Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLZ HELP ASAP. WILL RATE! Flores Fish Fine Foods has $2,, for capital investments this year and is considering two potential projects for the funds.

PLZ HELP ASAP. WILL RATE!

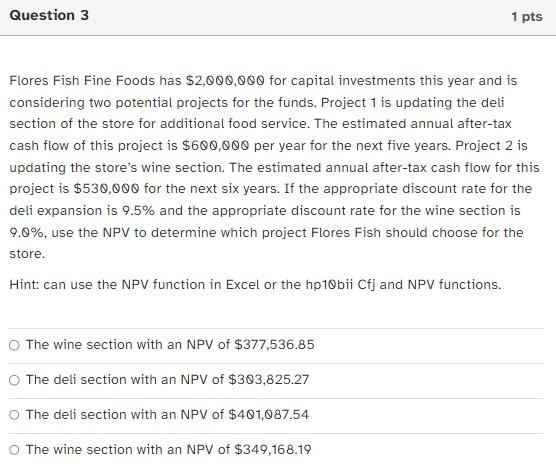

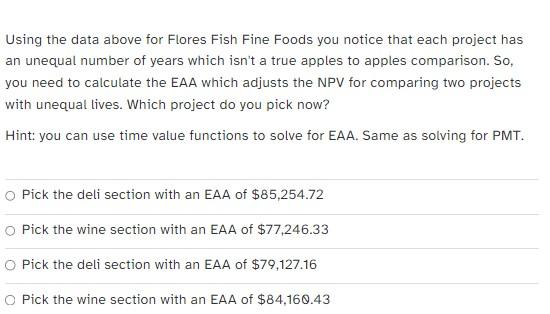

Flores Fish Fine Foods has $2,, for capital investments this year and is considering two potential projects for the funds. Project 1 is updating the deli section of the store for additional food service. The estimated annual after-tax cash flow of this project is $6QQ,QQ per year for the next five years. Project 2 is updating the store's wine section. The estimated annual after-tax cash flow for this project is $53Q, for the next six years. If the appropriate discount rate for the deli expansion is 9.5% and the appropriate discount rate for the wine section is 9.%, use the NPV to determine which project Flores Fish should choose for the store. Hint: can use the NPV function in Excel or the hp10bii Cfj and NPV functions. The wine section with an NPV of $377,536.85 The deli section with an NPV of $33,825.27 The deli section with an NPV of $401,87.54 The wine section with an NPV of $349,168.19 Using the data above for Flores Fish Fine Foods you notice that each project has an unequal number of years which isn't a true apples to apples comparison. So, you need to calculate the EAA which adjusts the NPV for comparing two projects with unequal lives. Which project do you pick now? Hint: you can use time value functions to solve for EAA. Same as solving for PMT. Pick the deli section with an EAA of $85,254.72 Pick the wine section with an EAA of $77,246.33 Pick the deli section with an EAA of $79,127.16 Pick the wine section with an EAA of $84,160.43

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started