Question

Pls type out, no handwritting, thanks. ACC307: Taxation of companies and partnership Required: (b) Apply the relevant exemptions and deduction rules and construct the correct

Pls type out, no handwritting, thanks.

ACC307: Taxation of companies and partnership

Required:

(b) Apply the relevant exemptions and deduction rules and construct the correct tax computation for the Year of Assessment 2022. Every line item of income and expense given must be accounted for in the tax computation. Where no adjustment is required, please insert 0. In arriving at statutory income, all items of income from the non-trade source must be accounted for. All related expenses should also be accounted for. If the expense is not deductible, please insert 0.

Show all workings clearly as application marks will be awarded even if the answer is incorrect. (30 marks)

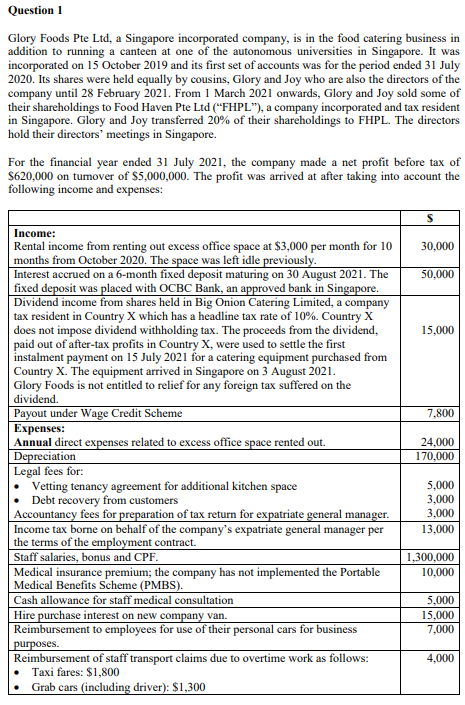

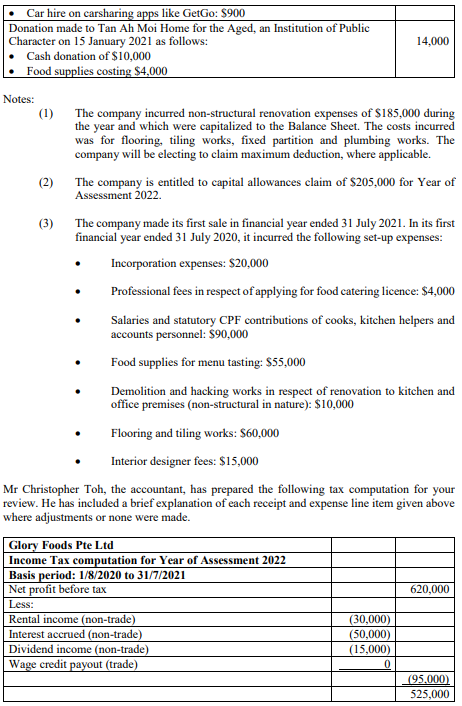

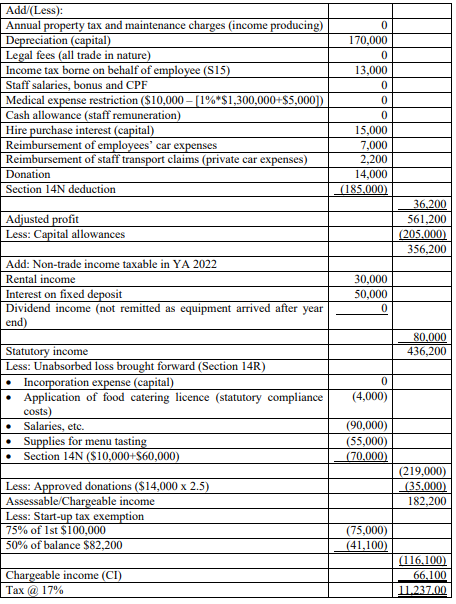

Question 1 Glory Foods Pte Ltd, a Singapore incorporated company, is in the food catering business in addition to running a canteen at one of the autonomous universities in Singapore. It was incorporated on 15 October 2019 and its first set of accounts was for the period ended 31 July 2020. Its shares were held equally by cousins, Glory and Joy who are also the directors of the company until 28 February 2021 . From 1 March 2021 onwards, Glory and Joy sold some of their shareholdings to Food Haven Pte Ltd ("FHPL"), a company incorporated and tax resident in Singapore. Glory and Joy transferred 20% of their shareholdings to FHPL. The directors hold their directors' meetings in Singapore. For the financial year ended 31 July 2021 , the company made a net profit before tax of $620,000 on tumover of $5,000,000. The profit was arrived at after taking into account the Notes: (1) The company incurred non-structural renovation expenses of $185,000 during the year and which were capitalized to the Balance Sheet. The costs incurred was for flooring, tiling works, fixed partition and plumbing works. The company will be electing to claim maximum deduction, where applicable. (2) The company is entitled to capital allowances claim of $205,000 for Year of Assessment 2022. (3) The company made its first sale in financial year ended 31 July 2021. In its first financial year ended 31 July 2020 , it incurred the following set-up expenses: - Incorporation expenses: $20,000 - Professional fees in respect of applying for food catering licence: $4,000 - Salaries and statutory CPF contributions of cooks, kitchen helpers and accounts personnel: $90,000 - Food supplies for menu tasting: $55,000 - Demolition and hacking works in respect of renovation to kitchen and office premises (non-structural in nature): $10,000 - Flooring and tiling works: $60,000 - Interior designer fees: $15,000 Mr Christopher Toh, the accountant, has prepared the following tax computation for your review. He has included a brief explanation of each receipt and expense line item given above where adjustments or none were made. Question 1 Glory Foods Pte Ltd, a Singapore incorporated company, is in the food catering business in addition to running a canteen at one of the autonomous universities in Singapore. It was incorporated on 15 October 2019 and its first set of accounts was for the period ended 31 July 2020. Its shares were held equally by cousins, Glory and Joy who are also the directors of the company until 28 February 2021 . From 1 March 2021 onwards, Glory and Joy sold some of their shareholdings to Food Haven Pte Ltd ("FHPL"), a company incorporated and tax resident in Singapore. Glory and Joy transferred 20% of their shareholdings to FHPL. The directors hold their directors' meetings in Singapore. For the financial year ended 31 July 2021 , the company made a net profit before tax of $620,000 on tumover of $5,000,000. The profit was arrived at after taking into account the Notes: (1) The company incurred non-structural renovation expenses of $185,000 during the year and which were capitalized to the Balance Sheet. The costs incurred was for flooring, tiling works, fixed partition and plumbing works. The company will be electing to claim maximum deduction, where applicable. (2) The company is entitled to capital allowances claim of $205,000 for Year of Assessment 2022. (3) The company made its first sale in financial year ended 31 July 2021. In its first financial year ended 31 July 2020 , it incurred the following set-up expenses: - Incorporation expenses: $20,000 - Professional fees in respect of applying for food catering licence: $4,000 - Salaries and statutory CPF contributions of cooks, kitchen helpers and accounts personnel: $90,000 - Food supplies for menu tasting: $55,000 - Demolition and hacking works in respect of renovation to kitchen and office premises (non-structural in nature): $10,000 - Flooring and tiling works: $60,000 - Interior designer fees: $15,000 Mr Christopher Toh, the accountant, has prepared the following tax computation for your review. He has included a brief explanation of each receipt and expense line item given above where adjustments or none were madeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started