Question

Question 1 The Profit and loss account of Wise Ltd for the year ended 31/12/2019 shows the following: Sales 80 000 Less COGS 15 000

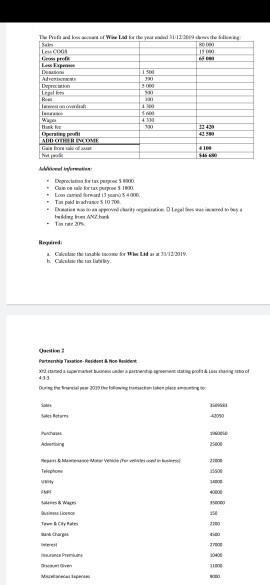

Question 1

The Profit and loss account of Wise Ltd for the year ended 31/12/2019 shows the following:

Sales 80 000

Less COGS 15 000

Gross profit 65 000

Less Expenses

Donations 1 500

Advertisements 390

Depreciation 5 000

Legal fees 500

Rent 100

Interest on overdraft 4 300

Insurance 5 600

Wages 4 330

Bank fee 700 22 420

Operating profit 42 580

ADD OTHER INCOME

Gain from sale of asset 4 100

Net profit $46 680

Additional information:

• Depreciation for tax purpose $ 8000.

• Gain on sale for tax purpose $ 1800.

• Loss carried forward (3 years) $ 4 000.

• Tax paid in advance $ 10 700.

• Donation was to an approved charity organization. Legal fees were incurred to buy a

building from ANZ bank;

• Tax rate 20%.

Required:

a. Calculate the taxable income for Wise Ltd as at 31/12/2019.

b. Calculate the tax liability.

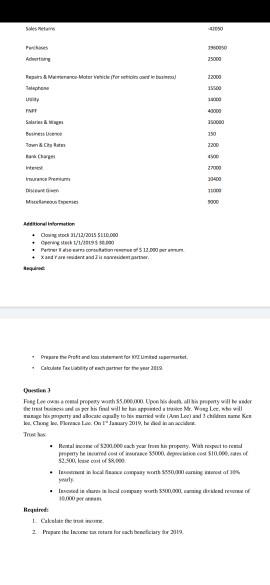

Question 2

Partnership Taxation- Resident & Non Resident

XYZ started a supermarket business under a partnership agreement stating profit & Loss sharing ratio of 4:3:3. During the financial year 2019, the following transaction has taken place amounting to:

Sales 3509583

Sales Returns -42050

Purchases 1960050

Advertising 25000

Repairs & Maintenance-Motor Vehicle (For vehicles used in business) 22000

Telephone 15500

Utility 14000

FNPF 40000

Salaries & Wages 350000

Business Licence 150

Town & City Rates 2200

Bank Charges 4500

Interest 27000

Insurance Premiums 10400

Discount Given 11000

Miscellaneous Expenses 9000

Additional Information

Closing stock 31/12/2015 $110,000

Opening stock 1/1/2019 $ 30,000

Partner X also earns consultation revenue of $ 12,000 per annum.

X and Y are residents and Z is a nonresident partner.

Required:

-Prepare the Profit and loss statement for XYZ Limited supermarket.

- Calculate the Tax Liability of each partner for the year 2019.

Question 3

Fong Lee owns a rental property worth $5,000,000. Upon his death, all his property will be under the trust business and as per his final will he has appointed a trustee Mr. Wong Lee, who will manage his property and allocate equally to his married wife (Ann Lee) and 3 children name Kenlee, Chong lee, Florence Lee. On 1st January 2019, he died in an accident.

Trust has:

Rental income of $200,000 each year from his property. With respect to rental property, he incurred cost of insurance $5000, depreciation cost of $10,000, rates of $2,500, lease cost of $8,000. Investment in local finance company worth $550,000 earning interest of 10% yearly. Invested in shares in the local company worth $500,000, earning dividend revenue of 10,000 per annum.

Required:

1. Calculate the trust income.

2. Prepare the Income-tax return for each beneficiary for 2019.

T Pufa ad k W Lad ke the yeu d 1 de n LeCoO pre Las Exp De Adveni L00 Legl Rie Wage Bink ke Operating pe ADO OTREN ME Ga ho aid 100 143 41 580 et iretin Degrectua rtas pereSO Caeceal kra I Lom ared nad 13 sano4 - Ta paid iadrase s 10 70 Eie apoa Dlegeles waied e Tan r an Clntae the tunat tacom ke Lad aviIv. h. Cal he ly. Patner Tee edetoe ke t meda a vtenta pro ha et ie Setu Adne e e veeer Teiphone ert es Wa TeC charga tiao weet na Prenane ven

Step by Step Solution

3.50 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 Cash flow statement Direct Method Cash flows from operating activities Working Amount Cas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started