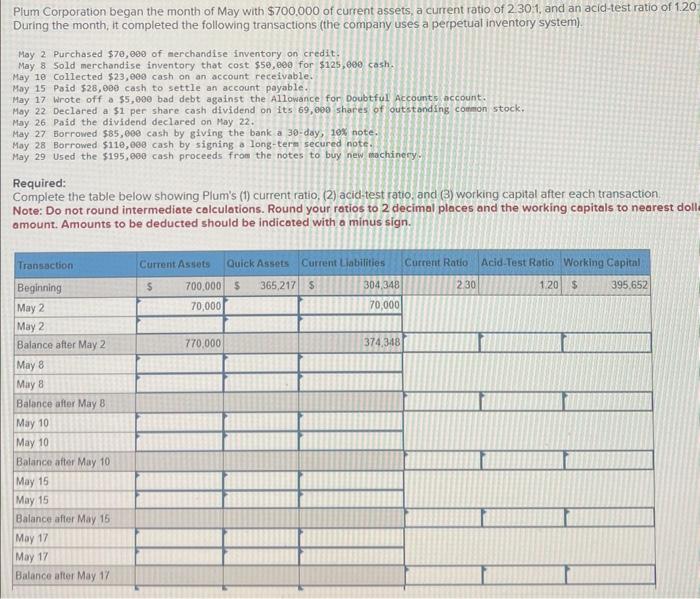

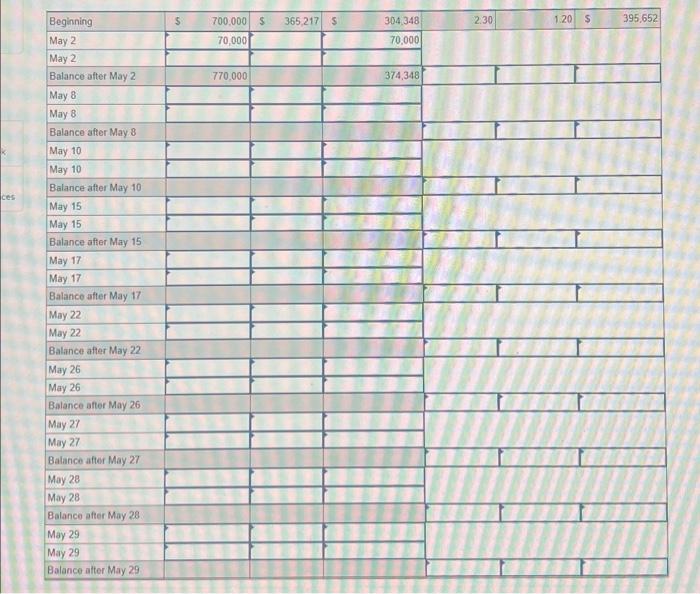

Plum Corporation began the month of May with $700,000 of current assets, a current ratio of 2301 , and an acid-test ratio of 1.20 During the month, it completed the following transactions (the company uses a perpetual inventory system). May 2 Purchased $70,000 of merchandise inventory on credit. May 8 sold merchandise inventory that cost $50,600 for $125,600 cash. May 18 collected $23, e0e cash on an account receivable. May 15 Paid 528,000 cash to settle an account payable. May 17 Wrote off a $5,000 bad debt against the Allowance for Doubtful Accounts account. May 22 Declared a $1 per share cash dividend on its 69 , 600 shares of outstonding corfion stock. May 26 Paid the dividend declared on May 22. May 27 Borrowed 585,900 cash by giving the bank a 30 -day, 10% note. May 28 Borrowed $118,000 cash by signing a long-tere secured note. May 29 Used the $195,000 cash proceeds from the notes to buy new machinery: Required: Complete the table below showing Plum's (1) current ratio, (2) acid-test ratio, and (3) working capital after each transaction Note: Do not round intermediate calculations. Round your ratios to 2 decimal places and the working capitals to nearest doll amount. Amounts to be deducted should be indicated with a minus sign. Plum Corporation began the month of May with $700,000 of current assets, a current ratio of 2301 , and an acid-test ratio of 1.20 During the month, it completed the following transactions (the company uses a perpetual inventory system). May 2 Purchased $70,000 of merchandise inventory on credit. May 8 sold merchandise inventory that cost $50,600 for $125,600 cash. May 18 collected $23, e0e cash on an account receivable. May 15 Paid 528,000 cash to settle an account payable. May 17 Wrote off a $5,000 bad debt against the Allowance for Doubtful Accounts account. May 22 Declared a $1 per share cash dividend on its 69 , 600 shares of outstonding corfion stock. May 26 Paid the dividend declared on May 22. May 27 Borrowed 585,900 cash by giving the bank a 30 -day, 10% note. May 28 Borrowed $118,000 cash by signing a long-tere secured note. May 29 Used the $195,000 cash proceeds from the notes to buy new machinery: Required: Complete the table below showing Plum's (1) current ratio, (2) acid-test ratio, and (3) working capital after each transaction Note: Do not round intermediate calculations. Round your ratios to 2 decimal places and the working capitals to nearest doll amount. Amounts to be deducted should be indicated with a minus sign