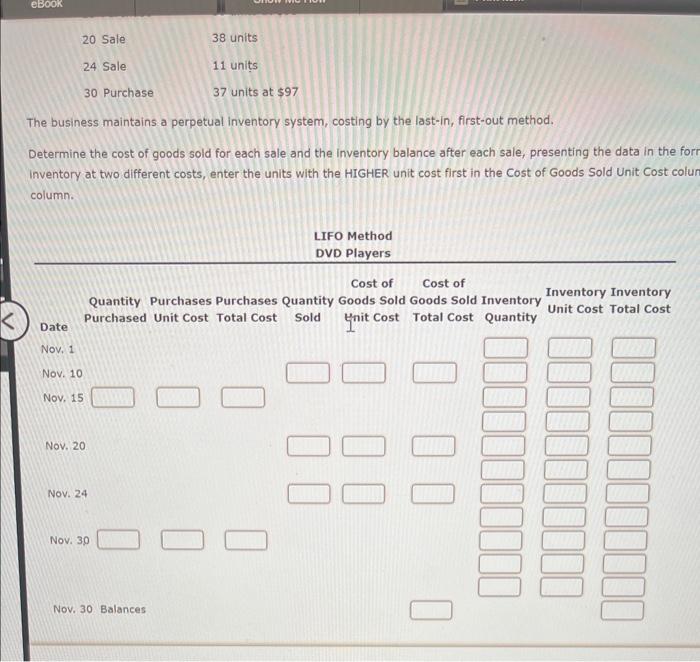

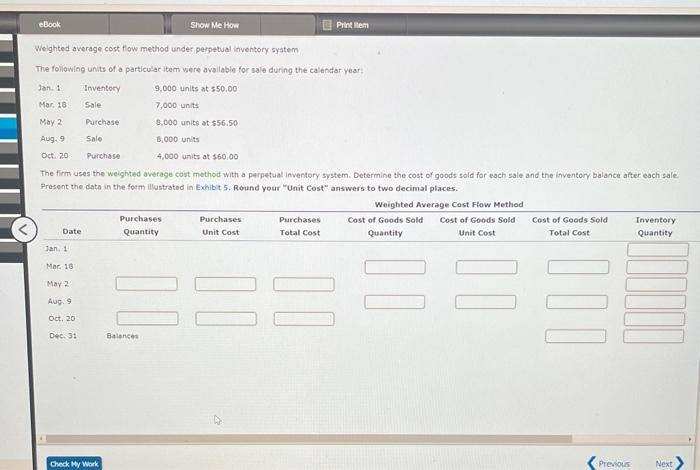

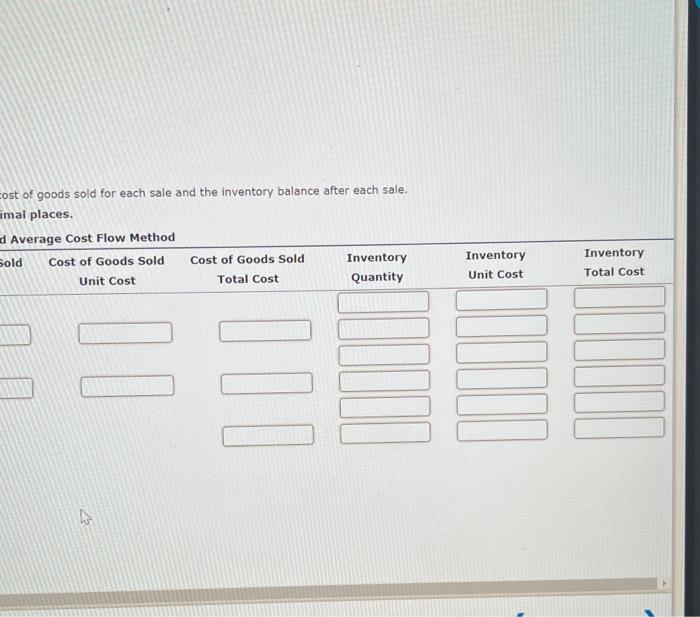

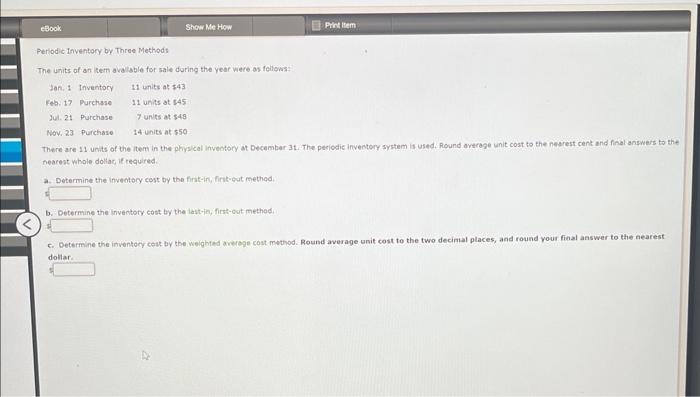

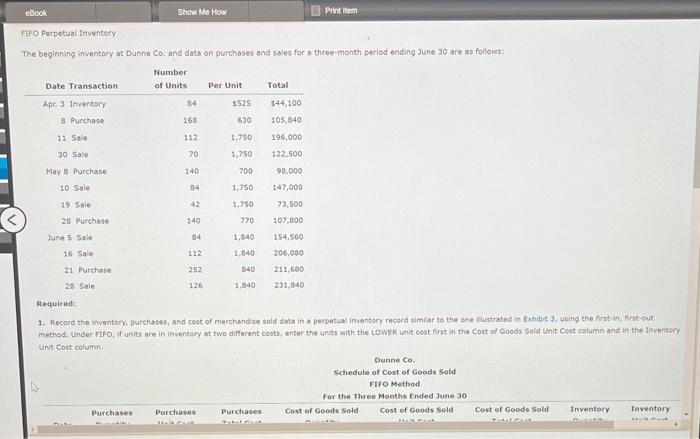

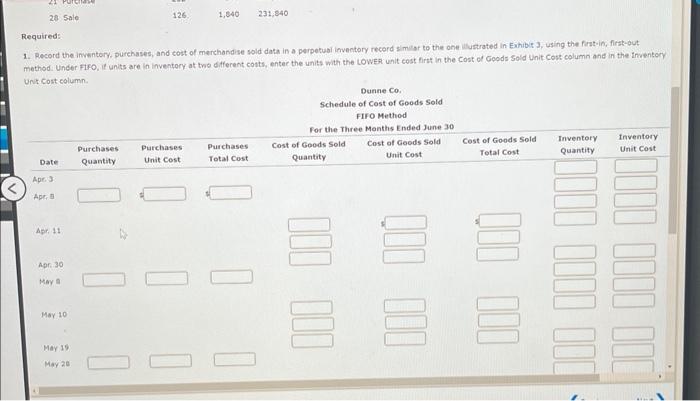

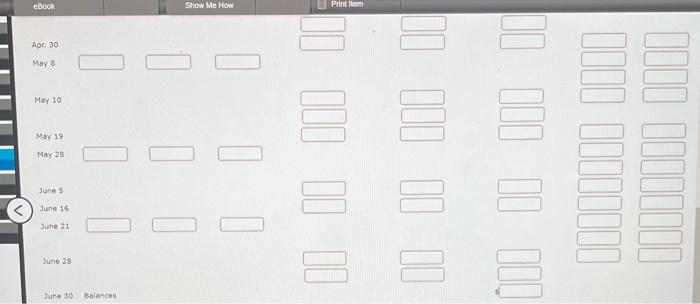

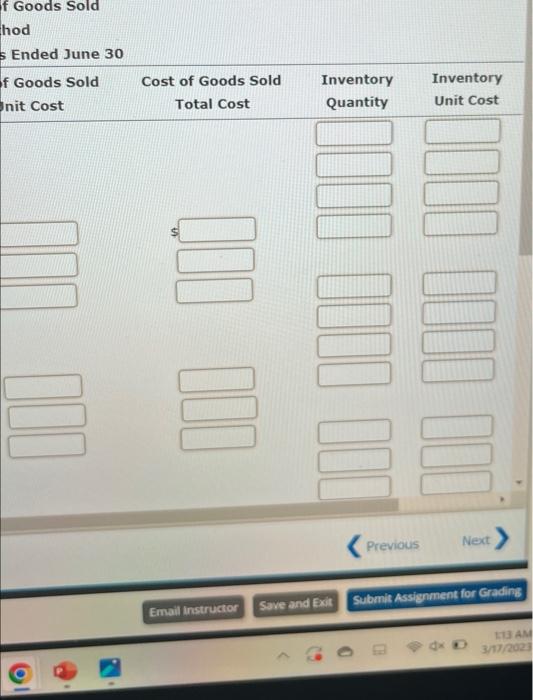

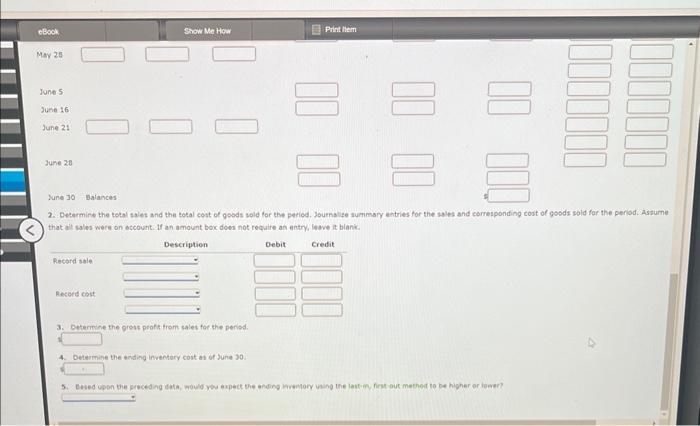

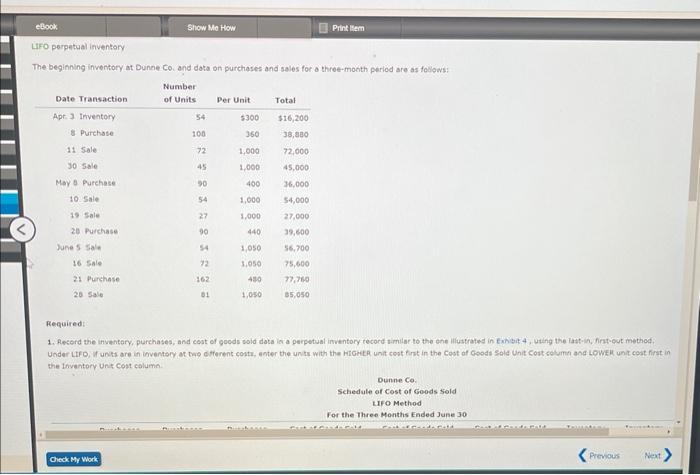

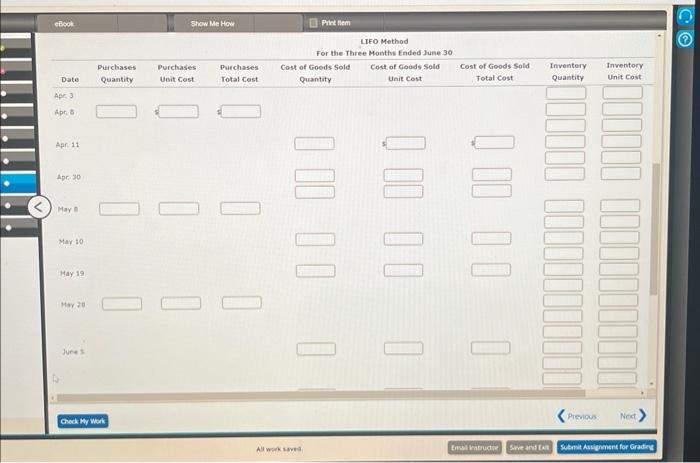

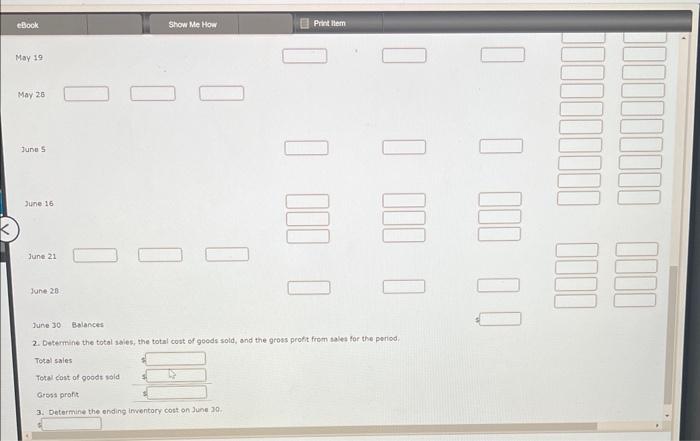

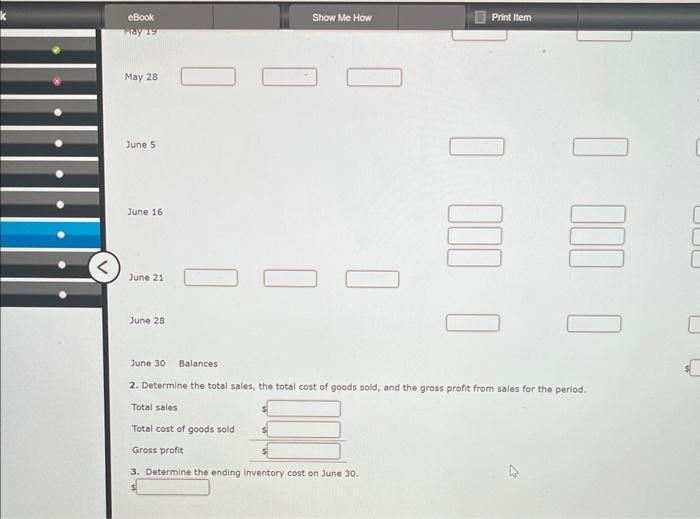

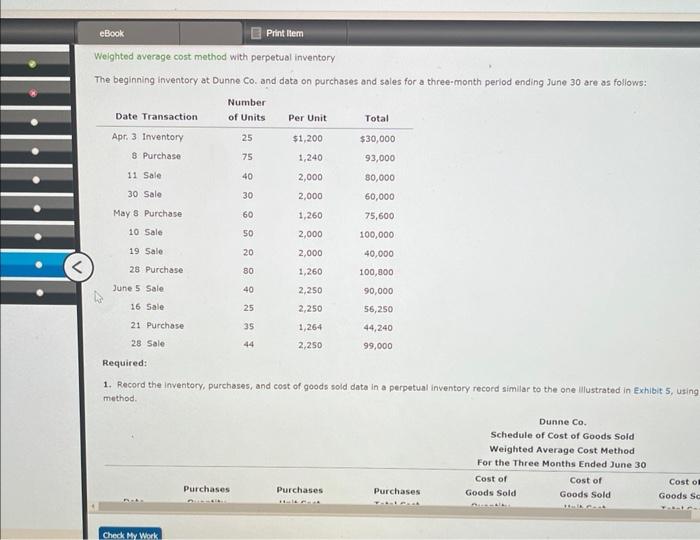

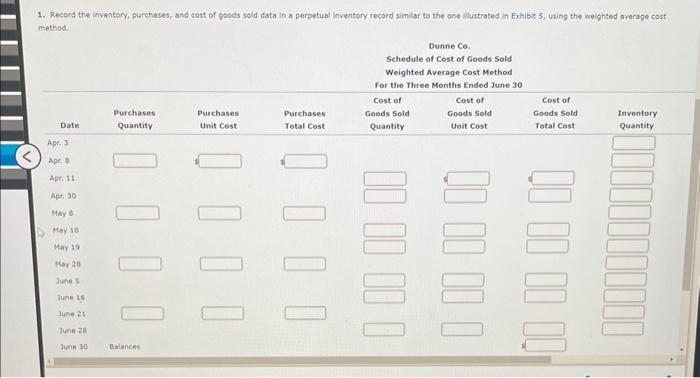

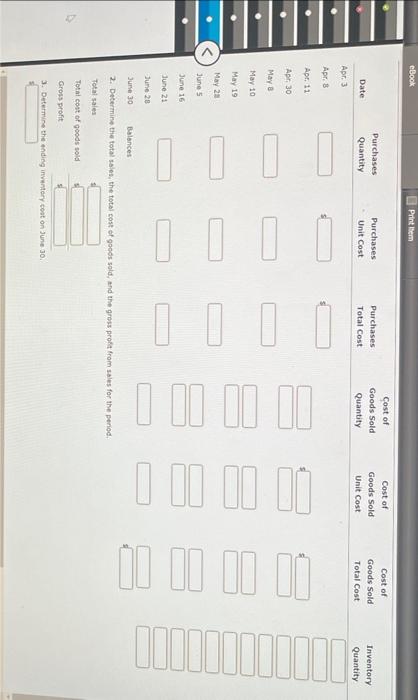

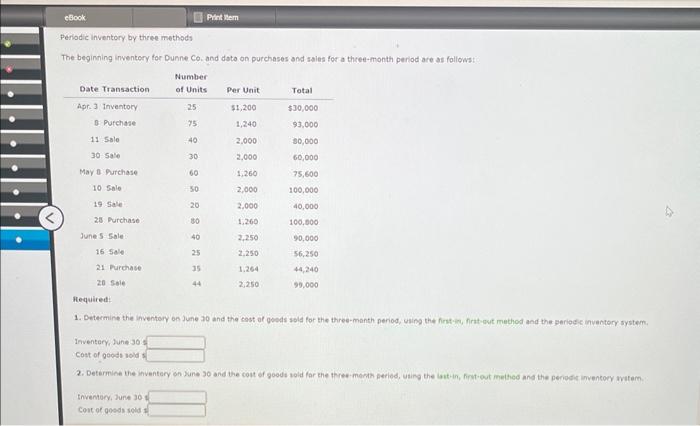

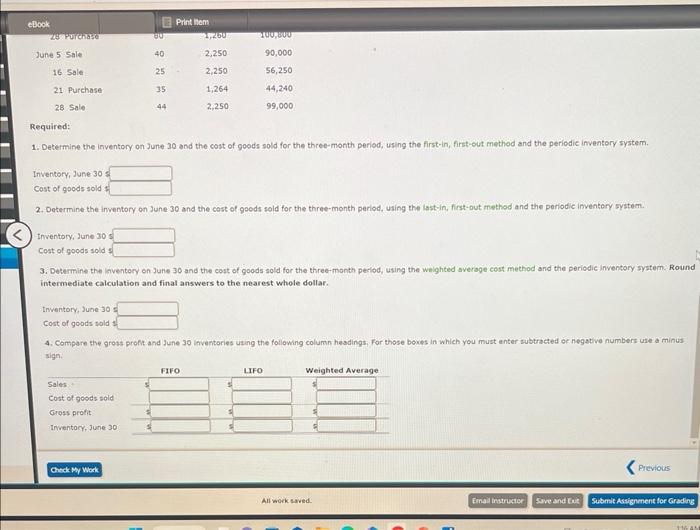

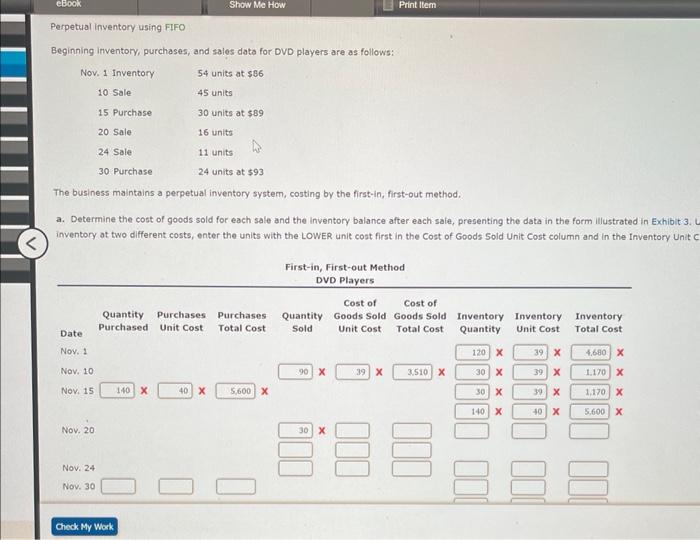

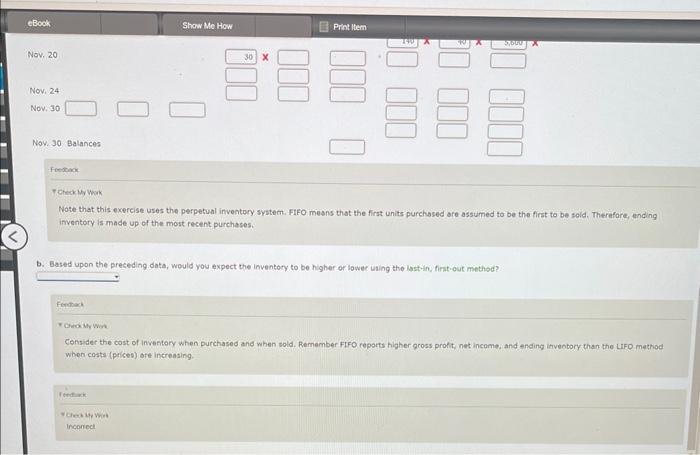

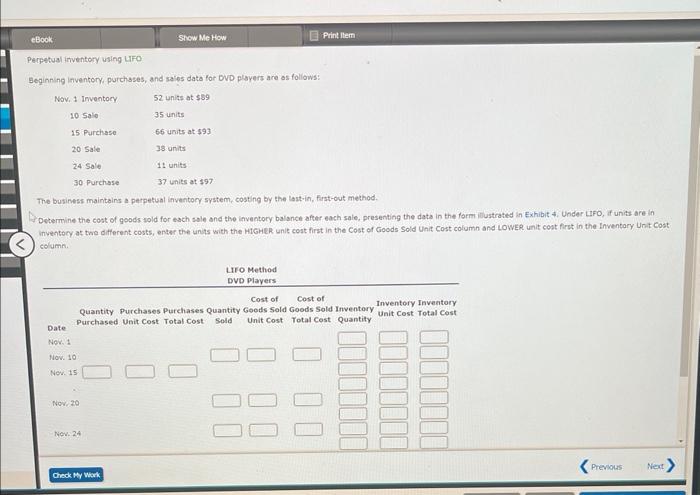

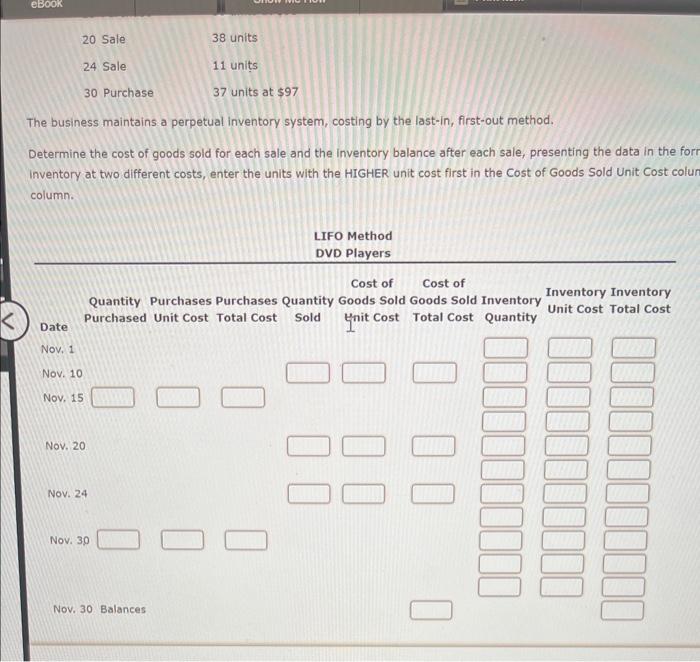

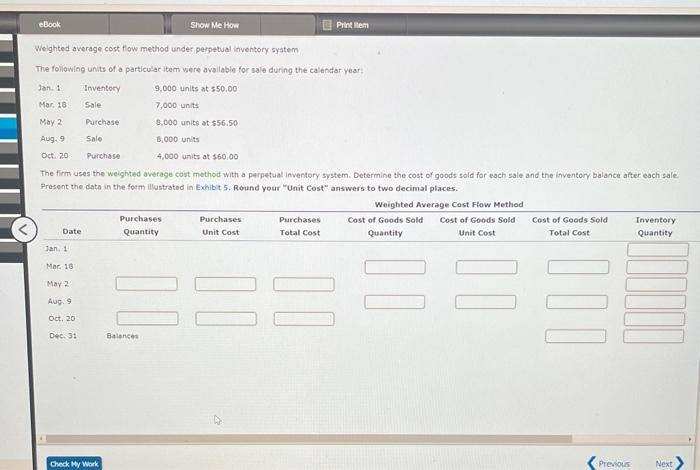

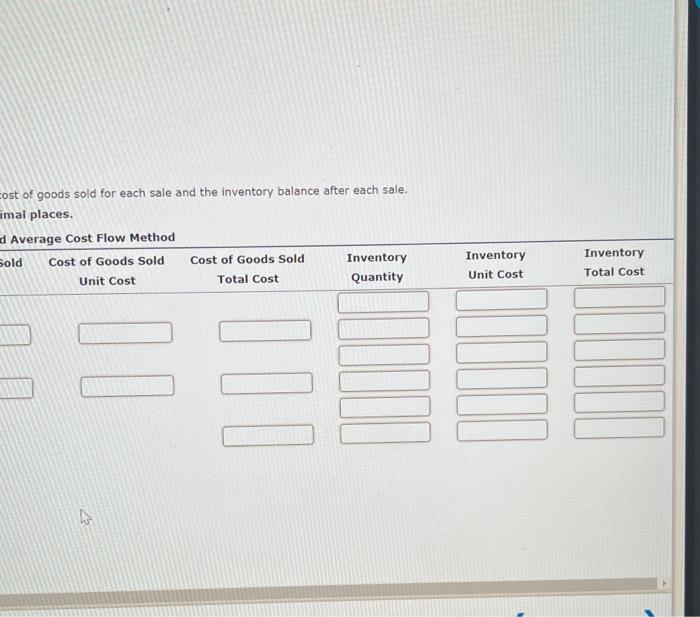

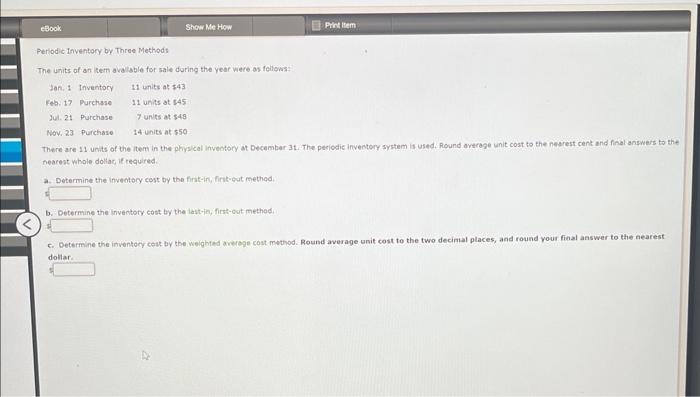

