Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz answer Earth's Best Light (EBL), a producer of energy-efliciont light bulbs, expects that demand will increase markedly over the next decade. Due to the

plz answer

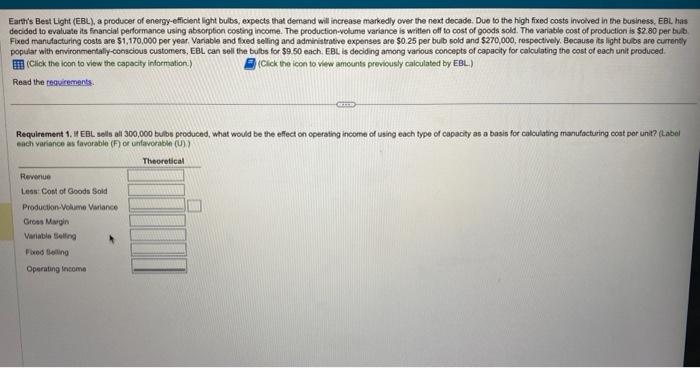

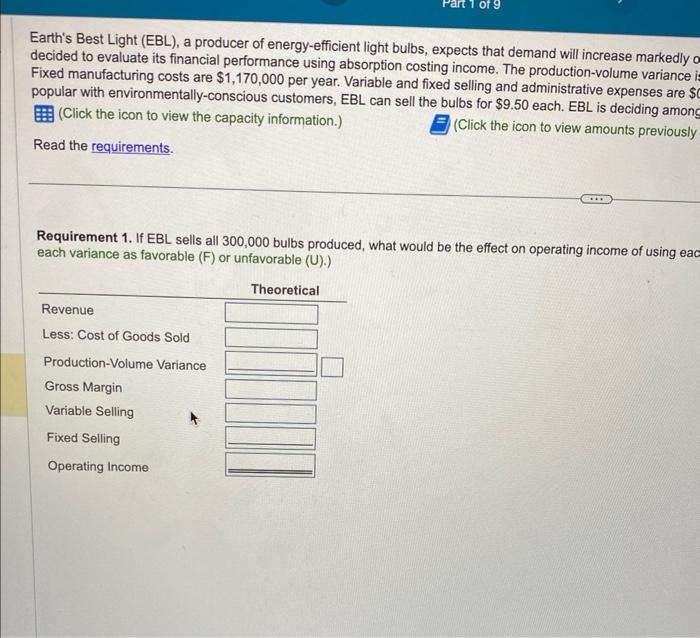

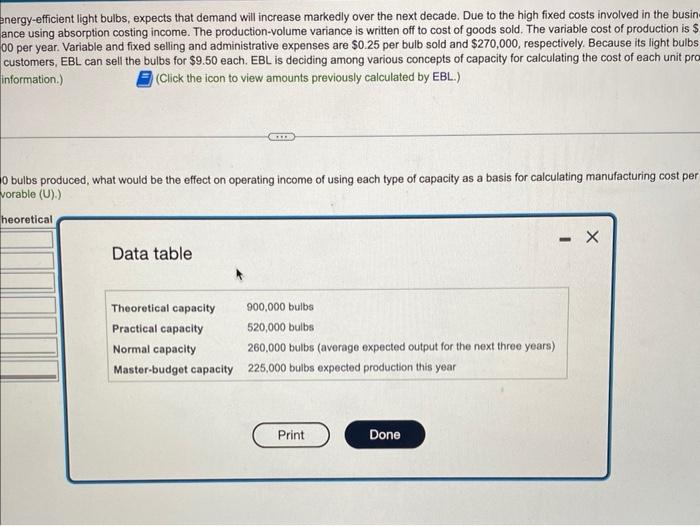

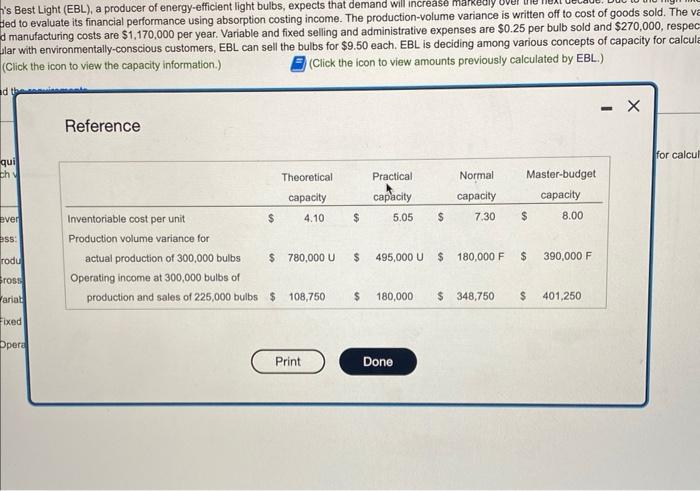

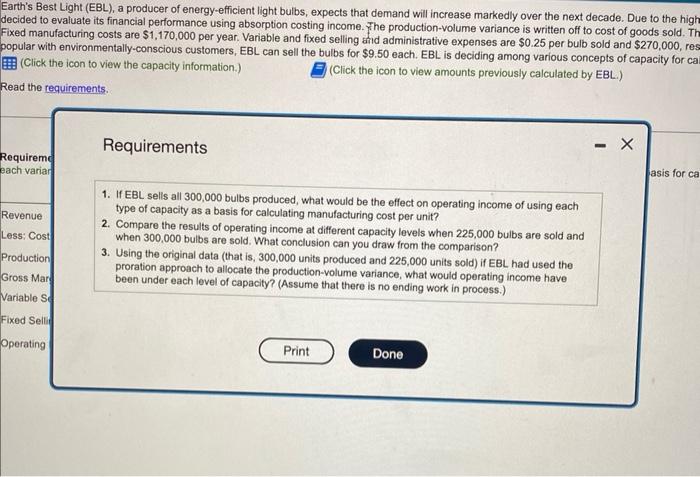

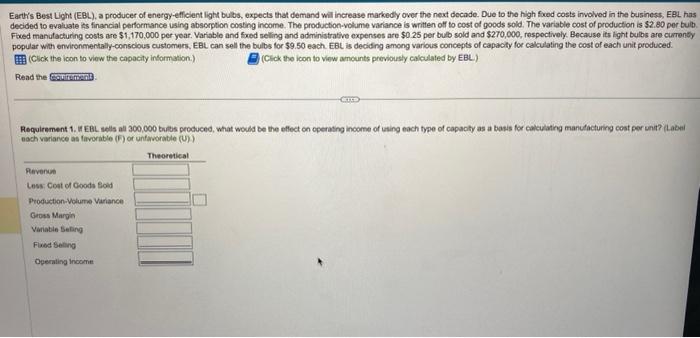

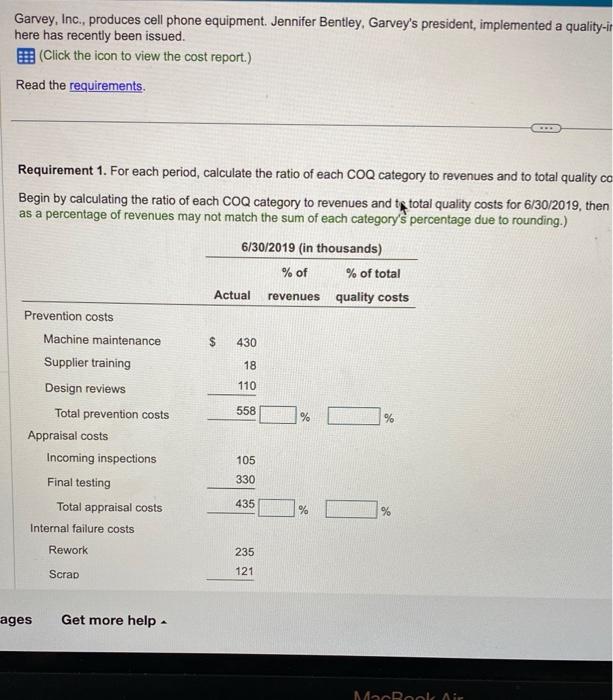

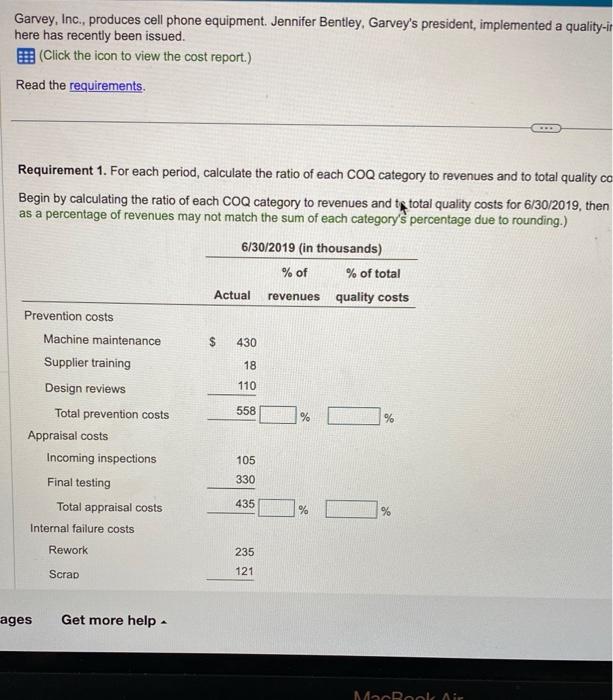

Earth's Best Light (EBL), a producer of energy-efliciont light bulbs, expects that demand will increase markedly over the next decade. Due to the high fixed costs involved in the business, EBL. has decided to evaluale its financial performance using absorption costing income. The production-volume variance is weitten off to cost of goods sold. The variable cost of production is $2.80 per bulb. Fixed manufacturing costs are $1,170,000 per year. Varible and fixed selling and adminiatrateve expenses are $0.25 per bulb sold and $270,000, respectively, Because its light bulos are currenty popular with ervironmertaly-conscious customers, EBL can sell the bulbs for $9.50 each. EBL is deciding among various concepts of capacity for calculating the cost of each unit produced (Click the ioon to view the capacity inlormation.) [Cick the icon to vitw amounts previously caiculated by EBL.) Read the teguirements. Requirament 1. I EBL sels all 300,000 bubs produced, what would be the effect on operating income of using each type of capocity as a basis for calculating manufacturing coat por unit? (Label each yariance as tayorable (F) of unfavorabin (U)? Earth's Best Light (EBL), a producer of energy-efficient light bulbs, expects that demand will increase markedly decided to evaluate its financial performance using absorption