Answered step by step

Verified Expert Solution

Question

1 Approved Answer

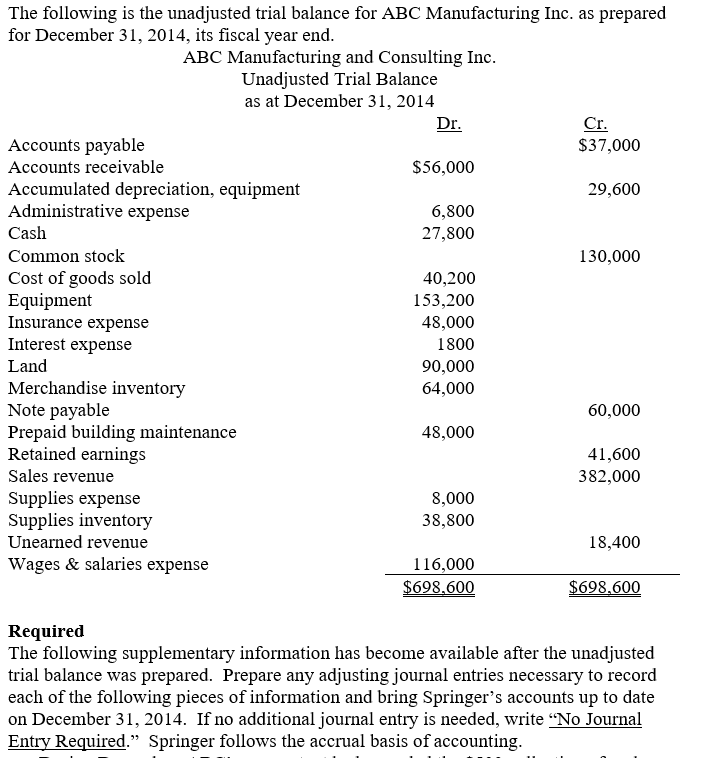

plz explain each step with detail, I will give u a thumb! The following is the unadjusted trial balance for ABC Manufacturing Inc. as prepared

plz explain each step with detail, I will give u a thumb!

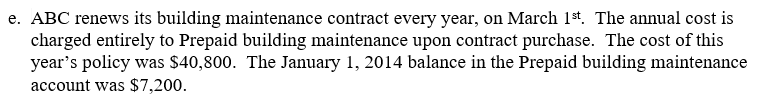

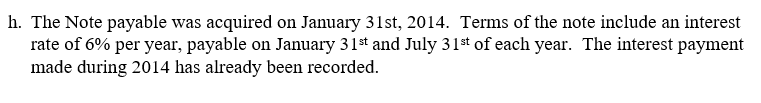

The following is the unadjusted trial balance for ABC Manufacturing Inc. as prepared for December 31, 2014, its fiscal year end. ABC Manufacturing and Consulting Inc Unadjusted Trial Balance as at December 31, 2014 Cr. $37,000 Dr. Accounts payable $56,000 Accounts receivable Accumulated depreciation, equipment Administrative expense 29,600 6,800 Cash 27,800 Common stock 130,000 Cost of goods sold Equipment Insurance expense Interest expense Land 40,200 153,200 48,000 1800 90,000 Merchandise inventory Note payable Prepaid building maintenance Retained earnings 64,000 60,000 48,000 41,600 Sales revenue 382,000 Supplies expense Supplies inventory Unearned revenue 8,000 38,800 18,400 Wages & salaries expense 116,000 $698,600 $698,600 Required The following supplementary information has become available after the unadjusted trial balance was prepared. Prepare any adjusting journal entries necessary to record each of the following pieces of information and bring Springer's accounts up to date on December 31, 2014. If no additional journal entry is needed, write "No Journal Entry Required." Springer follows the accrual basis of accounting e. ABC renews its building maintenance contract every year, on March 1st. The annual cost is charged entirely to Prepaid building maintenance upon contract purchase. The cost of this year's policy was $40,800. The January 1, 2014 balance in the Prepaid building maintenance account was $7,200. h. The Note payable was acquired on January 31st, 2014. Terms of the note include an interest rate of 6% per year, payable on January 31st and July 31st of each year. The interest payment made during 2014 has already been recordedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started