Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz explain 1. Stephen puts $10,000 into a five-year guaranteed investment certificate earning 3% annual compound interest. How much will he get when it matures?

plz explain

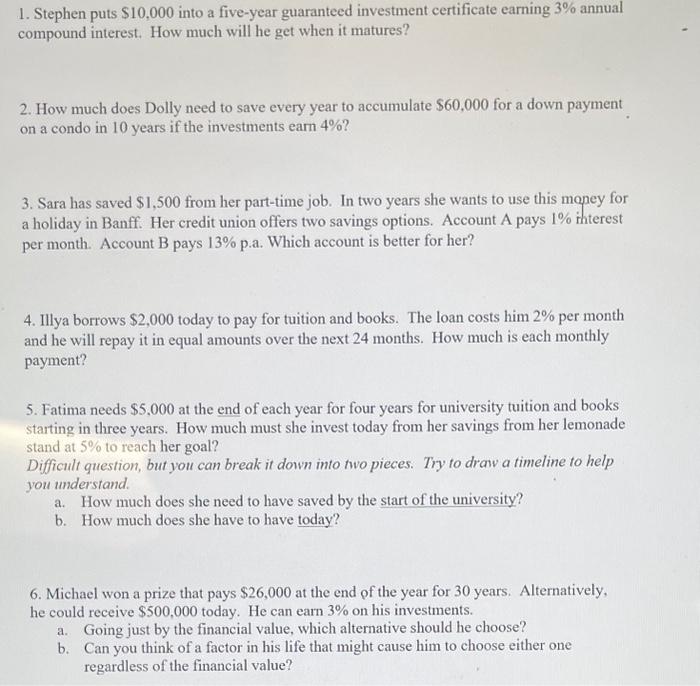

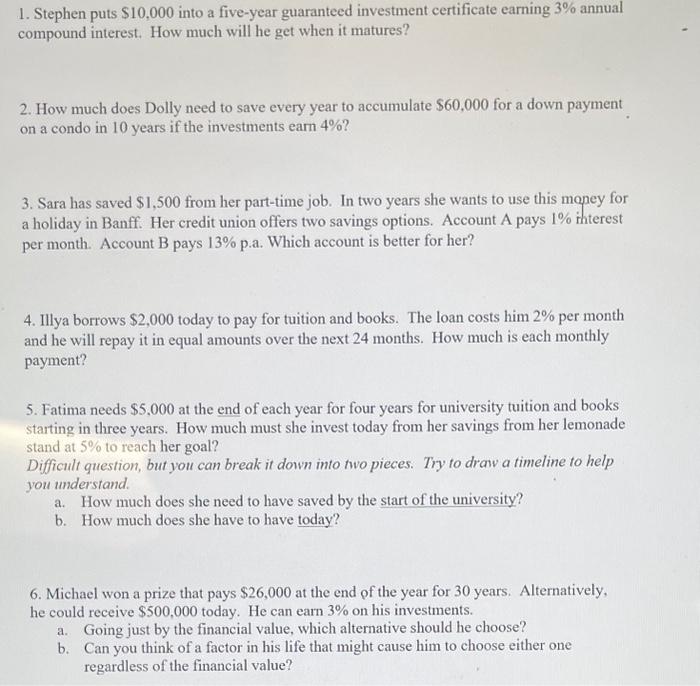

1. Stephen puts $10,000 into a five-year guaranteed investment certificate earning 3% annual compound interest. How much will he get when it matures? 2. How much does Dolly need to save every year to accumulate $60,000 for a down payment on a condo in 10 years if the investments earn 4% ? 3. Sara has saved \$1,500 from her part-time job. In two years she wants to use this money for a holiday in Banff. Her credit union offers two savings options. Account A pays 1% interest per month. Account B pays 13% p.a. Which account is better for her? 4. Illya borrows $2,000 today to pay for tuition and books. The loan costs him 2% per month and he will repay it in equal amounts over the next 24 months. How much is each monthly payment? 5. Fatima needs $5,000 at the end of each year for four years for university tuition and books starting in three years. How much must she invest today from her savings from her lemonade stand at 5% to reach her goal? Difficult question, but you can break it down imto two pieces. Try to draw a timeline to help you understand. a. How much does she need to have saved by the start of the university? b. How much does she have to have today? 6. Michael won a prize that pays $26,000 at the end of the year for 30 years. Alternatively, he could receive $500,000 today. He can earn 3% on his investments. a. Going just by the financial value, which alternative should he choose? b. Can you think of a factor in his life that might cause him to choose either one regardless of the financial value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started