Question

PLZ help!! I will give a thumbs up!! Use the following quotations from the ASX for November 15 th , 2019 to answer questions 1

PLZ help!! I will give a thumbs up!!

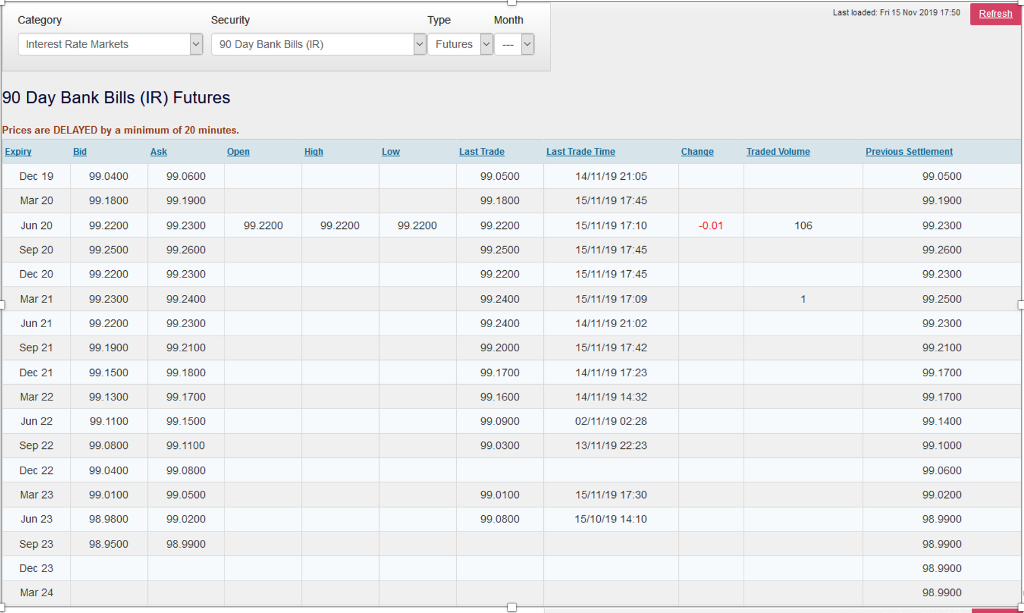

