Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Plz answer all sub-question as whole one question. Thanks so much. Pavlova Ltd, a New Zealand company, owns 100% of the share capital of Far

Plz answer all sub-question as whole one question. Thanks so much.

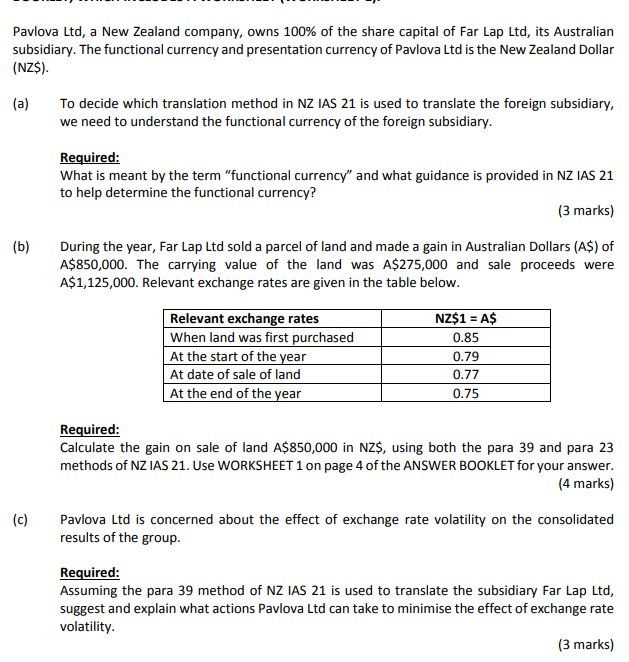

Pavlova Ltd, a New Zealand company, owns 100% of the share capital of Far Lap Ltd, its Australian subsidiary. The functional currency and presentation currency of Pavlova Ltd is the New Zealand Dollar (NZ$) (a) To decide which translation method in NZ IAS 21 is used to translate the foreign subsidiary, we need to understand the functional currency of the foreign subsidiary. Required: What is meant by the term "functional currency" and what guidance is provided in NZ IAS 21 to help determine the functional currency? (3 marks) During the year, Far Lap Ltd sold a parcel of land and made a gain in Australian Dollars (A$) of A$850,000. The carrying value of the land was A$275,000 and sale proceeds were A$1,125,000. Relevant exchange rates are given in the table below. (b) Relevant exchange rates NZ$1 A$ When land was first purchased 0.85 At the start of the year 0.79 At date of sale of land 0.77 At the end of the year 0.75 Required: Calculate the gain on sale of land A$850,000 in NZ$, using both the para 39 and para 23 methods of NZ IAS 21. Use WORKSHEET 1 on page 4 of the ANSWER BOOKLET for your answer. (4 marks) (c) Pavlova Ltd is concerned about the effect of exchange rate volatility on the consolidated results of the group Required: Assuming the para 39 method of NZ IAS 21 is used to translate the subsidiary Far Lap Ltd, suggest and explain what actions Pavlova Ltd can take to minimise the effect of exchange rate volatility (3 marks) Pavlova Ltd, a New Zealand company, owns 100% of the share capital of Far Lap Ltd, its Australian subsidiary. The functional currency and presentation currency of Pavlova Ltd is the New Zealand Dollar (NZ$) (a) To decide which translation method in NZ IAS 21 is used to translate the foreign subsidiary, we need to understand the functional currency of the foreign subsidiary. Required: What is meant by the term "functional currency" and what guidance is provided in NZ IAS 21 to help determine the functional currency? (3 marks) During the year, Far Lap Ltd sold a parcel of land and made a gain in Australian Dollars (A$) of A$850,000. The carrying value of the land was A$275,000 and sale proceeds were A$1,125,000. Relevant exchange rates are given in the table below. (b) Relevant exchange rates NZ$1 A$ When land was first purchased 0.85 At the start of the year 0.79 At date of sale of land 0.77 At the end of the year 0.75 Required: Calculate the gain on sale of land A$850,000 in NZ$, using both the para 39 and para 23 methods of NZ IAS 21. Use WORKSHEET 1 on page 4 of the ANSWER BOOKLET for your answer. (4 marks) (c) Pavlova Ltd is concerned about the effect of exchange rate volatility on the consolidated results of the group Required: Assuming the para 39 method of NZ IAS 21 is used to translate the subsidiary Far Lap Ltd, suggest and explain what actions Pavlova Ltd can take to minimise the effect of exchange rate volatilityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started