Answered step by step

Verified Expert Solution

Question

1 Approved Answer

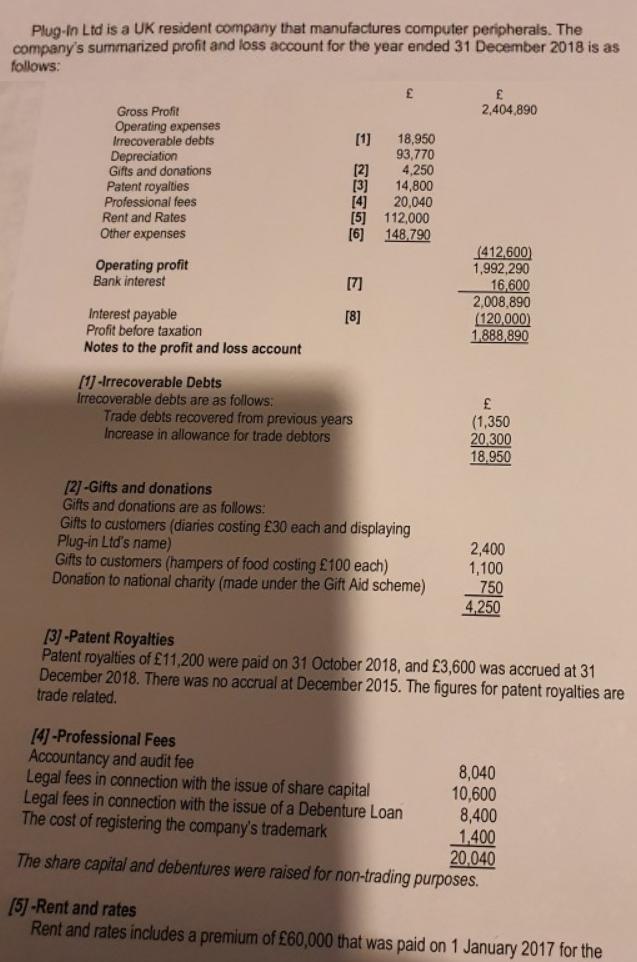

Plug-In Ltd is a UK resident company that manufactures computer peripherals. The company's summarized profit and loss account for the year ended 31 December