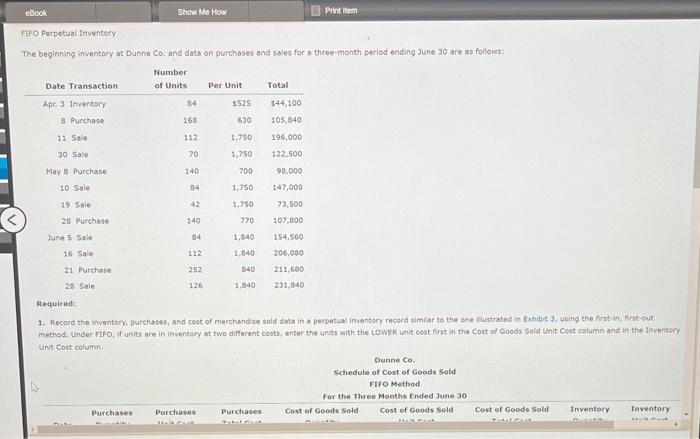

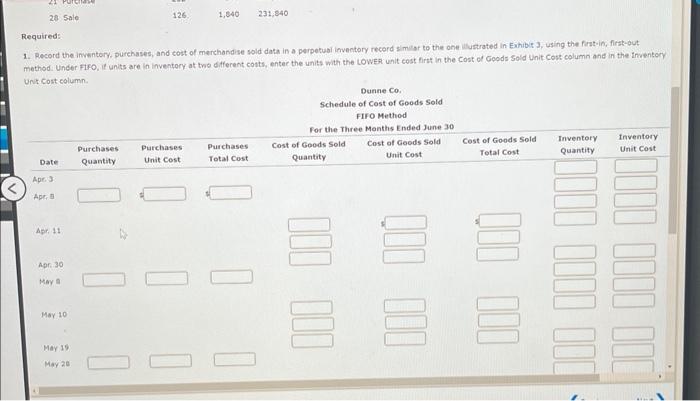

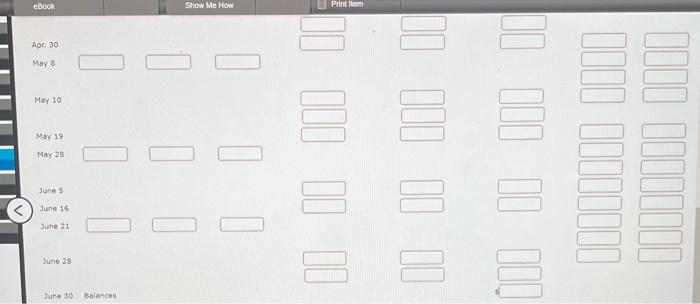

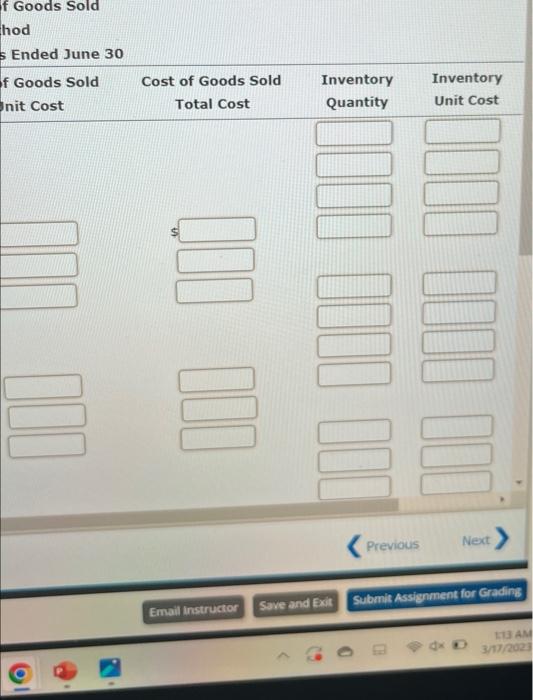

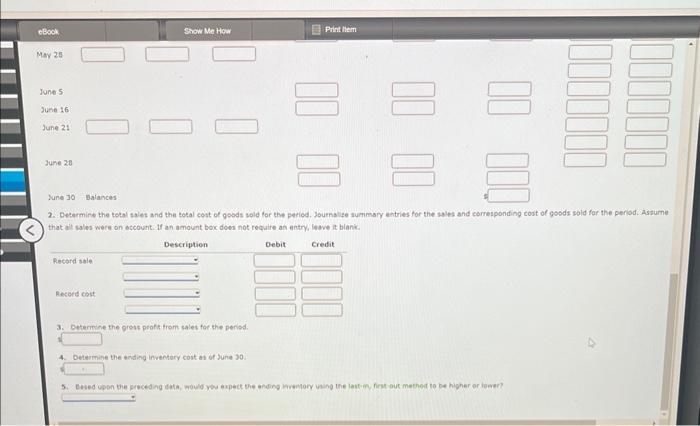

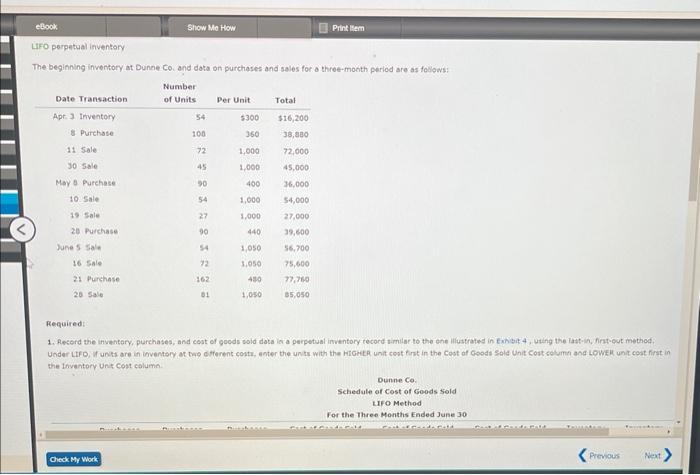

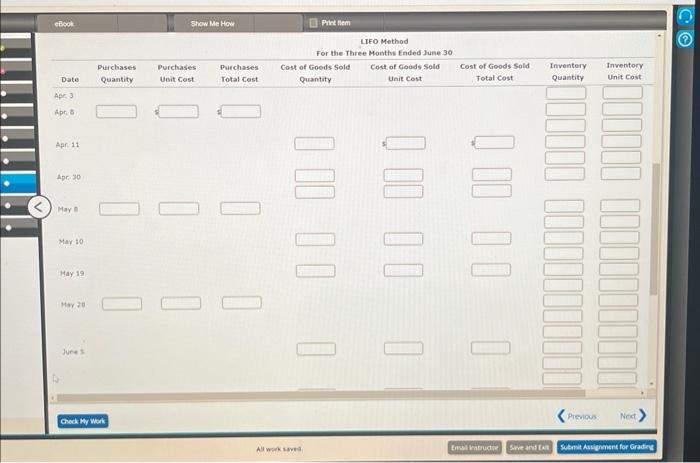

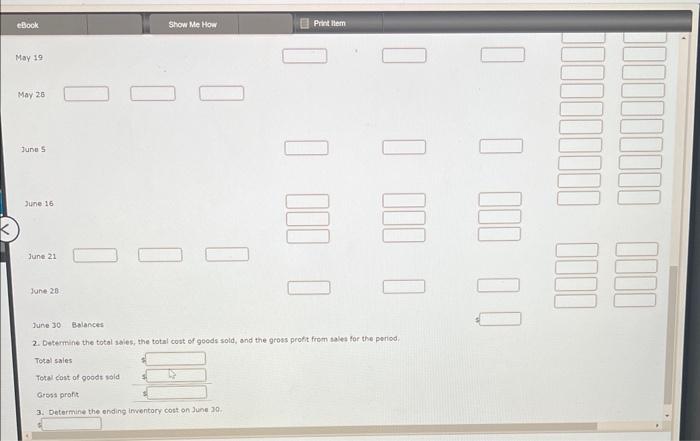

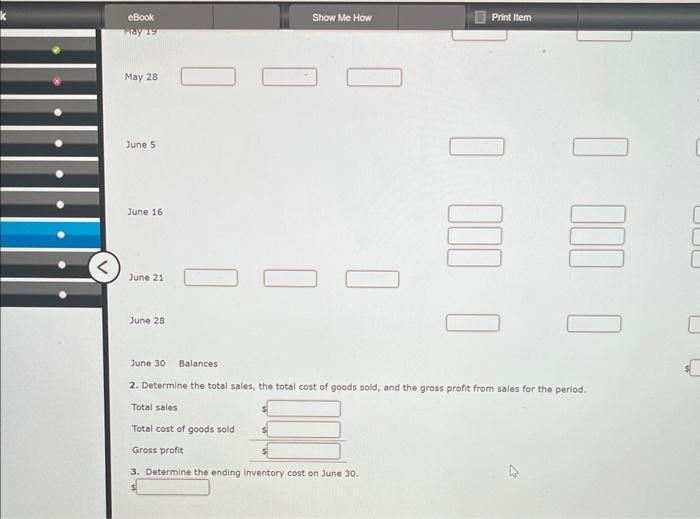

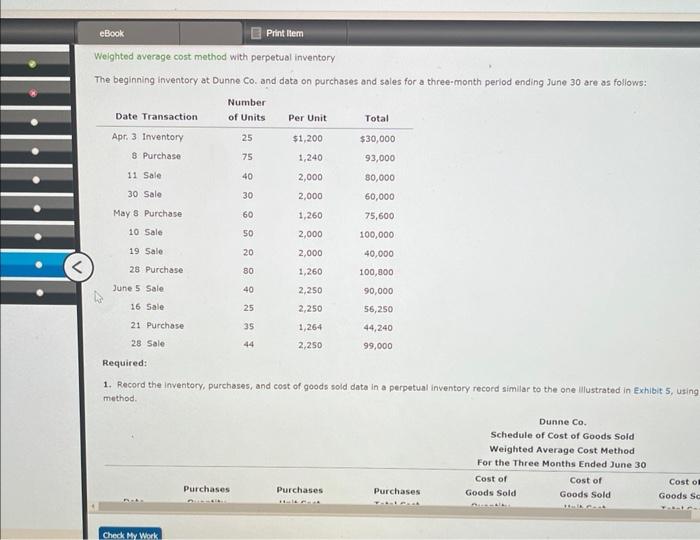

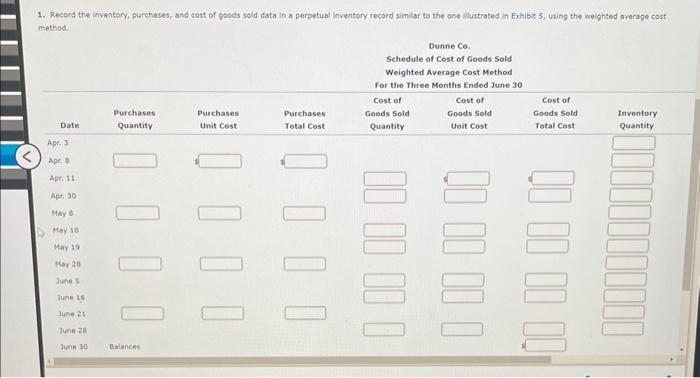

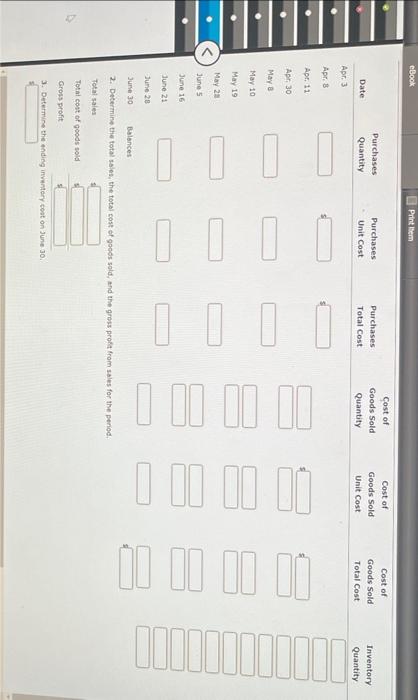

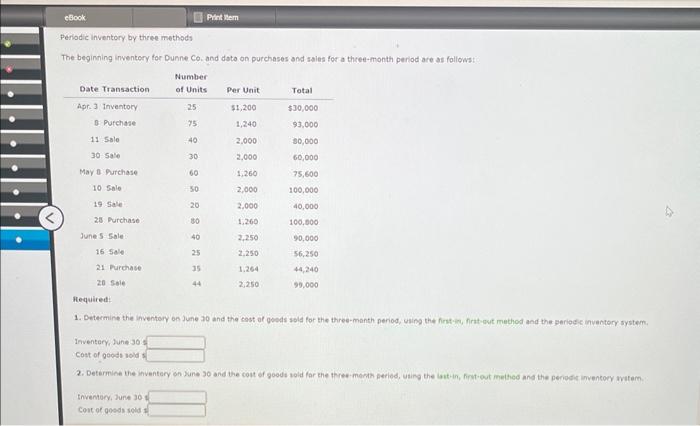

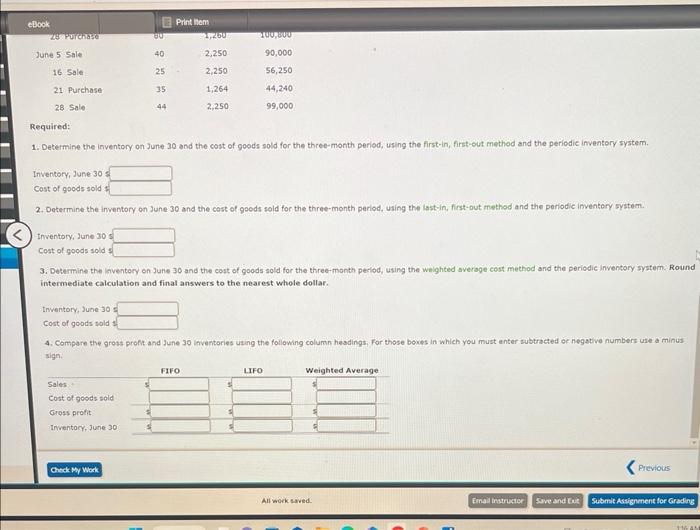

Perpetual inventory using FIFO Beginning inventory, purchases, and sales data for DVD players are as follows: The business maintains a perpetual inventory system, costing by the first-in, first-out method. a. Determine the cost of goods sold for each sale and the Inventory balance after each saie, presenting the data in the form illustrated in Exhibit 3 . inventory at two different costs, enter the units with the LOWER unit cost first in the Cost of Goods Sold Unit Cost column