Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Plz do both parts Habina Co, an unlisted ampany based in Tamibia, has been manufacturing components for Emergency Pendant Alarms (EPA) worn by disabled people

Plz do both parts

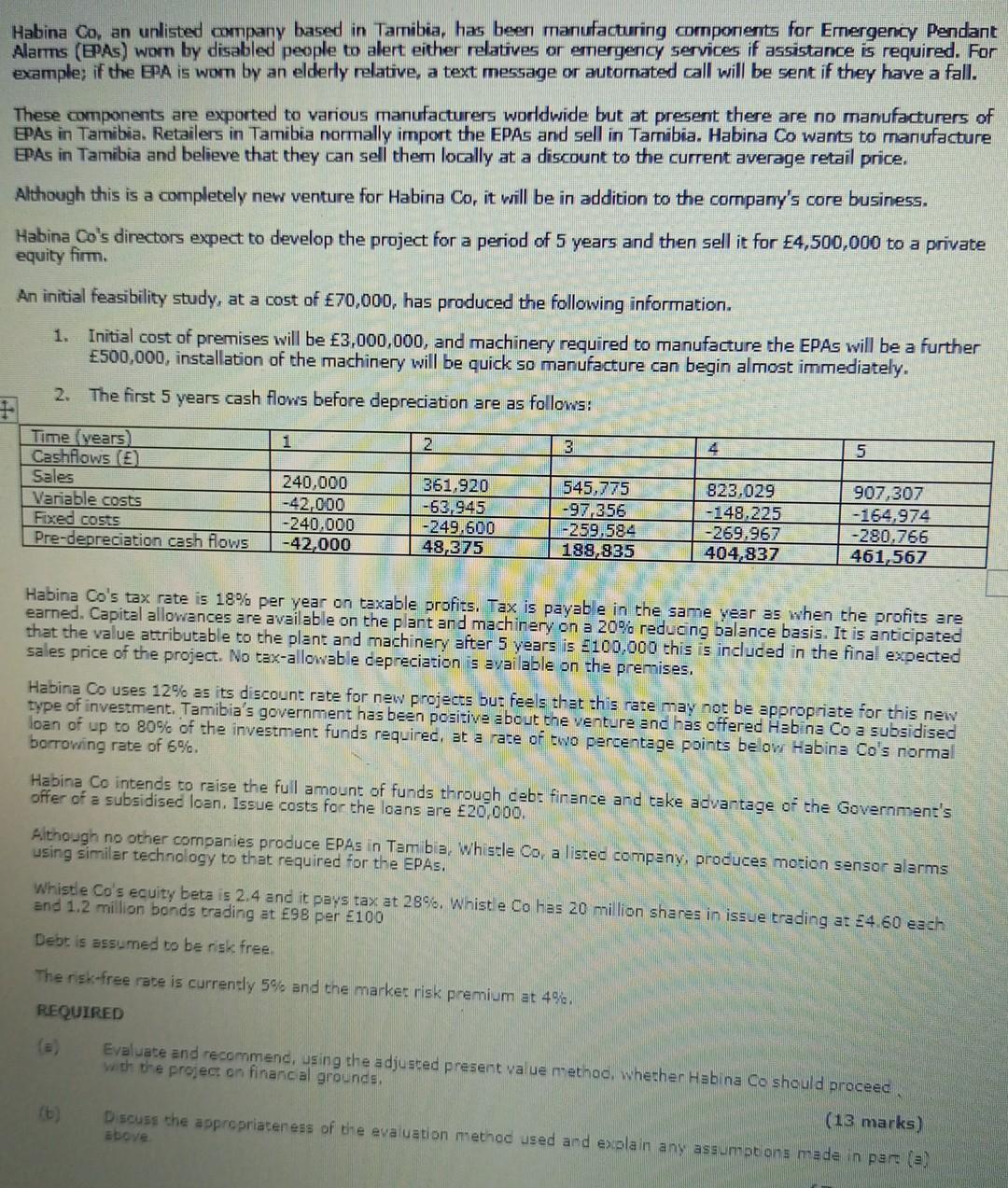

Habina Co, an unlisted ampany based in Tamibia, has been manufacturing components for Emergency Pendant Alarms (EPA) worn by disabled people to alert either relatives or emergency services if assistance is required. For example, if the EPA is wom by an elderly relative, a text message or automated call will be sent if they have a fall. These components are exported to various manufacturers worldwide but at present there are no manufacturers of EPAs in Tamibia. Retailers in Tamibia normally import the EPAs and sell in Tamibia. Habina Co wants to manufacture EPAs in Tamibia and believe that they can sell them locally at a discount to the current average retail price. Although this is a completely new venture for Habina Co, it will be in addition to the company's core business. Habina Co's directors expect to develop the project for a period of 5 years and then sell it for 4,500,000 to a private equity firm. An initial feasibility study, at a cost of 70,000, has produced the following information. 1. Initial cost of premises will be 3,000,000, and machinery required to manufacture the EPAs will be a further 500,000, installation of the machinery will be quick so manufacture can begin almost immediately. 2. The first 5 years cash flows before depreciation are as follows: 1 2 3 4 5 Time {vears) Cashflows (E) Sales Variable costs Fixed costs Pre-depreciation cash flows 240,000 -42.000 -240.000 -42.000 361.920 -63,945 -249.600 48,375 545.775 -97-356 -259,594 188,835 823,029 -148.225 -269.967 404,837 907,307 -164,974 -280,766 461,567 Habina Co's tax rate is 18% per year on taxable profits. Tax is payable in the same year as when the profits are earned. Capital allowances are available on the plant and machinery on a 20% reducing balance basis. It is anticipated that the value attributable to the plant and machinery after 5 years is 100,000 this is included in the final expected sales price of the project. No tax-allowable depreciation is available on the premises, Habina Co uses 12% as its discount rate for new projects but feels that this rate may not be appropriate for this new type of investment. Tamibia's government has been positive about the venture and has offered Habina Co a subsidised loan of up to 80% of the investment funds required, at a rate of two percentage points below Habina Co's normal borrowing rate of 6%. Habina Co intends to raise the full amount of funds through ceb: finance and take advantage of the Government's offer of a subsidised loan. Issue costs for the loans are 20,000. Although no other companies produce EPAs in Tamibia, Whistle Co, a listed company, produces motion sensor alarms using similar technology to that required for the EPAs. Whistle Co's equity beta is 2.4 and it pays tax at 28%. Whistle Co has 20 million shares in issue trading at 24.60 each and 1.2 million bonds trading at ESB per 100 Debt is assumed to be risk free. The risk-free rate is currently 5% and the market risk premium at 4%. REQUIRED (3) Evaluate and recommend using the adjusted present value method, whether Habina Co should proceed with the projec: on financial grounds. (13 