Answered step by step

Verified Expert Solution

Question

1 Approved Answer

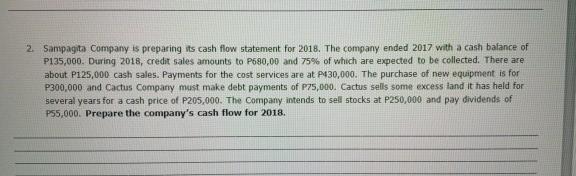

plss answer my 2 questions thank you 2. Sampagita Company is preparing its cash flow statement for 2018. The company ended 2017 with a cash

plss answer my 2 questions thank you

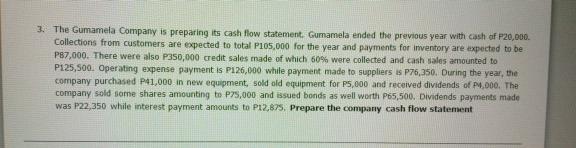

2. Sampagita Company is preparing its cash flow statement for 2018. The company ended 2017 with a cash balance of P135,000. During 2018, credit sales amounts to P680,00 and 75% of which are expected to be collected. There are about P125,000 cash sales. Payments for the cost services are at P430,000. The purchase of new equipment is for P300,000 and Cactus Company must make debt payments of P75,000. Cactus sells some excess and it has held for several years for a cash price of P205,000. The Company intends to sell stocks at P250,000 and pay dividends of P55,000. Prepare the company's cash flow for 2018. 3. The Gumamela Company is preparing its cash flow statement. Gumamela ended the previous year with cash of P20,000 Collections from customers are expected to total P105,000 for the year and payments for inventory are expected to be P87,000. There were also P350,000 credit sales made of which 60% were collected and cash sales amounted to P125,500. Operating expense payment is P126,000 while payment made to suppliers is P76,350. During the year, the company purchased P41,000 in new equipment sold old equipment for P5,000 and received dividends of P2,000. The company sold some shares amounting to P75,000 and issued bonds as well worth P65,500. Dividends payments made was P22,350 while interest payment amounts to P12,875. Prepare the company cash flow statementStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started