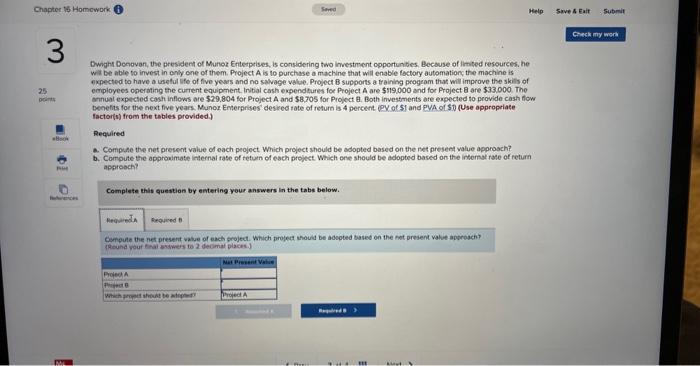

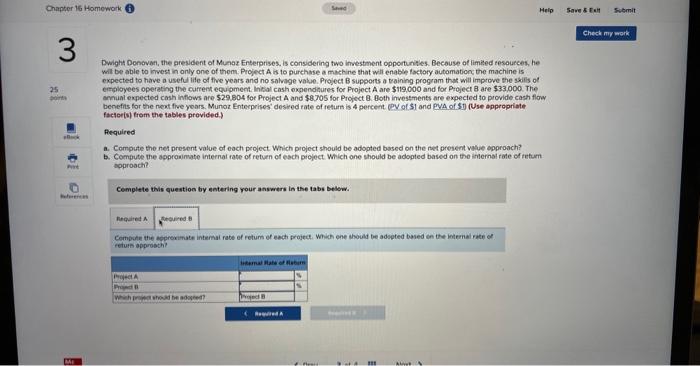

Dwight Donovan, the president of Munot Enterpises, is considering two investment opportunities. Becbuse of limited resources, he wit be able to invest in only one of them. Project A is to purchase a machine that will enable foctory automationc the machine is expected to have a useful life of five yewes and no salvage vilue. Project B supports a training program that will improve the skills of employees operating the current equipment. Inibal cash expendtures foe Project A are $199000 and for Project 8 are $33.000. The sonual expected cash inflows are $29.804 for Project A and 58,705 for Project B. Both investments are expected to provide cash flow benefiss for the next five years. Munou . Enterprises' desired tate of return is 4 percent (pY of $1 and pyA of 50 (Use appropriate factor(s) from the tables provided.) Required a. Compuse the net present value of each peoject. Which project should be adopted based on the net present walue approach? b. Compute the approwimate internal fase of tefuen of each project. Which one should be adopted based on the insernat rate of return approach? Complete this question by entering your answers in the tabs below. Compute the net present vatue of each project. Which project ahould be adeoted based on the not present value aboroach? Dwight Donovef, the aresident of Munar Enterprises, is considering two ifvestment opporturites. Because of limieed resources, he wit be able to invest in only one of thems. Project A is to purchuse a machine that will enabse factory automation, the machine is expected to have a useful life of five years and no salvage value. Project B supports a training program that will improve the skills of errployees operating the current eeupmeet. Inital cash oxpenditures for Project A are $119,000 and for Project B are $33,000. The anhual expected cosh inflows are $29.804 for Project A and $8705 for Project 8 . Both investments are expected to prowide cash flow benefits for the next five years. Munoz Enterprises' desired rate of teturn is 4 percent. (RY of S1 and PYA of 51) (Use appropriate factor(s) frem the tables provided.) Aequired a. Compute the net present value of each peoject. Which project should be adopted based on the net present value opproach? b. Compute the approwimate internal rate of retuen of esch pioject. Which one should be adopted based on the intlernal rate of rufumt noproach? Cemplete this question by entering rour answers in the tabs besie.. Cempote the acerenmate intemal rate of fetum of each project. Which one ahould be adopted based in the internal rate of. Feture approsth? Dwight Donovan, the president of Munot Enterpises, is considering two investment opportunities. Becbuse of limited resources, he wit be able to invest in only one of them. Project A is to purchase a machine that will enable foctory automationc the machine is expected to have a useful life of five yewes and no salvage vilue. Project B supports a training program that will improve the skills of employees operating the current equipment. Inibal cash expendtures foe Project A are $199000 and for Project 8 are $33.000. The sonual expected cash inflows are $29.804 for Project A and 58,705 for Project B. Both investments are expected to provide cash flow benefiss for the next five years. Munou . Enterprises' desired tate of return is 4 percent (pY of $1 and pyA of 50 (Use appropriate factor(s) from the tables provided.) Required a. Compuse the net present value of each peoject. Which project should be adopted based on the net present walue approach? b. Compute the approwimate internal fase of tefuen of each project. Which one should be adopted based on the insernat rate of return approach? Complete this question by entering your answers in the tabs below. Compute the net present vatue of each project. Which project ahould be adeoted based on the not present value aboroach? Dwight Donovef, the aresident of Munar Enterprises, is considering two ifvestment opporturites. Because of limieed resources, he wit be able to invest in only one of thems. Project A is to purchuse a machine that will enabse factory automation, the machine is expected to have a useful life of five years and no salvage value. Project B supports a training program that will improve the skills of errployees operating the current eeupmeet. Inital cash oxpenditures for Project A are $119,000 and for Project B are $33,000. The anhual expected cosh inflows are $29.804 for Project A and $8705 for Project 8 . Both investments are expected to prowide cash flow benefits for the next five years. Munoz Enterprises' desired rate of teturn is 4 percent. (RY of S1 and PYA of 51) (Use appropriate factor(s) frem the tables provided.) Aequired a. Compute the net present value of each peoject. Which project should be adopted based on the net present value opproach? b. Compute the approwimate internal rate of retuen of esch pioject. Which one should be adopted based on the intlernal rate of rufumt noproach? Cemplete this question by entering rour answers in the tabs besie.. Cempote the acerenmate intemal rate of fetum of each project. Which one ahould be adopted based in the internal rate of. Feture approsth