Answered step by step

Verified Expert Solution

Question

1 Approved Answer

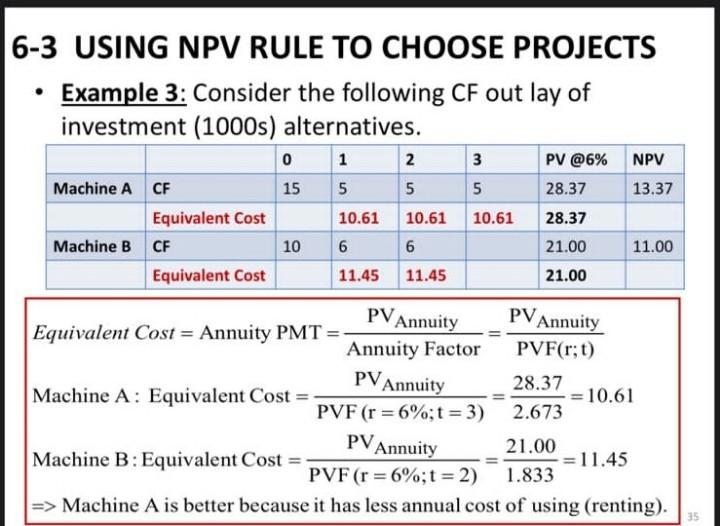

plz answer question with details and complete equation and law to understand how we calculate annuity factor?? 6-3 USING NPV RULE TO CHOOSE PROJECTS Example

plz answer question with details and complete equation and law to understand how we calculate annuity factor??

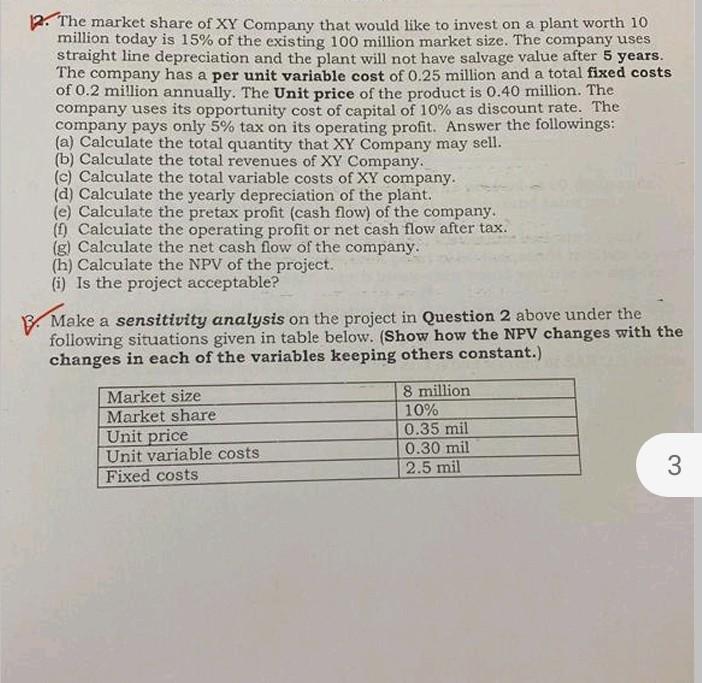

6-3 USING NPV RULE TO CHOOSE PROJECTS Example 3: Consider the following CF out lay of investment (1000s) alternatives. 0 1 2 3 PV @6% NPV Machine A CF 15 5 5 5 28.37 13.37 Equivalent Cost 10.61 10.61 10.61 28.37 Machine B CF 10 6 6 21.00 11.00 Equivalent Cost 11.45 11.45 21.00 PV Annuity PV Annuity PV Annuity Equivalent Cost = Annuity PMT= Annuity Factor PVF(r;t) 28.37 Machine A: Equivalent Cost = = 10.61 PVF (r =6%;t=3) 2.673 21.00 Machine B: Equivalent Cost = = 11.45 PVF (r= 6%;t=2) 1.833 => Machine A is better because it has less annual cost of using (renting). PV Annuity 35 12. The market share of XY Company that would like to invest on a plant worth 10 million today is 15% of the existing 100 million market size. The company uses straight line depreciation and the plant will not have salvage value after 5 years. The company has a per unit variable cost of 0.25 million and a total fixed costs of 0.2 million annually. The Unit price of the product is 0.40 million. The company uses its opportunity cost of capital of 10% as discount rate. The company pays only 5% tax on its operating profit. Answer the followings: (a) Calculate the total quantity that XY Company may sell. (b) Calculate the total revenues of XY Company. (c) Calculate the total variable costs of XY company. (d) Calculate the yearly depreciation of the plant. (e) Calculate the pretax profit (cash flow) of the company. (1) Calculate the operating profit or net cash flow after tax. (g) Calculate the net cash flow of the company. (h) Calculate the NPV of the project. (i) Is the project acceptable? B. Make a sensitivity analysis on the project in Question 2 above under the following situations given in table below. (Show how the NPV changes with the changes in each of the variables keeping others constant.) Market size 8 million Market share 10% Unit price 0.35 mil Unit variable costs 0.30 mil Fixed costs 2.5 mil 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started