Answered step by step

Verified Expert Solution

Question

1 Approved Answer

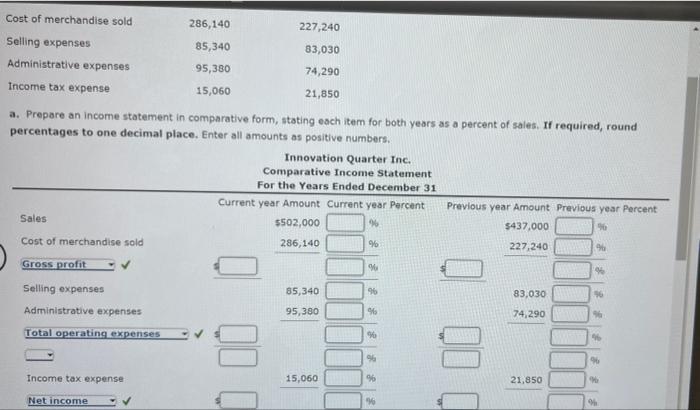

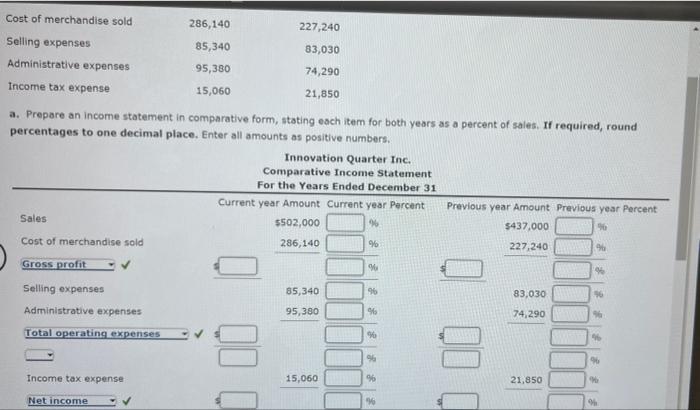

plz, help me!! Thank you! Cost of merchandise sold 286,140 227,240 85,340 83,030 Selling expenses Administrative expenses Income tax expense 95,380 74,290 15,060 21,850 a.

plz, help me!! Thank you!