and in the inventory Unit Ferstake Fexeck My Whok ifiventory is made up of the most resent purchases. b. Based upbn the preceding data, would you expect the Inventory to be higher or lower uting the last,in, first-gut method? Fingtoark * chici My wirk when costs (prices) of incireasing. Perpetual iriventory using UFO Geginning inventory, purchsses, and sales data for OVD players are os follows: The business maintains a perpetual inventory system, costing by the last-in, frst-out method. Determine the cost of goods sold for each sole and the inventory balance after each sale, presenting the dats in the form illustrated in Exhibit 4, Under Lifo, if units are in. inventocy at twe different costs, enter the units with the HiGHeR unit cost first in the Cost of Goods Sold Unit Cost column and LowER. unit cost first in the Inventary Unit Cost solumn. The business maintains a perpetual inventory system, costing by the last-in, first-out method. Determine the cost of goods sold for each sale and the inventory balance after each sale, presenting the data in the for inventory at two different costs, enter the units with the HIGHER unit cost first in the Cost of Goods Sold Unit Cost colu column. Weighted average cost flow method under perpetual inventory system The following units of a particular item vere avalabie for sale during the calendar year: The firm uses the weighted average cost method with a perpetual inventory svstem. Determine the cost of goods sold for each sale and the inventory balance after each sale. Present the date in the form lllustrated in Exhib t 5. Round your "Unit Cost" answers to two decimal places. ost of goods sold for each sale and the inventory balance after each sale. imal places. Perlodic Inventory by. Three Methods The units of an item avalsble for sale daring the year were as fellows: There are 11 . units of the item in the physical inveotory at December 3t. The periodic invectory system is used. Round overage unit cost to the nearest cent and final answers to the nearent whole dollac if requred. a. Determine the inveotory cost by the first-in, first-eut