Pls type out, no handwritting, thanks.

Following Singapore Financial Reporting Standards

ACC491: Advanced Consolidation and Corporate Reporting

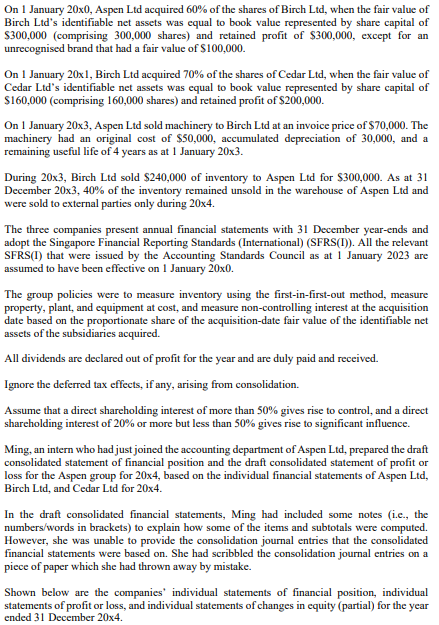

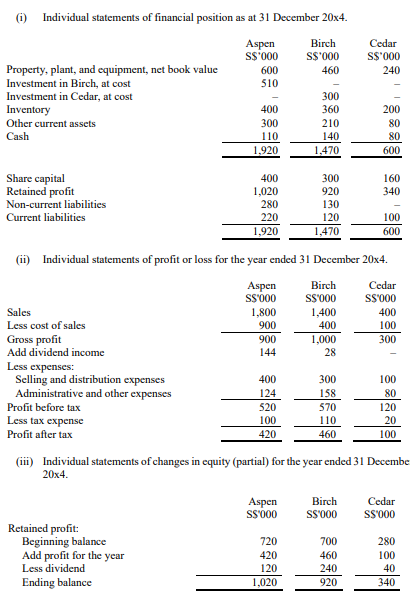

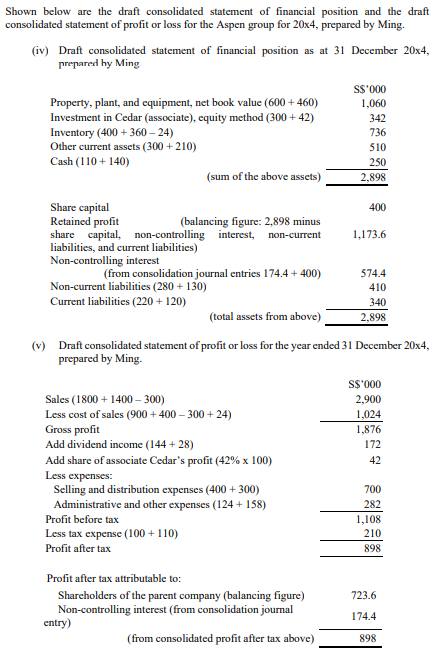

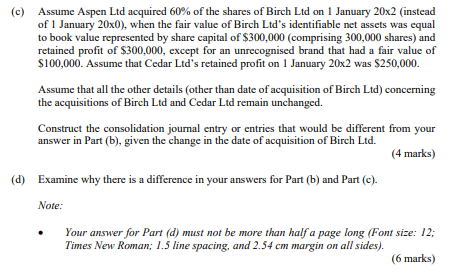

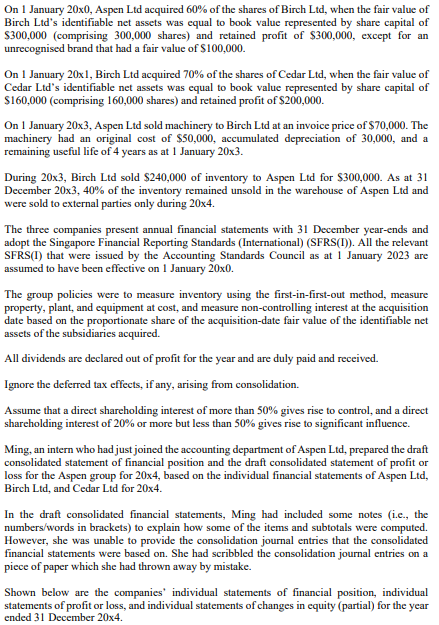

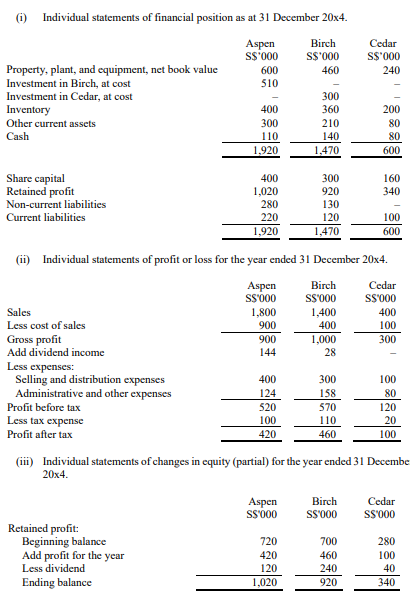

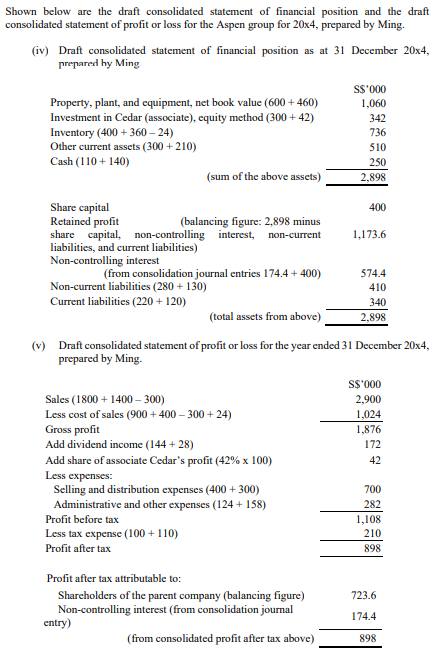

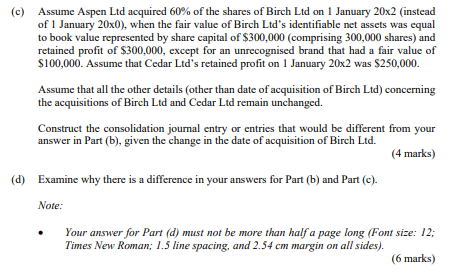

On 1 January 20x0, Aspen Ltd acquired 60% of the shares of Birch Ltd, when the fair value of Birch Ltd's identifiable net assets was equal to book value represented by share capital of $300,000 (comprising 300,000 shares) and retained profit of $300,000, except for an unrecognised brand that had a fair value of $100,000. On 1 January 20x1, Birch Ltd acquired 70\% of the shares of Cedar Ltd, when the fair value of Cedar Ltd's identifiable net assets was equal to book value represented by share capital of $160,000 (comprising 160,000 shares) and retained profit of $200,000. On 1 January 20x3, Aspen Ltd sold machinery to Birch Ltd at an invoice price of $70,000. The machinery had an original cost of $50,000, accumulated depreciation of 30,000 , and a remaining useful life of 4 years as at 1 January 203. During 20x3, Birch Ltd sold $240,000 of inventory to Aspen Ltd for $300,000. As at 31 December 203,40% of the inventory remained unsold in the warehouse of Aspen Ltd and were sold to external parties only during 20x4. The three companies present annual financial statements with 31 December year-ends and adopt the Singapore Financial Reporting Standards (International) (SFRS(I)). All the relevant SFRS(I) that were issued by the Accounting Standards Council as at 1 January 2023 are assumed to have been effective on 1 January 20x0. The group policies were to measure inventory using the first-in-first-out method, measure property, plant, and equipment at cost, and measure non-controlling interest at the acquisition date based on the proportionate share of the acquisition-date fair value of the identifiable net assets of the subsidiaries acquired. All dividends are declared out of profit for the year and are duly paid and received. Ignore the deferred tax effects, if any, arising from consolidation. Assume that a direct shareholding interest of more than 50% gives rise to control, and a direct shareholding interest of 20% or more but less than 50% gives rise to significant influence. Ming, an intern who had just joined the