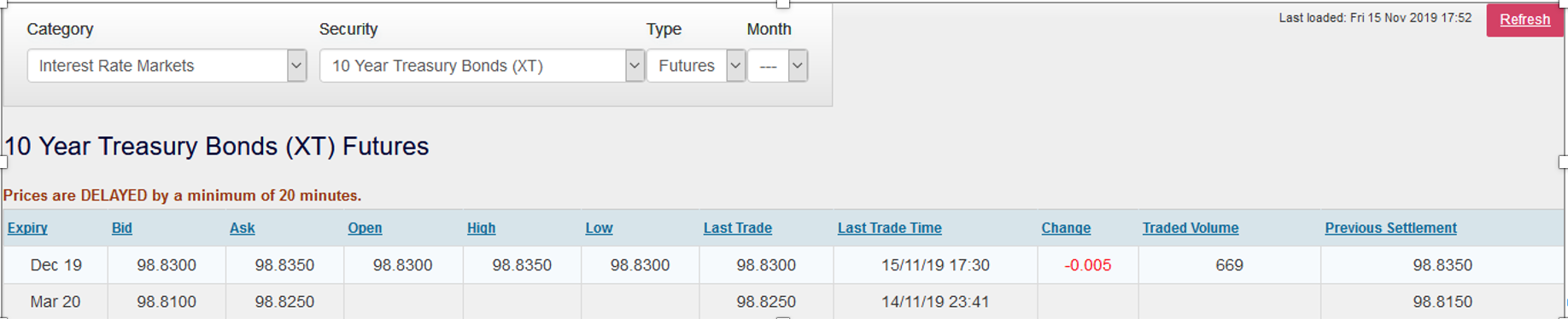

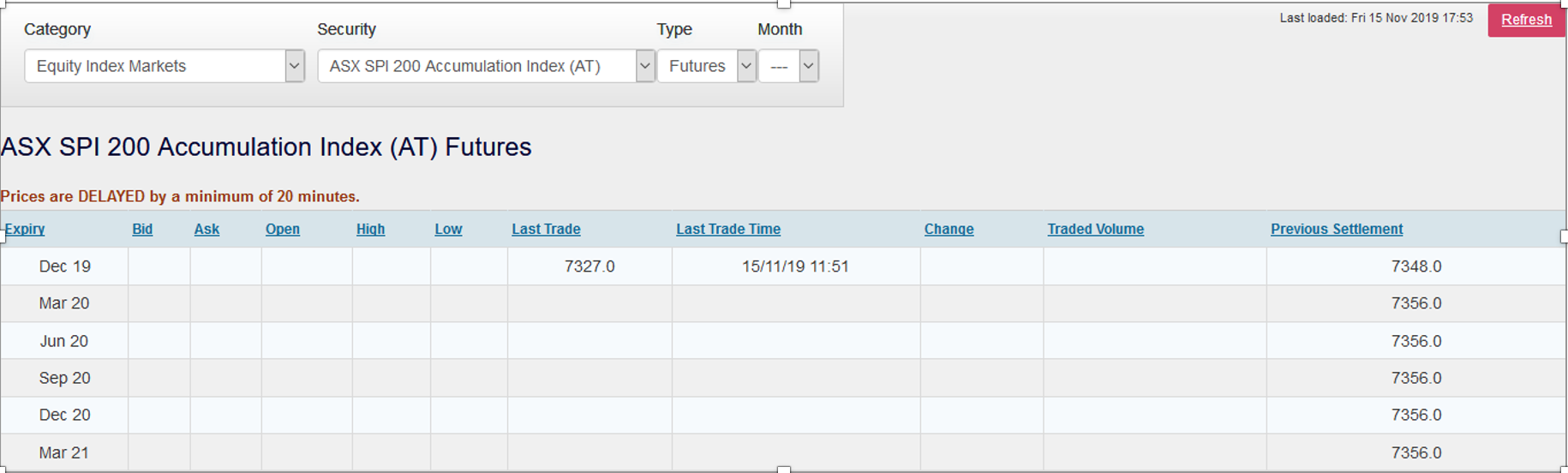

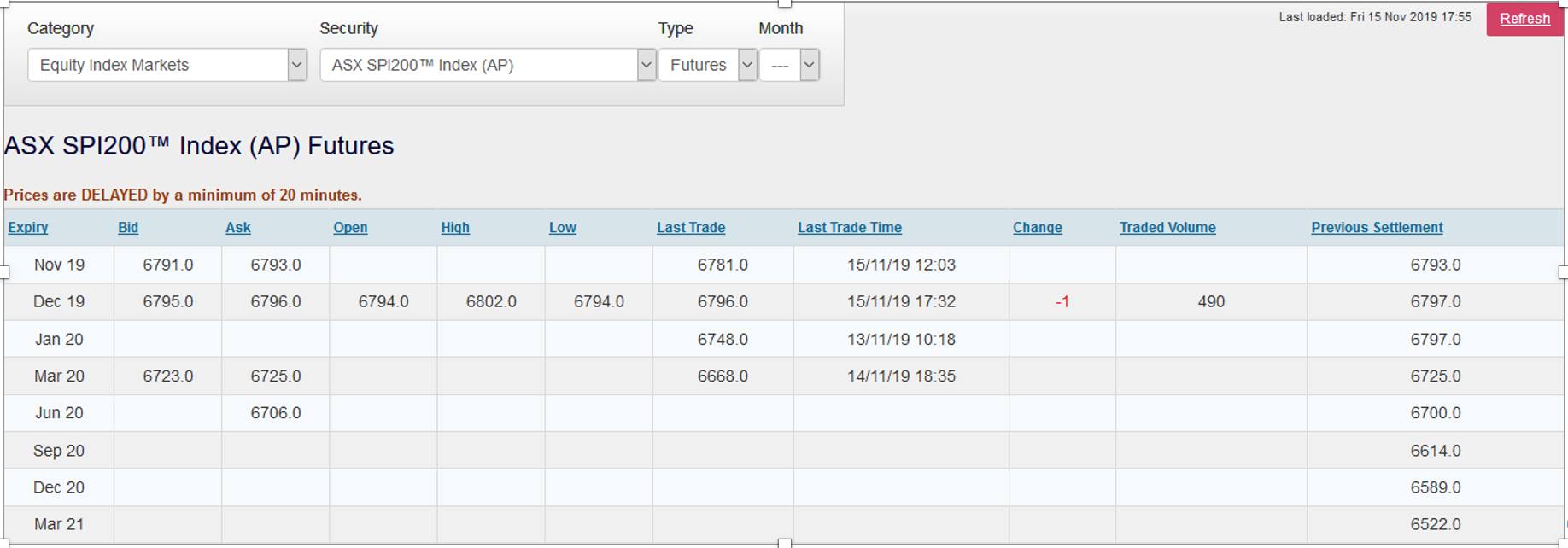

Use the following quotations from the ASX for November 15th, 2019 to answer questions 1 and 2.

