Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Plz answer all sub-question of one whole question. thanks so much. QUESTION 3: Accounting for financial instruments WRITE YOUR ANSsWERS TO QUESTION 3 IN THE

Plz answer all sub-question of one whole question. thanks so much.

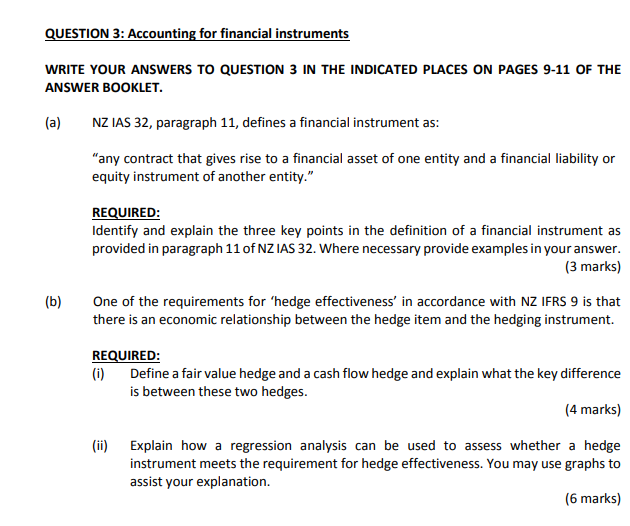

QUESTION 3: Accounting for financial instruments WRITE YOUR ANSsWERS TO QUESTION 3 IN THE INDICATED PLACES ON PAGES 9-11 OF THE ANSWER BOOKLET. (a) NZ IAS 32, paragraph 11, defines a financial instrument as: "any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity." REQUIRED: Identify and explain the three key points in the definition of a financial instrument provided in paragraph 11 of NZ IAS 32. Where necessary provide examples in your answer. (3 marks) (b) One of the requirements for 'hedge effectiveness' in accordance with NZ IFRS 9 is that there is an economic relationship between the hedge item and the hedging instrument. REQUIRED: (i) Define a fair value hedge and a cash flow hedge and explain what the key difference is between these two hedges. (4 marks) Explain how a instrument meets the requirement for hedge effectiveness. You may use graphs to assist your explanation. (ii) regression analysis can be used to assess whether a hedge (6 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started