Answered step by step

Verified Expert Solution

Question

1 Approved Answer

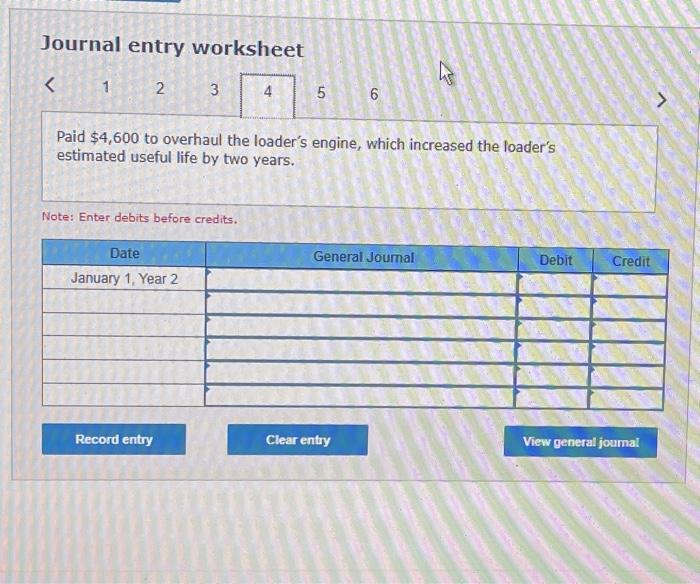

plz answer all questions fast and correctly! Journal entry worksheet Paid $4,600 to overhaul the loader's engine, which increased the loader's estimated useful life by

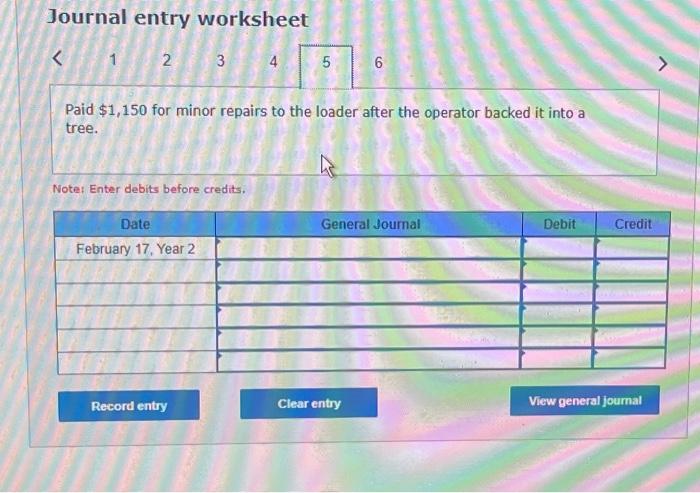

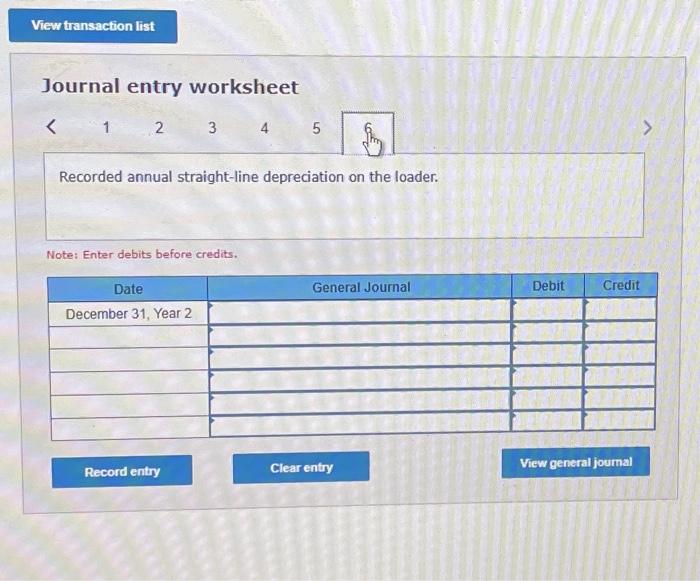

plz answer all questions fast and correctly!

