Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz answer all parts to receive thumbs up Suppose Compco Systems pays no dividends but spent $5.19 billion on share repurchases last year. If Compco's

plz answer all parts to receive thumbs up

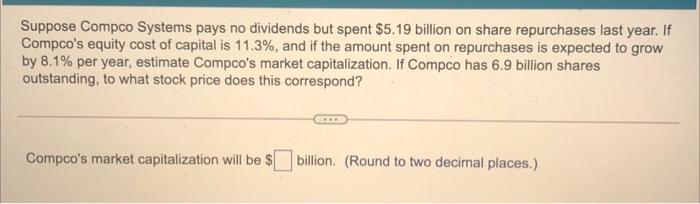

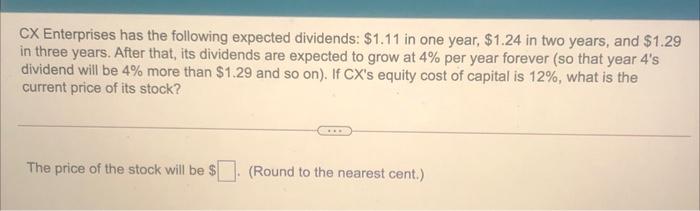

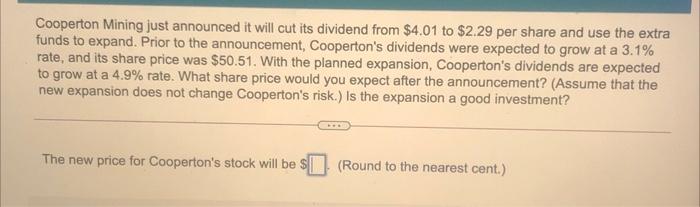

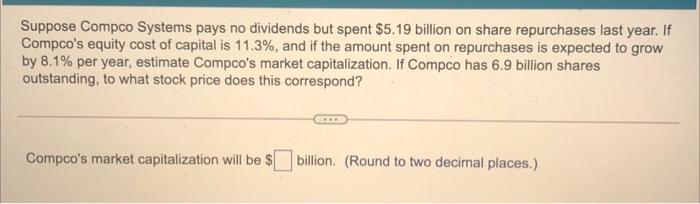

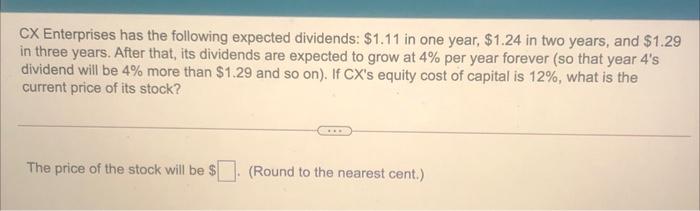

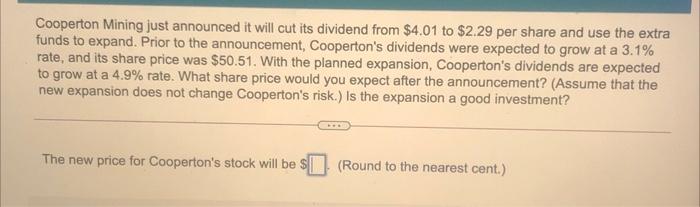

Suppose Compco Systems pays no dividends but spent $5.19 billion on share repurchases last year. If Compco's equity cost of capital is 11.3%, and if the amount spent on repurchases is expected to grow by 8.1% per year, estimate Compco's market capitalization. If Compco has 6.9 billion shares outstanding, to what stock price does this correspond? Compco's market capitalization will be $ billion. (Round to two decimal places.) CX Enterprises has the following expected dividends: $1.11 in one year, $1.24 in two years, and $1.29 in three years. After that, its dividends are expected to grow at 4% per year forever (so that year 4's dividend will be 4% more than $1.29 and so on). If CX's equity cost of capital is 12%, what is the current price of its stock? The price of the stock will be $ . (Round to the nearest cent.) Cooperton Mining just announced it will cut its dividend from $4.01 to $2.29 per share and use the extra funds to expand. Prior to the announcement, Cooperton's dividends were expected to grow at a 3.1% rate, and its share price was $50.51. With the planned expansion, Cooperton's dividends are expected to grow at a 4.9% rate. What share price would you expect after the announcement? (Assume that the new expansion does not change Cooperton's risk.) Is the expansion a good investment? The new price for Cooperton's stock will be s I (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started