Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz fill table accordingly. Case study: BMAC Research & Development decision BMAC, a research and development ( R & D) company, must decide whether to

plz fill table accordingly.

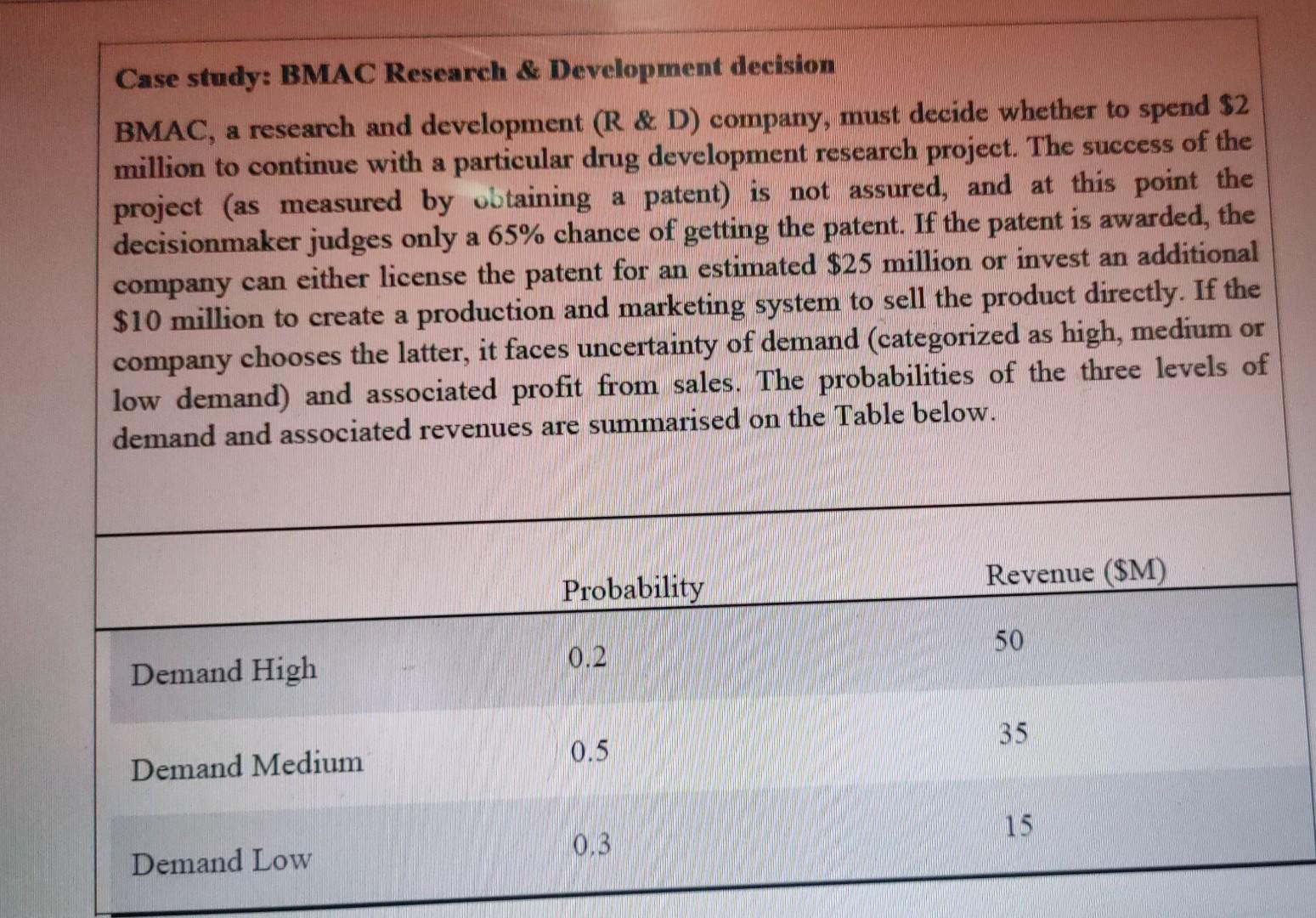

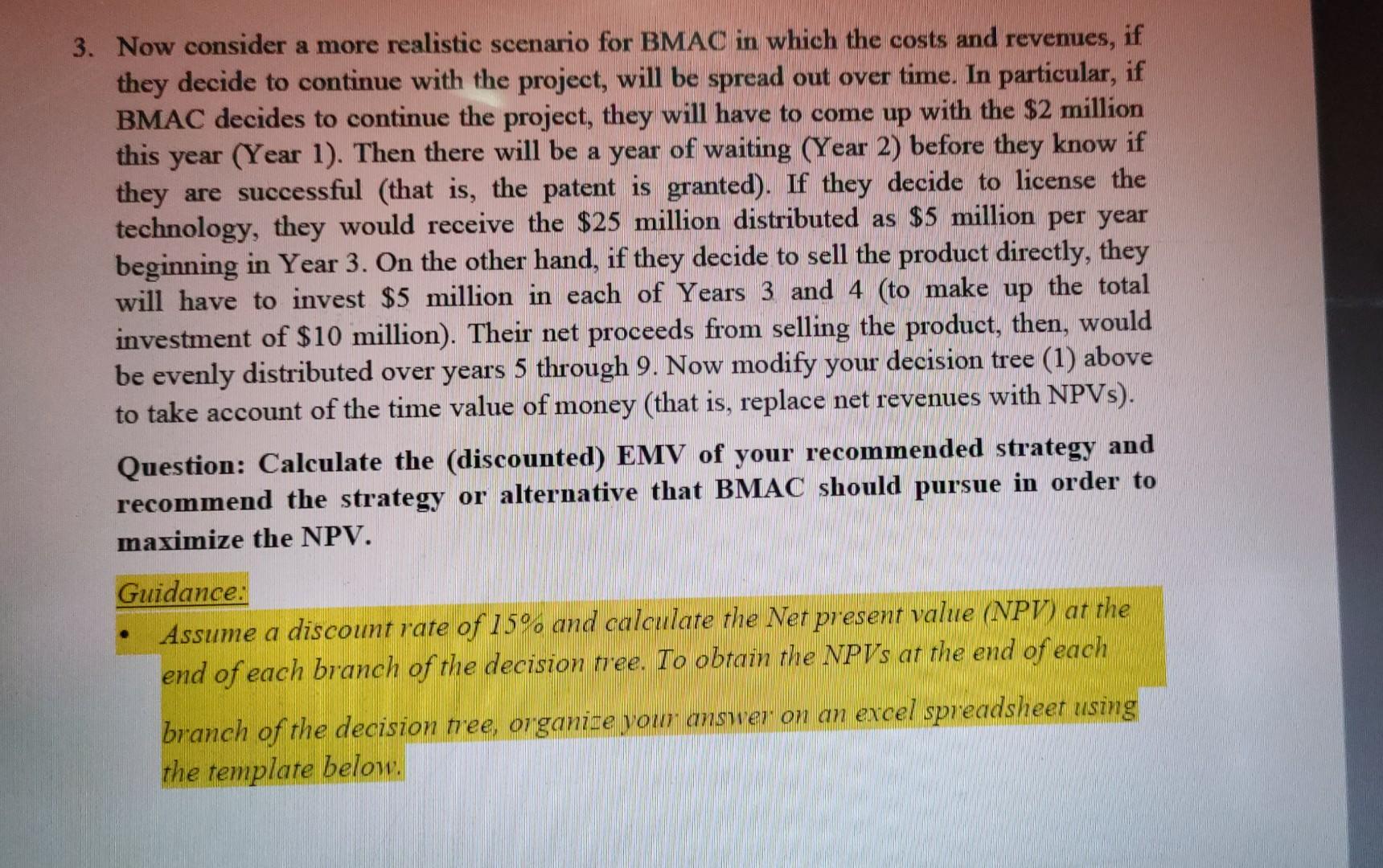

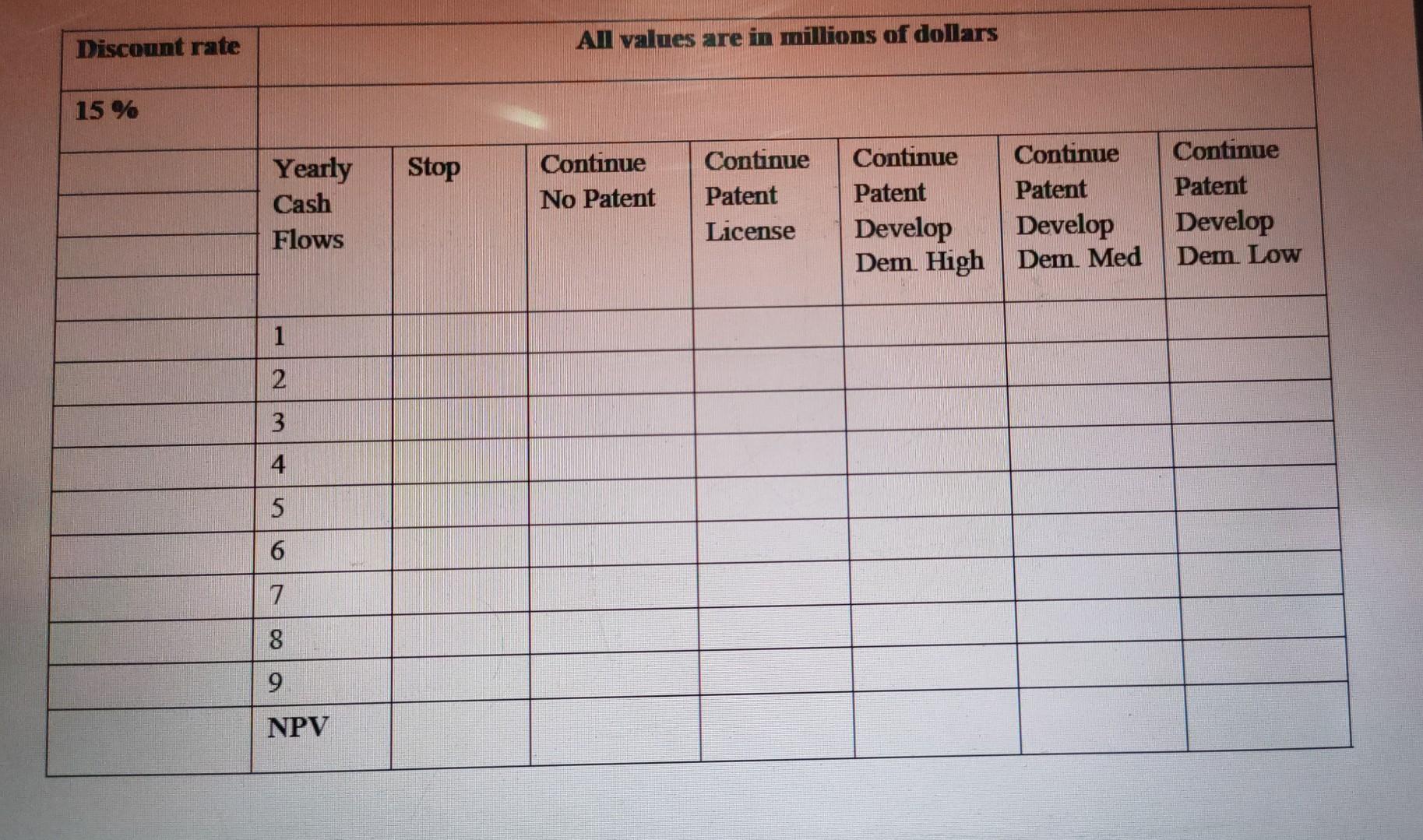

Case study: BMAC Research \& Development decision BMAC, a research and development ( R \& D) company, must decide whether to spend $2 million to continue with a particular drug development research project. The success of the project (as measured by obtaining a patent) is not assured, and at this point the decisionmaker judges only a 65% chance of getting the patent. If the patent is awarded, the company can either license the patent for an estimated $25 million or invest an additional $10 million to create a