Answered step by step

Verified Expert Solution

Question

1 Approved Answer

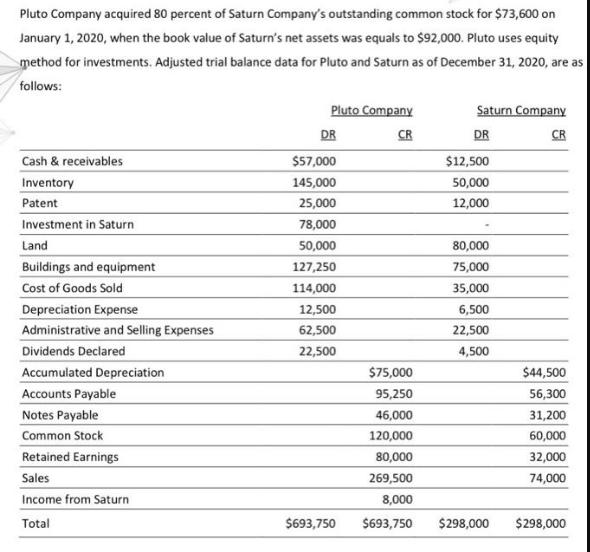

Pluto Company acquired 80 percent of Saturn Company's outstanding common stock for $73,600 on January 1, 2020, when the book value of Saturn's net

Pluto Company acquired 80 percent of Saturn Company's outstanding common stock for $73,600 on January 1, 2020, when the book value of Saturn's net assets was equals to $92,000. Pluto uses equity method for investments. Adjusted trial balance data for Pluto and Saturn as of December 31, 2020, are as follows: Cash & receivables Inventory Patent Investment in Saturn Land Buildings and equipment Cost of Goods Sold Depreciation Expense Administrative and Selling Expenses Dividends Declared Accumulated Depreciation Accounts Payable Notes Payable Common Stock Retained Earnings Sales Income from Saturn Total Pluto Company CR DR $57,000 145,000 25,000 78,000 50,000 127,250 114,000 12,500 62,500 22,500 $75,000 95,250 46,000 120,000 80,000 269,500 8,000 $693,750 $693,750 Saturn Company DR $12,500 50,000 12,000 80,000 75,000 35,000 6,500 22,500 4,500 $298,000 CR $44,500 56,300 31,200 60,000 32,000 74,000 $298,000 d) Prepare accumulated depreciation consolidation entry (10 points). e) Prepare a consolidation worksheet for 2020 in good form (30 points).

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started