1. On November 15, 2019, Mary believes that the share market will suffer a correction (fall) of 20% in late February. It is November 15, 2019 and the ASX 200 index stands at 6780. If Mary commonly speculates using 5 SPI 200 contracts;

i) Outline the position she should take to profit from her expectations.

ii) Calculate her profit or loss on February 28th, 2012 for this position if the bid and ask quotations for March 2020 SPI 200 contracts are quoted at 6582.0 and 6584.0 respectively.

iii) Outline the action she should take to realise this profit or loss.

Use the quotations from the ASX table above, while assuming that all futures trades are conducted using market orders, and document her various actions in the table below. Recall that SPI futures are valued at $25 times the index.

| Date | Futures Market | Physical Market |

|

15 Nov 2019

|

|

|

|

28 Feb 2020

|

|

|

|

March 2020

|

|

|

2. It is November 15th 2019, and Jerry will need to borrow $5,000,000 for 90-days next June. If today's yield on 90-day bank bills is 1.0% p.a. and Jerry believes that 90-day interest rates may fall to 0.8% p.a. by June. What futures position should Jerry take to hedge this exposure? What borrowing rate would Jerry lock-in, if in June, the June futures quotations are 98.8800 (bid) and 98.8650 (ask), and September futures 98.8500 (bid) and 98.8650 (ask), while Jerry is able to issue 90-day bills at 1.70% p.a.?

Use the quotations from the ASX table above, while assuming that all futures trades are conducted using market orders, and document his various actions in the table below.

