Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz help 12. Assume that John and Kevin want to incorporate a business. John performs services for the corp oration and receives $20,000 wotth of

plz help

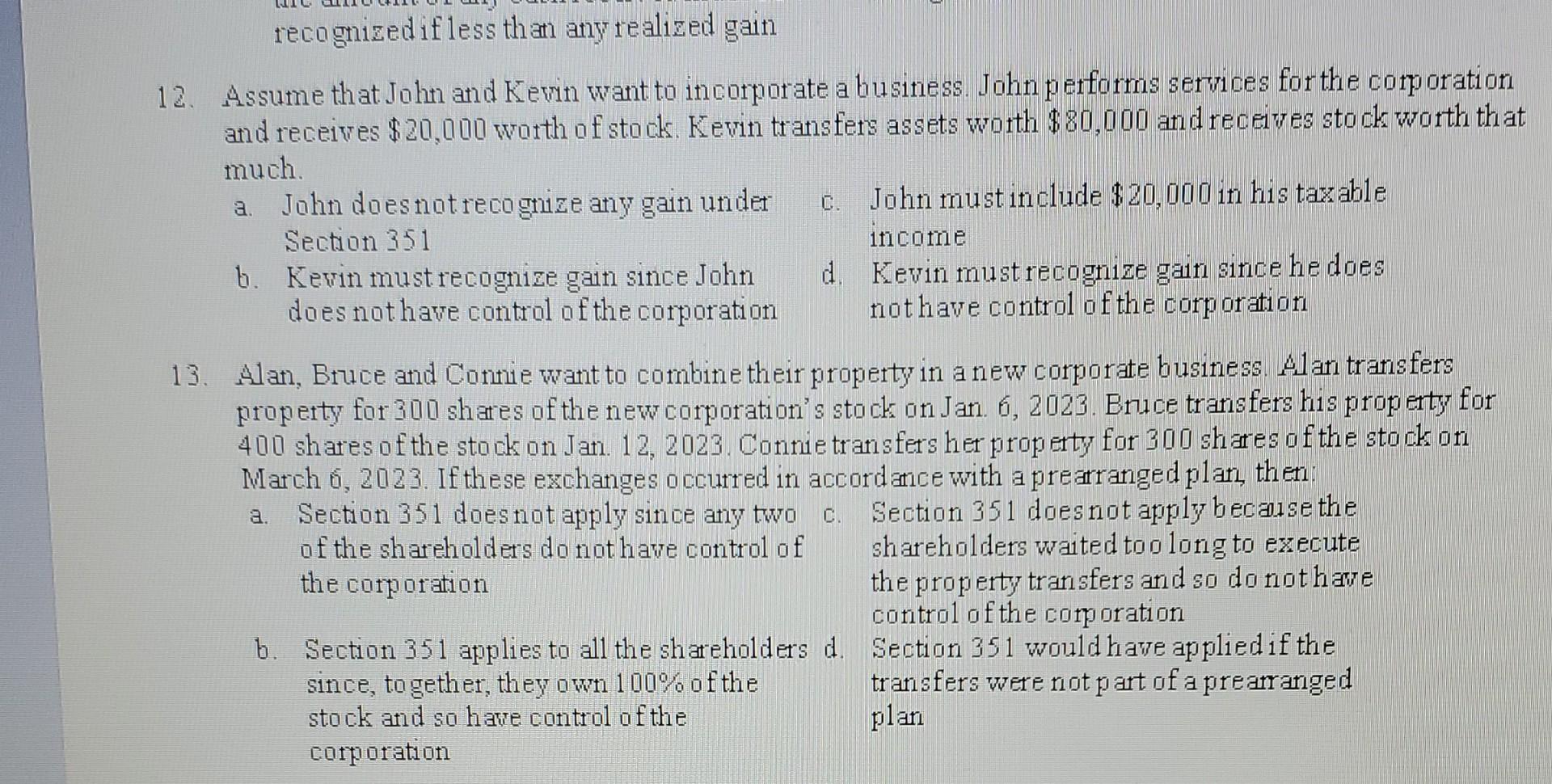

12. Assume that John and Kevin want to incorporate a business. John performs services for the corp oration and receives $20,000 wotth of stock. Kevin transfers assets wotth $80,000 and receives stock worth that much. a. John does not recognize any gain under c. John must include $20,000 in his taxable Section 351 income b. Kevin must recognize gain since John d. Kevin must recognize gain since he does does not have control of the corporation nothave control of the corporation 13. Alan, Bruce and Connie want to combine their property in a new corporate business. Alan transfers property for 300 shares of the new corporation's stock on Jan. 6,2023. Bnuce transfers his prop erty for 400 shares of the stock on Jan. 12,2023. Connie transfers her property for 300 shares of the stock on March 6, 2023. If these exchanges occurred in accordance with a prearranged p lan, then: a. Section 351 doesnot apply since any two c. Section 351 does not apply because the of the shareholders do not have conitrol of shareholders waited too long to execute the corporation the property transfers and so do not have control of the comporation b. Section 351 applies to all the shareholders d. Section 351 would have applied if the since, to gether, they own 100% of the transfers were not p art of a prearranged stock and so have control of the plan corporationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started