costing income. The production-volume variance Fixed manufacturing costs are $1,170,000 per year. Variable and fixed selling and administrative expenses are $ popular with environmentally-conscious customers, EBL can sell the bulbs for $9.50 each. EBL is deciding amon (Click the icon to view the capacity information.) (Click the icon to view amounts previously Read the requirements. Requirement 1. If EBL sells all 300,000 bulbs produced, what would be the effect on operating income of using eac each variance as favorable (F) or unfavorable (U).) Sulbs, expects that demand will increase markedly over the next decade. Due to the high fixed costs involved in the business, EBL has n costing income. The production-volume variance is written off to cost of goods sold. The variable cost of production is $2.80 per bulb. and fixed selling and administrative expenses are $0.25 per bulb sold and $270,000, respectively. Because its light bulbs are currently sell the bulbs for $9.50 each. EBL is deciding among various concepts of capacity for calculating the cost of each unit produced. (Click the icon to view amounts previously calculated by EBL.) What would be the effect on operating income of using each type of capacity as a basis for calculating manufacturing cost per unit? (Label anergy-efficient light bulbs, expects that demand will increase markedly over the next decade. Due to the high fixed costs involved in the busin ance using absorption costing income. The production-volume variance is written off to cost of goods sold. The variable cost of production is $ 00 per year. Variable and fixed selling and administrative expenses are $0.25 per bulb sold and $270,000, respectively. Because its light bulbs customers, EBL can sell the bulbs for $9.50 each. EBL is deciding among various concepts of capacity for calculating the cost of each unit pro information.) (Click the icon