accounting department of Aspen Ltd, prepared the draft consolidated statement of financial position and the draft consolidated statement of profit or loss for the Aspen group for 20x4, based on the individual financial statements of Aspen Ltd, Birch Ltd, and Cedar Ltd for 20x4. In the draft consolidated financial statements, Ming had included some notes (i.e., the numbers/words in brackets) to explain how some of the items and subtotals were computed. However, she was unable to provide the consolidation journal entries that the consolidated financial statements were based on. She had scribbled the consolidation journal entries on a piece of paper which she had thrown away by mistake. Shown below are the companies' individual statements of financial position, individual statements of profit or loss, and individual statements of changes in equity (partial) for the year ended 31 December 20x4. (i) Individual statements of financial position as at 31 December 204. (ii) Individual statements of profit or loss for the year ended 31 December 20x4. (iii) Individual statements of changes in equity (partial) for the year ended 31 Decembe 204 Shown below are the draft consolidated statement of financial position and the draft consolidated statement of profit or loss for the Aspen group for 20x4, prepared by Ming. (iv) Draft consolidated statement of financial position as at 31 December 20x4, prepared hy Ming (v) Draft consolidated statement of profit or loss for the year ended 31 December 20x4, prepared by Ming. (c) Assume Aspen Ltd acquired 60% of the shares of Birch Ltd on 1 January 202 (instead of 1 January 20x0 ), when the fair value of Birch Ltd's identifiable net assets was equal to book value represented by share capital of $300,000 (comprising 300,000 shares) and retained profit of $300,000, except for an unrecognised brand that had a fair value of $100,000. Assume that Cedar Ltd's retained profit on 1 January 20x2 was $250,000. Assume that all the other details (other than date of acquisition of Birch Ltd) concerning the acquisitions of Birch Ltd and Cedar Ltd remain unchanged. Construct the consolidation journal entry or entries that would be different from your answer in Part (b), given the change in the date of acquisition of Birch Ltd. (4 marks) (d) Examine why there is a difference in your answers for Part (b) and Part (c). Note: - Your answer for Part (d) must not be more than half a page long (Font size: 12; Times New Roman; 1.5 line spacing, and 2.54cm margin on all sides). (6 marks)