marks) Discuss the appropriateness of the evaluation method used and explain any assumptons made in part (a) above Habina Co, an unlisted ampany based in Tamibia, has been manufacturing components for Emergency Pendant Alarms (EPA) worn by disabled people to alert either relatives or emergency services if assistance is required. For example, if the EPA is wom by an elderly relative, a text message or automated call will be sent if they have a fall. These components are exported to various manufacturers worldwide but at present there are no manufacturers of EPAs in Tamibia. Retailers in Tamibia normally import the EPAs and sell in Tamibia. Habina Co wants to manufacture EPAs in Tamibia and believe that they can sell them locally at a discount to the current average retail price. Although this is a completely new venture for Habina Co, it will be in addition to the company's core business. Habina Co's directors expect to develop the project for a period of 5 years and then sell it for 4,500,000 to a private equity firm. An initial feasibility study, at a cost of 70,000, has produced the following information. 1. Initial cost of premises will be 3,000,000, and machinery required to manufacture the EPAs will be a further 500,000, installation of the machinery will be quick so manufacture can begin almost immediately. 2. The first 5 years cash flows before depreciation are as follows: 1 2 3 4 5 Time {vears) Cashflows (E) Sales Variable costs Fixed costs Pre-depreciation cash flows 240,000 -42.000 -240.000 -42.000 361.920 -63,945 -249.600 48,375 545.775 -97-356 -259,594 188,835 823,029 -148.225 -269.967 404,837 907,307 -164,974 -280,766 461,567 Habina Co's tax rate is 18% per year on taxable profits. Tax is payable in the same year as when the profits are earned. Capital allowances are available on the plant and machinery on a 20% reducing balance basis. It is anticipated that the value attributable to the plant and machinery after 5 years is 100,000 this is included in the final expected sales price of the project. No tax-allowable depreciation is available on the premises, Habina Co uses 12% as its discount rate for new projects but feels that this rate may not be appropriate for this new type of investment. Tamibia's government has been positive about the venture and has offered Habina Co a subsidised loan of up to 80% of the investment funds required, at a rate of two percentage points below Habina Co's normal borrowing rate of 6%. Habina Co intends to raise the full amount of funds through ceb: finance and take advantage of the Government's offer of a subsidised loan. Issue costs for the loans are 20,000. Although no other companies produce EPAs in Tamibia, Whistle Co, a listed company, produces motion sensor alarms using similar technology to that required for the EPAs. Whistle Co's equity beta is 2.4 and it pays tax at 28%. Whistle Co has 20 million shares in issue trading at 24.60 each and 1.2 million bonds trading at ESB per 100 Debt is assumed to be risk free. The risk-free rate is currently 5% and the market risk premium at 4%. REQUIRED (3) Evaluate and recommend using the adjusted present value method, whether Habina Co should proceed with the projec: on financial grounds. (13 marks) Discuss the appropriateness of the evaluation method used and explain any assumptons made in part (a) aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started