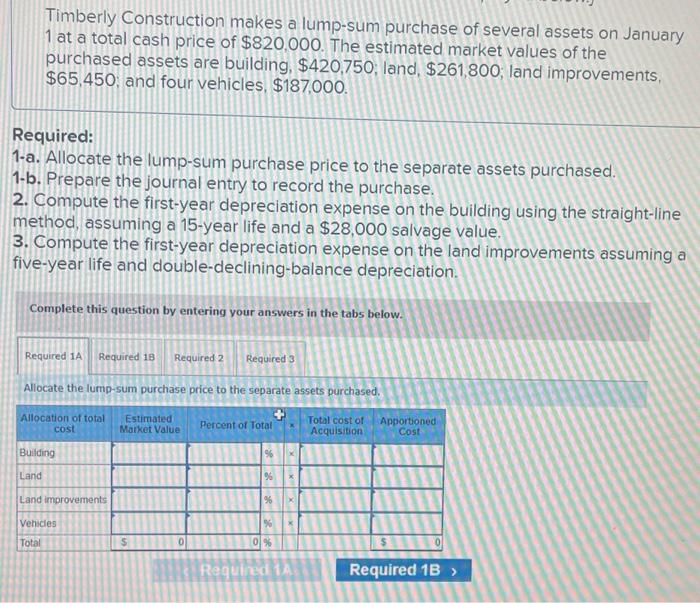

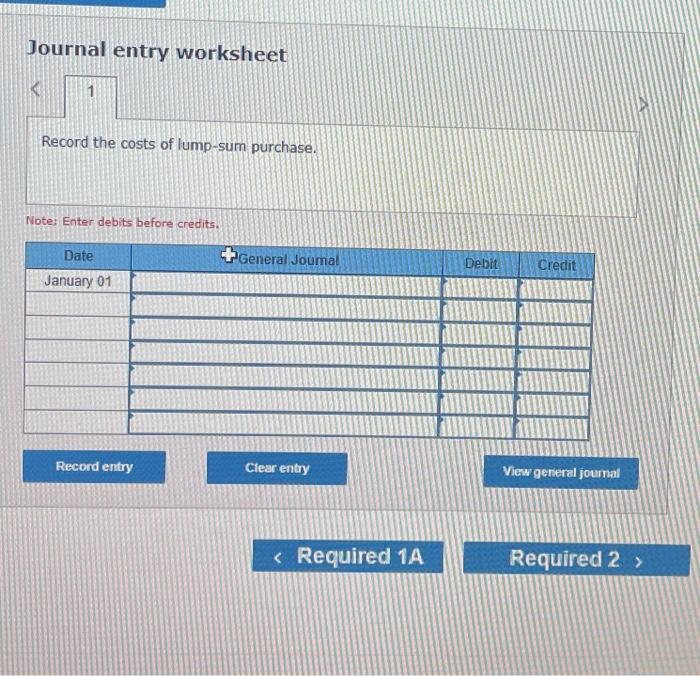

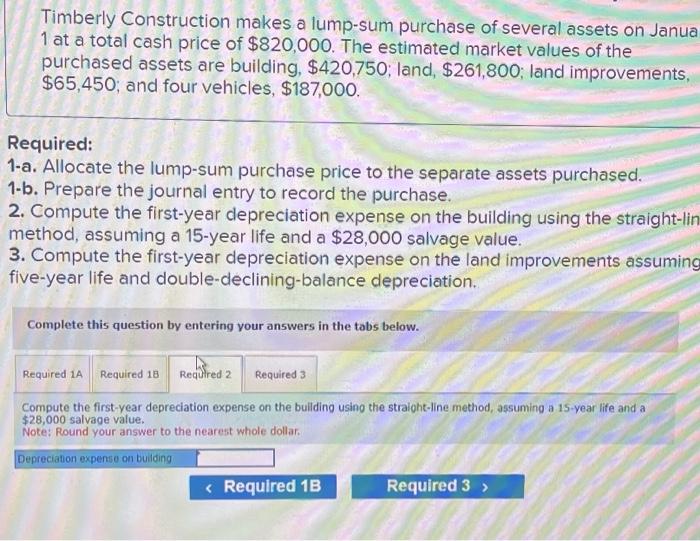

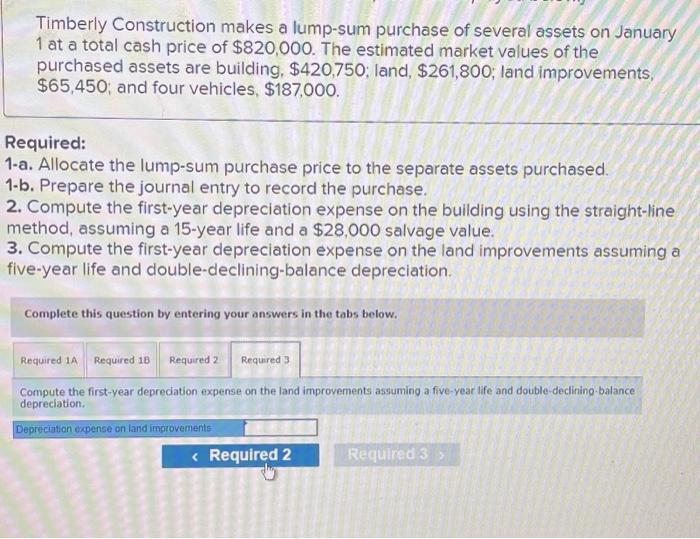

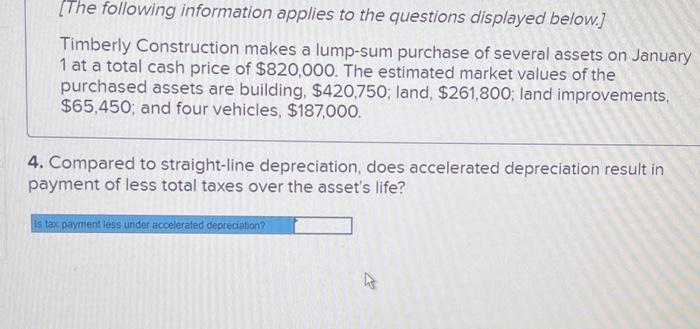

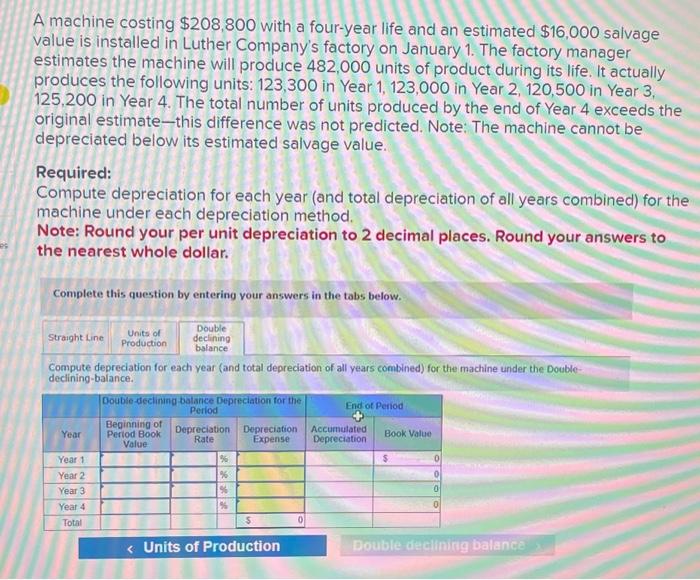

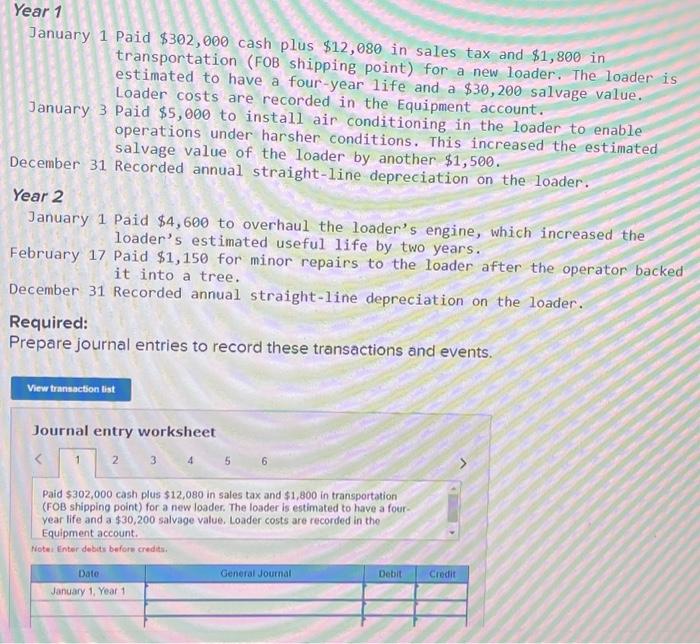

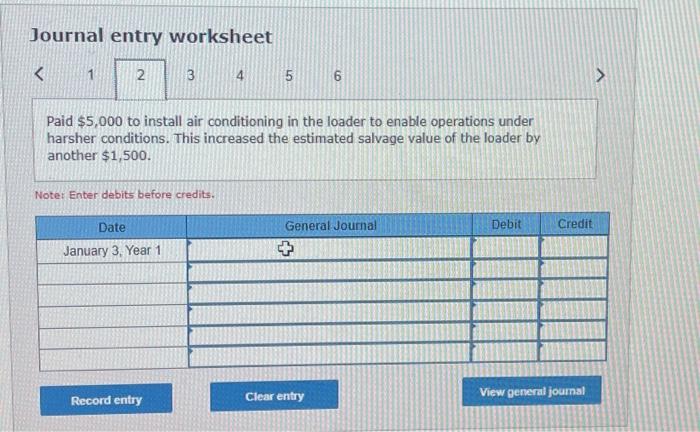

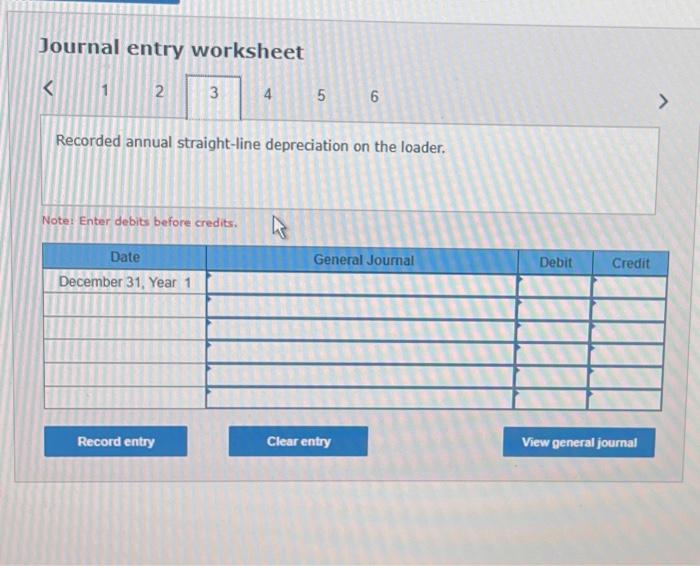

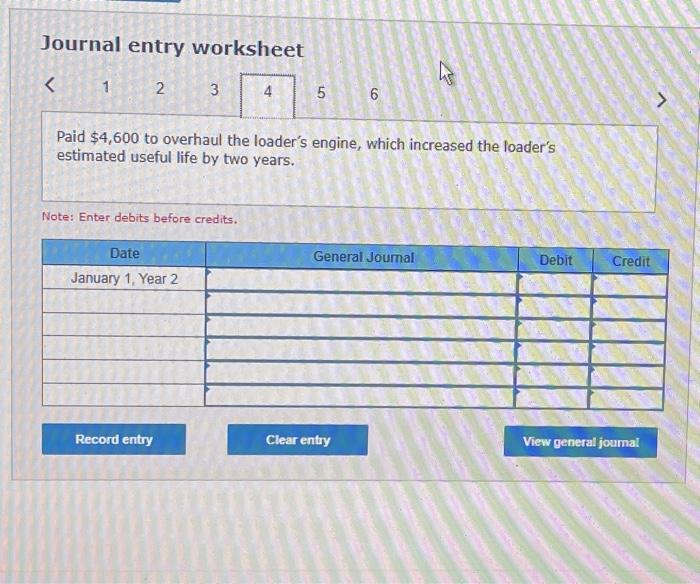

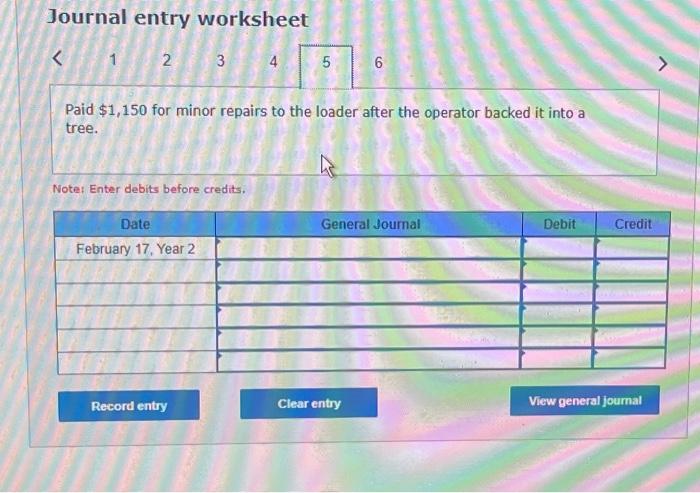

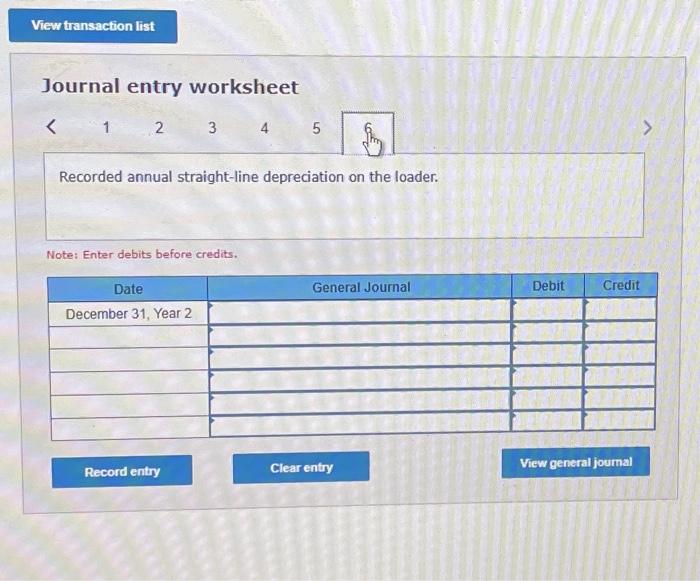

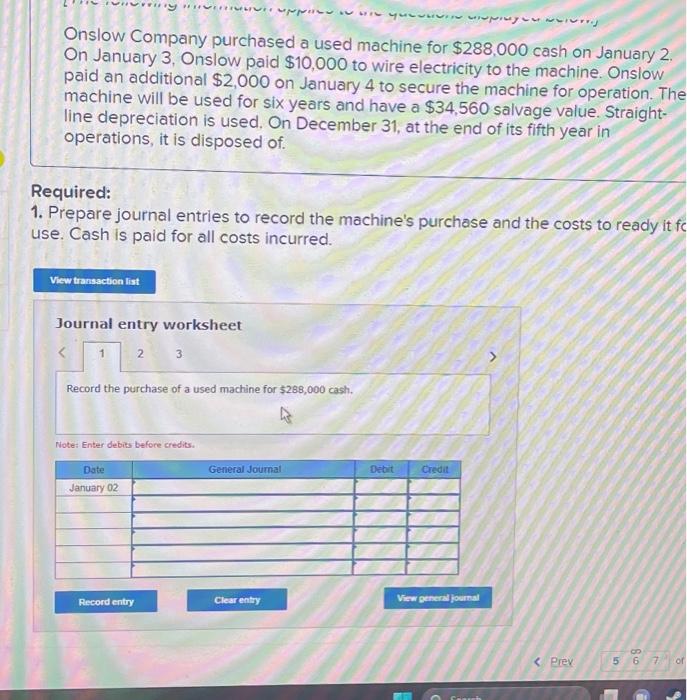

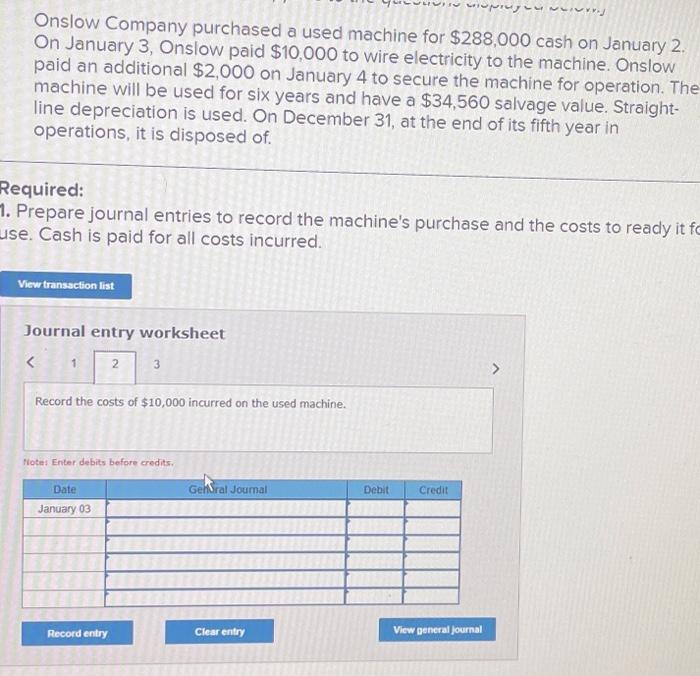

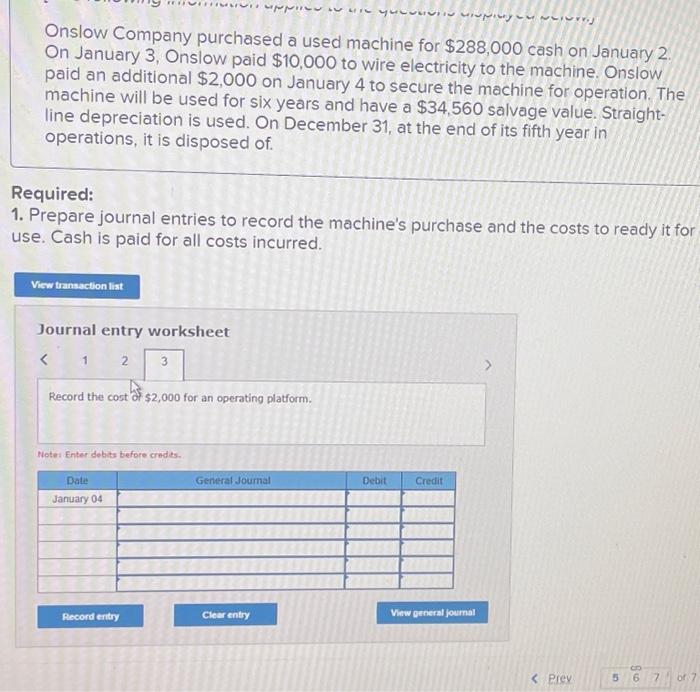

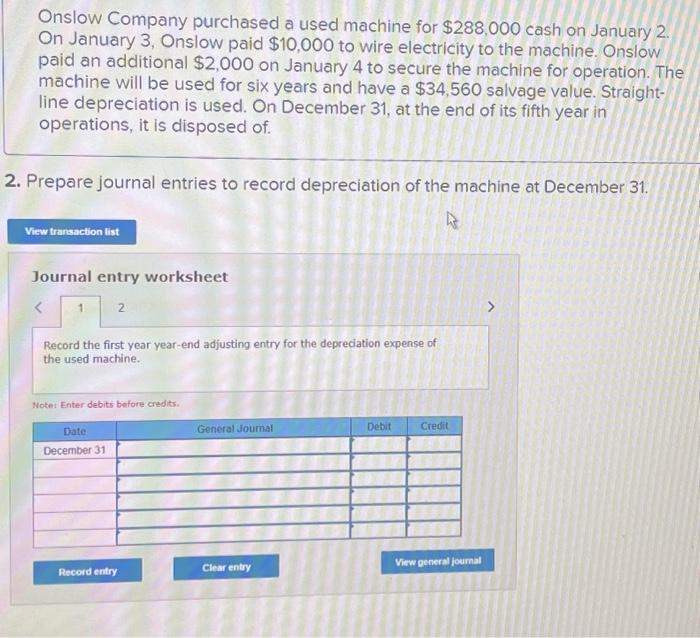

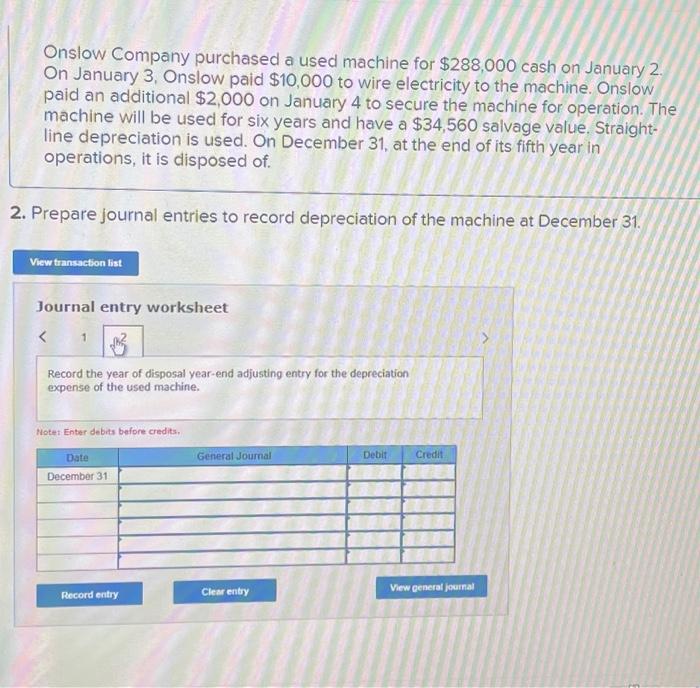

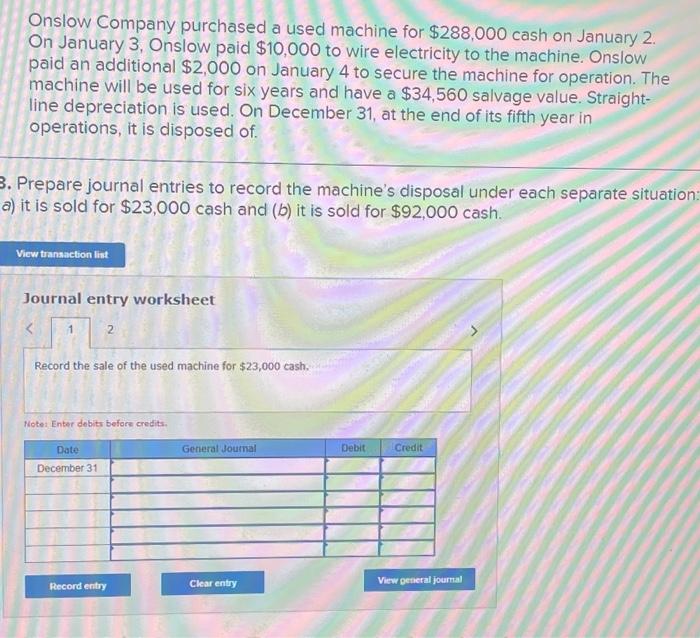

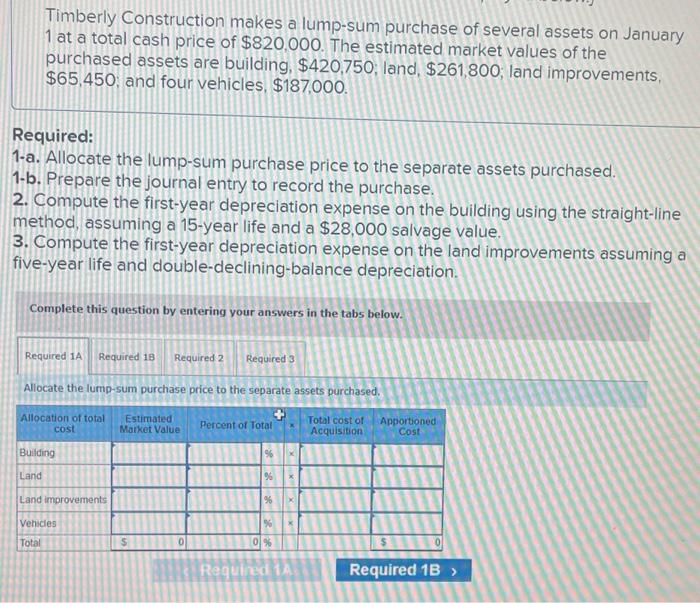

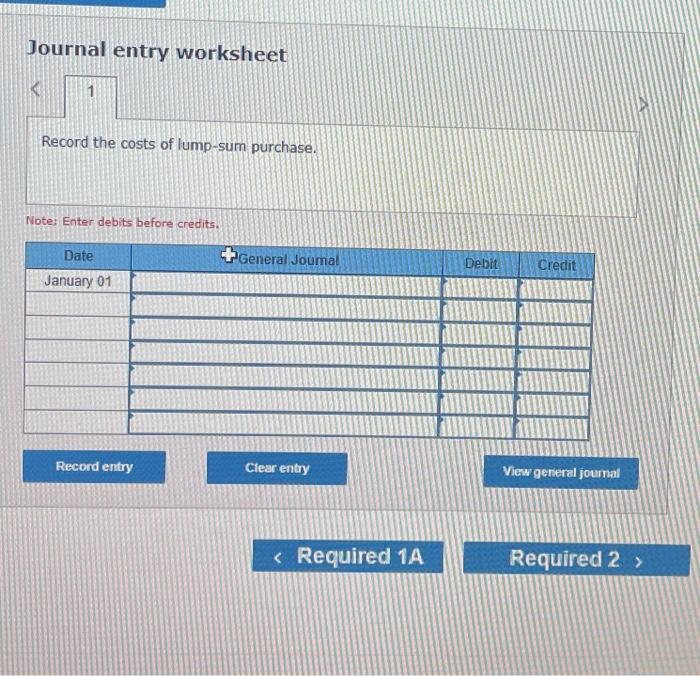

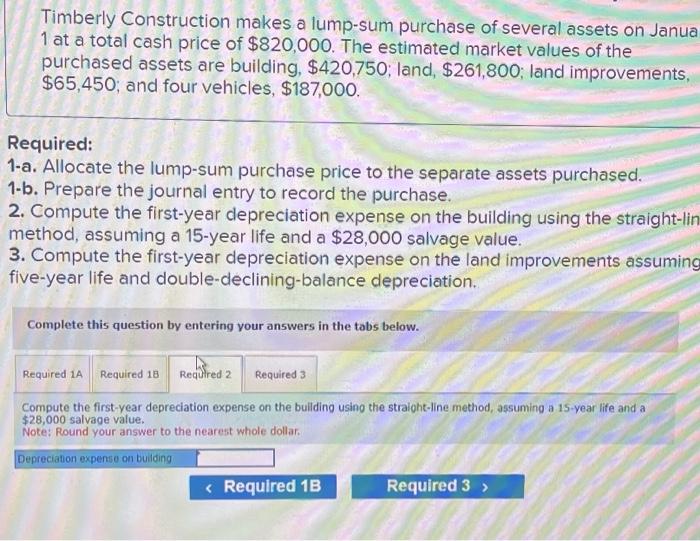

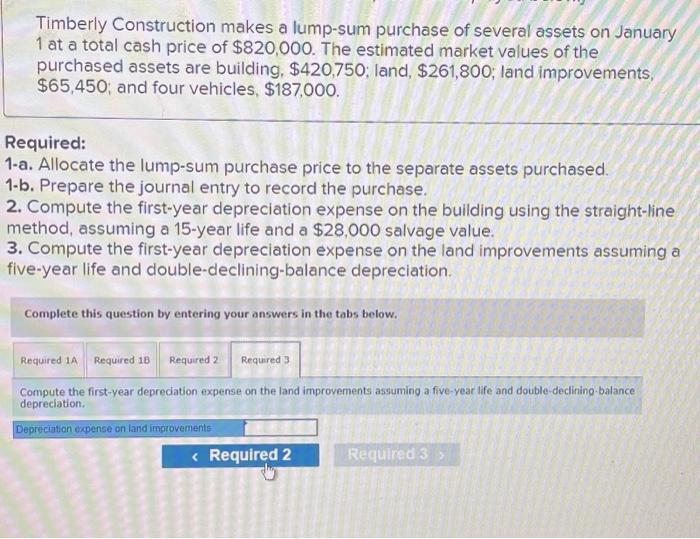

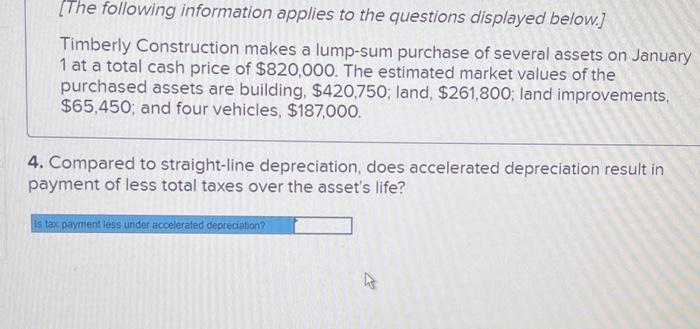

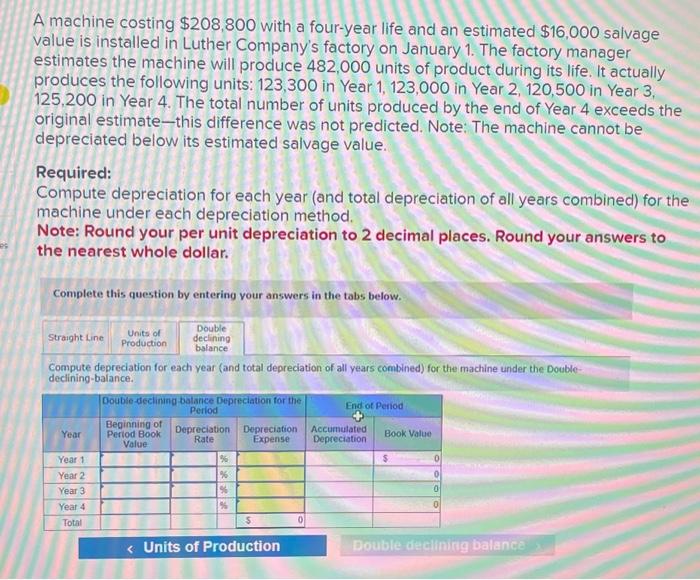

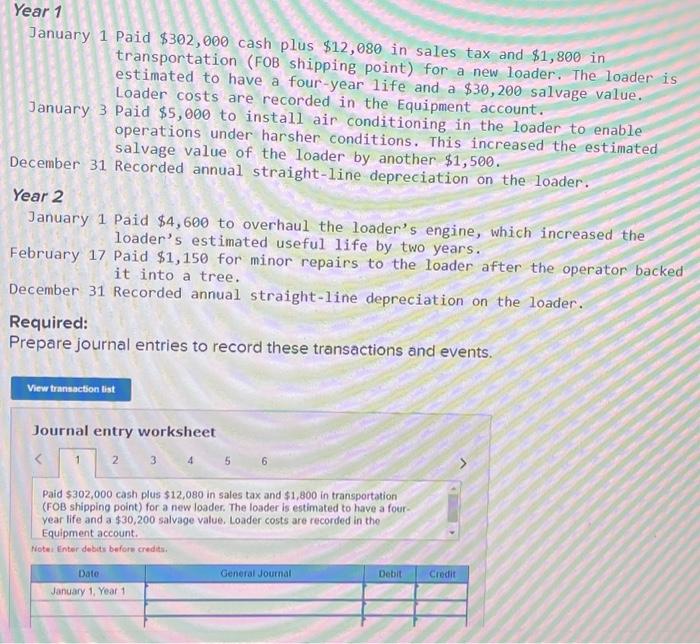

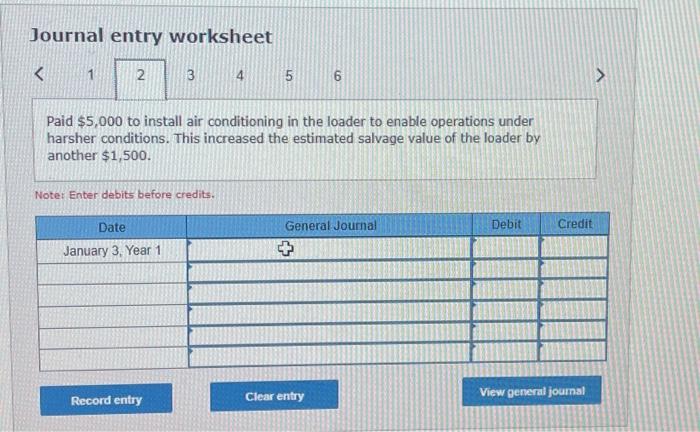

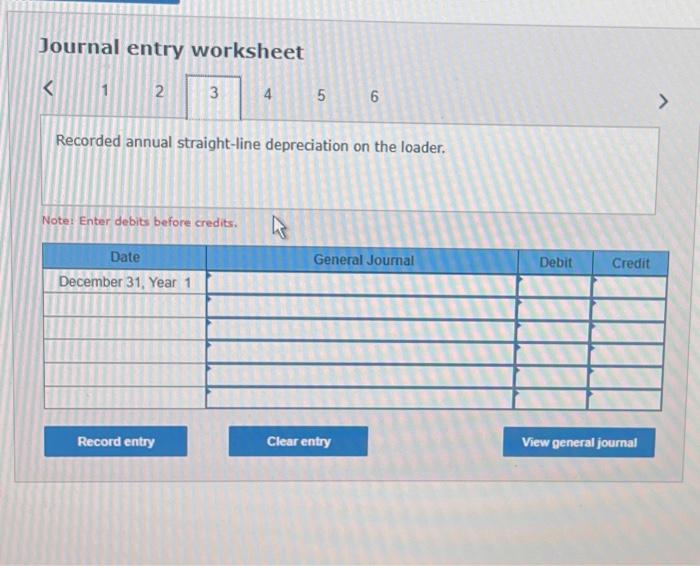

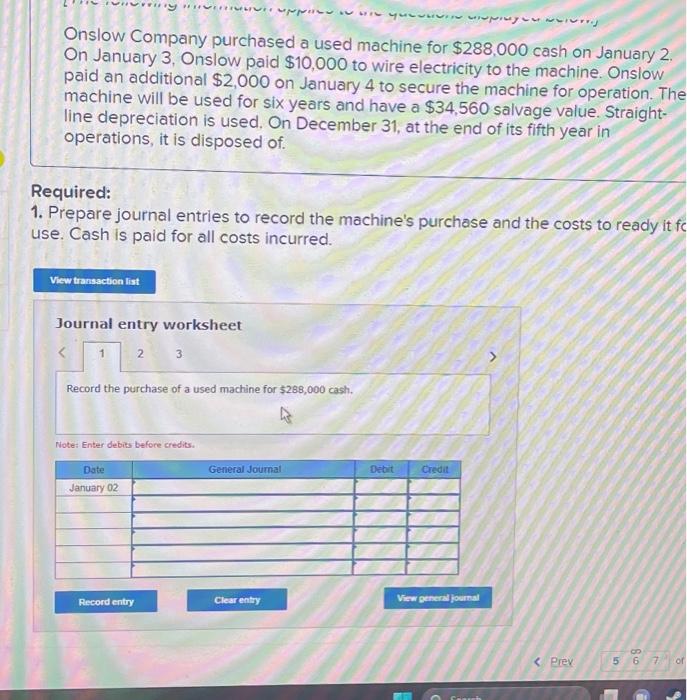

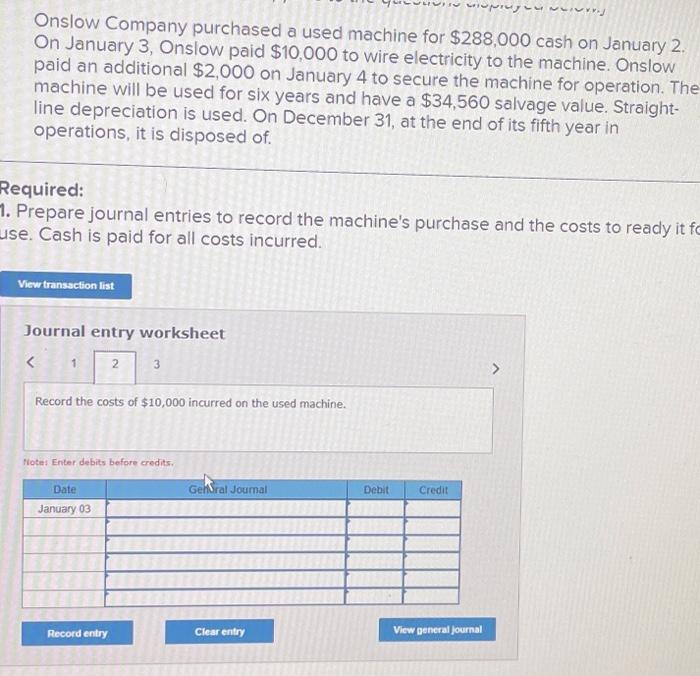

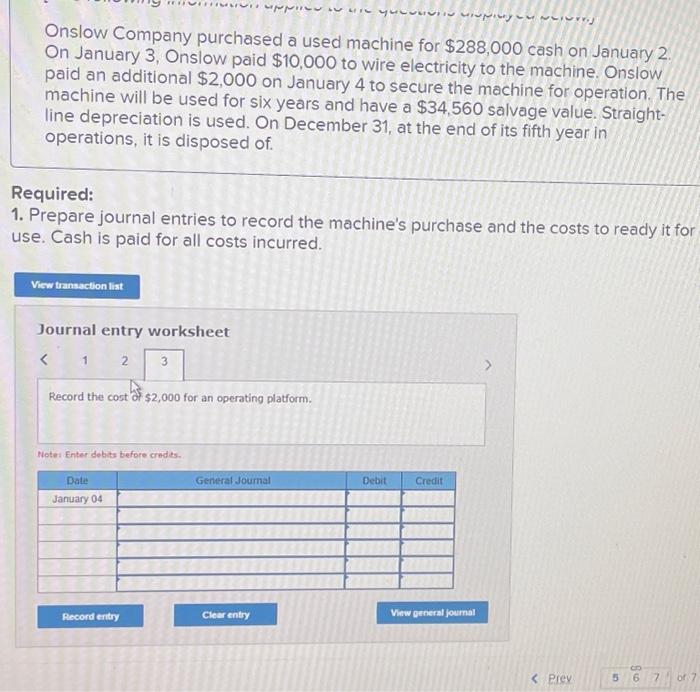

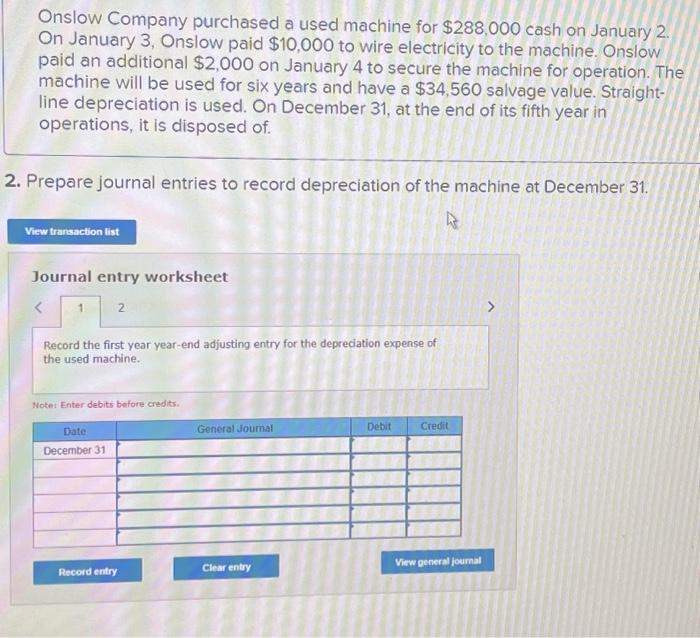

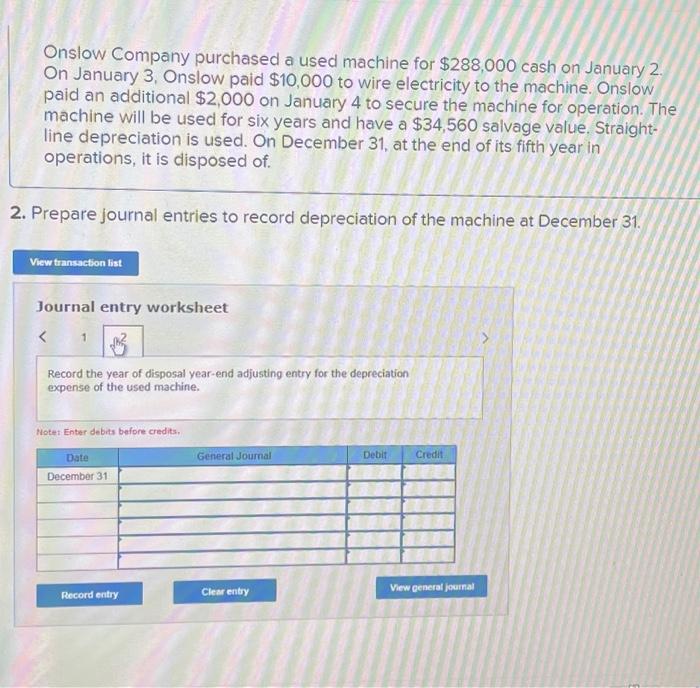

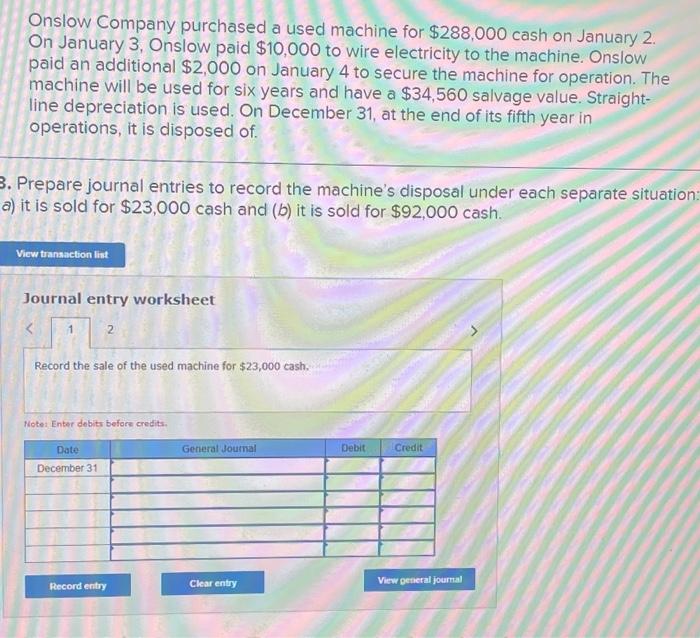