| Date | Futures Market | Physical Market |

|

15 Nov 2019

|

|

|

|

June 2020

|

|

|

Last loaded: Fri 15 Nov 2019 17:50 Refresh Type Month Category Interest Rate Markets Security 90 Day Bank Bills (IR) () Futures 90 Day Bank Bills (IR) Futures High Low Last Trade Last Trade Time Change Traded Volume Previous Settlement Prices are DELAYED by a minimum of 20 minutes. Expiry Bid Ask Open Dec 19 99.0400 99.0600 Mar 20 99.1800 99.1900 99.0500 14/11/19 21:05 99.0500 99.1800 15/11/19 17:45 99.1900 Jun 20 99.2200 99.2300 99.2200 99 2200 99.2200 99.2200 15/11/19 17:10 -0.01 106 99.2300 Sep 20 99.2500 99.2600 99 2500 99 2600 15/11/19 17:45 15/11/19 17:45 Dec 20 99.2200 99 2300 99 2200 99.2300 Mar 21 99.2300 99,2400 99,2400 15/11/19 17:09 1 99.2500 Jun 21 99.2200 99.2300 99,2400 14/11/19 21:02 99.2300 Sep 21 99 1900 99 2100 99 2000 15/11/19 17:42 99 2100 Dec 21 99. 1500 99.1800 14/11/19 17:23 99.1700 99. 1600 99.1700 99.1700 Mar 22 99.1300 99. 1700 14/11/19 14:32 Jun 22 99.1100 99.1500 99.0900 02/11/19 02:28 99.1400 Sep 22 99.0800 99.1100 99.0300 13/11/19 22:23 99.1000 Dec 22 99.0400 99.0800 99.0600 Mar 23 99.0100 99.0500 15/11/19 17:30 99.0200 99.0100 99.0800 Jun 23 98.9800 99.0200 15/10/19 14:10 98.9900 Sep 23 98.9500 98.9900 98.9900 Dec 23 98.9900 Mar 24 98.9900 Last loaded: Fri 15 Nov 2019 17:52 Refresh Category Security Type Month Interest Rate Markets 10 Year Treasury Bonds (XT) Futures (10 Year Treasury Bonds (XT) Futures Prices are DELAYED by a minimum of 20 minutes. Expiry Bid Ask Open High Low Last Trade Last Trade Time Change Traded Volume Previous Settlement Dec 19 98.8300 98.8350 98.8300 98.8350 98.8300 98.8300 15/11/19 17:30 -0.005 669 98.8350 Mar 20 98.8100 98.8250 98.8250 14/11/19 23:41 98.8150 Last loaded: Fri 15 Nov 2019 17:53 Refresh Category Security Type Month Equity Index Markets ASX SPI 200 Accumulation Index (AT) Futures ASX SPI 200 Accumulation Index (AT) Futures Prices are DELAYED by a minimum of 20 minutes. Expiry Bid Ask Open High Low Last Trade Last Trade Time Change Traded Volume Previous Settlement Dec 19 7327.0 15/11/19 11:51 7348.0 Mar 20 7356.0 Jun 20 7356.0 Sep 20 7356.0 Dec 20 7356.0 Mar 21 7356.0 Last loaded: Fri 15 Nov 2019 17:55 Refresh Category Security Type Month Equity Index Markets ASX SP1200T Index (AP) Futures ASX SP1200T Index (AP) Futures Prices are DELAYED by a minimum of 20 minutes. Expiry Bid Ask Open High Low Last Trade Last Trade Time Change Traded Volume Previous Settlement Nov 19 6791.0 6793.0 6781.0 15/11/19 12:03 6793.0 Dec 19 6795.0 6796.0 6794.0 6802.0 6794.0 6796.0 15/11/19 17:32 -1 490 6797.0 Jan 20 6748.0 13/11/19 10:18 6797.0 Mar 20 6723.0 6725.0 6668.0 14/11/19 18:35 6725.0 Jun 20 6706.0 6700.0 Sep 20 6614.0 Dec 20 6589.0 Mar 21 6522.0 Last loaded: Fri 15 Nov 2019 17:50 Refresh Type Month Category Interest Rate Markets Security 90 Day Bank Bills (IR) () Futures 90 Day Bank Bills (IR) Futures High Low Last Trade Last Trade Time Change Traded Volume Previous Settlement Prices are DELAYED by a minimum of 20 minutes. Expiry Bid Ask Open Dec 19 99.0400 99.0600 Mar 20 99.1800 99.1900 99.0500 14/11/19 21:05 99.0500 99.1800 15/11/19 17:45 99.1900 Jun 20 99.2200 99.2300 99.2200 99 2200 99.2200 99.2200 15/11/19 17:10 -0.01 106 99.2300 Sep 20 99.2500 99.2600 99 2500 99 2600 15/11/19 17:45 15/11/19 17:45 Dec 20 99.2200 99 2300 99 2200 99.2300 Mar 21 99.2300 99,2400 99,2400 15/11/19 17:09 1 99.2500 Jun 21 99.2200 99.2300 99,2400 14/11/19 21:02 99.2300 Sep 21 99 1900 99 2100 99 2000 15/11/19 17:42 99 2100 Dec 21 99. 1500 99.1800 14/11/19 17:23 99.1700 99. 1600 99.1700 99.1700 Mar 22 99.1300 99. 1700 14/11/19 14:32 Jun 22 99.1100 99.1500 99.0900 02/11/19 02:28 99.1400 Sep 22 99.0800 99.1100 99.0300 13/11/19 22:23 99.1000 Dec 22 99.0400 99.0800 99.0600 Mar 23 99.0100 99.0500 15/11/19 17:30 99.0200 99.0100 99.0800 Jun 23 98.9800 99.0200 15/10/19 14:10 98.9900 Sep 23 98.9500 98.9900 98.9900 Dec 23 98.9900 Mar 24 98.9900 Last loaded: Fri 15 Nov 2019 17:52 Refresh Category Security Type Month Interest Rate Markets 10 Year Treasury Bonds (XT) Futures (10 Year Treasury Bonds (XT) Futures Prices are DELAYED by a minimum of 20 minutes. Expiry Bid Ask Open High Low Last Trade Last Trade Time Change Traded Volume Previous Settlement Dec 19 98.8300 98.8350 98.8300 98.8350 98.8300 98.8300 15/11/19 17:30 -0.005 669 98.8350 Mar 20 98.8100 98.8250 98.8250 14/11/19 23:41 98.8150 Last loaded: Fri 15 Nov 2019 17:53 Refresh Category Security Type Month Equity Index Markets ASX SPI 200 Accumulation Index (AT) Futures ASX SPI 200 Accumulation Index (AT) Futures Prices are DELAYED by a minimum of 20 minutes. Expiry Bid Ask Open High Low Last Trade Last Trade Time Change Traded Volume Previous Settlement Dec 19 7327.0 15/11/19 11:51 7348.0 Mar 20 7356.0 Jun 20 7356.0 Sep 20 7356.0 Dec 20 7356.0 Mar 21 7356.0 Last loaded: Fri 15 Nov 2019 17:55 Refresh Category Security Type Month Equity Index Markets ASX SP1200T Index (AP) Futures ASX SP1200T Index (AP) Futures Prices are DELAYED by a minimum of 20 minutes. Expiry Bid Ask Open High Low Last Trade Last Trade Time Change Traded Volume Previous Settlement Nov 19 6791.0 6793.0 6781.0 15/11/19 12:03 6793.0 Dec 19 6795.0 6796.0 6794.0 6802.0 6794.0 6796.0 15/11/19 17:32 -1 490 6797.0 Jan 20 6748.0 13/11/19 10:18 6797.0 Mar 20 6723.0 6725.0 6668.0 14/11/19 18:35 6725.0 Jun 20 6706.0 6700.0 Sep 20 6614.0 Dec 20 6589.0 Mar 21 6522.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started