Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz can you that qoustions thanks Problem Al-1A Payroll register and payroll deductions LO2,3 CHECK FIGURE: Total deductions $2,298.42 The payroll records of Brownlee Company

plz can you that qoustions thanks

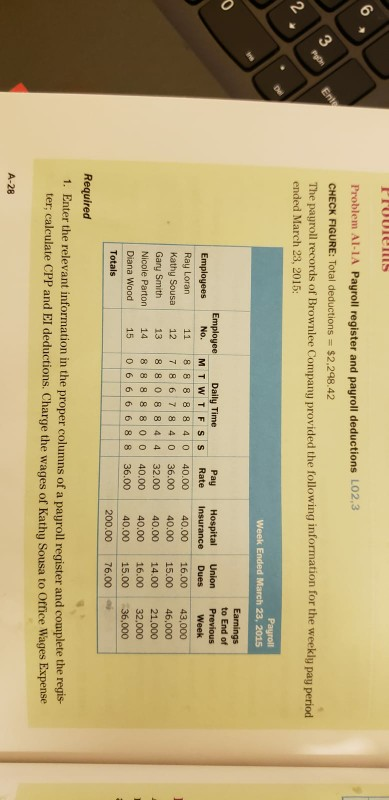

Problem Al-1A Payroll register and payroll deductions LO2,3 CHECK FIGURE: Total deductions $2,298.42 The payroll records of Brownlee Company provided the following information for the weekly pay period ended March 23, 2015: Week Ended March 23, 2015 to End of Pay Hospital Union Previous Employees No. M T WTFS s Rate Insurance Dues Week Ray Loran 11 88 8 8 8 4 40.0040.00 16.00 43,000 Kathy Sousa 12 7 8 6 7 8 4 36.0040.0015.00 46.000 Gary Smith 13 8 8 0 8 8 4 4 32.00 40.00 14.00 21,000 Nicole Parton 14 8 8 8 8 8 o 40.00 40.00 16.00 32.000 Diana Wood15 0 6 6 6 6 8 8 36.00 40.00 15.00 36,000 EmployeeDaily Time Totals 200.00 76.00 Required ete the regis- ter, calculate CPP and El deductions. Charge the wages of Kathy Sousa to Office Wages Expense A-28 and the wages of the remaining employees to Service Wages Expense. Calculate income tax de- ductions at 20% of gross pay. Employees are paid an overtime premium of 50% for all hours in excess of 40 per week. 2 Prepare general journal entries to record the payroll register information, including the emploger's expensesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started