Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Plumb Co Ltd (PC) is a plumbing supply and service company owned by four shareholders who are also directors. The company has a 31

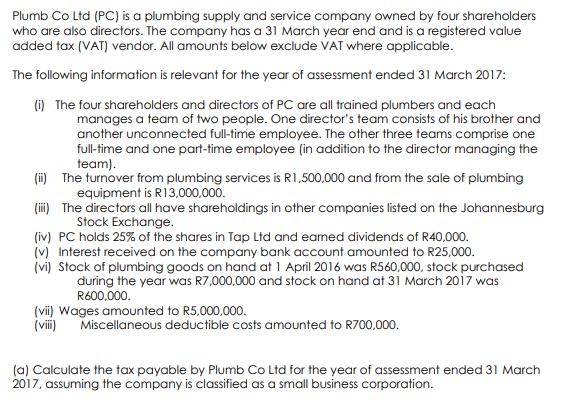

Plumb Co Ltd (PC) is a plumbing supply and service company owned by four shareholders who are also directors. The company has a 31 March year end and is a registered value added tax (VAT) vendor. All amounts below exclude VAT where applicable. The following information is relevant for the year of assessment ended 31 March 2017: (i) The four shareholders and directors of PC are all trained plumbers and each manages a team of two people. One director's team consists of his brother and another unconnected full-time employee. The other three teams comprise one full-time and one part-time employee (in addition to the director managing the team). (ii) The turnover from plumbing services is R1,500,000 and from the sale of plumbing equipment is R13,000,000. (iii) The directors all have shareholdings in other companies listed on the Johannesburg Stock Exchange. (iv) PC holds 25% of the shares in Tap Ltd and earned dividends of R40,000. (v) Interest received on the company bank account amounted to R25,000. (vi) Stock of plumbing goods on hand at 1 April 2016 was R560,000, stock purchased during the year was R7,000,000 and stock on hand at 31 March 2017 was R600,000. (vii) Wages amounted to R5,000,000. (viii) Miscellaneous deductible costs amounted to R700,000. (a) Calculate the tax payable by Plumb Co Ltd for the year of assessment ended 31 March 2017, assuming the company is classified as a small business corporation.

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the tax payable by Plumb Co Ltd for the year of assessment ended 31 March 2017 we need ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started