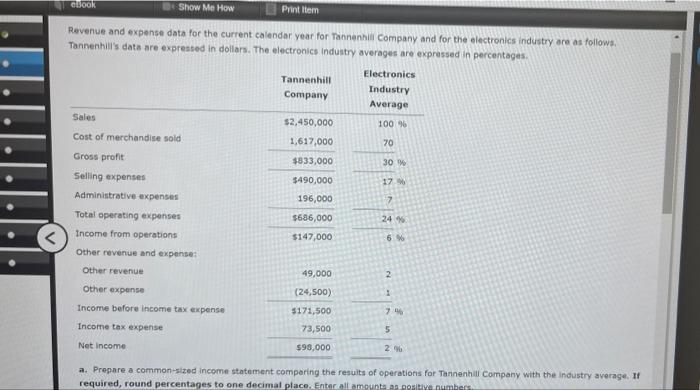

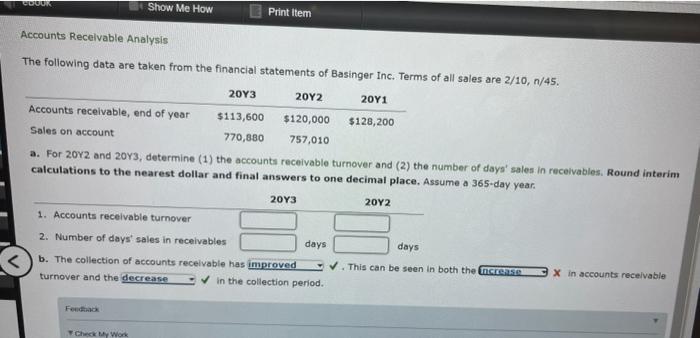

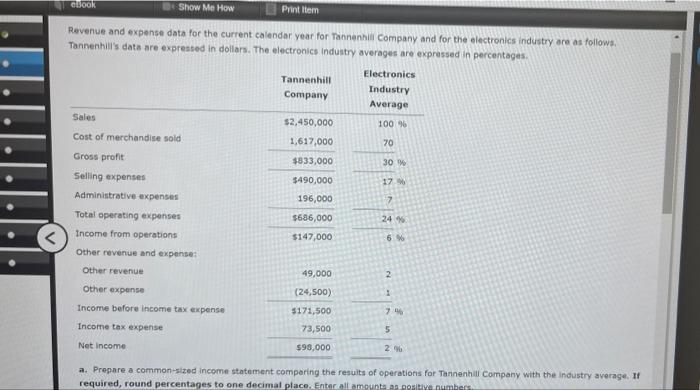

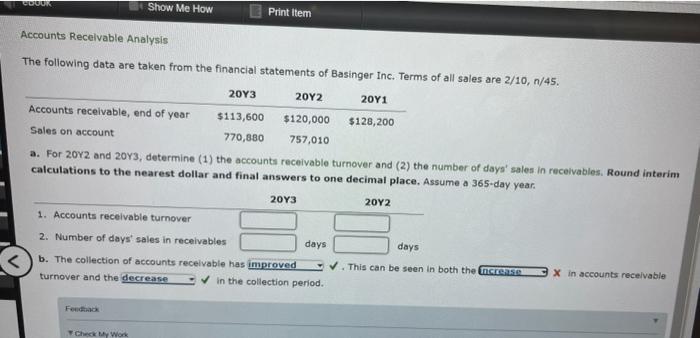

Cost of merchandise sold 286,140 227,240 85,340 83,030 Selling expenses Administrative expenses Income tax expense 95,380 74,290 15,060 21,850 a. Prepare an income statement in comparative form, stating each item for both years as a percent of sales. If required, round percentages to one decimal place. Enter all amounts as positive numbers. Innovation Quarter Inc. Comparative Income Statement For the Years Ended December 31 Current year Amount Current year Percent Previous year Amount Previous year Percent Sales $502,000 $437,000 Cost of merchandise sold 286,140 % 227,240 96 Gross profit o o 85,340 96 96 Selling expenses Administrative expenses Total operating expenses 83,030 74,290 95,380 965 % ID Q0 90 Income tax expense 15,060 96 21,850 Net income CBOOK Bt Show Me How Print Item Revenue and expense data for the current calendar year for Tannenhill Company and for the electronics Industry are as follows Tannenhill's data are expressed in dollars. The electronics Industry averages are expressed in percentages Electronics Tannenhill Industry Company Average Sales $2,450,000 100% Cost of merchandise sold 1,617,000 70 Gross profit $833,000 30 Selling expenses $490,000 17 Administrative expenses 196,000 7 Total operating expenses $636,000 24 Income from operations $147,000 6% Other revenue and expenses Other revenue 49,000 Other expense (24,500) 1 Income before income tax expense 5171,500 7. Income tax expense 73,500 5 Net income $98,000 2.9 2 2 a. Prepare a common-sized income statement comparing the results of operations for Tannenhill Company with the industry average. If required, round percentages to one decimal place. Enter all amounts as positive numbers COOK Show Me How Print Item 2013 Accounts Receivable Analysis The following data are taken from the financial statements of Basinger Inc. Terms of all sales are 2/10, 1/45. 2012 2011 Accounts receivable, end of year $113,600 $120,000 $128,200 Sales on account 770,880 757,010 a. For 2012 and 2083, determine (1) the accounts receivable turnover and (2) the number of days' sales in receivables. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume a 365-day year. 2013 20Y2 1. Accounts receivable turnover 2. Number of days' sales in receivables days days b. The collection of accounts receivable has improved turnover and the decrease in the collection period. . This can be seen in both the team X in accounts receivable Feux CheckMy Wor

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started