plz help me question

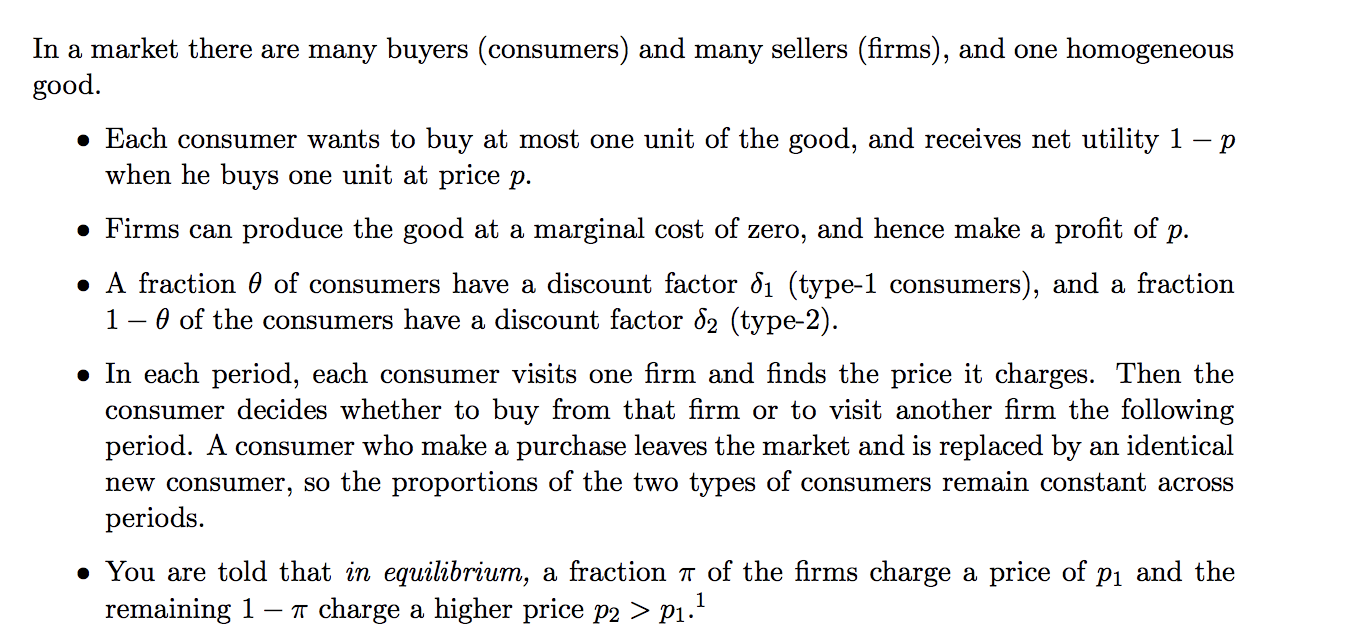

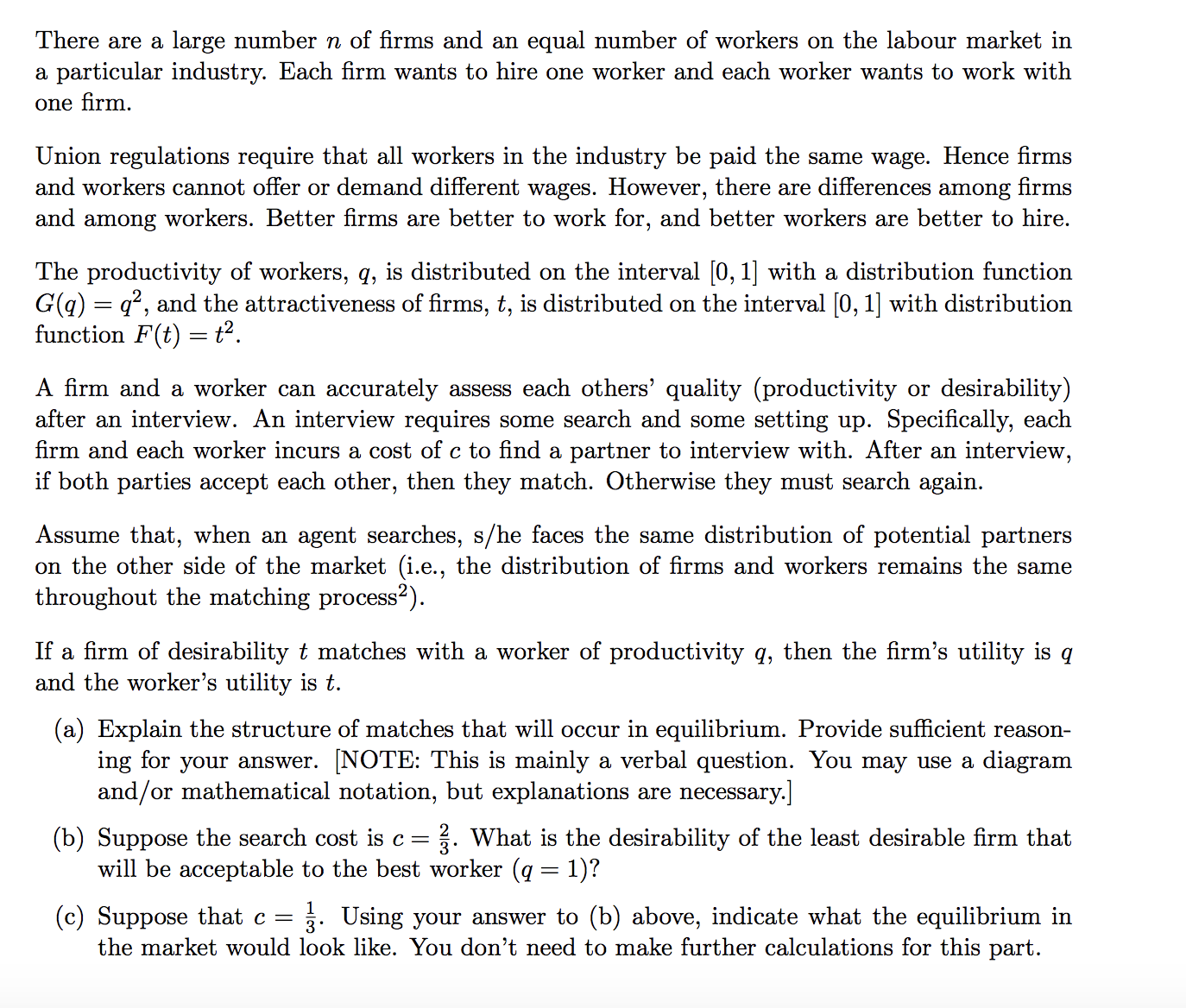

In a market there are many buyers (consumers) and many sellers (rms), and one homogeneous good. Each consumer wants to buy at most one unit of the good, and receives net utility 1 p when he buys one unit at price 1). Firms can produce the good at a marginal cost of zero, and hence make a prot of p. A fraction 6 of consumers have a discount factor 61 (type-1 consumers), and a fraction 1 6 of the consumers have a discount factor 62 (type-2). In each period, each consumer visits one rm and nds the price it charges. Then the consumer decides whether to buy from that rm or to visit another rm the following period. A consumer who make a purchase leaves the market and is replaced by an identical new consumer, so the proportions of the two types of consumers remain constant across periods. You are told that in equilibrium, a fraction or of the rms charge a price of 191 and the remaining 1 7r charge a higher price p2 > 191.1 There are a large number n of firms and an equal number of workers on the labour market in a particular industry. Each firm wants to hire one worker and each worker wants to work with one firm. Union regulations require that all workers in the industry be paid the same wage. Hence firms and workers cannot offer or demand different wages. However, there are differences among firms and among workers. Better firms are better to work for, and better workers are better to hire. The productivity of workers, q, is distributed on the interval [0, 1] with a distribution function G(q) = q2, and the attractiveness of firms, t, is distributed on the interval [0, 1] with distribution function F(t) = t2. A firm and a worker can accurately assess each others' quality (productivity or desirability) after an interview. An interview requires some search and some setting up. Specifically, each firm and each worker incurs a cost of c to find a partner to interview with. After an interview, if both parties accept each other, then they match. Otherwise they must search again. Assume that, when an agent searches, s/he faces the same distribution of potential partners on the other side of the market (i.e., the distribution of firms and workers remains the same throughout the matching process?). If a firm of desirability t matches with a worker of productivity q, then the firm's utility is q and the worker's utility is t. (a) Explain the structure of matches that will occur in equilibrium. Provide sufficient reason- ing for your answer. [NOTE: This is mainly a verbal question. You may use a diagram and/or mathematical notation, but explanations are necessary.] (b) Suppose the search cost is c = . What is the desirability of the least desirable firm that will be acceptable to the best worker (q = 1)? (c) Suppose that c = 3. Using your answer to (b) above, indicate what the equilibrium in the market would look like. You don't need to make further calculations for this part