to view amounts previously calculated by EBL.) 0 bulbs produced, what would be the effect on operating income of using each type of capacity as a basis for calculating manufacturing cost per Jorable (U).) Data table is Best Light (EBL), a producer of energy-efficient light bulbs, expects that demand will increase markialy is written off to cost of goods sold. The ve production-volume variance is lar with environmentally-conscious customers, EBL can sell the bulbs for $9.50 each. EBL is deciding among various concepts of capacity for calcula (Click the icon to view the capacity information.) (Click the icon to view amounts previously calculated by EBL.) Reference Earth's Best Light (EBL), a producer of energy-efficient light bulbs, expects that demand will increase markedly over the next decade. Due to the high decided to evaluate its financial performance using absorption costing income. The production-volume variance is written off to cost of goods sold. Th Fixed manufacturing costs are $1,170,000 per year. Variable and fixed selling didd administrative expenses are $0.25 per bulb sold and $270,000, res popular with environmentally-conscious customers, EBL can sell the bulbs for $9.50 each. EBL is deciding among various concepts of capacity for ca (Click the icon to view the capacity information.) (Click the icon to view amounts previously calculated by EBL.) Read the requirements. Requirements 1. If EBL sells all 300,000 bulbs produced, what would be the effect on operating income of using each type of capacity as a basis for calculating manufacturing cost per unit? 2. Compare the results of operating income at different capacity levels when 225,000 bulbs are sold and when 300,000 bulbs are sold. What conclusion can you draw from the comparison? 