plz asapp

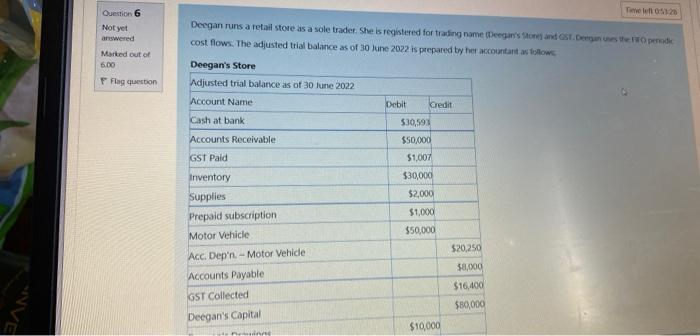

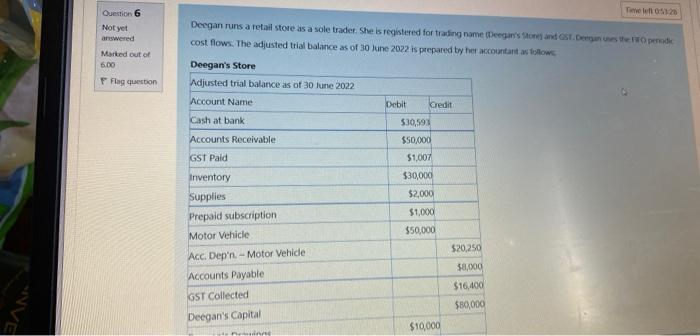

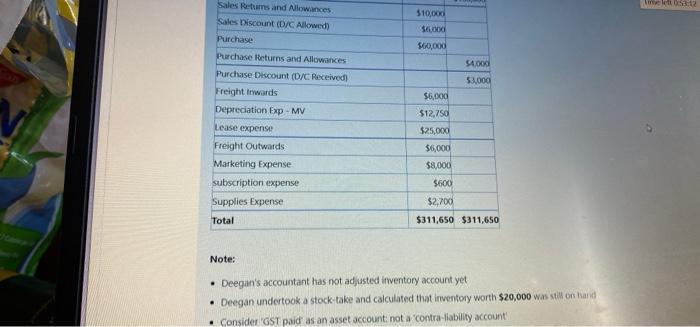

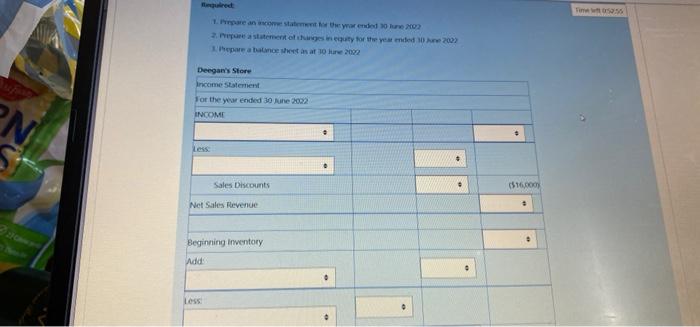

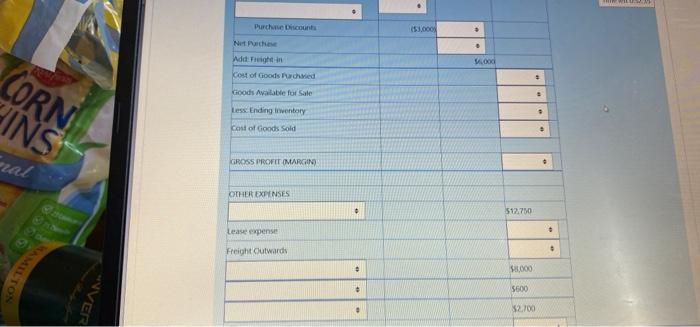

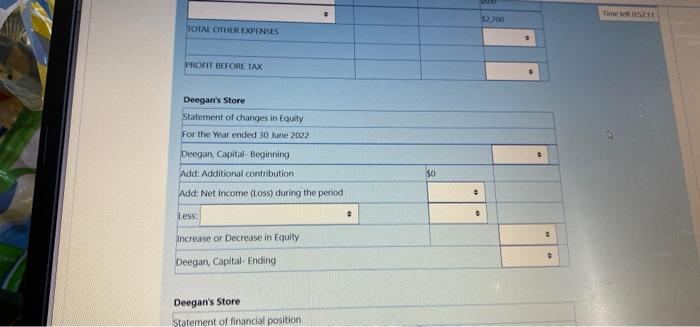

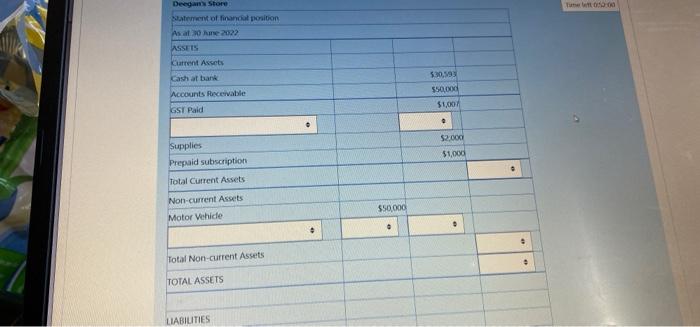

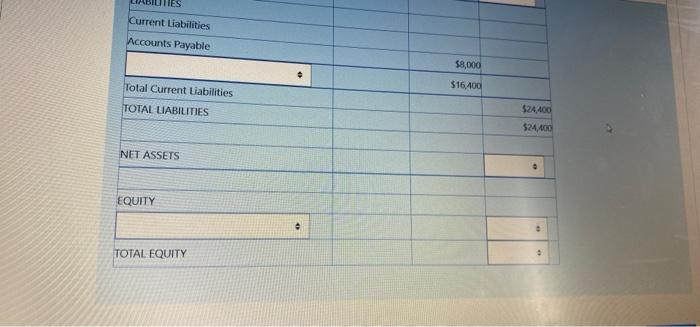

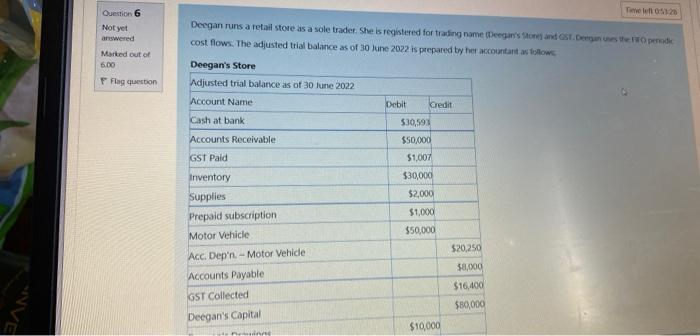

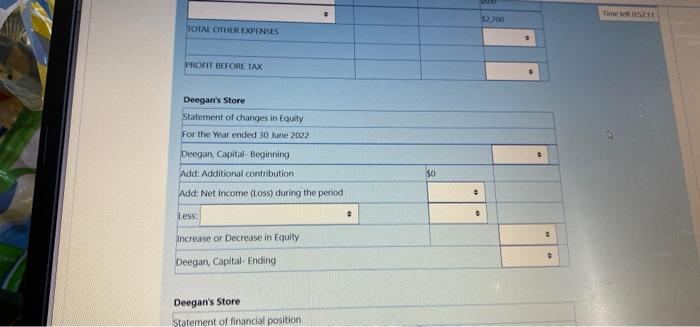

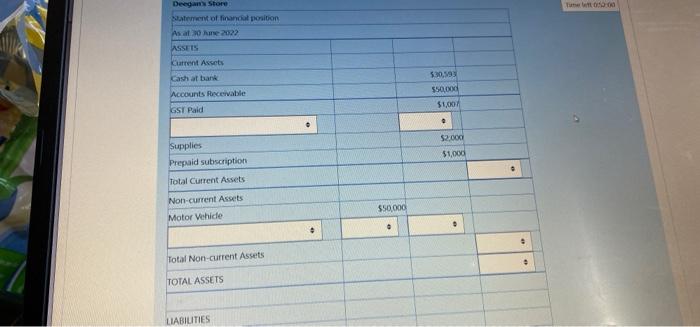

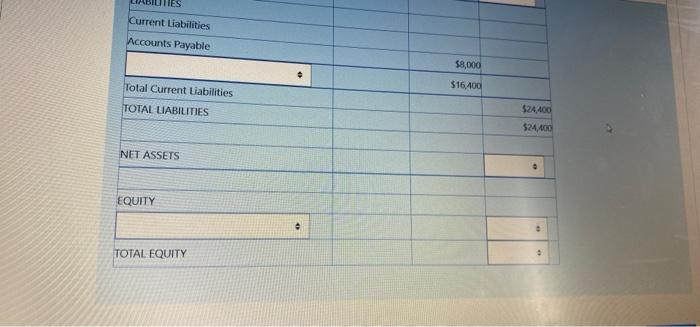

Tiene 65120 Question 6 Not yet answered Deegan runs a retail store as a sole trader. She is registered for trading name Deega on and St Dengan pero cost flows. The adjusted trial balance as of 30 June 2022 is prepared by her accountant as follows Marked out of 600 F Flag question Deegan's Store Adjusted trial balance as of 30 June 2022 Account Name Cash at bank Accounts Receivable Debit kredit $30,593 $50,000 $1.007 $30,000 GST Paid Inventory Supplies Prepaid subscription Motor Vehicle $2,000 $1,000 $50,000 Acc. Dep'n. - Motor Vehicle Accounts Payable GST Collected Deegan's Capital $20,250 $8,000 $16,400 $80,000 $10,000 53:12 Sales Returns and Allowances Sales Discount (D/C Allowed) $10,000 5600 Purchase $60,000 54,000 53,000 Purchase Returns and Allowances Purchase Discount (D/C Received) Freight Inwards Depreciation Exp - MV Lease expense Freight Outwards Marketing Expense subscription expense Supplies Expense Total $6,000 $12,750 $25,000 $6,000 $8,000 $600 $2,700 $311,650 $311,650 Note: . Deegan's accountant has not adjusted Inventory account yet Deegan undertook a stock take and calculated that inventory worth $20,000 was still on tund . Consider GST paid as an asset account not a 'contra-liability account Tim 1. Prepare a constateeyarendedore MO2 2. Prepare a statementetsinguty for the year ended 0 2003 pare a tance sheets ar 10 ure 2002 Deegan's Store Income statement For the yewended 30 e 2002 INCOME PN Sales Discounts (516.000 Net Sales Revende 3 Beginning Inventory Add Less Purch Discount 53,000 . Net Add Fight Cost of Goods Purchased Wood . CORN Goods Available for Sale Less Ending inventory Cost of Goods Sold . HINS . nal GROSS PROFIT MARGIN OTHER EXPENSES . $12.750 Lease expense Freight Outwards TAMILT $8.000 5600 Van . $2.700 Time: 100 TOTAL OTHER EXPENSES PROFIT BEFORE TAX Deegan's Store Statement of changes in Equity For the Year ended 30 June 2022 . Deegan, Capital Beginning Add: Additional contribution SO Add: Net Income (Loss) during the period Less Increase or Decrease in Equity Deegan, Capital Ending Deegan's Store Statement of financial position Deegans Store Natement of financial position As ale2022 ASSES Kurrent Assets Cash at bank Accounts Receivable GST Paid 530,19 $50,00 $1,001 $2.000 $1,000 Supplies Prepaid subscription Total Current Assets Non-current Assets Motor Vehide $50,000 . Total Non-current Assets TOTAL ASSETS LIABILITIES Current Liabilities Accounts Payable $8,000 Total Current Liabilities $16400 TOTAL LIABILITIES $24.400 $24.400 NET ASSETS EQUITY TOTAL EQUITY