methed. b. Determine the inventory cost by the last-in, first-eut method. c. Determine the inventocy cest by the weighted averogs cost mwthod. Round average unit cost to the two decimal places, and round your final answer to the aearest doliar. Fifo Perpetual Inventory The beginning inwentory at Dunne Co. and deta on purchases and sales for a three-month periad ending June 30 are as follows: Requised: 1. Record the inventory, purchapes, and cost of merchandise sold dote in a perpetual inventory record similar to the one illustrated in Exhibie 3, iusing the first-in, first-eut method. Under FIFO, if units are in inventery at two different costs, enter the ungs with the LowieA unit cost fint in the Cost of Goods: Sold Unit Cost column and in the Inventary unt cost column. Required: 1. Record the inventory. purchases, and cost of merchondise sold data in a perpetubi ievectory record simitar to the one illustrated in Exhibit 3, using the firat-in, first-out. method. Under F1FO, if units are in inventory at twe different costs, enter the units with the Lower unit cost firtt in the Cost of Goods sold Unit Cost column and in the inventory Apr.30 May B May 10 May 19 Mar 28 June 5 June 16 June 21 June 25 June 30 Bolances Goods Sold 5 Ended June 30 Previous Next. 2. Oetarmint the total ssles and the total coat of goods sold for the peried. Journslife summary entries for the sales and carresponding cost of goods sold far the period. Assume that all sales were on eccount. If an amount bok does not recuire an entry, ieave it blanic. 3. Beternine the greas perafi frem sales for the penisd. 4. Determine the anding invemery cost as of June 30 . LFo porpetual inventory The beginning inventory at Dunne co. and dota on purchases and sales for a three-mocth period are as foliows: Pequired Under LIFO, if units are in imventscy at tap efterent contr, anter the units with the HiGief unit ceat fint in the Cest af Goods Sold Unit Coat selume and Lowell unit cost firat in the thiventory unic cost caluma 2. Dafdrithe the totat saiefr ghe totm codt gr gucay auvu. 3. Determine the onding imentary cost on June. 39 . 