Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plsase provide answer for all parts as soon as possible will give u best rating Check my wo Table A below shows abbreviated balance sheets

plsase provide answer for all parts as soon as possible will give u best rating

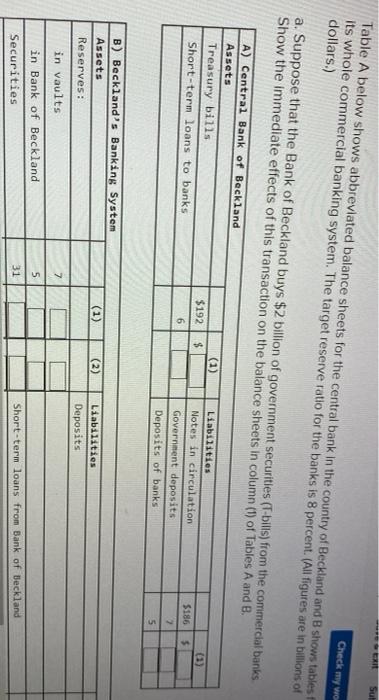

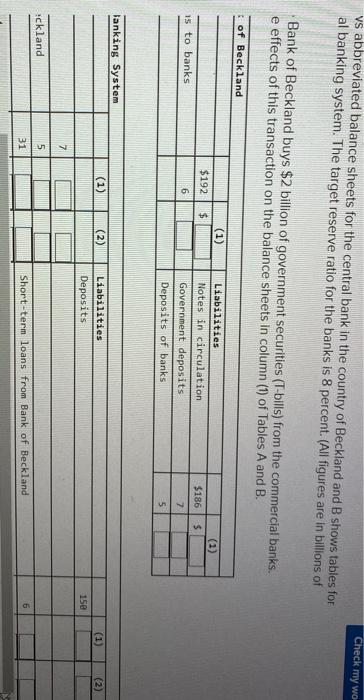

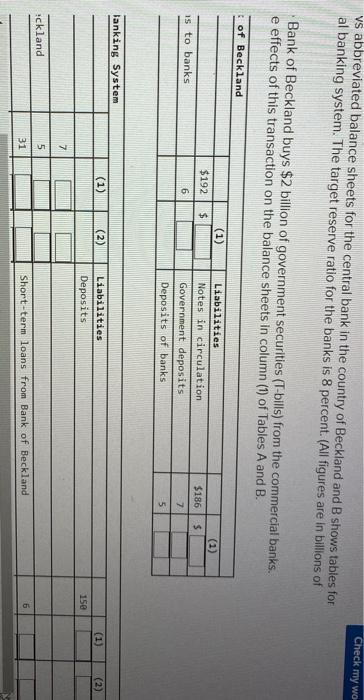

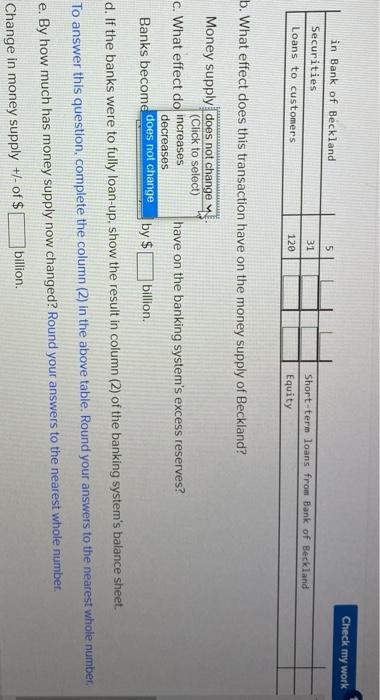

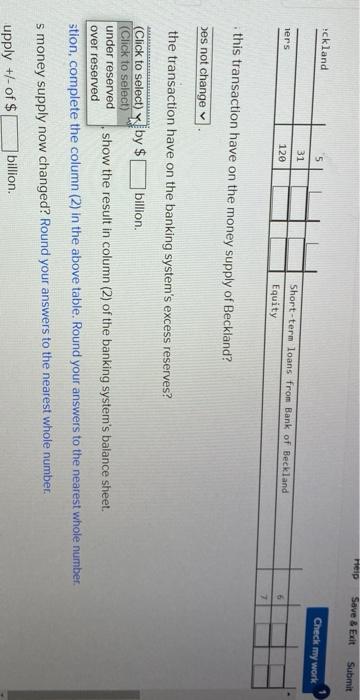

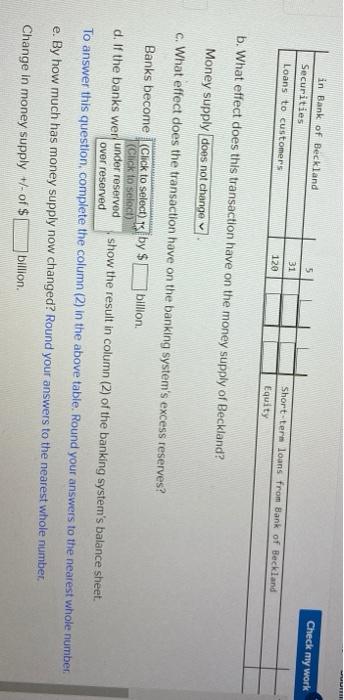

Check my wo Table A below shows abbreviated balance sheets for the central bank in the country of Beckland and B shows tables its whole commercial banking system. The target reserve ratio for the banks is 8 percent. (All figures are in billions of dollars.) a. Suppose that the Bank of Beckland buys $2 billion of government securities (T-bills) from the commercial banks Show the immediate effects of this transaction on the balance sheets in column (1) of Tables A and B. A) Central Bank of Beckland Assets Treasury bills Short-term loans to banks (1) $192 $ 6 Liabilities Notes in circulation Government deposits Deposits of banks $ $186 2 5 B) Beckland's Banking System Assets Reserves: (2) Liabilities Deposits 7 in Vaults in Bank of Beckland Securities 5 31 Short-term loans from Bank of Beckland Check my wo vs abbreviated balance sheets for the central bank in the country of Beckland and B shows tables for al banking system. The target reserve ratio for the banks is 8 percent. (All figures are in billions of Bank of Beckland buys $2 billion of government securities (T-bills) from the commercial banks. e effects of this transaction on the balance sheets in column (1) of Tables A and B. of Beckland (1) (1) $192 $ $186 $ is to banks 6 Liabilities Notes in circulation Government deposits Deposits of banks 7 5 lanking System (1) (2) Liabilities Deposits 150 7 ckland 5 6 31 Short-term loans from Bank of Beckland Check my wo vs abbreviated balance sheets for the central bank in the country of Beckland and B shows tables for al banking system. The target reserve ratio for the banks is 8 percent. (All figures are in billions of Bank of Beckland buys $2 billion of government securities (T-bills) from the commercial banks. e effects of this transaction on the balance sheets in column (1) of Tables A and B. of Beckland (1) $192 $ $186 $ is to banks 6 Liabilities Notes in circulation Government deposits Deposits of banks 7 5 lanking System (1) (2) Liabilities Deposits (1) (2) 15e 7 ckland 5 6 Short-term loans from Bank of Beckland 31 Check my work in Bank of Beckland Securities 5 31 Loans to customers Short-term loans from Bank of Beckland Equity 120 b. What effect does this transaction have on the money supply of Beckland? Money supply does not change (Click to select) c. What effect do increases decreases Banks become does not change have on the banking system's excess