Journal entry worksheet Paid $4,600 to overhaul the loader's engine, which increased the loader's estimated useful life by two years. Note: Enter debits before credits. Journal entry worksheet Recorded annual straight-line depreciation on the loader. Note: Enter debits before credits. Onslow Company purchased a used machine for $288,000 cash on January 2 . On January 3 , Onslow paid $10,000 to wire electricity to the machine. Onslow paid an additional $2,000 on January 4 to secure the machine for operation. The machine will be used for six years and have a $34,560 salvage value. Straightline depreciation is used. On December 31 , at the end of its fifth year in operations, it is disposed of. Prepare journal entries to record depreciation of the machine at December 31. Journal entry worksheet Notei Enter debits before credits. A machine costing $208,800 with a four-year life and an estimated $16,000 salvage value is installed in Luther Company's factory on January 1. The factory manager estimates the machine will produce 482,000 units of product during its life. It actually produces the following units: 123,300 in Year 1, 123,000 in Year 2, 120,500 in Year 3. 125,200 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate-this difference was not predicted. Note: The machine cannot be depreciated below its estimated salvage value. Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. Note: Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar. Complete this question by entering vour answers in the tabs below. Compute depreciation for each year (and total depreciation of all years combined) for the machine under the Doubledeclining-balance. Onslow Company purchased a used machine for $288,000 cash on January 2 . On January 3 , Onslow paid $10,000 to wire electricity to the machine. Onslow paid an additional $2,000 on January 4 to secure the machine for operation. The machine will be used for six years and have a $34,560 salvage value. Straightline depreciation is used. On December 31 , at the end of its fifth year in operations, it is disposed of. Required: 1. Prepare journal entries to record the machine's purchase and the costs to ready it for use. Cash is paid for all costs incurred. Journal entry worksheet Record the cost of $2,000 for an operating platform. Onslow Company purchased a used machine for $288,000 cash on January 2 . On January 3, Onslow paid $10,000 to wire electricity to the machine. Onslow paid an additional $2,000 on January 4 to secure the machine for operation. The machine will be used for six years and have a $34,560 salvage value. Straightline depreciation is used. On December 31 , at the end of its fifth year in operations, it is disposed of. Prepare journal entries to record the machine's disposal under each separate situation a) it is sold for $23,000 cash and (b) it is sold for $92,000 cash. Journal entry worksheet Record the sale of the used machine for $23,000 cash. Note: Enter dobits before credits. Journal entry worksheet Record the costs of lump-sum purchase. Note: Enter debits before credits. Journal entry worksheet Paid $1,150 for minor repairs to the loader after the operator backed it into a tree. Note: Enter debits before credits. Timberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $820,000. The estimated market values of the purchased assets are building, $420,750; land, $261,800; land improvements, $65,450; and four vehicles, $187,000. Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $28,000 salvage value. 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-balance depreciation. Complete this question by entering your answers in the tabs below. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-balance depreciation. Onslow Company purchased a used machine for $288,000 cash on January 2 . On January 3, Onslow paid $10,000 to wire electricity to the machine. Onslow paid an additional $2,000 on January 4 to secure the machine for operation. The machine will be used for six years and have a $34,560 salvage value. Straightline depreciation is used. On December 31, at the end of its fifth year in operations, it is disposed of. Prepare journal entries to record depreciation of the machine at December 31. Journal entry worksheet Record the year of disposal year-end adjusting entry for the depreciation expense of the used machine. Notet Enter debits before credits. Journal entry worksheet Recorded annual straight-line depreciation on the loader. Note: Enter debits before credits. Timberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $820,000. The estimated market values of the purchased assets are building, $420,750; land, $261,800; land improvements, $65,450; and four vehicles, $187,000. Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15 -year life and a $28,000 salvage value. 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-balance depreciation. Complete this question by entering your answers in the tabs below. Allocate the lump-sum purchase price to the separate assets purchased. Onslow Company purchased a used machine for $288,000 cash on January 2 . On January 3, Onslow paid $10,000 to wire electricity to the machine. Onslow paid an additional $2,000 on January 4 to secure the machine for operation. The machine will be used for six years and have a $34,560 salvage value. Straightline depreciation is used. On December 31 , at the end of its fifth year in operations, it is disposed of. Required: Prepare journal entries to record the machine's purchase and the costs to ready it f ise. Cash is paid for all costs incurred. Journal entry worksheet Record the costs of $10,000 incurred on the used machine. flotes Enter debits before credits. January 1 Paid $302,000 cash plus $12,080 in sales tax and $1,800 in transportation ( FOB shipping point) for a new