Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz help 21. Which of the following might be reasons for a corporation to redeen its stock from a shareholder? a. The shareholder wants to

plz help

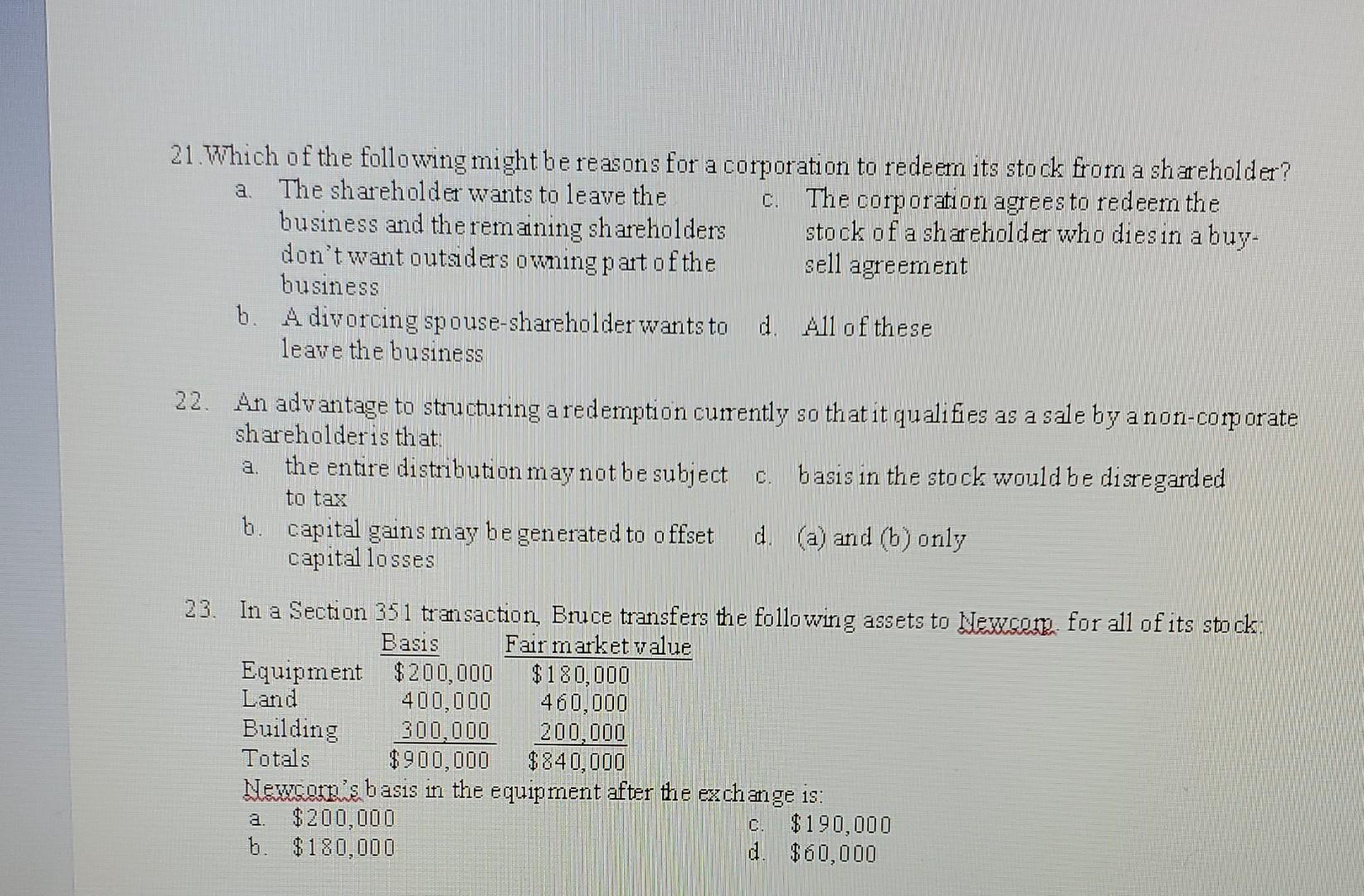

21. Which of the following might be reasons for a corporation to redeen its stock from a shareholder? a. The shareholder wants to leave the c. The corporation agrees to redeem the business and the remaining shareholders stock of a shareholder who dies in a buydon't want outaders owning part of the sell agreement business b. A divorcing spouse-shareholder wants to d. All of these leave the business 22. An advantage to structuring a redemption currently so that it qualifies as a sale by a non-corp orate shareholder is that: a. the entire distribution may not be subject c. basis in the stock would be disregarded to tax b. capital gains may be generated to offset d. (a) and (b) only capital losses 23. In a Section 351 transaction, Bruce transfers the following assets to Lewcent for all of its stock: Neucotg's basis in the equipment after the exchange is: a. $200,000 c. $190,000 b. $180,000 d. $60,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started