production and marketing system to sell the product directly. If the company chooses the latter, it faces uncertainty of demand (categorized as high, medium or low demand) and associated profit from sales. The probabilities of the three levels of demand and associated revenues are summarised on the Table below. 3. Now consider a more realistic scenario for BMAC in which the costs and revenues, if they decide to continue with the project, will be spread out over time. In particular, if BMAC decides to continue the project, they will have to come up with the $2 million this year (Year 1). Then there will be a year of waiting (Year 2) before they know if they are successful (that is, the patent is granted). If they decide to license the technology, they would receive the $25 million distributed as $5 million per year beginning in Year 3. On the other hand, if they decide to sell the product directly, they will have to invest $5 million in each of Years 3 and 4 (to make up the total investment of $10 million). Their net proceeds from selling the product, then, would be evenly distributed over years 5 through 9. Now modify your decision tree (1) above to take account of the time value of money (that is, replace net revenues with NPVs). Question: Calculate the (discounted) EMV of your recommended strategy and recommend the strategy or alternative that BMAC should pursue in order to maximize the NPV. Guidance: - Assume a discount rate of 15% and calculate the Net present value (NPV) at the end of each branch of the decision tree. To obtain the NPVS at the end of each branch of the decision tree, organize your answer on an excel spreadsheet using the template belowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started