Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Plz do both parts Learn Live Co is a provider of learning materials that historically has delivered commercial courses to the business sector. Recent events

Plz do both parts

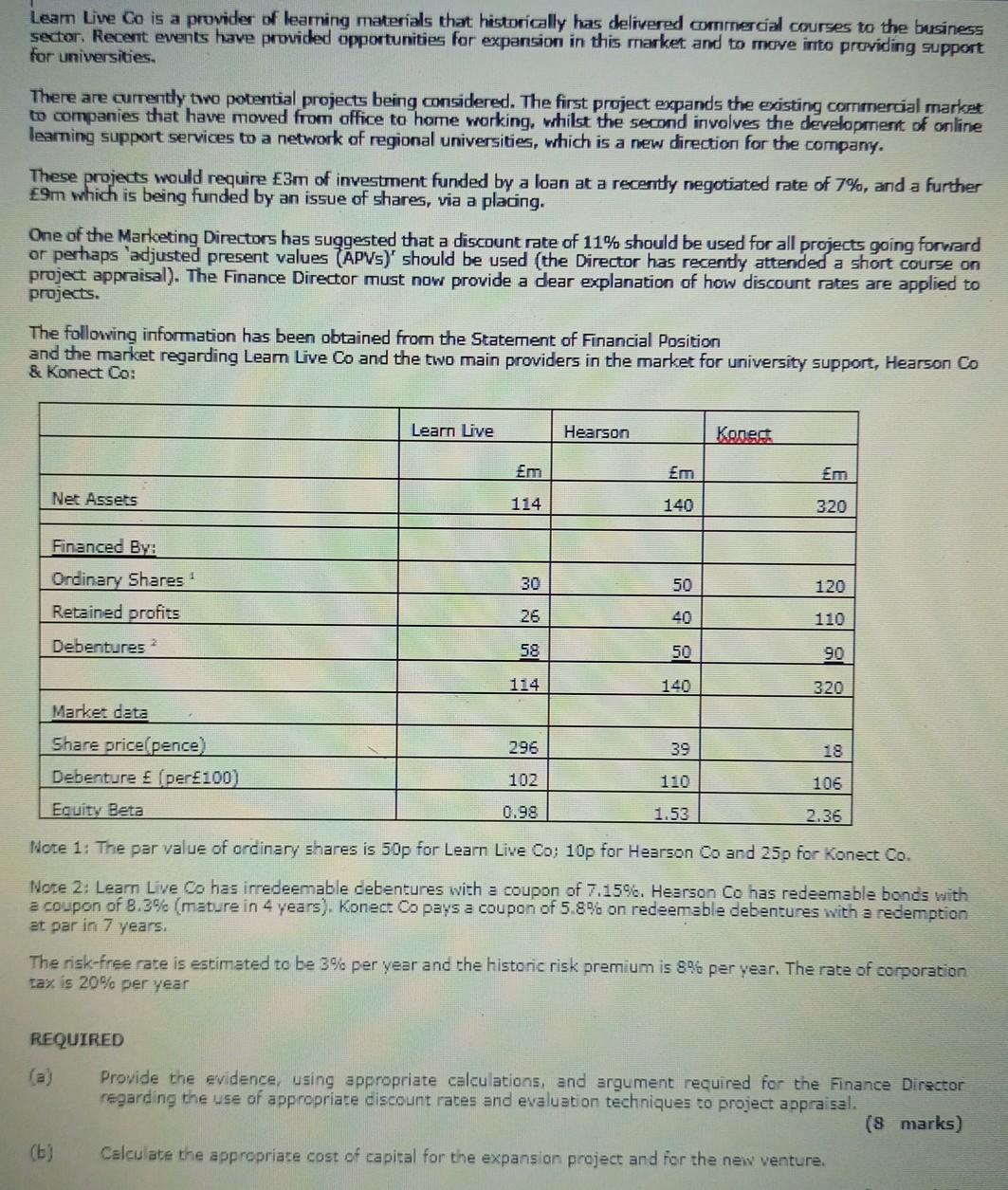

Learn Live Co is a provider of learning materials that historically has delivered commercial courses to the business sector. Recent events have provided opportunities for expansion in this market and to move into providing support for universities. There are currently two potential projects being considered. The first project expands the existing commercial market to companies that have moved from office to home working, whilst the second involves the development of online learning support services to a network of regional universities, which is a new direction for the company. These projects would require 3m of investment funded by a loan at a recently negotiated rate of 7%, and a further 9m which is being funded by an issue of shares, via a placing. One of the Marketing Directors has suggested that a discount rate of 11% should be used for all projects going forward or perhaps 'adjusted present values (APVS)' should be used the Director has recently attended a short course on project appraisal). The Finance Director must now provide a dear explanation of how discount rates are applied to projects. The following information has been obtained from the Statement of Financial Position and the market regarding Learn Live Co and the two main providers in the market for university support, Hearson Co & Konect Co: Learn Live Hearson Konect Em Em Net Assets 114 140 320 Financed By: 30 50 120 Ordinary Shares Retained profits 26 Debentures 58 50 90 114 140 320 Market data 296 39 Share price pence) Debenture (per100) 102 106 Equity Beta 0.98 1.53 2.36 Note 1: The par value of ordinary shares is 50p for Learn Live Co; 10p for Hearson Co and 250 for Konect Co. Note 2: Learn Live Co has irredeemable debentures with a coupon of 7.15%. Hearson Co has redeemable bonds with a coupon of 8.3% (mature in 4 years). Konect Co pays a coupon of 5.8% on redeemable debentures with a redemption at par in 7 years. The risk-free rate is estimated to be 3% per year and the historic risk premium is 8% per year. The rate of corporation tax is 20% per year REQUIRED Provide the evidence, using appropriate calculations, and argument required for the Finance Director regarding the use of appropriate discount rates and evaluation techniques to project appraisal. (8 