3. Using the original data (that is, 300,000 units produced and 225,000 units sold) if EBL had used the proration approach to allocate the production-volume variance, what would operating income have been under each level of capacity? (Assume that there is no ending work in process.) Earti's Best Liht (EBL), a producer of energy-eflicient light bulbs, expects that demand wil increase markedy over the next docade. Due to the high fwod costs involved in the business, EBL has decided to evaluate iss financial performance using abscrption costing income. The producton-volume variance is written ofl to cost of goods sold. The variable cost of production is $2.80 per bub. Fxed manutacturing costs are $1,170,000 per year. Variable and fxed seling and administrative expenses are $0.25 per bulb sold and $270,000, respoctively. Because its ight bulbs are cumenty popular with environmentaly-conscious customers. EBL can sell the bulbs for $9.50 each. EBE is deciding among various concepts of capacity for calculating the cost of each unit produced. (Cick the icon to view the capacity information.) (Clck the icon to view anounts previously calculated by EBL) Read the Hequirement 1. If EBL sells all 300,000 buibs produced, what would be the eflect on operating income of iaing each type of capachy as a basis for calculating manutacturing cost per unit? (Labil each variance as favorible (F) or unfavorable (U)) Garvey, Inc., produces cell phone equipment. Jennifer Bentley, Garvey's president, implemented a quality- here has recently been issued. (Click the icon to view the cost report.) Read the requirements. Requirement 1. For each period, calculate the ratio of each COQ category to revenues and to total quality Begin by calculating the ratio of each COQ category to revenues and total quality costs for 6/30/2019, then as a percentage of revenues may not match the sum of each category's percentage due to rounding.) Get more help

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started