reserves? by $ billion. d. If the banks were to fully loan-up, show the result in column (2) of the banking system's balance sheet. To answer this question, complete the column (2) in the above table. Round your answers to the nearest whole number e. By how much has money supply now changed? Round your answers to the nearest whole number. billion. Change in money supply +/- of $ Help Save & Exit Submit Eckland 5 Check my work 31 ters 120 Short-term loans from Bank of Beckland Equity this transaction have on the money supply of Beckland? Des not change the transaction have on the banking system's excess reserves? (Click to select) by $ billion. (Click to select) under reserved show the result in column (2) of the banking system's balance sheet. over reserved stion, complete the column (2) in the above table. Round your answers to the nearest whole number s money supply now changed? Round your answers to the nearest whole number upply +/- of $ billion. in Bank of Beckland Securities Loans to customers Check my work 31 120 Short-term loans from Bank of Beckland Equity b. What effect does this transaction have on the money supply of Beckland? Money supply does not change c. What effect does the transaction have on the banking system's excess reserves? Banks become (Click to select) by $ billion (Click to select) d. If the banks wer under reserved show the result in column (2) of the banking system's balance sheet. over reserved To answer this question, complete the column (2) in the above table. Round your answers to the nearest whole number e. By how much has money supply now changed? Round your answers to the nearest whole number Change in money supply +/- of $ billion Check my wo Table A below shows abbreviated balance sheets for the central bank in the country of Beckland and B shows tables its whole commercial banking system. The target reserve ratio for the banks is 8 percent. (All figures are in billions of dollars.) a. Suppose that the Bank of Beckland buys $2 billion of government securities (T-bills) from the commercial banks Show the immediate effects of this transaction on the balance sheets in column (1) of Tables A and B. A) Central Bank of Beckland Assets Treasury bills Short-term loans to banks (1) $192 $ 6 Liabilities Notes in circulation Government deposits Deposits of banks $ $186 2 5 B) Beckland's Banking System Assets Reserves: (2) Liabilities Deposits 7 in Vaults in Bank of Beckland Securities 5 31 Short-term loans from Bank of Beckland Check my wo vs abbreviated balance sheets for the central bank in the country of Beckland and B shows tables for al banking system. The target reserve ratio for the banks is 8 percent. (All figures are in billions of Bank of Beckland buys $2 billion of government securities (T-bills) from the commercial banks. e effects of this transaction on the balance sheets in column (1) of Tables A and B. of Beckland (1) (1) $192 $ $186 $ is to banks 6 Liabilities Notes in circulation Government deposits Deposits of banks 7 5 lanking System (1) (2) Liabilities Deposits 150 7 ckland 5 6 31 Short-term loans from Bank of Beckland Check my wo vs abbreviated balance sheets for the central bank in the country of Beckland and B shows tables for al banking system. The target reserve ratio for the banks is 8 percent. (All figures are in billions of Bank of Beckland buys $2 billion of government securities (T-bills) from the commercial banks. e effects of this transaction on the balance sheets in column (1) of Tables A and B. of Beckland (1) $192 $ $186 $ is to banks 6 Liabilities Notes in circulation Government deposits Deposits of banks 7 5 lanking System (1) (2) Liabilities Deposits (1) (2) 15e 7 ckland 5 6 Short-term loans from Bank of Beckland 31 Check my work in Bank of Beckland Securities 5 31 Loans to customers Short-term loans from Bank of Beckland Equity 120 b. What effect does this transaction have on the money supply of Beckland? Money supply does not change (Click to select) c. What effect do increases decreases Banks become does not change have on the banking system's excess reserves? by $ billion. d. If the banks were to fully loan-up, show the result in column (2) of the banking system's balance sheet. To answer this question, complete the column (2) in the above table. Round your answers to the nearest whole number e. By how much has money supply now changed? Round your answers to the nearest whole number. billion. Change in money supply +/- of $ Help Save & Exit Submit Eckland 5 Check my work 31 ters 120 Short-term loans from Bank of Beckland Equity this transaction have on the money supply of Beckland? Des not change the transaction have on the banking system's excess reserves? (Click to select) by $ billion. (Click to select) under reserved show the result in column (2) of the banking system's balance sheet. over reserved stion, complete the column (2) in the above table. Round your answers to the nearest whole number s money supply now changed? Round your answers to the nearest whole number upply +/- of $ billion. in Bank of Beckland Securities Loans to customers Check my work 31 120 Short-term loans from Bank of Beckland Equity b. What effect does this transaction have on the money supply of Beckland? Money supply does not change c. What effect does the transaction have on the banking system's excess reserves? Banks become (Click to select) by $ billion (Click to select) d. If the banks wer under reserved show the result in column (2) of the banking system's balance sheet. over reserved To answer this question, complete the column (2) in the above table. Round your answers to the nearest whole number e. By how much has money supply now changed? Round your answers to the nearest whole number Change in money supply +/- of $ billion Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started