3. Determine the ending inventory cost on June 30 . Weighted average cost method with perpetual inventory The beginning inventory at Dunne Co. and data on purchases and sales for a three-month period ending June 30 are as follows: 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one ulustrated in Exhibit 5, using method. 1. Record the inventory, purchases, and cost of goods sold data in a perpetusi inventory record similar to the one ilustrated in Exhibit 5 , using the weighted average cost method. Dunne Co. Schedule of Cost of Goods sold 3. Detemvine the anding invetery toat on Junne 30 . Perlodic inventory by theee methods The beginning inventery for Dunne Co. and dote on purchases and saies for a three-month period are as follows: Hequired! 1. Determine the inventory on June 30 and the cost af goeds sold for the three-manth penod, uing the firstimy, frat-out method and the periogic inventory system. Inventery, Junis. 30 . Cost of gepds sold s 2. Determini the inventary on Xune 30 and the cout of goods sold far the thres-marth peried, usirg the lastin, first+out melhed and the periodit inventory ivatam. thventeri, Junt 10 Cout of goded soid : tequired: 1. Determine the inventory on June 30 and the cost of goods sold for the three-month period, using the first-in, first-out method and the periodic inventory system. Inventory, June 30} Cost of goods sold s 2. Determine the inventory on June 30 and the cost of goods sold for the three-month period, using the iast-in, first-out method and the periodic inventery system. Inventory, June 30s Cost of goods sold st 3. Determine the laventery on June 30 and the eost of goods sold for the three-month perlod, using the whighted average cost method and the periodic inventory iystern. Rour intermediate calculation and final answers to the nearest whole dollar. tnventory, June 30 Cost of goods sold 1 4. Compare the gross proft and June 39 inventories using the following column headings, For those bouss in which you must enter subtrscted or negative numbers use a minus sign

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started