loader. The loader is estimated to have a four-year life and a $30,200 salvage value. Loader costs are recorded in the Equipment account. January 3 Paid $5,000 to install air conditioning in the loader to enable operations under harsher conditions. This increased the estimated salvage value of the loader by another $1,500. December 31 Recorded annual straight-line depreciation on the loader. Year 2 January 1 Paid $4,600 to overhaul the loader's engine, which increased the loader's estimated useful life by two years. February 17 Paid $1,150 for minor repairs to the loader after the operator backed it into a tree. December 31 Recorded annual straight-line depreciation on the loader. Required: Prepare journal entries to record these transactions and events. Onslow Company purchased a used machine for $288,000 cash on January 2 . On January 3, Onslow paid $10,000 to wire electricity to the machine. Onslow paid an additional $2,000 on January 4 to secure the machine for operation. The machine will be used for six years and have a $34,560 salvage value. Straightline depreciation is used. On December 31, at the end of its fifth year in operations, it is disposed of. Required: 1. Prepare journal entries to record the machine's purchase and the costs to ready it f use. Cash is paid for all costs incurred. Record the purchase of a used machine for $288,000 cash. Note: Enter debits before credits. [The following information applies to the questions displayed below.] Timberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $820,000. The estimated market values of the purchased assets are building, $420,750; land, $261,800; land improvements, $65,450; and four vehicles, $187,000. 4. Compared to straight-line depreciation, does accelerated depreciation result in payment of less total taxes over the asset's life? Journal entry worksheet Paid $5,000 to install air conditioning in the loader to enable operations under harsher conditions. This increased the estimated salvage value of the loader by another $1,500. Notet Enter debits before credits. Timberly Construction makes a lump-sum purchase of several assets on Janua 1 at a total cash price of $820,000. The estimated market values of the purchased assets are building, $420,750; land, $261,800; land improvements, $65,450; and four vehicles, $187,000. Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-lir method, assuming a 15year life and a $28,000 salvage value. 3. Compute the first-year depreciation expense on the land improvements assuming five-year life and double-declining-balance depreciation. Complete this question by entering your answers in the tabs below. Compute the first-year depreciation expense on the bullding using the straight-line method, assuming a 15 -year life and a $28,000 salvage value. Note: Round your answer to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started