marks) (b) Calculate the appropriate cost of capital for the expansion project and for the new venture. Learn Live Co is a provider of learning materials that historically has delivered commercial courses to the business sector. Recent events have provided opportunities for expansion in this market and to move into providing support for universities. There are currently two potential projects being considered. The first project expands the existing commercial market to companies that have moved from office to home working, whilst the second involves the development of online learning support services to a network of regional universities, which is a new direction for the company. These projects would require 3m of investment funded by a loan at a recently negotiated rate of 7%, and a further 9m which is being funded by an issue of shares, via a placing. One of the Marketing Directors has suggested that a discount rate of 11% should be used for all projects going forward or perhaps 'adjusted present values (APVS)' should be used the Director has recently attended a short course on project appraisal). The Finance Director must now provide a dear explanation of how discount rates are applied to projects. The following information has been obtained from the Statement of Financial Position and the market regarding Learn Live Co and the two main providers in the market for university support, Hearson Co & Konect Co: Learn Live Hearson Konect Em Em Net Assets 114 140 320 Financed By: 30 50 120 Ordinary Shares Retained profits 26 Debentures 58 50 90 114 140 320 Market data 296 39 Share price pence) Debenture (per100) 102 106 Equity Beta 0.98 1.53 2.36 Note 1: The par value of ordinary shares is 50p for Learn Live Co; 10p for Hearson Co and 250 for Konect Co. Note 2: Learn Live Co has irredeemable debentures with a coupon of 7.15%. Hearson Co has redeemable bonds with a coupon of 8.3% (mature in 4 years). Konect Co pays a coupon of 5.8% on redeemable debentures with a redemption at par in 7 years. The risk-free rate is estimated to be 3% per year and the historic risk premium is 8% per year. The rate of corporation tax is 20% per year REQUIRED Provide the evidence, using appropriate calculations, and argument required for the Finance Director regarding the use of appropriate discount rates and evaluation techniques to project appraisal. (8 marks) (b) Calculate the appropriate cost of capital for the expansion project and for the new ventureStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started