Question

Plymouth Corporation has only one class of stock. There are 76,000 shares outstanding. During 20X1, the corporation's net income after taxes was $486,400. The

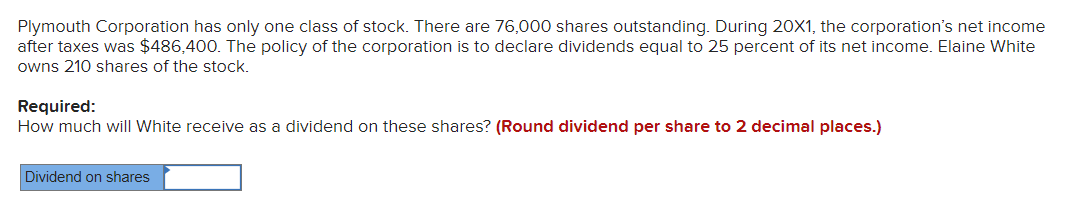

Plymouth Corporation has only one class of stock. There are 76,000 shares outstanding. During 20X1, the corporation's net income after taxes was $486,400. The policy of the corporation is to declare dividends equal to 25 percent of its net income. Elaine White owns 210 shares of the stock. Required: How much will White receive as a dividend on these shares? (Round dividend per share to 2 decimal places.) Dividend on shares

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the dividend Elaine White will receive on her 210 shares we need ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Accounting Chapters 1-30

Authors: David Haddock, John Price, Michael Farina

16th Edition

1260247902, 978-1260247909

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App