Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz answer all the questions with details and step by step calculation Exercise 1 XYZ is a company which provides services. On December 31, 2018,

plz answer all the questions with details and step by step calculation

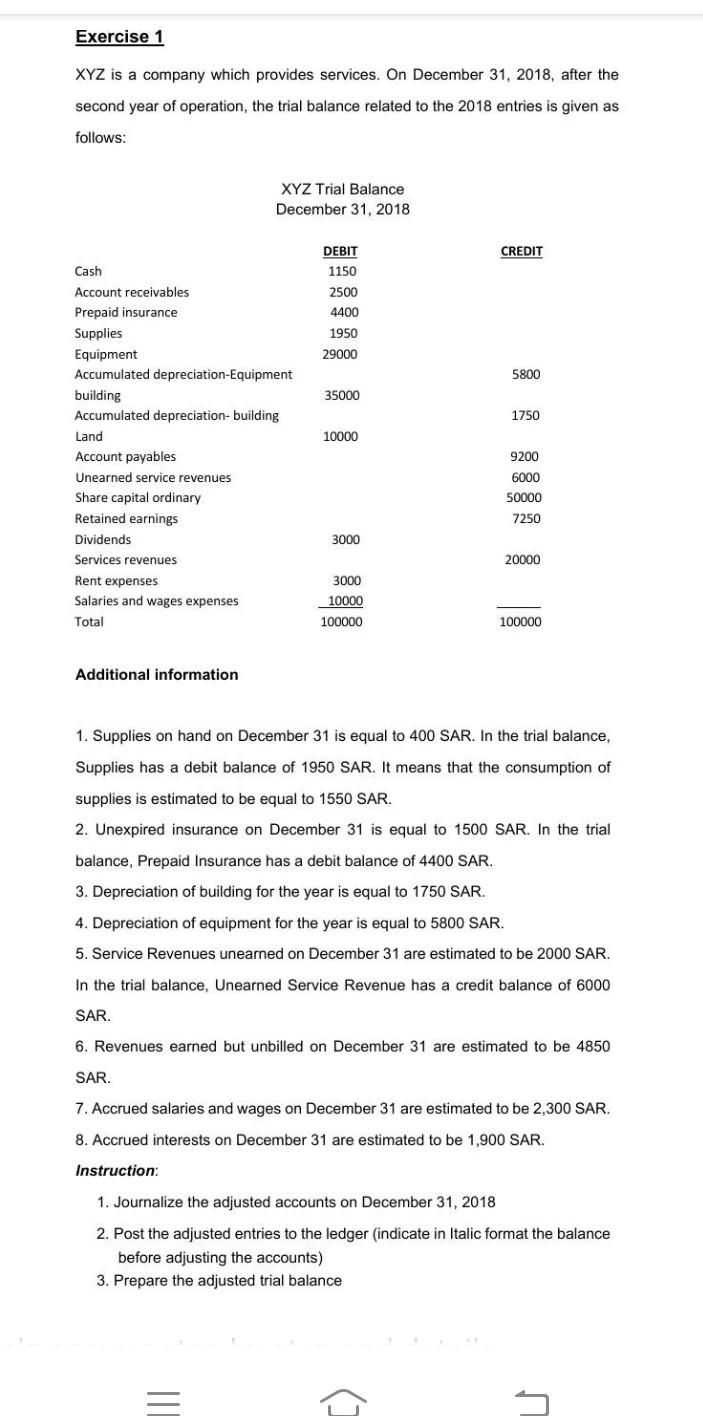

Exercise 1 XYZ is a company which provides services. On December 31, 2018, after the second year of operation, the trial balance related to the 2018 entries is given as follows: Additional information 1. Supplies on hand on December 31 is equal to 400 SAR. In the trial balance, Supplies has a debit balance of 1950 SAR. It means that the consumption of supplies is estimated to be equal to 1550 SAR. 2. Unexpired insurance on December 31 is equal to 1500 SAR. In the trial balance, Prepaid Insurance has a debit balance of 4400 SAR. 3. Depreciation of building for the year is equal to 1750 SAR. 4. Depreciation of equipment for the year is equal to 5800SAR. 5. Service Revenues unearned on December 31 are estimated to be 2000 SAR. In the trial balance, Unearned Service Revenue has a credit balance of 6000 SAR. 6. Revenues earned but unbilled on December 31 are estimated to be 4850 SAR. 7. Accrued salaries and wages on December 31 are estimated to be 2,300 SAR. 8. Accrued interests on December 31 are estimated to be 1,900 SAR. Instruction: 1. Journalize the adjusted accounts on December 31, 2018 2. Post the adjusted entries to the ledger (indicate in Italic format the balance before adjusting the accounts) 3. Prepare the adjusted trial balanceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started