Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pluto Limited (PL) manufactures a single product ZAA and operates at a normal capacity of 45,000 machine hours per annum which is 90% of

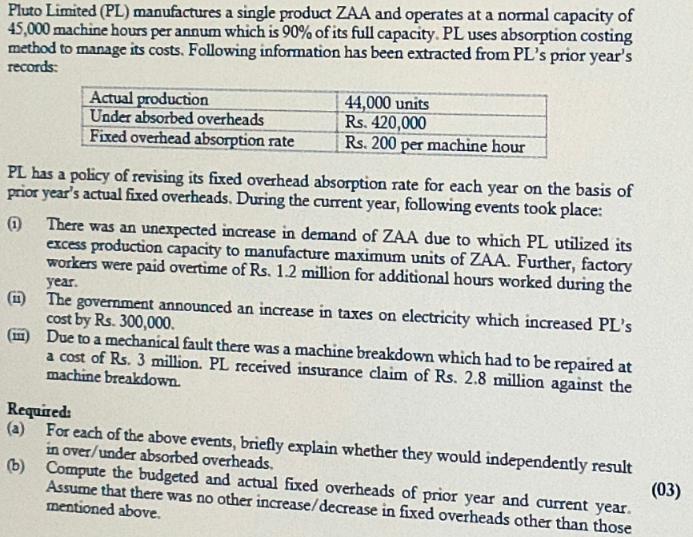

Pluto Limited (PL) manufactures a single product ZAA and operates at a normal capacity of 45,000 machine hours per annum which is 90% of its full capacity. PL uses absorption costing method to manage its costs. Following information has been extracted from PL's prior year's records: Actual production Under absorbed overheads Fixed overhead absorption rate 44,000 units Rs. 420,000 Rs. 200 per machine hour PL has a policy of revising its fixed overhead absorption rate for each year on the basis of prior year's actual fixed overheads. During the current year, following events took place: (1) There was an unexpected increase in demand of ZAA due to which PL utilized its excess production capacity to manufacture maximum units of ZAA. Further, factory workers were paid overtime of Rs. 1.2 million for additional hours worked during the year. (i) The government announced an increase in taxes on electricity which increased PL's cost by Rs. 300,000. Due to a mechanical fault there was a machine breakdown which had to be repaired at a cost of Rs. 3 million. PL received insurance claim of Rs. 2.8 million against the machine breakdown. Required: (a) For each of the above events, briefly explain whether they would independently result in over/under absorbed overheads. (b) Compute the budgeted and actual fixed overheads of prior year and current year. Assume that there was no other increase/decrease in fixed overheads other than those mentioned above. (03)

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Explanation of overunder absorbed overheads for each event 1 Unexpected Increase in Demand and Overtime Payments Since PL operated at 90 of its full capacity in the prior year 45000 machine hours an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started