Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz answer will thumbs up The Western Division of Claremont Company had net operating income of $135,000 and average invested assets of $568,000. Claremont has

plz answer will thumbs up

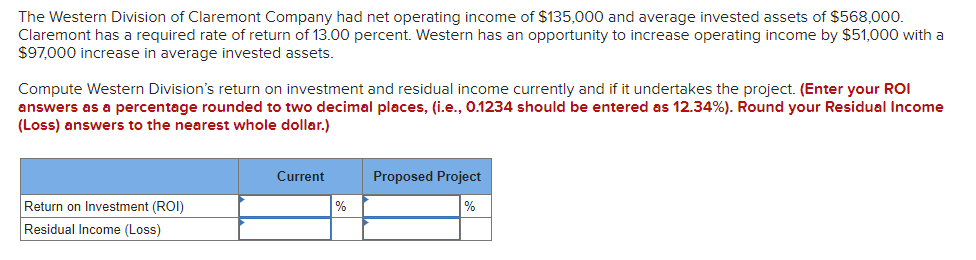

The Western Division of Claremont Company had net operating income of $135,000 and average invested assets of $568,000. Claremont has a required rate of return of 13.00 percent. Western has an opportunity to increase operating income by $51,000 with a $97,000 increase in average invested assets. Compute Western Division's return on investment and residual income currently and if it undertakes the project. (Enter your ROI answers as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%). Round your Residual Income (Loss) answers to the nearest whole dollar.) Current Proposed Project % % Return on Investment (ROI) Residual Income (Loss)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started