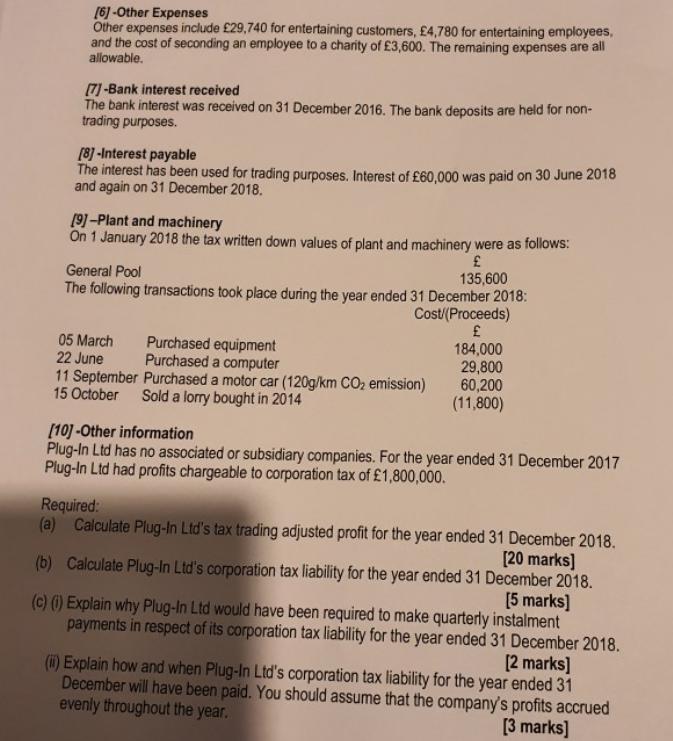

Plug-In Ltd is a UK resident company that manufactures computer peripherals. The company's summarized profit and loss account for the year ended 31 December 2018 is as follows: Gross Profit Operating expenses Irrecoverable debts Depreciation Gifts and donations Patent royalties Professional fees Rent and Rates Other expenses Operating profit Bank interest Interest payable Profit before taxation Notes to the profit and loss account [1]-Irrecoverable Debts Irrecoverable debts are as follows: [1] [2] [3] [4] [5] [6] [7] [8] Trade debts recovered from previous years Increase in allowance for trade debtors 18,950 93,770 4,250 14,800 20,040 112,000 148,790 [2]-Gifts and donations Gifts and donations are as follows: Gifts to customers (diaries costing 30 each and displaying Plug-in Ltd's name) Gifts to customers (hampers of food costing 100 each) Donation to national charity (made under the Gift Aid scheme) 2,404,890 [4]-Professional Fees Accountancy and audit fee Legal fees in connection with the issue of share capital Legal fees in connection with the issue of a Debenture Loan The cost of registering the company's trademark (412,600) 1,992,290 16,600 2,008,890 (120,000) 1.888,890 (1,350 20,300 18,950 2,400 1,100 750 4,250 [3]-Patent Royalties Patent royalties of 11,200 were paid on 31 October 2018, and 3,600 was accrued at 31 December 2018. There was no accrual at December 2015. The figures for patent royalties are trade related. 8,040 10,600 8,400 1,400 20,040 The share capital and debentures were raised for non-trading purposes. [5]-Rent and rates Rent and rates includes a premium of 60,000 that was paid on 1 January 2017 for the [6]-Other Expenses Other expenses include 29,740 for entertaining customers, 4,780 for entertaining employees, and the cost of seconding an employee to a charity of 3,600. The remaining expenses are all allowable. [7] -Bank interest received The bank interest was received on 31 December 2016. The bank deposits are held for non- trading purposes. [8]-Interest payable The interest has been used for trading purposes. Interest of 60,000 was paid on 30 June 2018 and again on 31 December 2018. [9]-Plant and machinery On 1 January 2018 the tax written down values of plant and machinery were as follows: 135,600 General Pool The following transactions took place during the year ended 31 December 2018: Cost/(Proceeds) 05 March 22 June Purchased equipment Purchased a computer 11 September Purchased a motor car (120g/km CO emission) 15 October Sold a lorry bought in 2014 184,000 29,800 60,200 (11,800) [10]-Other information Plug-In Ltd has no associated or subsidiary companies. For the year ended 31 December 2017 Plug-In Ltd had profits chargeable to corporation tax of 1,800,000. Required: (a) Calculate Plug-In Ltd's tax trading adjusted profit for the year ended 31 December 2018. [20 marks] (b) Calculate Plug-In Ltd's corporation tax liability for the year ended 31 December 2018. instalment [5 marks] (c) (i) Explain why Plug-In Ltd would have been required to make quarterly payments in respect of its corporation tax liability for the year ended 31 December 2018. [2 marks] (ii) Explain how and when Plug-In Ltd's corporation tax liability for the year ended 31 December will have been paid. You should assume that the company's profits accrued evenly throughout the year. [3 marks] Plug-In Ltd is a UK resident company that manufactures computer peripherals. The company's summarized profit and loss account for the year ended 31 December 2018 is as follows: Gross Profit Operating expenses Irrecoverable debts Depreciation Gifts and donations Patent royalties Professional fees Rent and Rates Other expenses Operating profit Bank interest Interest payable Profit before taxation Notes to the profit and loss account [1]-Irrecoverable Debts Irrecoverable debts are as follows: [1] [2] [3] [4] [5] [6] [7] [8] Trade debts recovered from previous years Increase in allowance for trade debtors 18,950 93,770 4,250 14,800 20,040 112,000 148,790 [2]-Gifts and donations Gifts and donations are as follows: Gifts to customers (diaries costing 30 each and displaying Plug-in Ltd's name) Gifts to customers (hampers of food costing 100 each) Donation to national charity (made under the Gift Aid scheme) 2,404,890 [4]-Professional Fees Accountancy and audit fee Legal fees in connection with the issue of share capital Legal fees in connection with the issue of a Debenture Loan The cost of registering the company's trademark (412,600) 1,992,290 16,600 2,008,890 (120,000) 1.888,890 (1,350 20,300 18,950 2,400 1,100 750 4,250 [3]-Patent Royalties Patent royalties of 11,200 were paid on 31 October 2018, and 3,600 was accrued at 31 December 2018. There was no accrual at December 2015. The figures for patent royalties are trade related. 8,040 10,600 8,400 1,400 20,040 The share capital and debentures were raised for non-trading purposes. [5]-Rent and rates Rent and rates includes a premium of 60,000 that was paid on 1 January 2017 for the [6]-Other Expenses Other expenses include 29,740 for entertaining customers, 4,780 for entertaining employees, and the cost of seconding an employee to a charity of 3,600. The remaining expenses are all allowable. [7] -Bank interest received The bank interest was received on 31 December 2016. The bank deposits are held for non- trading purposes. [8]-Interest payable The interest has been used for trading purposes. Interest of 60,000 was paid on 30 June 2018 and again on 31 December 2018. [9]-Plant and machinery On 1 January 2018 the tax written down values of plant and machinery were as follows: 135,600 General Pool The following transactions took place during the year ended 31 December 2018: Cost/(Proceeds) 05 March 22 June Purchased equipment Purchased a computer 11 September Purchased a motor car (120g/km CO emission) 15 October Sold a lorry bought in 2014 184,000 29,800 60,200 (11,800) [10]-Other information Plug-In Ltd has no associated or subsidiary companies. For the year ended 31 December 2017 Plug-In Ltd had profits chargeable to corporation tax of 1,800,000. Required: (a) Calculate Plug-In Ltd's tax trading adjusted profit for the year ended 31 December 2018. [20 marks] (b) Calculate Plug-In Ltd's corporation tax liability for the year ended 31 December 2018. instalment [5 marks] (c) (i) Explain why Plug-In Ltd would have been required to make quarterly payments in respect of its corporation tax liability for the year ended 31 December 2018. [2 marks] (ii) Explain how and when Plug-In Ltd's corporation tax liability for the year ended 31 December will have been paid. You should assume that the company's profits accrued evenly throughout the year. [3 marks]

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a PlugIn Ltds tax trading adjusted profit for the year ended 31 December 2018 is 1819890 This figure ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started